- United Kingdom

- /

- Oil and Gas

- /

- LSE:BP.

BP (LSE:BP.) Divests US Wind Assets to Focus on Core Growth and Value Initiatives

Reviewed by Simply Wall St

BP(LSE:BP.) is navigating a dynamic environment marked by both opportunities and challenges. Recent highlights include a 10% increase in dividend payouts and strong financial performance, juxtaposed against rising upstream costs and regulatory uncertainties. In the discussion that follows, we will delve into BP's financial health, operational efficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click here and access our complete analysis report to understand the dynamics of BP.

Strengths: Core Advantages Driving Sustained Success For BP

BP demonstrates strong financial performance, evidenced by generating $8.1 billion in operating cash flow and reducing net debt by $1.4 billion to $22.6 billion, as highlighted by CEO Murray Auchincloss in the latest earnings call. The company also announced a 10% increase in its dividend, reinforcing its commitment to returning value to shareholders. Additionally, BP's cost reduction initiatives aim to deliver $2 billion in savings, showcasing operational efficiency and strategic financial management. The company’s upstream plant reliability and 96% refining availability further underline its operational strengths. BP is also innovating in convenience stores, now ranking in the top five in the U.S., according to Emma Delaney, EVP Customers and Products.

Weaknesses: Critical Issues Affecting BP's Performance and Areas For Growth

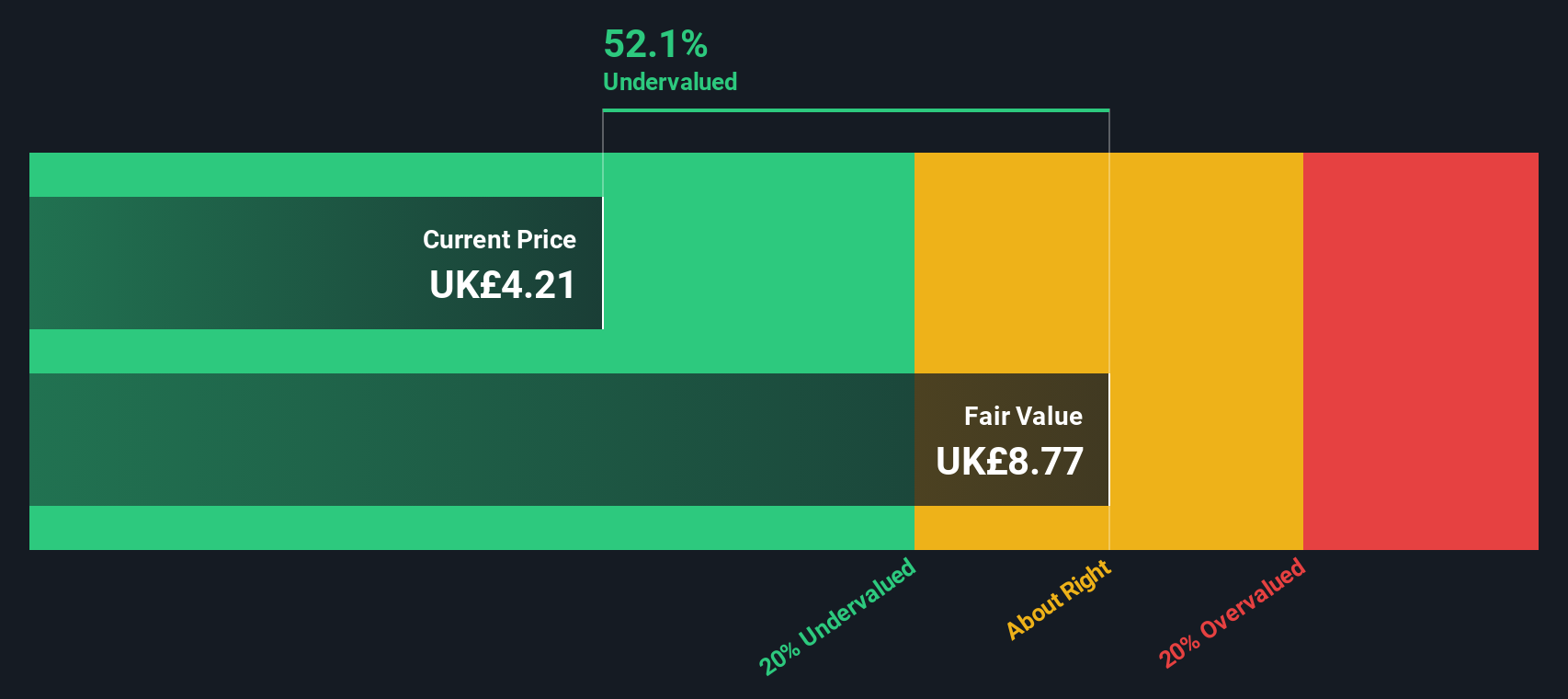

BP faces several financial challenges, including a 4% increase in unit upstream costs and a significant decline in Transition Engine EBITDA, which has halved year-on-year. The market's concern about BP's debt levels, as noted by Biraj Borkhataria from RBC, adds to the financial strain. Additionally, impairments in refining have contributed to high operating costs, as CFO Katherine Thomson pointed out. BP's current Price-To-Earnings Ratio of 11.7x is higher than the peer average of 8.3x and the UK Oil and Gas industry average of 8.7x, suggesting it is expensive compared to its peers. Despite these challenges, BP's dividend payments, covered by earnings with a payout ratio of 68.1%, offer some reassurance of financial stability. The company is currently trading at a Price-To-Earnings Ratio of 11.7x, which is considered expensive compared to its peers and the industry average, yet it is trading below the estimated fair value of £5.13, indicating potential undervaluation according to analyst forecasts.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

BP has several strategic opportunities to enhance its market position. The company is on track to deliver around $1.5 billion from convenience and electrification, as noted by Emma Delaney. The acquisition of Bunge is expected to close in the fourth quarter, potentially adding $2 billion of EBITDA by 2025, according to CEO Murray Auchincloss. BP's market expansion efforts, including rolling out self-serve checkout at retail convenience stores, demonstrate a focus on value and operational efficiency. The company's involvement in the Ruwais LNG project in the UAE, with a 10% stake, further highlights its strategic alliances and market expansion. Learn more about how these opportunities could impact BP's future growth by reviewing our analysis of BP's Future Performance.

Threats: Key Risks and Challenges That Could Impact BP's Success

BP faces several external threats that could impact its growth and market share. Market volatility, as highlighted by Carol Howle, EVP Trading and Shipping, has resulted in lower transport tickets in Europe and short-term oversupply. Regulatory uncertainty also poses a risk, potentially affecting operational stability. The competitive landscape in the energy sector remains intense, with BP needing to maintain flexibility, as noted by CEO Murray Auchincloss. Economic factors, such as signs of consumer recession in the U.S. mentioned by Emma Delaney, could further impact consumer demand and BP's profitability. These challenges underscore the need for BP to navigate external pressures carefully to sustain its market position.

Conclusion

BP's strong financial performance, including significant operating cash flow and debt reduction, underscores its operational efficiency and strategic financial management, which are further supported by cost reduction initiatives and high plant reliability. However, the company faces challenges such as increased upstream costs and declining EBITDA, which highlight areas needing attention. BP's strategic opportunities, like the acquisition of Bunge and expansion into convenience and electrification, offer potential for future growth. Despite trading at a higher Price-To-Earnings Ratio of 11.7x compared to peers, BP's current price below the estimated fair value of £5.13 suggests potential for appreciation, provided it navigates external threats such as market volatility and regulatory uncertainties effectively. This balance of strengths, weaknesses, opportunities, and threats will shape BP's future performance and market position.

Seize The Opportunity

- Have a stake in BP? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

Valuation is complex, but we're here to simplify it.

Discover if BP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:BP.

Adequate balance sheet with moderate growth potential.