- United Kingdom

- /

- Communications

- /

- AIM:FTC

February 2025's Top UK Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100, influenced by weak trade data from China and declining commodity prices, the UK market is navigating through a challenging phase. Penny stocks, though an older term, remain relevant as they often highlight smaller or emerging companies that can offer significant value. By focusing on those with strong financial health and potential for growth, investors might uncover opportunities that align with both stability and upside potential in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £808.27M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.92 | £148.21M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.25 | £81.05M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £40.03M | ★★★★★★ |

| Union Jack Oil (AIM:UJO) | £0.1075 | £11.72M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.646 | £2.07B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.44 | £184.02M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alumasc Group (AIM:ALU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Alumasc Group plc is a company that manufactures and sells building products, systems, and solutions across various regions including the United Kingdom, Europe, North America, the Middle East, and the Far East with a market cap of £103.39 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: £103.39M

Alumasc Group has demonstrated solid financial performance, with recent earnings showing a rise in sales to £57.36 million and net income increasing to £4.9 million for the half year ending December 31, 2024. The company maintains a satisfactory net debt to equity ratio of 12.2% and covers its debt well with operating cash flow at 138.2%. Additionally, Alumasc's Return on Equity is high at 25.5%, indicating efficient use of equity capital. Despite an unstable dividend track record, the firm trades at good value compared to peers and industry benchmarks while maintaining stable weekly volatility of 4%.

- Click here and access our complete financial health analysis report to understand the dynamics of Alumasc Group.

- Assess Alumasc Group's future earnings estimates with our detailed growth reports.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology globally with a market cap of £217.89 million.

Operations: The company has not reported any revenue segments.

Market Cap: £217.89M

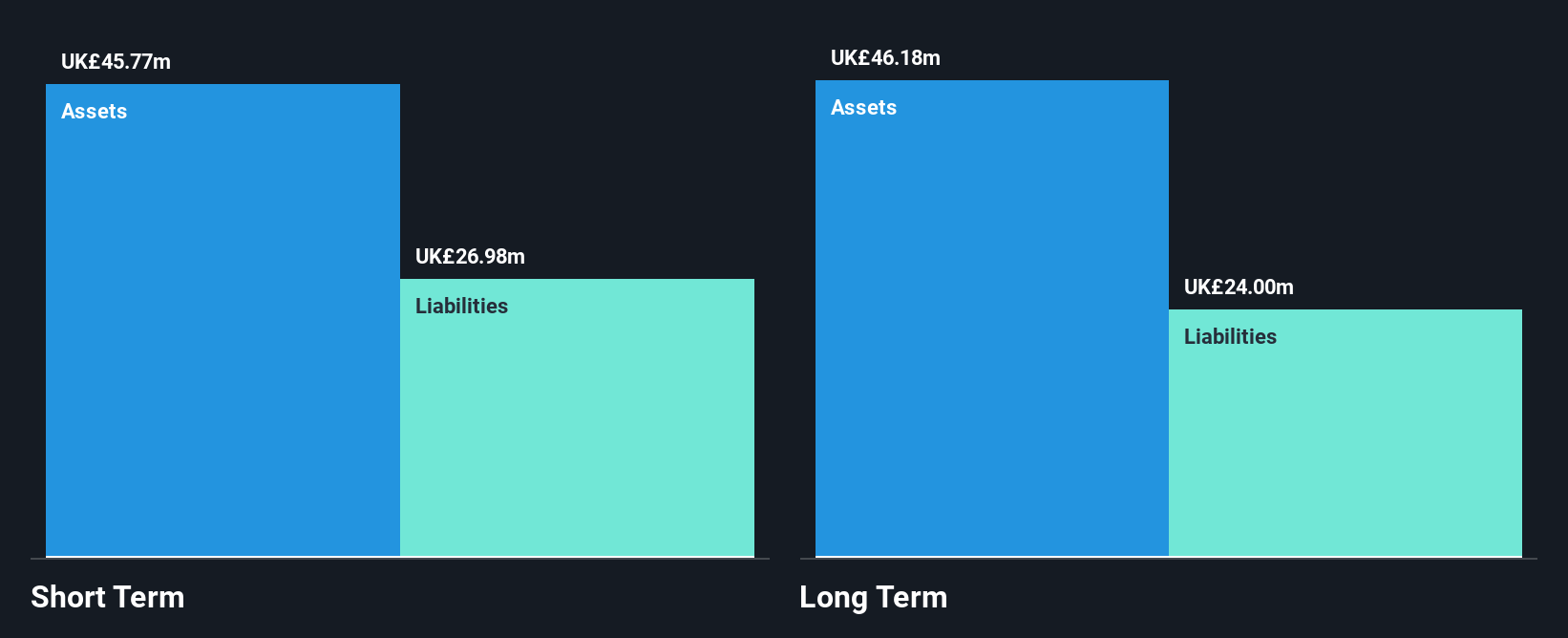

Filtronic plc has shown significant improvement in financial performance, reporting half-year sales of £25.6 million and a net income of £6.73 million, reversing from a loss last year. The company is debt-free, with short-term assets comfortably exceeding liabilities and an outstanding Return on Equity of 42.5%. Recent strategic moves include appointing Antonino Spatola as Chief Commercial Officer to drive growth and opening a new engineering design center at Cambridge Science Park to enhance innovation in RF technology. Despite these strengths, earnings are forecasted to decline over the next three years by consensus estimates.

- Jump into the full analysis health report here for a deeper understanding of Filtronic.

- Review our growth performance report to gain insights into Filtronic's future.

Seplat Energy (LSE:SEPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.18 billion.

Operations: The company's revenue is derived from its oil segment, generating $846.68 million, and its gas segment, contributing $119.56 million.

Market Cap: £1.18B

Seplat Energy Plc, with a market cap of £1.18 billion, has demonstrated robust earnings growth of 199.5% over the past year, significantly outperforming the oil and gas industry average. Despite this growth, its Return on Equity remains low at 4.6%, and short-term assets exceed liabilities but do not cover long-term liabilities fully. The company's debt is well managed with operating cash flow covering 71.9% of it, though its debt-to-equity ratio has increased over five years to 40.3%. Seplat's dividend yield of 6.9% is not adequately supported by earnings, indicating potential sustainability concerns.

- Dive into the specifics of Seplat Energy here with our thorough balance sheet health report.

- Explore Seplat Energy's analyst forecasts in our growth report.

Next Steps

- Explore the 444 names from our UK Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives