- United Kingdom

- /

- Oil and Gas

- /

- LSE:ENOG

UK Growth Companies With Insider Ownership Up To 19%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China and declining commodity prices impacting major mining companies. In this environment, identifying growth companies with high insider ownership can be particularly appealing, as such ownership often signals confidence in the company's long-term prospects despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.1% | 26.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Judges Scientific (AIM:JDG) | 11.2% | 24.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 20.6% | 20.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 24.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.1% | 56.8% |

| Cordel Group (AIM:CRDL) | 33.1% | 148.6% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Let's review some notable picks from our screened stocks.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments and services with a market cap of £558.14 million.

Operations: The company generates revenue through its Vacuum segment, which accounts for £69 million, and its Materials Sciences segment, contributing £64.60 million.

Insider Ownership: 11.2%

Judges Scientific demonstrates robust growth potential with earnings forecasted to grow significantly at 24.4% annually, outpacing the UK market. Despite a high level of debt, its projected return on equity is strong at 20.5%. Recent financial results show modest revenue decline but improved net income and EPS. Insider activity indicates more buying than selling recently, though not in substantial volumes. A proposed dividend increase underscores confidence in future performance pending shareholder approval today.

- Unlock comprehensive insights into our analysis of Judges Scientific stock in this growth report.

- Our valuation report here indicates Judges Scientific may be overvalued.

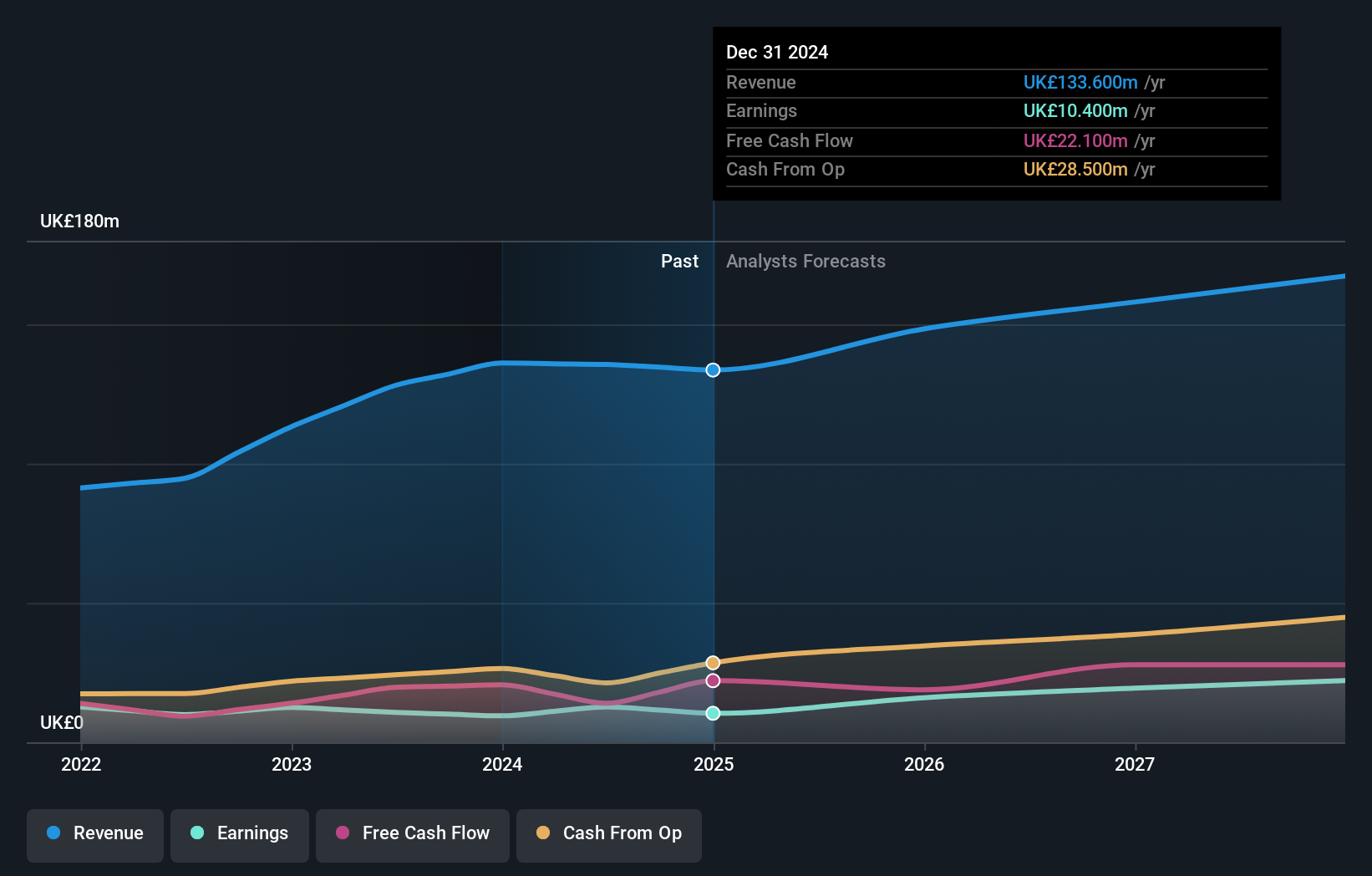

Energean (LSE:ENOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.61 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, amounting to $1.31 billion.

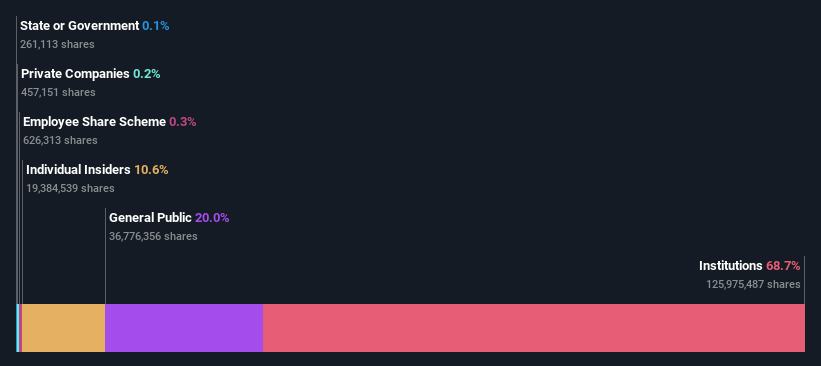

Insider Ownership: 20%

Energean's earnings are forecast to grow at 15% annually, surpassing the UK market average. Despite trading below analyst price targets, insider activity shows more buying than selling recently. However, its dividend yield of 10.25% is not well covered by earnings, and interest payments strain financials. Energean seeks M&A opportunities while focusing on strategic growth and asset optimization in Israel and other regions. The company faces challenges with regulatory approvals for asset sales but remains committed to shareholder returns.

- Click here to discover the nuances of Energean with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Energean's share price might be too pessimistic.

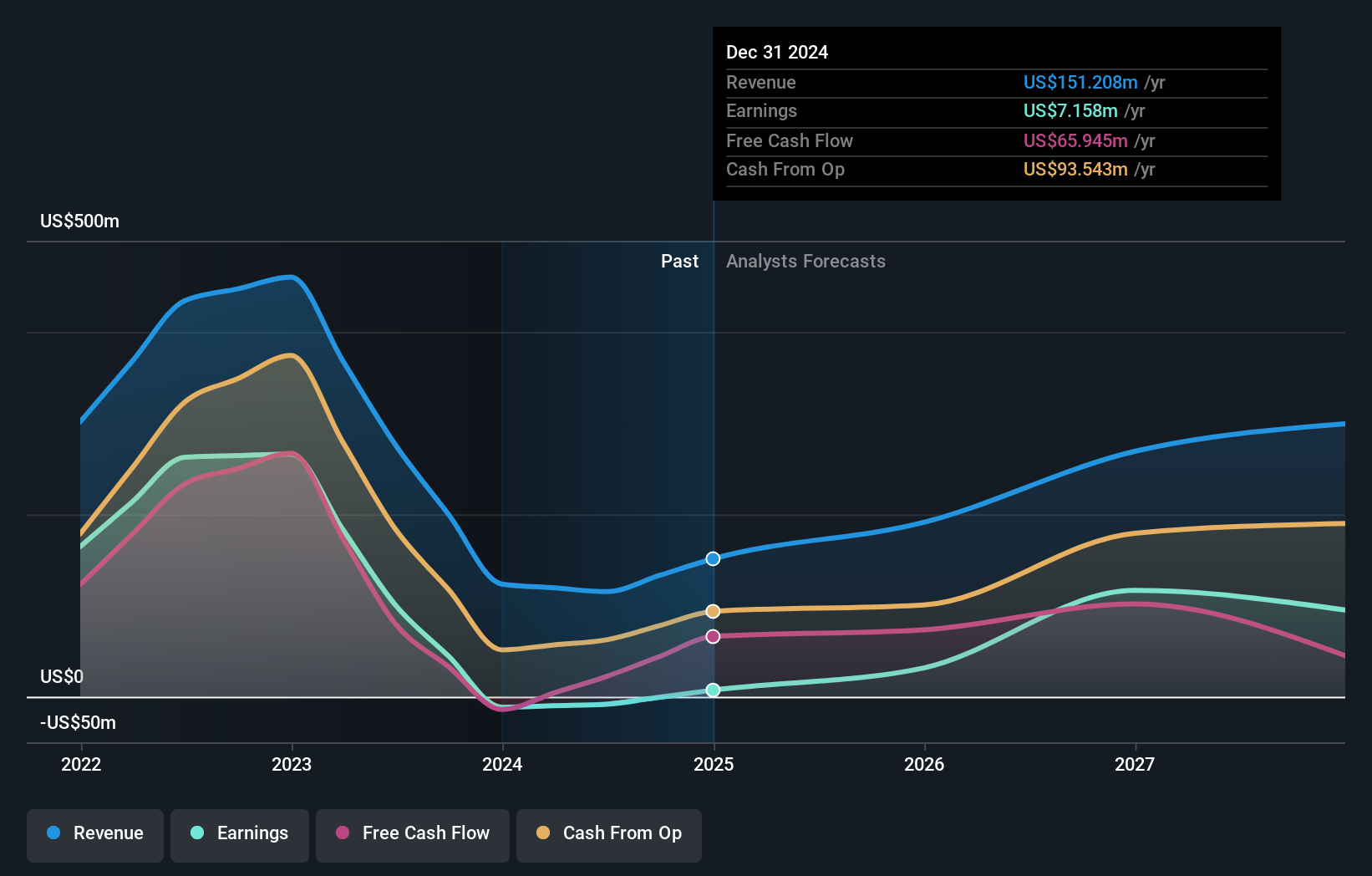

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of approximately £331 million.

Operations: The company's revenue is primarily derived from its activities in the exploration and production of oil and gas, amounting to $151.21 million.

Insider Ownership: 12.4%

Gulf Keystone Petroleum's earnings are projected to grow significantly at 59.2% annually, outpacing the UK market. The company's revenue growth forecast of 23.4% also exceeds the market average, reflecting strong performance potential despite a dividend yield of 11.25% that isn't well covered by earnings. Recent announcements include a $25 million interim dividend under its new shareholder distribution framework and confirmation of production guidance for 2025 amid operational challenges like field decline and regional logistics issues.

- Take a closer look at Gulf Keystone Petroleum's potential here in our earnings growth report.

- Our expertly prepared valuation report Gulf Keystone Petroleum implies its share price may be too high.

Turning Ideas Into Actions

- Get an in-depth perspective on all 62 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Energean, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Energean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENOG

Energean

Engages in the exploration, production, and development of oil and gas.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives