- United Kingdom

- /

- Professional Services

- /

- AIM:ELIX

Undiscovered Gems in the UK Market for January 2025

Reviewed by Simply Wall St

In the current landscape, the United Kingdom's stock market has faced challenges, with the FTSE 100 index retreating due to weak trade data from China and a sluggish global economic recovery. Amidst these broader market pressures, discerning investors might find opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite external headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Somero Enterprises | NA | 8.19% | 7.39% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc is a management consultancy firm offering services in the United Kingdom, the United States, and globally, with a market capitalization of £336.93 million.

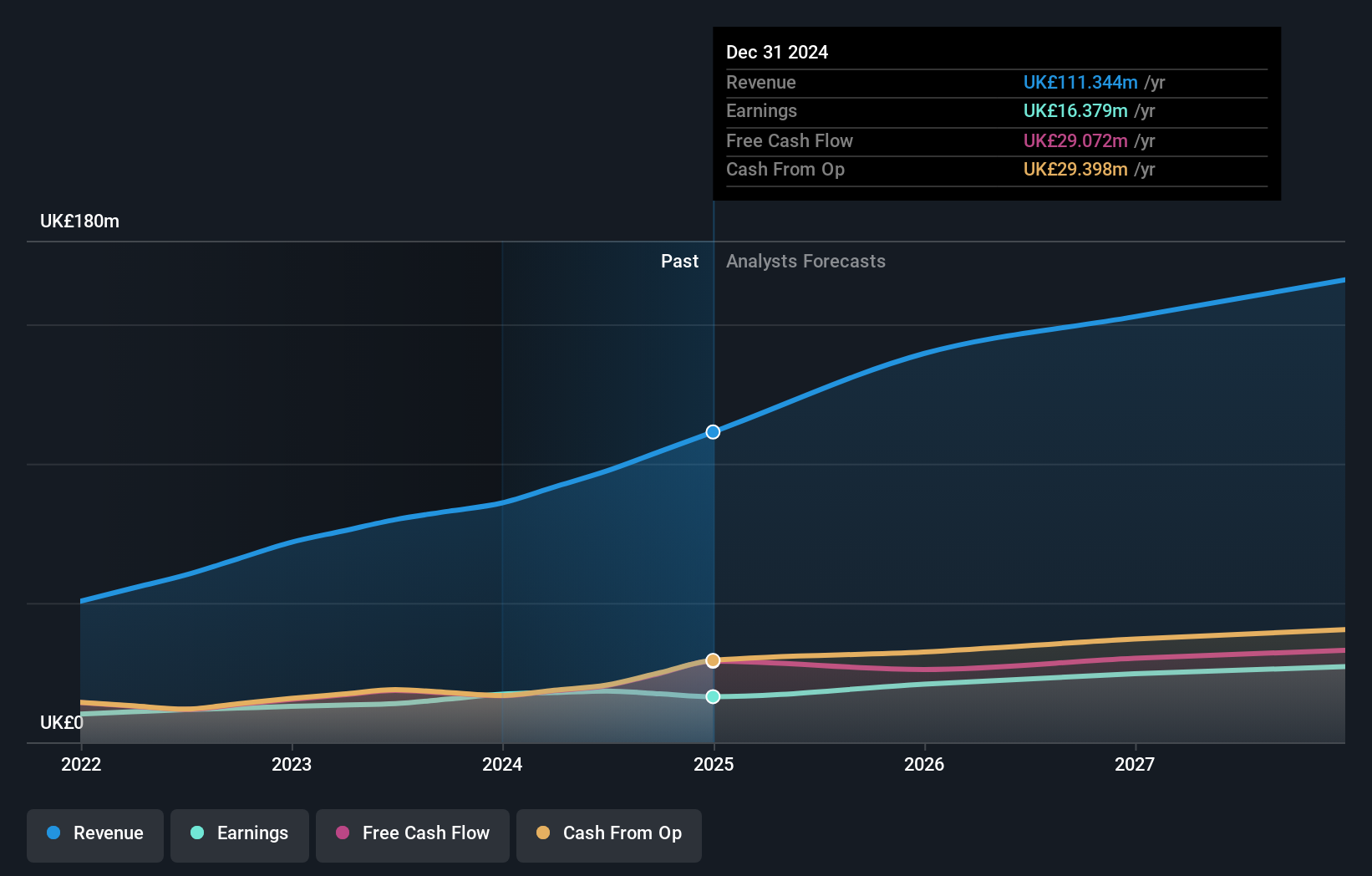

Operations: Elixirr generates revenue primarily from management consulting services, amounting to £97.37 million.

