- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

Craneware plc's (LON:CRW) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Craneware to hold its Annual General Meeting on 13th of November

- Total pay for CEO Keith Neilson includes US$451.3k salary

- Total compensation is similar to the industry average

- Craneware's EPS declined by 11% over the past three years while total shareholder loss over the past three years was 15%

Shareholders will probably not be too impressed with the underwhelming results at Craneware plc (LON:CRW) recently. At the upcoming AGM on 13th of November, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Craneware

How Does Total Compensation For Keith Neilson Compare With Other Companies In The Industry?

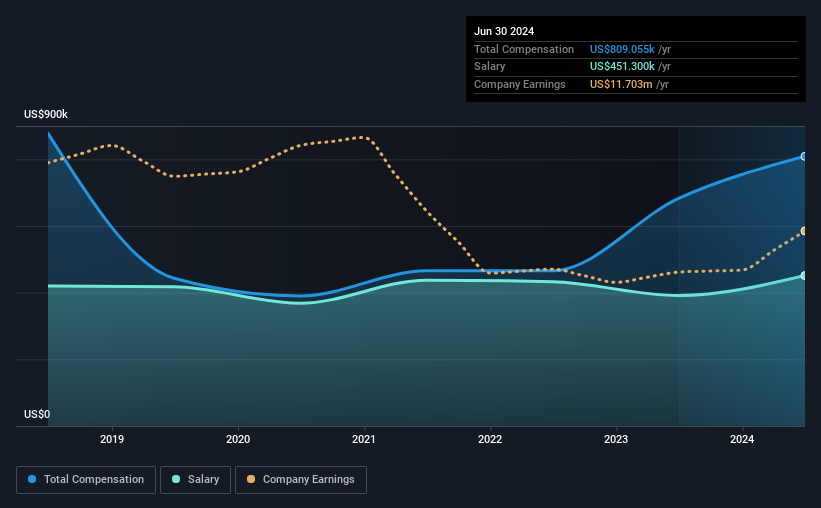

Our data indicates that Craneware plc has a market capitalization of UK£689m, and total annual CEO compensation was reported as US$809k for the year to June 2024. Notably, that's an increase of 19% over the year before. We note that the salary of US$451.3k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar companies from the British Healthcare Services industry with market caps ranging from UK£307m to UK£1.2b, we found that the median CEO total compensation was US$768k. This suggests that Craneware remunerates its CEO largely in line with the industry average. Furthermore, Keith Neilson directly owns UK£60m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$451k | US$391k | 56% |

| Other | US$358k | US$291k | 44% |

| Total Compensation | US$809k | US$683k | 100% |

Speaking on an industry level, nearly 79% of total compensation represents salary, while the remainder of 21% is other remuneration. In Craneware's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Craneware plc's Growth Numbers

Over the last three years, Craneware plc has shrunk its earnings per share by 11% per year. In the last year, its revenue is up 8.8%.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Craneware plc Been A Good Investment?

With a three year total loss of 15% for the shareholders, Craneware plc would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Craneware that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)