- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

3 UK Growth Stocks With High Insider Ownership Expecting 80% Earnings Growth

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience declines amid weak trade data from China, investors in the United Kingdom are navigating a complex market landscape. In such uncertain times, growth companies with high insider ownership can offer a unique appeal, as they often indicate strong confidence from those closest to the business and potential resilience against broader economic challenges.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Tortilla Mexican Grill (AIM:MEX) | 27.4% | 120.4% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.6% |

We'll examine a selection from our screener results.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £418.45 million, offers mortgage advice services across the United Kingdom through its subsidiaries.

Operations: The company generates revenue of £243.31 million from its financial services provision in the UK.

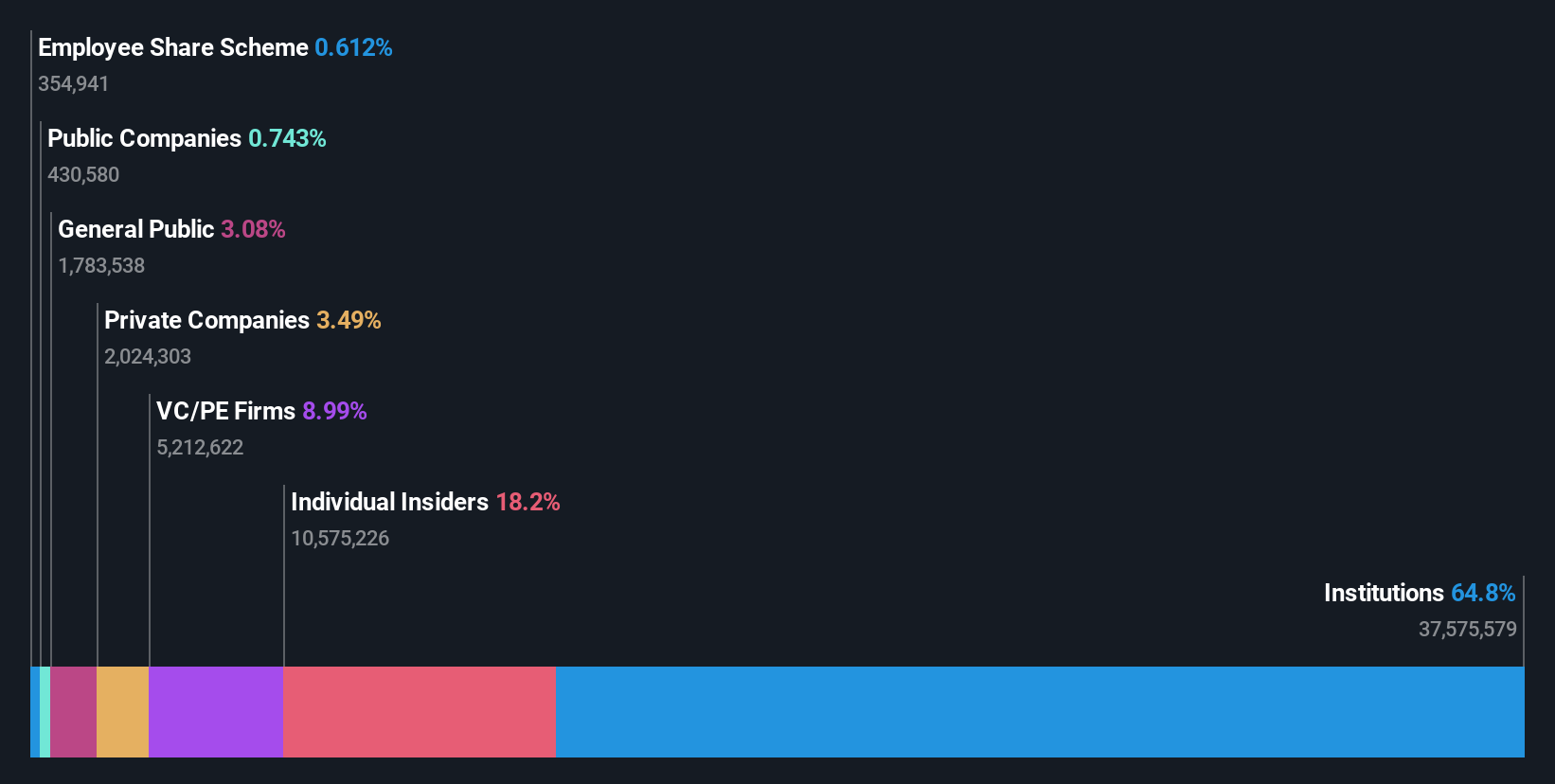

Insider Ownership: 19.8%

Earnings Growth Forecast: 29.6% p.a.

Mortgage Advice Bureau (Holdings) plc showcases strong insider confidence with substantial recent insider buying and no significant selling. Despite a volatile share price, the company is poised for growth, with earnings forecasted to grow significantly at 29.6% annually, outpacing the UK market's 14.1%. However, recent earnings have declined to £3.7 million from £6.42 million year-on-year, raising concerns about dividend sustainability despite high return on equity projections of 27%.

- Click to explore a detailed breakdown of our findings in Mortgage Advice Bureau (Holdings)'s earnings growth report.

- Our comprehensive valuation report raises the possibility that Mortgage Advice Bureau (Holdings) is priced higher than what may be justified by its financials.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £292.79 million.

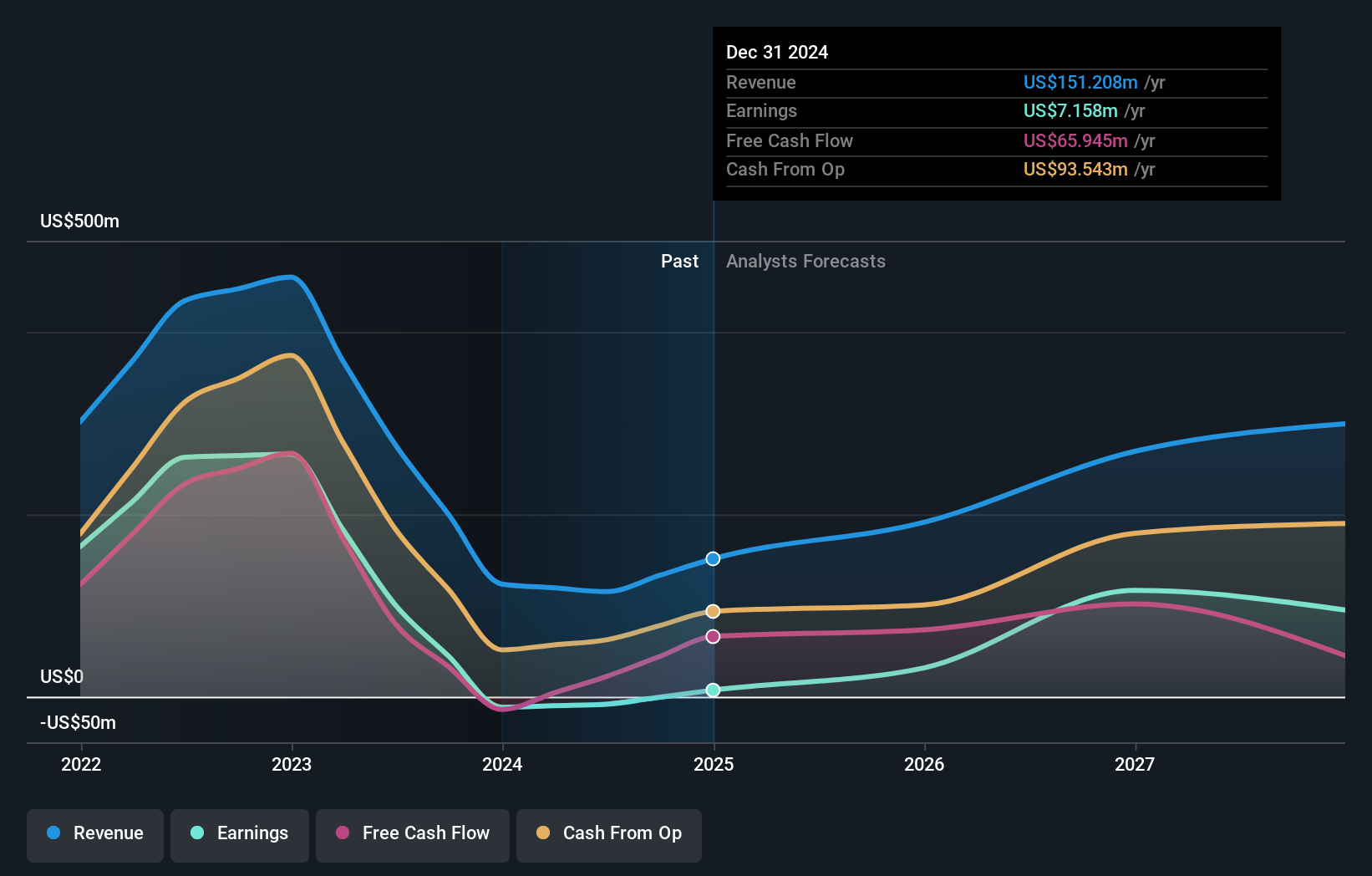

Operations: The company's revenue segment consists of $115.15 million from the exploration and production of oil and gas in the Kurdistan Region of Iraq.

Insider Ownership: 12.2%

Earnings Growth Forecast: 80.6% p.a.

Gulf Keystone Petroleum demonstrates robust insider confidence with substantial recent insider buying and no significant selling. The company is trading at a discount to its estimated fair value and is poised for rapid revenue growth, forecasted at 42.8% annually, significantly outpacing the UK market average. While the company reported modest net income improvement recently, it faces challenges with low return on equity projections. Recent board changes may impact strategic direction positively.

- Delve into the full analysis future growth report here for a deeper understanding of Gulf Keystone Petroleum.

- Insights from our recent valuation report point to the potential overvaluation of Gulf Keystone Petroleum shares in the market.

Stelrad Group (LSE:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally, with a market cap of £193.58 million.

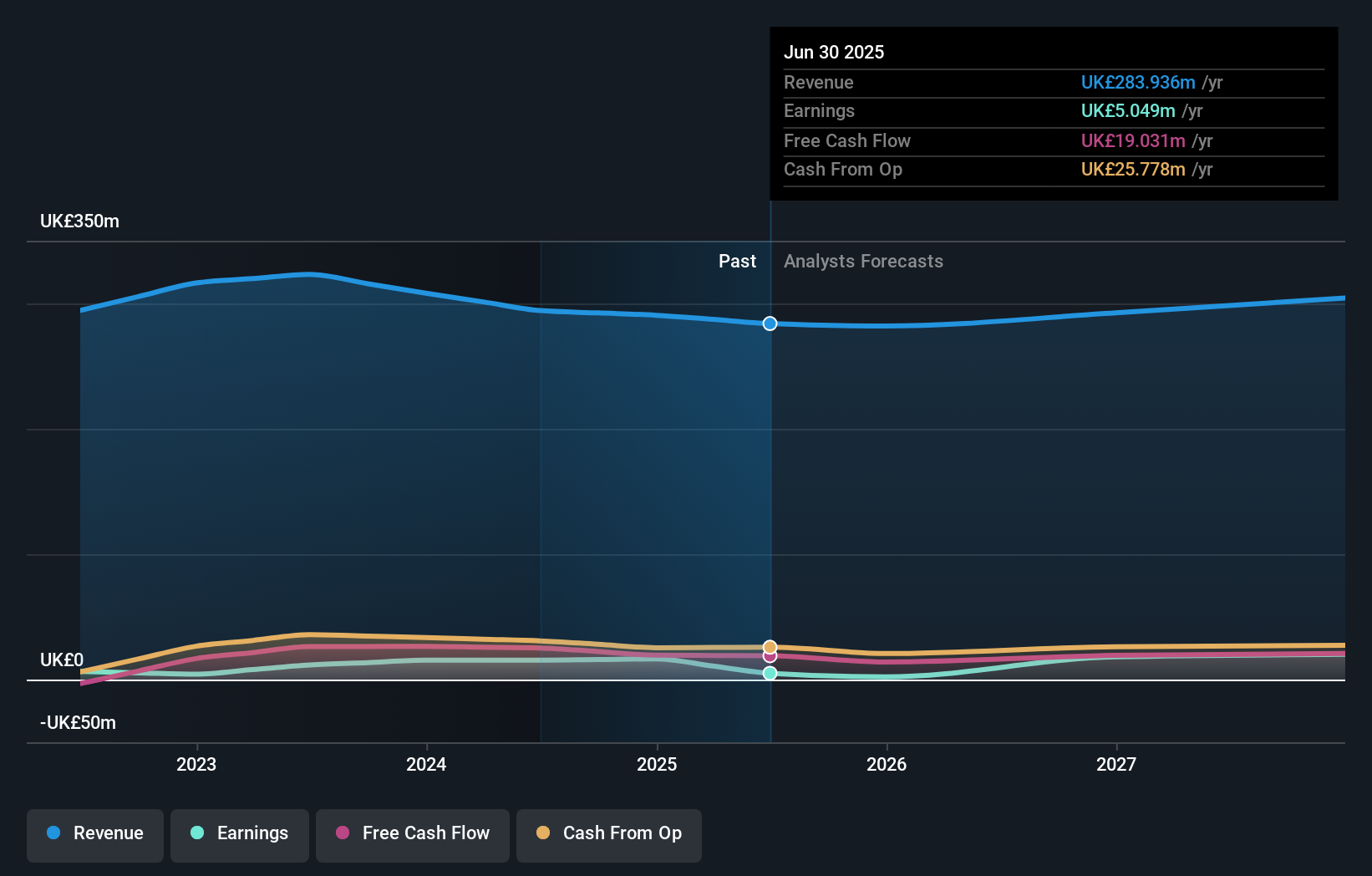

Operations: The company's revenue is primarily derived from the manufacture and distribution of radiators, totaling £294.27 million.

Insider Ownership: 14.8%

Earnings Growth Forecast: 14.5% p.a.

Stelrad Group's high insider ownership is complemented by a stable leadership team, with Leigh Wilcox's recent appointments as CFO and board member. The company trades at a substantial discount to its estimated fair value, despite having a high debt level. Earnings are forecasted to grow 14.5% annually, outpacing the UK market average, though revenue growth remains moderate at 5.2%. Recent earnings showed slight improvement in net income despite declining sales.

- Get an in-depth perspective on Stelrad Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Stelrad Group is priced lower than what may be justified by its financials.

Make It Happen

- Reveal the 65 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

High growth potential with mediocre balance sheet.