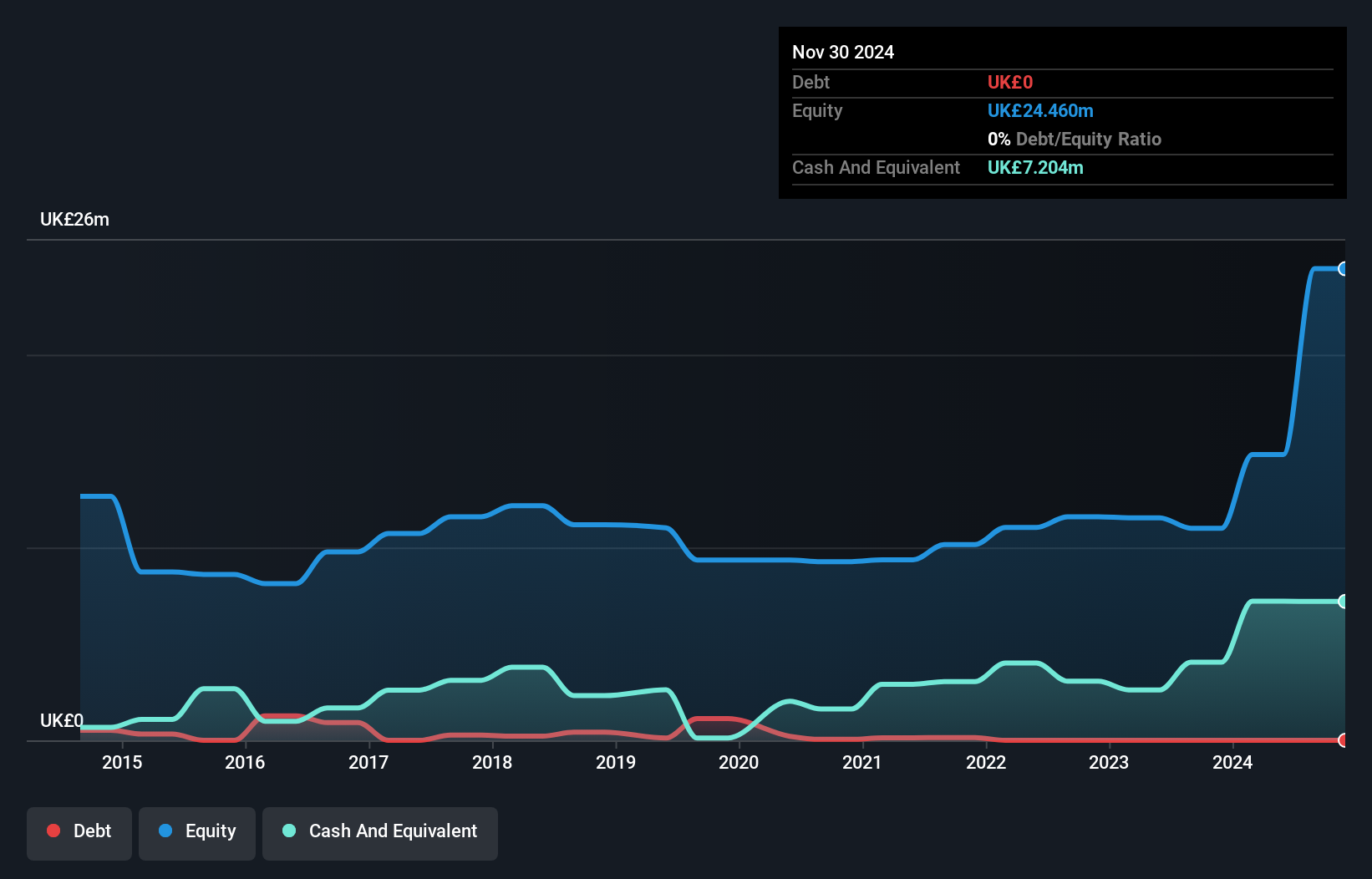

Elixirr International, a nimble player in the consultancy space, has shown impressive growth with earnings surging 32.8% over the past year, outpacing its industry peers. The company is trading at 56.6% below its estimated fair value and remains debt-free, highlighting its sound financial health. However, significant insider selling in recent months and shareholder dilution last year may raise some eyebrows. On a positive note, Elixirr's follow-on equity offering raised nearly £25 million to bolster operations and acquisitions. Recent executive changes include Graham Busby's promotion to Deputy CEO while maintaining his strategic acquisition role since 2020.

- Delve into the full analysis health report here for a deeper understanding of Elixirr International.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology across the United Kingdom, Europe, the Americas, and internationally with a market cap of £223.36 million.

Operations: Revenue from wireless communications equipment totals £25.43 million.

Filtronic, a UK-based player in RF and microwave solutions, has seen a significant earnings growth of 576.9% over the past year, outpacing the Communications industry which faced a -9.1%. This debt-free company is poised for further expansion with its new engineering design centre at Cambridge Science Park, enhancing its technical prowess and market reach. The recent appointment of Antonino Spatola as Chief Commercial Officer aims to bolster Filtronic's commercial strategy and innovation capabilities. With high-quality past earnings and free cash flow positivity, Filtronic seems well-positioned for continued success in niche markets like Space and Defence.

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senior plc is a company that designs, manufactures, and sells high-technology components and systems for major original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy sectors globally, with a market cap of approximately £655.77 million.

Operations: Revenue primarily comes from the Aerospace segment at £651.10 million and the Flexonics segment at £333 million.

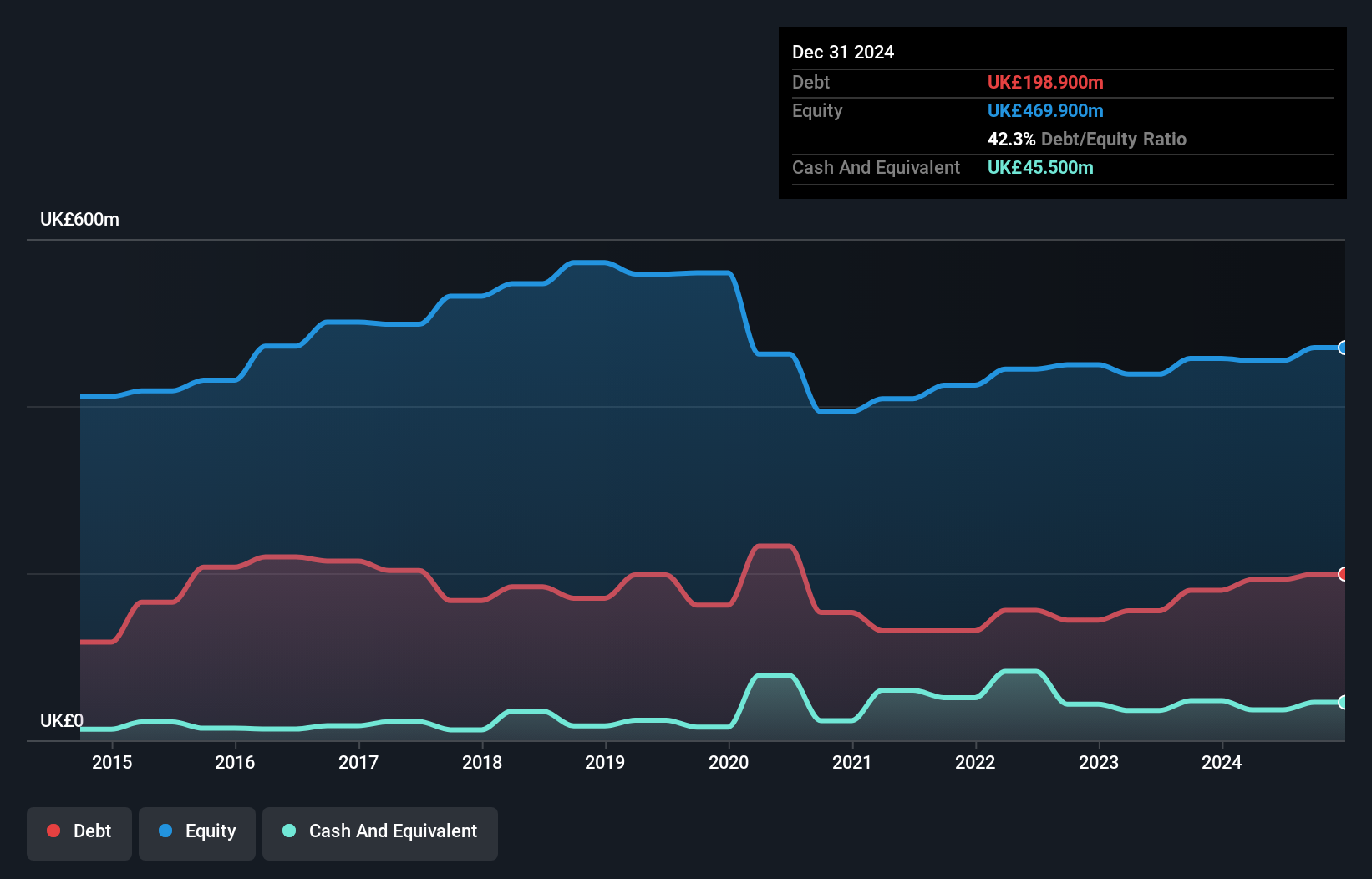

Senior plc, a notable player in the Aerospace & Defense industry, has demonstrated impressive earnings growth of 40% over the past year, outpacing its industry peers. The company is trading at an attractive valuation, 24% below its estimated fair value. Despite an increase in debt to equity ratio from 35.5% to 42.4% over five years, their net debt to equity remains satisfactory at 34.4%. With high-quality past earnings and interest payments well covered by EBIT (3.1x), Senior appears poised for continued performance improvement as it anticipates further earnings growth of 31.5% annually.

- Click to explore a detailed breakdown of our findings in Senior's health report.

Evaluate Senior's historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 62 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elixirr International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ELIX

Elixirr International

Through its subsidiaries, provides management consultancy services in the United Kingdom, the United States, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives