- United Kingdom

- /

- Retail REITs

- /

- LSE:SUPR

Benchmark Holdings And 2 Other UK Stocks That May Be Undervalued

Reviewed by Simply Wall St

The United Kingdom's stock market has experienced some turbulence recently, with the FTSE 100 index closing lower due to weak trade data from China and falling commodity prices affecting major companies. Despite these challenges, there are opportunities to find undervalued stocks that may offer potential for growth in such a fluctuating environment. Identifying stocks that are trading below their intrinsic value can be particularly advantageous during periods of economic uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £2.09 | £4.10 | 49% |

| Topps Tiles (LSE:TPT) | £0.478 | £0.92 | 47.9% |

| AstraZeneca (LSE:AZN) | £124.06 | £246.72 | 49.7% |

| Mercia Asset Management (AIM:MERC) | £0.35 | £0.68 | 48.9% |

| Redcentric (AIM:RCN) | £1.30 | £2.46 | 47.2% |

| Ricardo (LSE:RCDO) | £5.18 | £10.18 | 49.1% |

| Foxtons Group (LSE:FOXT) | £0.624 | £1.21 | 48.3% |

| Velocity Composites (AIM:VEL) | £0.435 | £0.83 | 47.5% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.116 | £2.10 | 46.9% |

Let's review some notable picks from our screened stocks.

Benchmark Holdings (AIM:BMK)

Overview: Benchmark Holdings plc, with a market cap of £310.71 million, provides technical services, products, and specialist knowledge to support the development of food and farming industries.

Operations: Benchmark Holdings plc generates revenue from four primary segments: Health (£16.27 million), Genetics (£57.06 million), Corporate (£5.20 million), and Advanced Nutrition (£74.31 million).

