- United Kingdom

- /

- Oil and Gas

- /

- AIM:EDR

Should You Be Adding Egdon Resources (LON:EDR) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Egdon Resources (LON:EDR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Egdon Resources

How Fast Is Egdon Resources Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Egdon Resources grew its EPS from UK£0.0014 to UK£0.0046, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

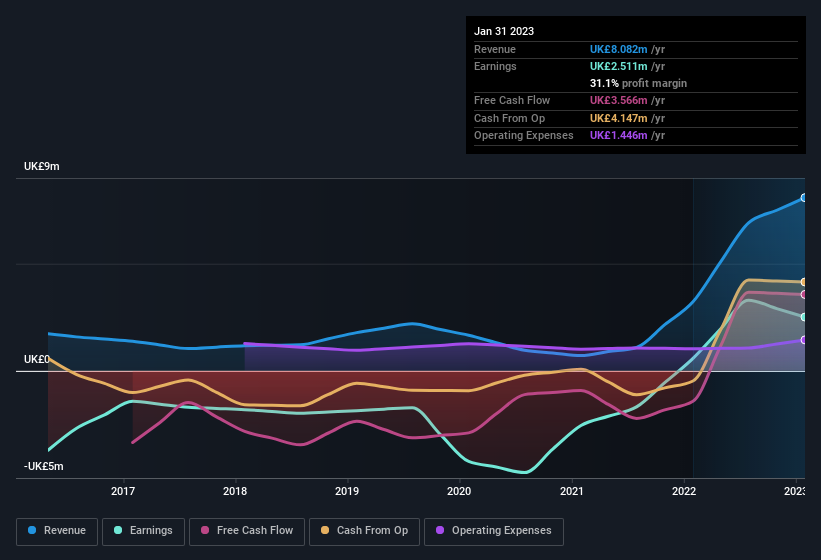

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Egdon Resources is growing revenues, and EBIT margins improved by 5.0 percentage points to 31%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Egdon Resources?

Are Egdon Resources Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Egdon Resources with market caps under UK£160m is about UK£281k.

Egdon Resources' CEO took home a total compensation package worth UK£182k in the year leading up to July 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Egdon Resources To Your Watchlist?

Egdon Resources' earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Egdon Resources has the hallmarks of a quality business; and that would make it well worth watching. Still, you should learn about the 3 warning signs we've spotted with Egdon Resources (including 1 which shouldn't be ignored).

Although Egdon Resources certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Egdon Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:EDR

Egdon Resources

Egdon Resources plc, together with its subsidiaries, explores for and produces hydrocarbons in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)