- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

Top 3 UK Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

The UK market has been experiencing turbulence, with the FTSE 100 closing lower amid weak trade data from China and declining commodity prices affecting major companies. In these uncertain times, identifying growth companies with significant insider ownership can be a prudent strategy, as high insider stakes often indicate confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Petrofac (LSE:PFC) | 16.6% | 124% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let's explore several standout options from the results in the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £810.92 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: The company's revenue segment includes Healthcare Software, generating $189.27 million.

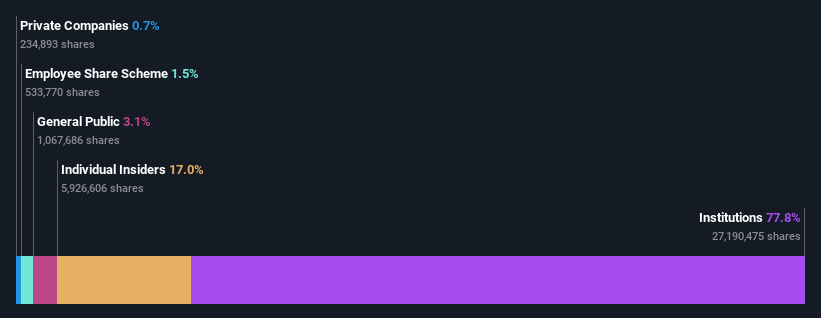

Insider Ownership: 17%

Earnings Growth Forecast: 25.6% p.a.

Craneware plc, a UK-based healthcare software company, reported full-year 2024 sales of US$189.27 million and net income of US$11.7 million, showing solid growth from the previous year. With earnings expected to grow significantly over the next three years and revenue forecasted to outpace the UK market at 8.2% annually, Craneware's strategic focus includes acquisitions and partnerships like its recent collaboration with Microsoft Azure to enhance its Trisus Platform offerings.

- Unlock comprehensive insights into our analysis of Craneware stock in this growth report.

- Our expertly prepared valuation report Craneware implies its share price may be too high.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £362.81 million, provides mortgage advice services in the United Kingdom through its subsidiaries.