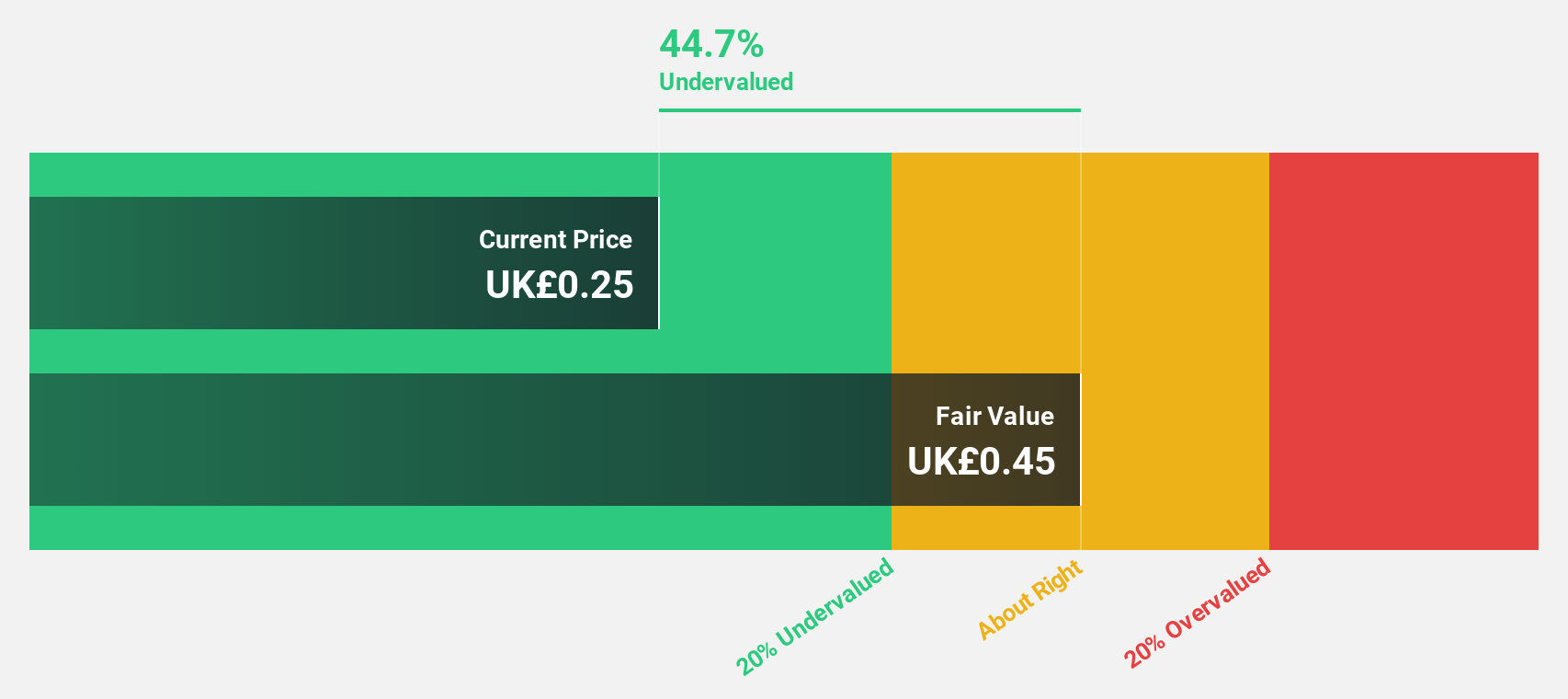

Estimated Discount To Fair Value: 41.3%

Benchmark Holdings is trading at 41.3% below its estimated fair value of £0.72 per share, with current price at £0.42, indicating significant undervaluation based on discounted cash flows. Despite recent financial challenges, including a net loss of GBP 18.86 million for the nine months ended June 30, 2024, the company is forecast to become profitable within three years and achieve revenue growth faster than the UK market average (15.1% vs 3.7%).

- Our comprehensive growth report raises the possibility that Benchmark Holdings is poised for substantial financial growth.

- Take a closer look at Benchmark Holdings' balance sheet health here in our report.

Foresight Group Holdings (LSE:FSG)

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the UK, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £585.54 million.

Operations: The company's revenue segments are comprised of £84.17 million from Infrastructure, £47.35 million from Private Equity, and £9.80 million from Foresight Capital Management.

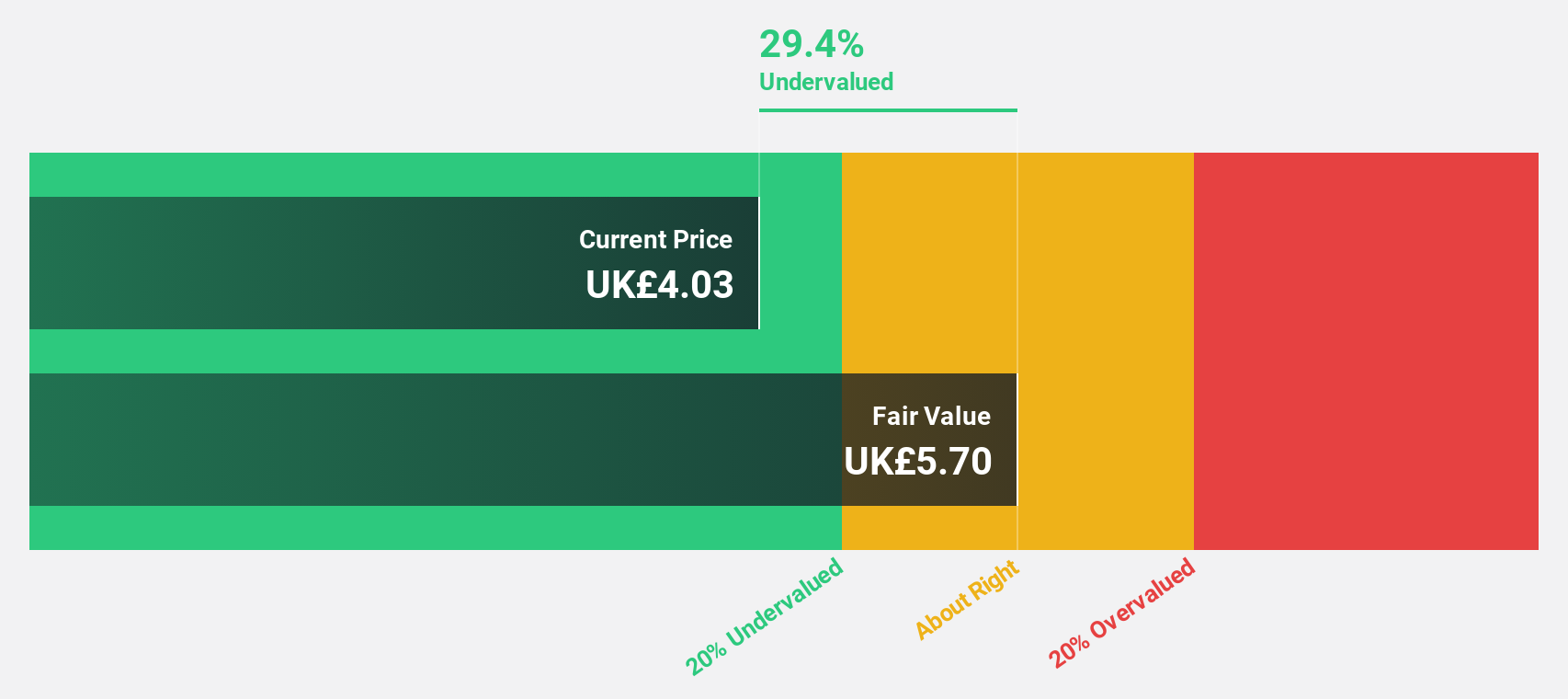

Estimated Discount To Fair Value: 33.3%

Foresight Group Holdings (FSG) is trading at £5.06, significantly below its estimated fair value of £7.58, indicating substantial undervaluation based on discounted cash flows. Analysts agree the stock price could rise by 22.1%. Despite a dividend yield of 4.39% not being well-covered by earnings, FSG's earnings are forecast to grow 27.88% per year, outpacing the UK market's growth rate of 14.4%. Recent announcements include a final dividend payment and an increased equity buyback plan totaling £10 million.

- The growth report we've compiled suggests that Foresight Group Holdings' future prospects could be on the up.

- Dive into the specifics of Foresight Group Holdings here with our thorough financial health report.

Supermarket Income REIT (LSE:SUPR)

Overview: Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust focused on investing in UK grocery properties, with a market cap of approximately £953.37 million.

Operations: Supermarket Income REIT's revenue from real estate investment in grocery properties is £106.29 million.

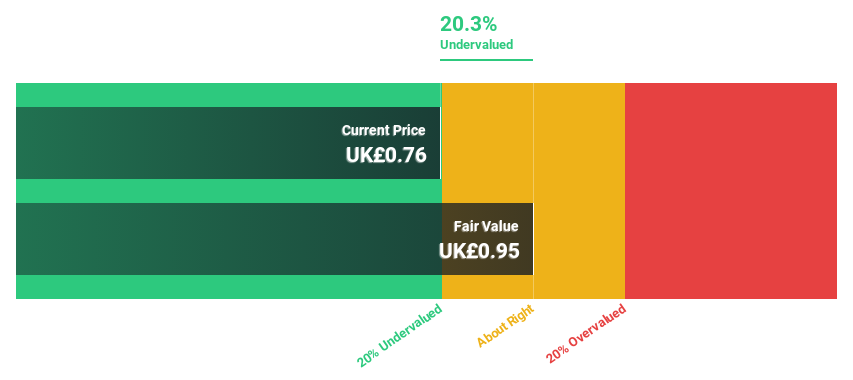

Estimated Discount To Fair Value: 20.1%

Supermarket Income REIT recently completed a £170 million refinancing through private placement and a new unsecured bank facility, enhancing its financial flexibility. Despite an unstable dividend track record, the company is trading at 20.1% below its estimated fair value of £0.96 per share. Earnings are forecast to grow significantly at 90.24% per year, outpacing both revenue growth and the UK market's average profit growth rate of 14.4%, indicating strong future cash flow potential despite current debt coverage concerns.

- In light of our recent growth report, it seems possible that Supermarket Income REIT's financial performance will exceed current levels.

- Navigate through the intricacies of Supermarket Income REIT with our comprehensive financial health report here.

Where To Now?

- Gain an insight into the universe of 54 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SUPR

Supermarket Income REIT

Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the UK's feed the nation infrastructure.

Reasonable growth potential average dividend payer.