- United Kingdom

- /

- Beverage

- /

- AIM:NICL

Undervalued Small Caps With Insider Activity In Global December 2025

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have garnered attention as the Federal Reserve's recent interest rate cuts have propelled indices like the Russell 2000 to new highs, highlighting their sensitivity to monetary policy shifts. With concerns about labor market risks and tech sector valuations influencing broader sentiment, investors are increasingly focused on identifying opportunities in sectors that may benefit from these dynamics. In this context, a good stock often exhibits strong fundamentals and resilience in volatile conditions, making it an attractive consideration for those navigating today's economic environment.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 27.56% | ★★★★★★ |

| Norcros | 13.8x | 0.7x | 40.76% | ★★★★★☆ |

| A.G. BARR | 14.3x | 1.6x | 48.47% | ★★★★★☆ |

| Russel Metals | 14.4x | 0.5x | 30.31% | ★★★★★☆ |

| Eastnine | 11.7x | 7.4x | 49.54% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 4.8x | 1.7x | 28.66% | ★★★★★☆ |

| Eurocell | 16.8x | 0.3x | 38.92% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 12.35% | ★★★★☆☆ |

| PSC | 9.6x | 0.4x | 21.42% | ★★★★☆☆ |

| CVS Group | 45.6x | 1.3x | 27.00% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

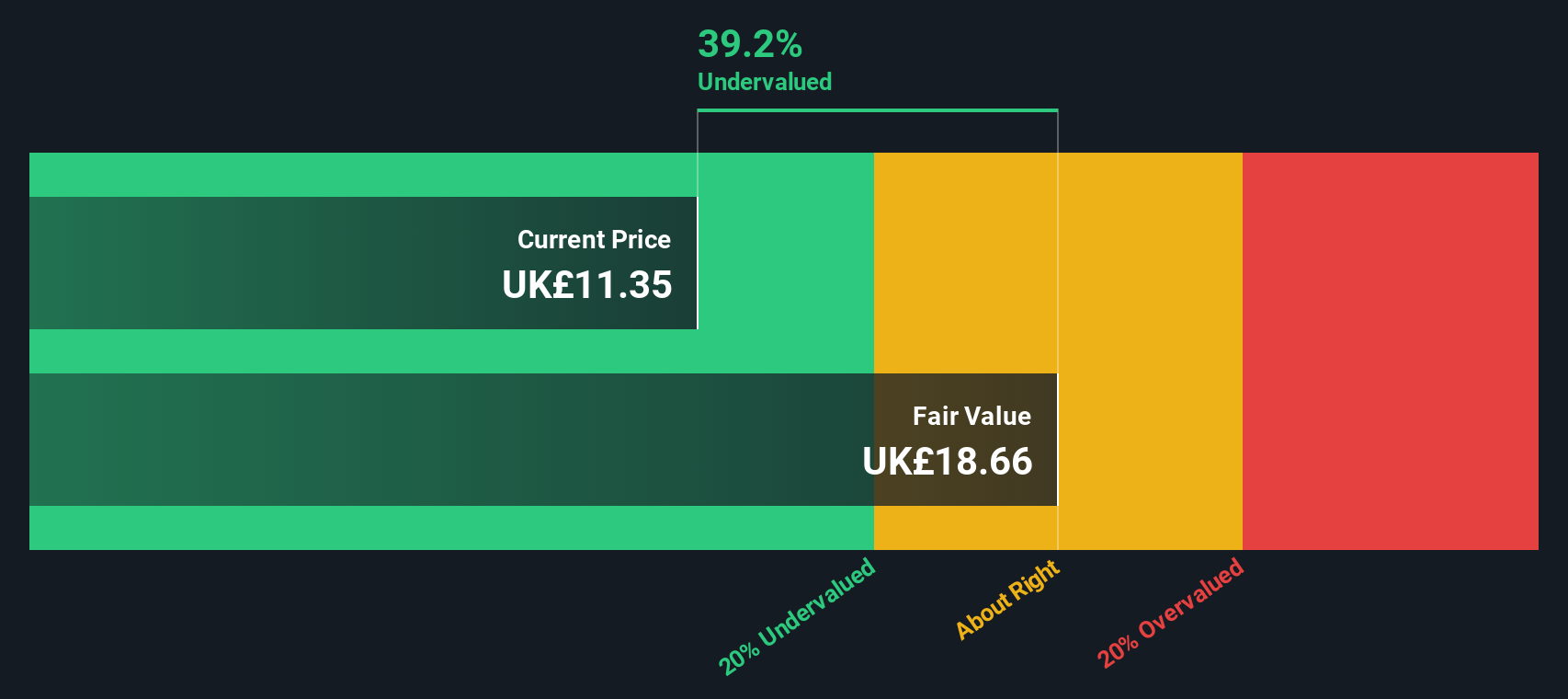

Nichols (AIM:NICL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nichols is a company engaged in the production and distribution of soft drinks, with operations divided into Packaged and Out of Home segments, and has a market capitalization of approximately £0.44 billion.

Operations: Revenue is primarily generated from Packaged and Out of Home segments, totaling £170.49 million in the latest quarter. The gross profit margin has shown fluctuations, peaking at 53.16% in mid-2017 and most recently recorded at 45.72%. Operating expenses are a significant component of costs, with General & Administrative expenses consistently being the largest portion within this category.

PE: 20.4x

Nichols, a smaller company with potential for growth, recently announced the appointment of Matthew Rothwell as CFO and Company Secretary. His extensive experience in UK consumer-facing businesses is expected to support Nichols' development. Despite relying on external borrowing for funding, which carries higher risk, the company is forecasted to grow earnings by 16% annually. Insider confidence was demonstrated through share purchases over the past year, indicating belief in Nichols' future prospects amidst executive changes.

- Delve into the full analysis valuation report here for a deeper understanding of Nichols.

Review our historical performance report to gain insights into Nichols''s past performance.

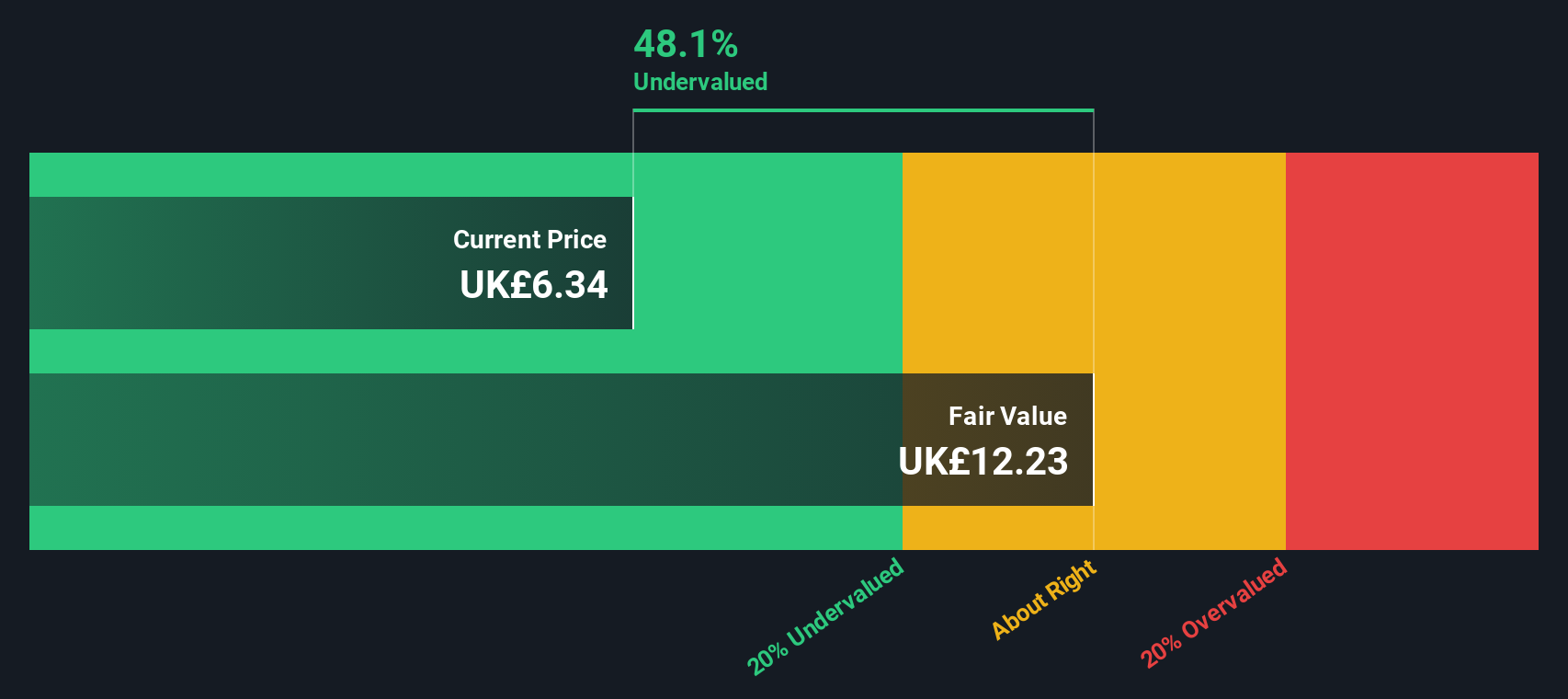

A.G. BARR (LSE:BAG)

Simply Wall St Value Rating: ★★★★★☆

Overview: A.G. BARR is a UK-based company primarily engaged in the production and distribution of soft drinks, with additional operations in cocktail solutions and other segments, boasting a market capitalization of approximately £0.54 billion.

Operations: A.G. BARR generates its revenue primarily from the Soft Drinks segment, contributing £375.20 million, followed by Cocktail Solutions at £39.20 million. The company has experienced a downward trend in gross profit margin over recent years, with the most recent figure at 40.15%. Operating expenses have increased alongside revenue growth, impacting net income margins which stood at 11.40% in the latest period analyzed.

PE: 14.3x

A.G. BARR, a company with a market cap under £1 billion, recently displayed insider confidence through share purchases in the first half of 2025. This aligns with their positive earnings report for the same period, showing sales of £228.1 million and net income growth to £27.7 million from £18.7 million last year. Despite relying solely on external borrowing for funding, their increased interim dividend and projected annual earnings growth suggest potential value for investors seeking smaller companies with promising prospects in the beverage industry.

- Click here to discover the nuances of A.G. BARR with our detailed analytical valuation report.

Assess A.G. BARR's past performance with our detailed historical performance reports.

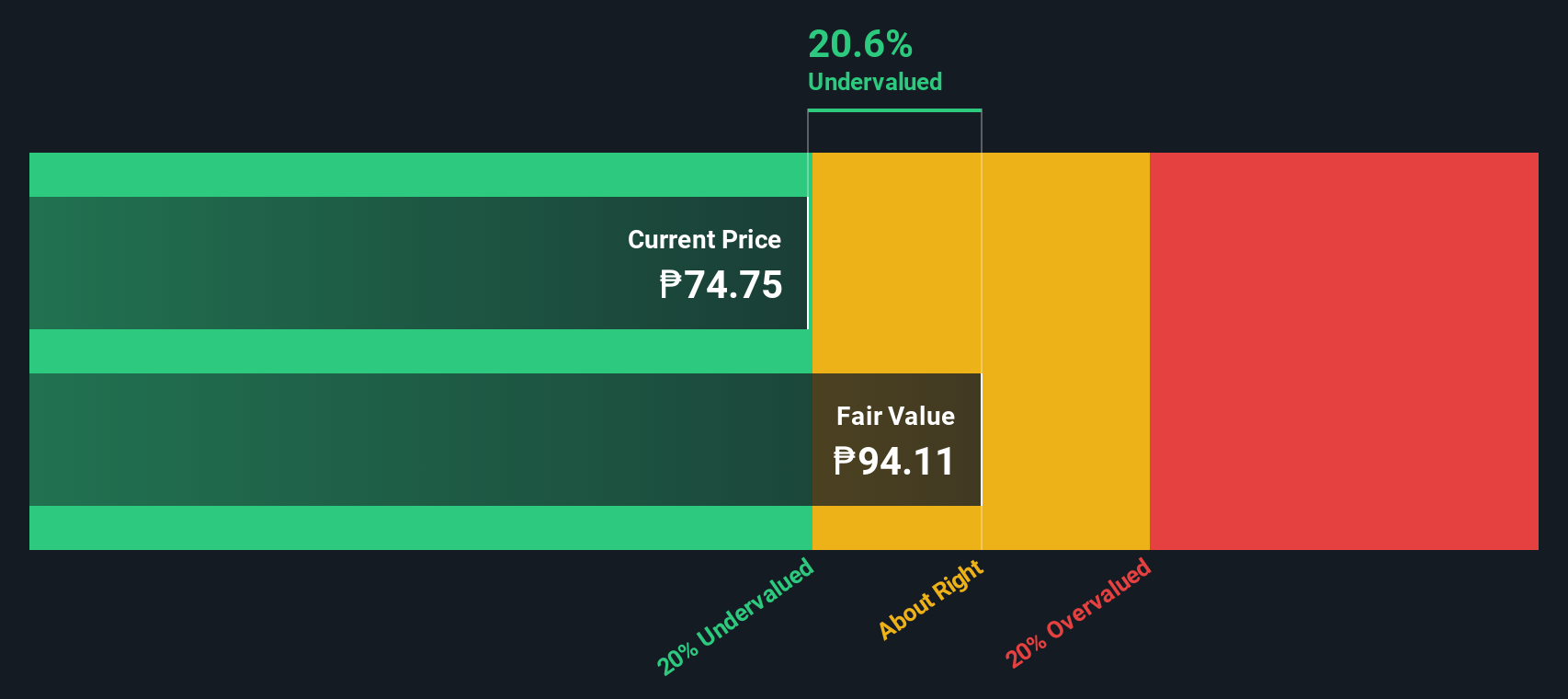

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank is a Philippines-based financial institution offering a range of services, including branch banking, consumer banking, commercial banking, and treasury operations, with a market capitalization of ₱16.42 billion.

Operations: The company's revenue streams are primarily derived from Branch Banking, Treasury, Consumer Banking, and Commercial Banking. Over the periods analyzed, the net income margin showed an upward trend reaching 56.02% in early 2025. Operating expenses consistently form a significant portion of costs, with General & Administrative Expenses being a major component.

PE: 4.7x

Asia United Bank has shown insider confidence with Ernesto Tan Uy purchasing 30,000 shares for PHP 1.05 million in November 2025, indicating a belief in the bank's potential. Despite a slight dip in third-quarter net income to PHP 3.24 billion from PHP 3.35 billion last year, nine-month figures reveal growth with net income rising to PHP 9.37 billion from PHP 8.58 billion previously. The recent leadership change could further drive strategic initiatives and enhance trust banking operations moving forward.

- Dive into the specifics of Asia United Bank here with our thorough valuation report.

Understand Asia United Bank's track record by examining our Past report.

Summing It All Up

- Dive into all 144 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nichols might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NICL

Nichols

Engages in supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries in the United Kingdom, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)