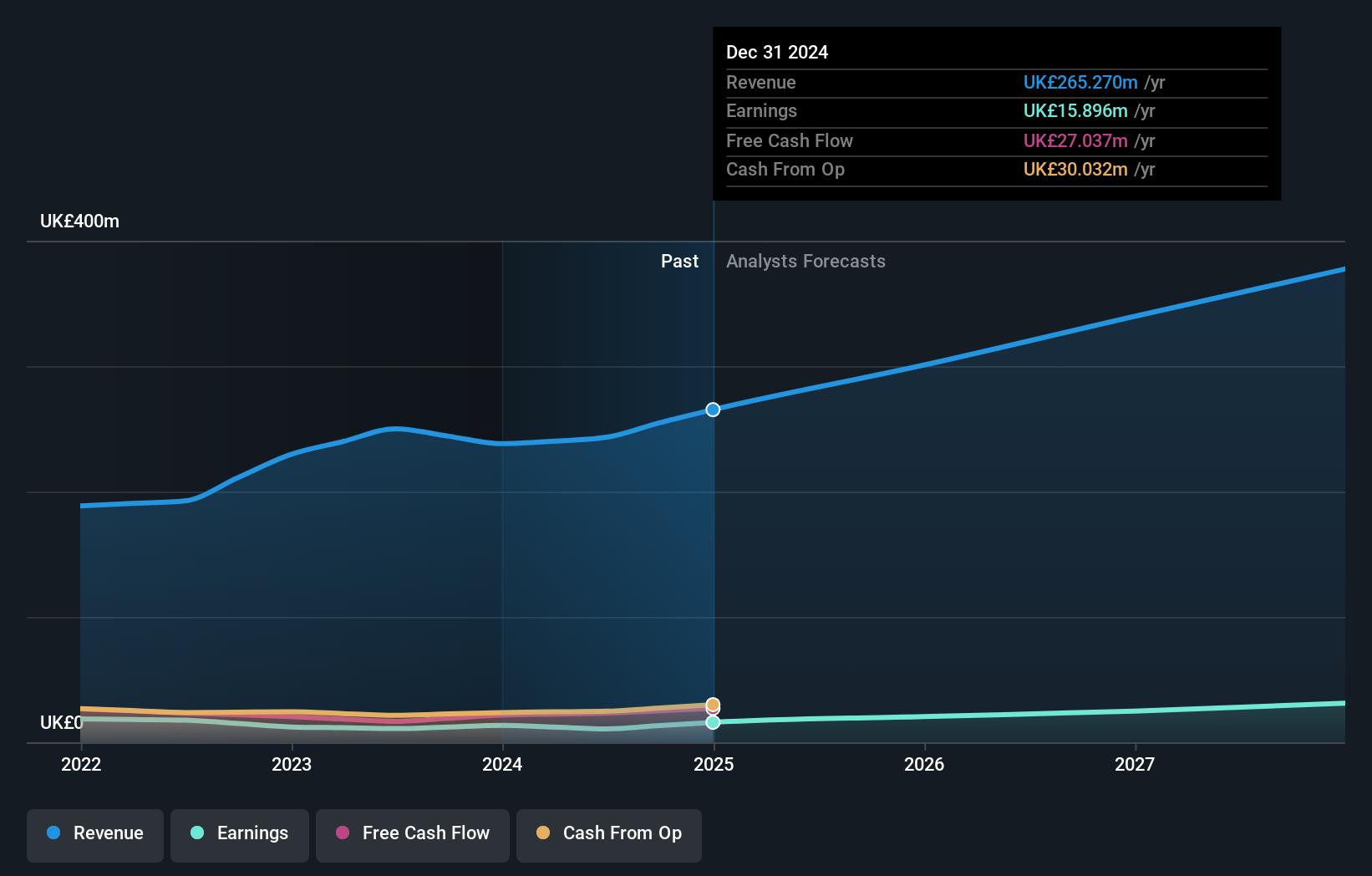

Operations: The company's revenue segment consists of £236.92 million from the provision of financial services.

Insider Ownership: 19.8%

Earnings Growth Forecast: 19.6% p.a.

Mortgage Advice Bureau (Holdings) demonstrates strong growth potential with high insider ownership. Earnings are forecast to grow at 19.62% annually, outpacing the UK market's 14.4%. Revenue is expected to increase by 13.6% per year, faster than the overall market's 3.7%. Despite a dividend yield of 4.49%, it isn't well covered by earnings, and large one-off items have impacted financial results recently. Notably, more shares have been bought than sold by insiders in the past three months.

- Navigate through the intricacies of Mortgage Advice Bureau (Holdings) with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Mortgage Advice Bureau (Holdings)'s shares may be trading at a premium.

Genel Energy (LSE:GENL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genel Energy plc, with a market cap of £203.73 million, operates as an independent oil and gas exploration and production company through its subsidiaries.

Operations: Revenue from production amounts to $74.40 million.

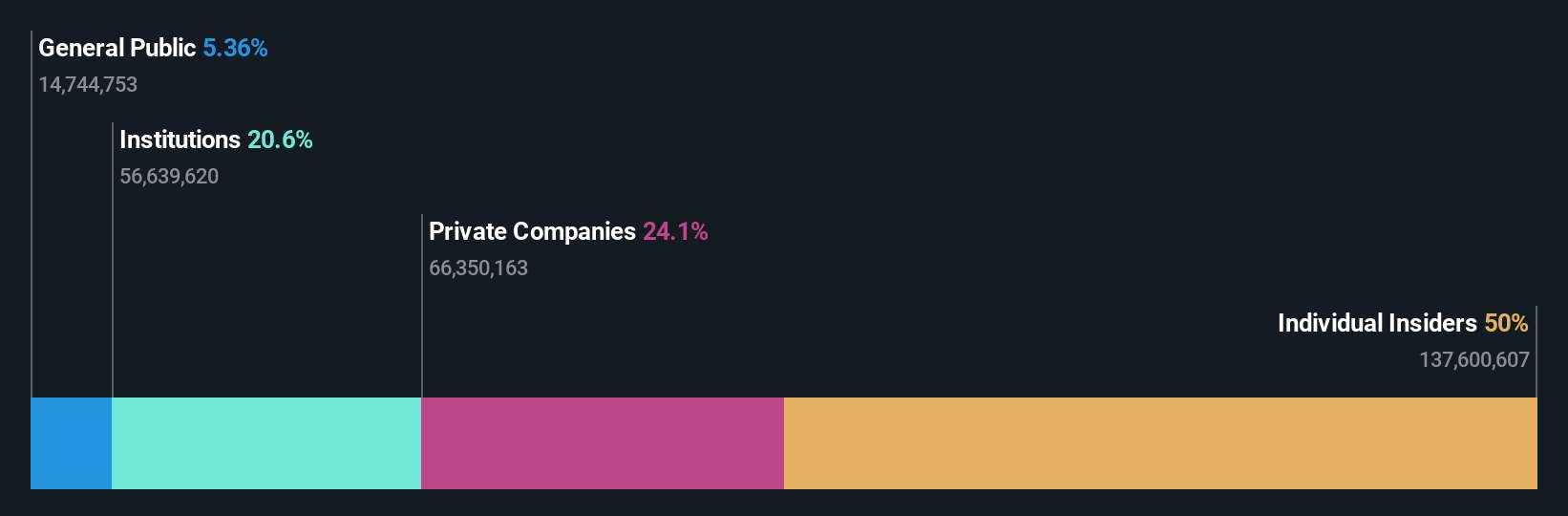

Insider Ownership: 25.4%

Earnings Growth Forecast: 57.5% p.a.

Genel Energy shows promise as a growth company with high insider ownership. The company is expected to become profitable within the next three years, with earnings forecasted to grow at 57.51% annually. Despite trading at 44.7% below its estimated fair value, revenue growth is projected at 13.4% per year, outpacing the UK market's average of 3.7%. Recent executive changes include appointing Sir Dominick Chilcott as an Independent Non-Executive Director, enhancing governance and strategic oversight.

- Click here and access our complete growth analysis report to understand the dynamics of Genel Energy.

- The valuation report we've compiled suggests that Genel Energy's current price could be quite moderate.

Summing It All Up

- Click through to start exploring the rest of the 61 Fast Growing UK Companies With High Insider Ownership now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.