- United Kingdom

- /

- Energy Services

- /

- LSE:HTG

UK Penny Stocks: 3 Picks With Market Caps Under £800M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping amid concerns over weak trade data from China, highlighting the global interconnectedness of economies. Despite these broader market fluctuations, investors often look to penny stocks as potential opportunities for growth due to their affordability and the possibility of significant returns. While the term "penny stocks" may seem outdated, these smaller or newer companies can still offer intriguing investment prospects when they demonstrate strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.62 | £517.24M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.20 | £258.52M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.306 | £142.77M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.415 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.882 | £326.14M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.68 | £275.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.44 | £123.71M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.185 | £188.63M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.765 | £10.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.38 | £73.14M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc specializes in designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally, with a market cap of £302.48 million.

Operations: The company generates revenue from its NIOX® segment, totaling £41.8 million.

Market Cap: £302.48M

NIOX Group, with a market cap of £302.48 million, stands out in the penny stock arena due to its focus on medical devices for asthma management and a revenue stream from its NIOX® segment totaling £41.8 million. The company has transitioned to profitability over the past five years, although recent earnings growth has been negative. Its short-term assets comfortably exceed both short and long-term liabilities, and it operates debt-free, eliminating interest payment concerns. Trading at 34% below estimated fair value suggests potential undervaluation despite low return on equity (5.7%) and declining profit margins compared to last year.

- Jump into the full analysis health report here for a deeper understanding of NIOX Group.

- Evaluate NIOX Group's prospects by accessing our earnings growth report.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, along with its subsidiaries, is engaged in the global manufacturing of components, technology systems, and precision parts, with a market cap of £523.72 million.

Operations: The company's revenue is derived from several segments: Asia Pacific ($240.6 million), Hunting Titan ($230.3 million), Subsea Technologies ($147.1 million), North America excluding Subsea Technologies ($388.4 million), and Europe, Middle East and Africa (EMEA) ($87.7 million).

Market Cap: £523.72M

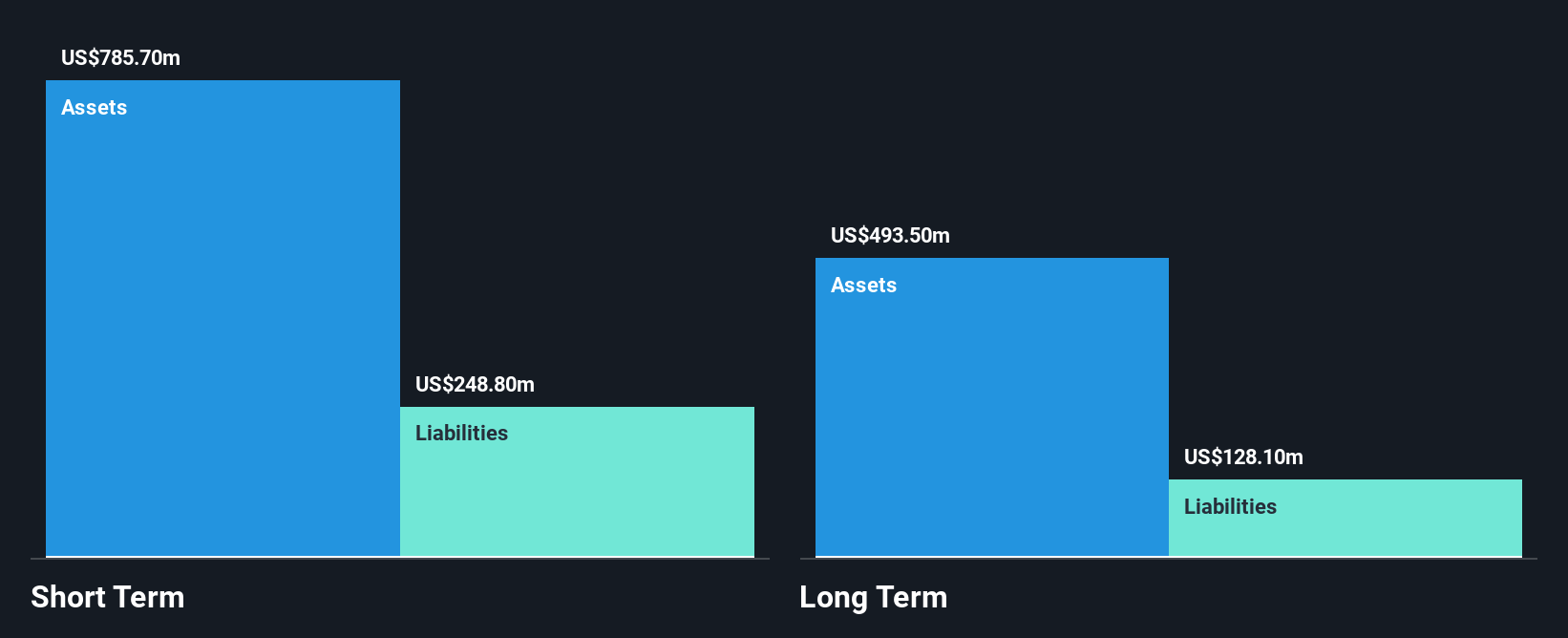

Hunting PLC, with a market cap of £523.72 million, has been actively expanding its subsea operations, highlighted by a recent $31 million order for titanium stress joints in the Black Sea. Despite being unprofitable and having a negative return on equity (-2.83%), Hunting's short-term assets ($785.7M) exceed both short and long-term liabilities, ensuring financial stability. The company is pursuing M&A opportunities to bolster growth and has announced potential share buybacks supported by robust cash generation. Trading significantly below estimated fair value indicates possible undervaluation amidst efforts to enhance revenue from high-growth segments like deepwater projects.

- Click here to discover the nuances of Hunting with our detailed analytical financial health report.

- Learn about Hunting's future growth trajectory here.

Irish Continental Group (LSE:ICGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Irish Continental Group plc is a maritime transport company operating in Ireland, the United Kingdom, and Continental Europe with a market cap of £788.06 million.

Operations: The company's revenue is derived from its Ferries segment, generating €433.5 million, and its Container and Terminal operations, contributing €203.5 million.

Market Cap: £788.06M

Irish Continental Group, with a market cap of £788.06 million, derives substantial revenue from its Ferries (€433.5M) and Container operations (€203.5M). The company's experienced board and management team bolster its operational stability, while its net debt to equity ratio of 17.1% is satisfactory, supported by strong cash flow coverage (136.7%). Despite stable weekly volatility and no significant shareholder dilution recently, ICGC faces challenges with negative earnings growth over the past year and declining profit margins (9.9% vs 10.8%). Trading below fair value suggests potential undervaluation despite an unstable dividend record and low return on equity (18.6%).

- Take a closer look at Irish Continental Group's potential here in our financial health report.

- Gain insights into Irish Continental Group's future direction by reviewing our growth report.

Next Steps

- Investigate our full lineup of 299 UK Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 23 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HTG

Hunting

Manufactures components, technology systems, and precision parts worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives