- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

Top UK Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure amid weak trade data from China, investors in the United Kingdom are navigating a challenging market environment. In such conditions, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to weather economic fluctuations while benefiting from steady cash flows.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.26% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.47% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.43% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.02% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.66% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.63% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.87% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.98% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.57% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

BP (LSE:BP.)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BP p.l.c. is a company that offers carbon products and services, with a market cap of approximately £65.01 billion.

Operations: BP p.l.c.'s revenue segments include Customers & Products generating $164.28 billion, Gas & Low Carbon Energy contributing $36.47 billion, and Oil Production & Operations accounting for $26.07 billion.

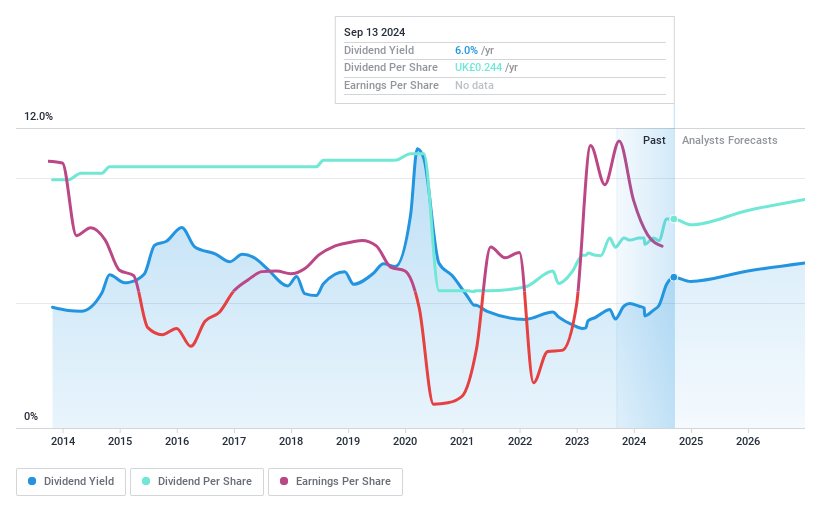

Dividend Yield: 6%

BP's dividend yield is competitive, ranking in the top 25% of UK payers, yet its dividend history shows volatility and reductions over the past decade. The payout ratios are sustainable, with earnings covering dividends at 68.1% and cash flows at 31.1%. Recent strategic moves include divesting its US wind business for an estimated $2 billion to streamline operations and focus on value. Despite a recent net loss, BP continues share buybacks and maintains production guidance for 2024.

- Dive into the specifics of BP here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that BP is priced lower than what may be justified by its financials.

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is involved in iron casting and machining operations across various regions including the United Kingdom, Germany, Sweden, the Netherlands, other parts of Europe, and North and South America, with a market cap of £130.81 million.

Operations: Castings P.L.C. generates its revenue primarily from Foundry Operations (£250.98 million) and Machining Operations (£37.65 million).

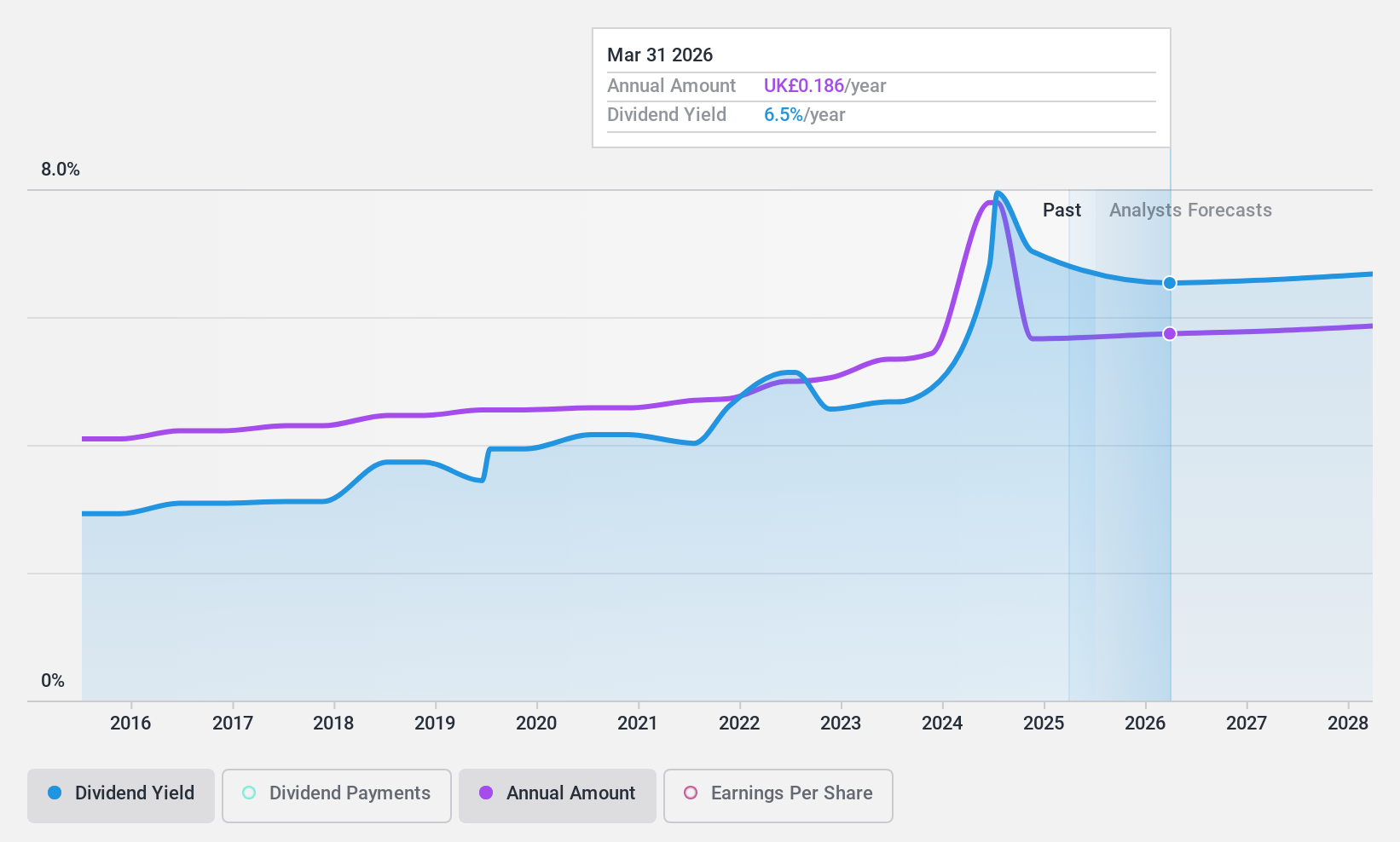

Dividend Yield: 8.4%

Castings offers an attractive dividend yield, ranking in the top 25% of UK payers, with stable and growing dividends over the past decade. However, its payout sustainability is questionable as dividends are not covered by free cash flows, despite being well-covered by earnings. Trading at a significant discount to estimated fair value presents potential appeal. The recent appointment of Stephen Harrison as an independent Non-Executive Director adds experienced leadership but does not directly impact dividend sustainability.

- Navigate through the intricacies of Castings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Castings' share price might be too pessimistic.

Norcros (LSE:NXR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc, with a market cap of £216.38 million, develops, manufactures, and markets bathroom and kitchen products across the United Kingdom, Ireland, and South Africa.

Operations: Norcros plc generates its revenue primarily from the Building Products segment, which accounted for £392.10 million.

