- United Kingdom

- /

- Marine and Shipping

- /

- LSE:ICGC

Exploring 3 Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, yet it has seen a 6.6% increase over the past year with earnings projected to grow by 14% annually in the coming years. In such a dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover promising opportunities for investors seeking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland with a market capitalization of £1.07 billion.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million.

Cairn Homes, a notable player in the UK market, has demonstrated robust growth with earnings surging by 49.5% over the past year. The company's price-to-earnings ratio of 11.4x suggests it trades at a favorable value compared to the broader UK market's 16.5x. Despite an increase in its debt-to-equity ratio from 31.3% to 39.1% over five years, Cairn maintains satisfactory interest coverage at 9.5x EBIT and net debt levels remain appropriate at 20.7%.

- Delve into the full analysis health report here for a deeper understanding of Cairn Homes.

Understand Cairn Homes' track record by examining our Past report.

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc is a maritime transport company with a market capitalization of £803.15 million.

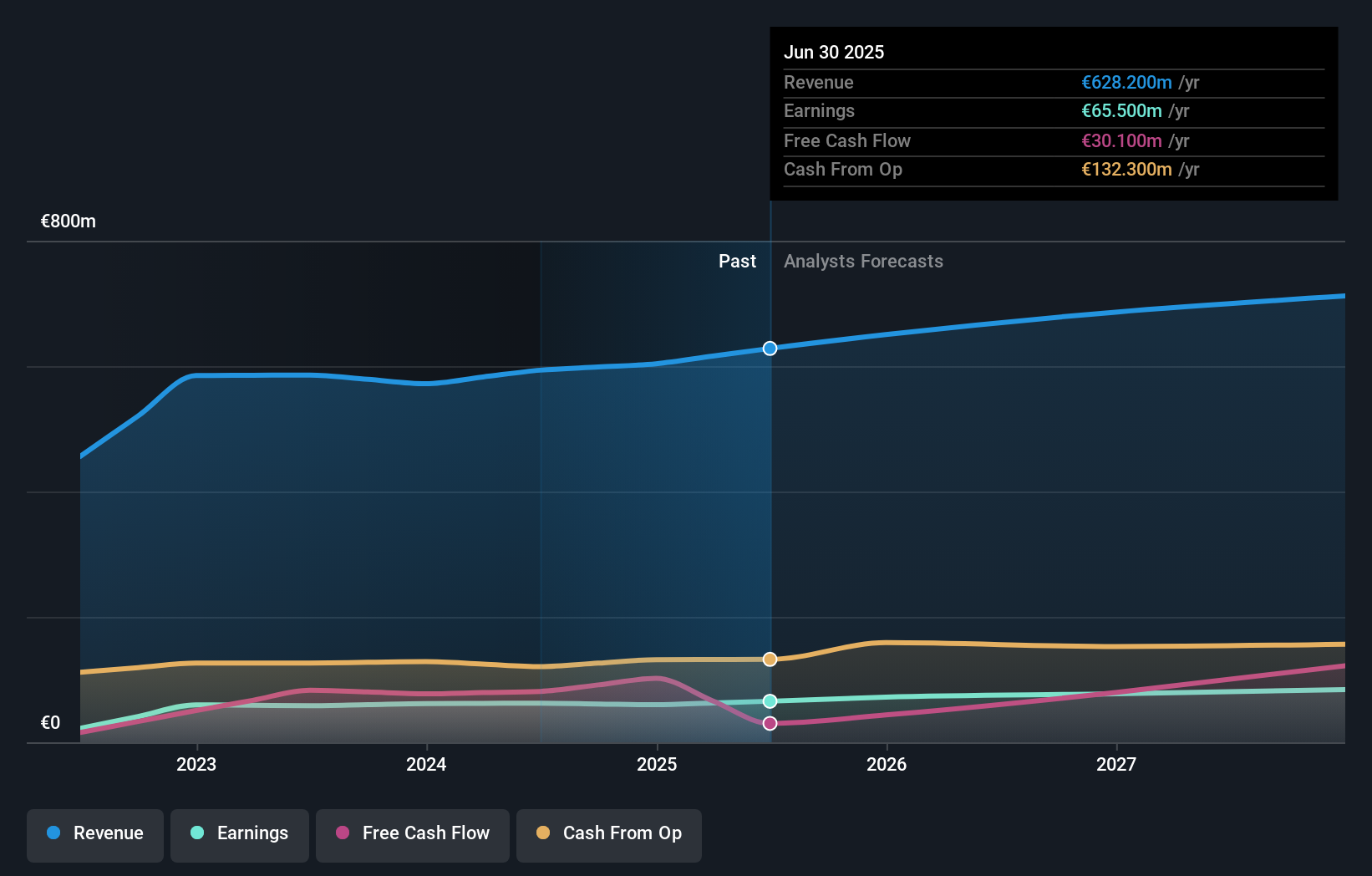

Operations: Irish Continental Group generates revenue primarily from its Ferries segment (€430.10 million) and Container and Terminal operations (€195.80 million).

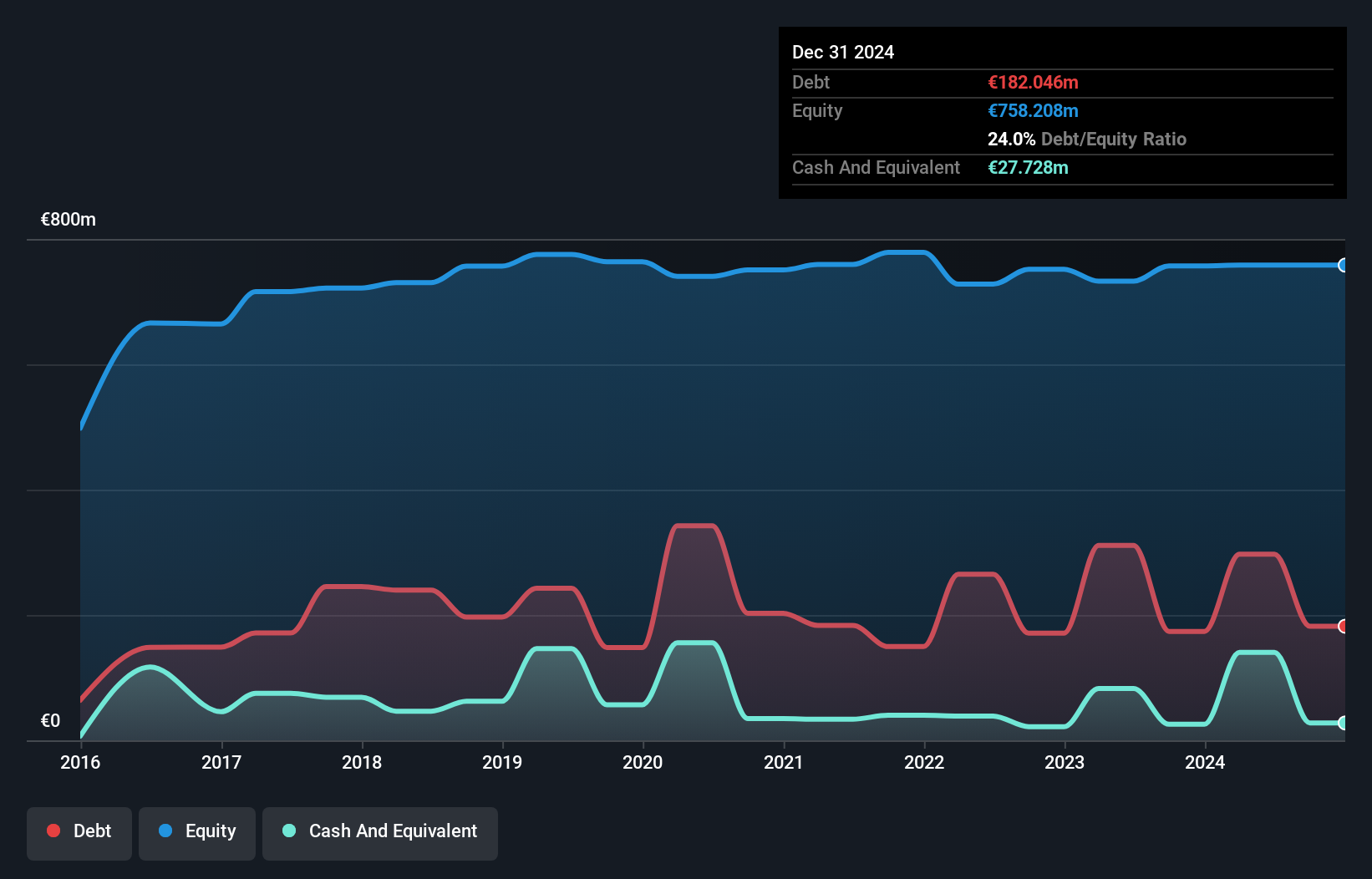

Irish Continental Group, a notable player in the shipping sector, has shown resilience with earnings growth of 7.2% over the past year, outpacing the industry's -34%. Its debt to equity ratio improved from 76% to 53.5% over five years, reflecting prudent financial management. Trading at nearly 10% below its estimated fair value and with interest payments well-covered by EBIT at a 10x ratio, it offers potential for investors seeking undervalued opportunities.

- Dive into the specifics of Irish Continental Group here with our thorough health report.

Gain insights into Irish Continental Group's past trends and performance with our Past report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market capitalization of £1.23 billion.

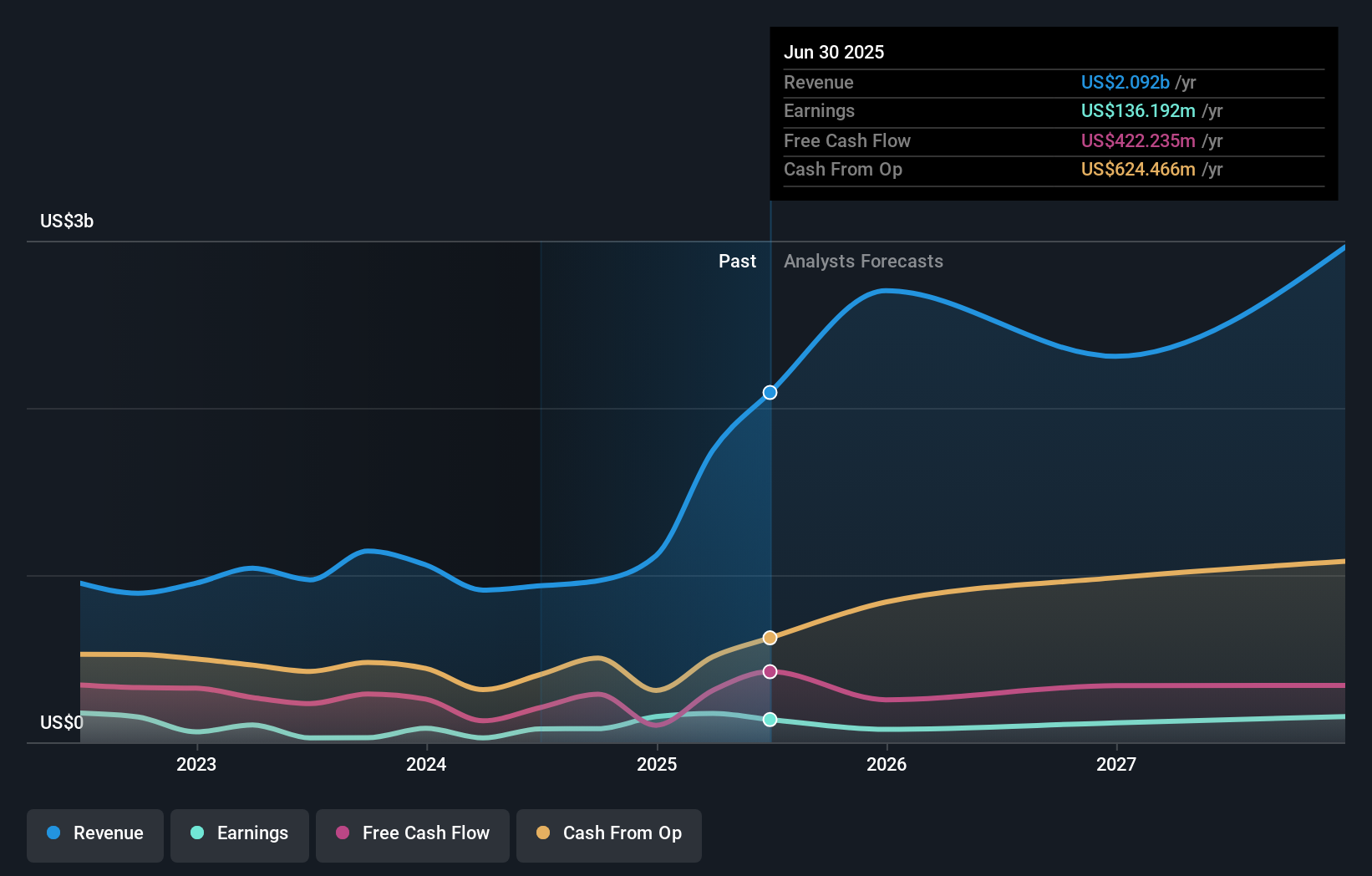

Operations: Seplat Energy generates revenue primarily from oil and gas, with oil contributing $815.03 million and gas $120.87 million.

Seplat Energy, a nimble player in the oil and gas sector, posted impressive earnings growth of 207.6% last year, outpacing the industry's -46.9%. The company's net debt to equity ratio is satisfactory at 20.6%, though it has risen to 41.5% over five years. Recent results show a turnaround with net income at US$39.72 million for Q2 2024, compared to a loss previously, alongside steady production guidance between 44,000-52,000 boepd for the year.

Taking Advantage

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 82 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICGC

Solid track record with adequate balance sheet and pays a dividend.