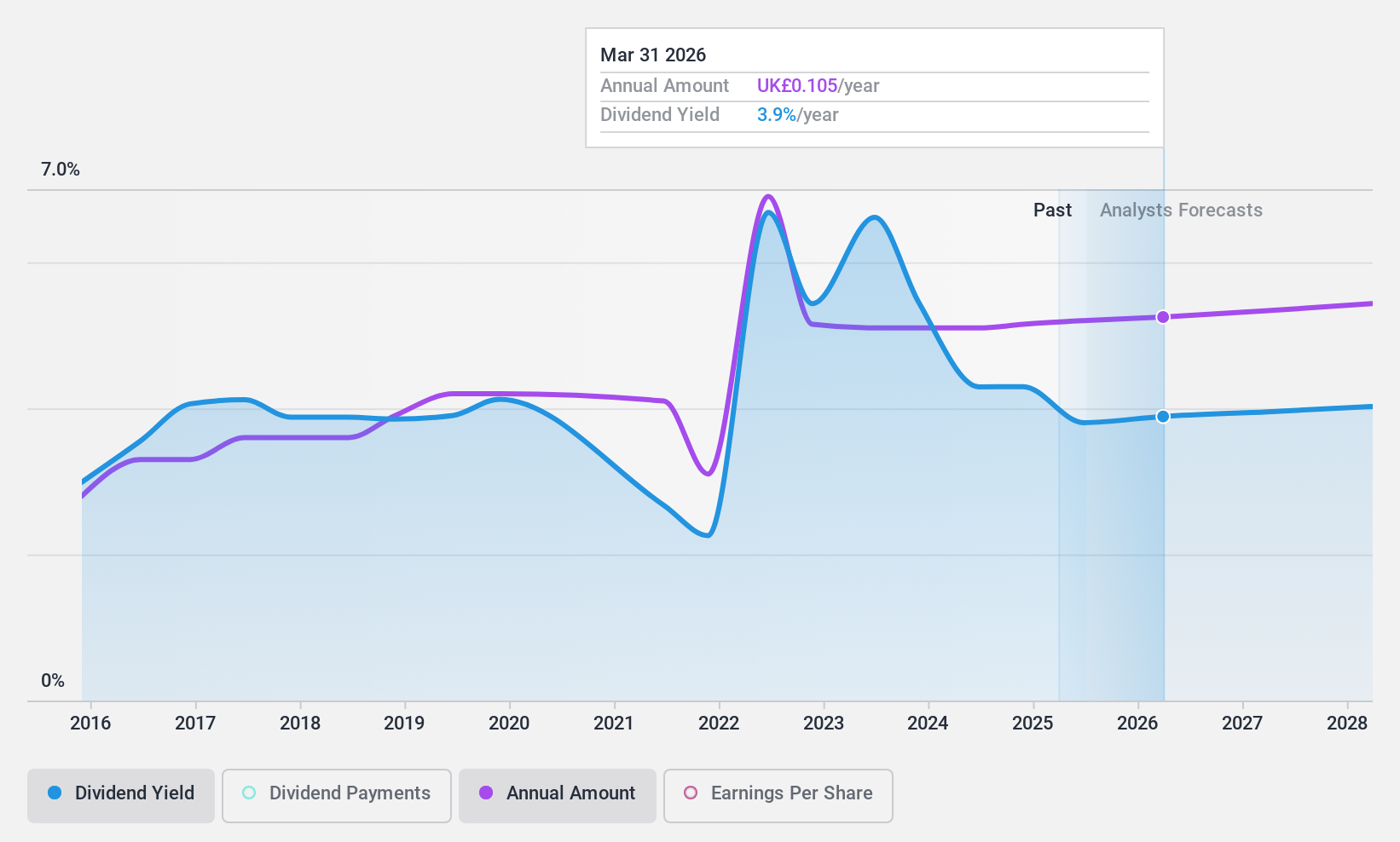

Dividend Yield: 4.2%

Norcros maintains a low cash payout ratio of 31.3%, ensuring dividends are well-covered by cash flows, though its dividend yield of 4.23% is below the top UK payers. Despite earnings growing by £59.5 million last year and a low price-to-earnings ratio of 8.1x, dividend reliability remains an issue due to past volatility and forecasted earnings decline. Recent AGM affirmed a final dividend, but revenue dipped following strategic exits from certain segments.

- Click to explore a detailed breakdown of our findings in Norcros' dividend report.

- The valuation report we've compiled suggests that Norcros' current price could be quite moderate.

Key Takeaways

- Explore the 60 names from our Top UK Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.