- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

3 UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices seeing declines amid weak trade data from China, which has impacted commodity prices and companies tied to Chinese demand. In this uncertain environment, identifying growth companies with high insider ownership can be appealing as it often indicates strong confidence from those closely involved in the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 108.1% |

| Foresight Group Holdings (LSE:FSG) | 34.9% | 27% |

| Helios Underwriting (AIM:HUW) | 23.8% | 23.1% |

| LSL Property Services (LSE:LSL) | 10.4% | 26.9% |

| Facilities by ADF (AIM:ADF) | 13.2% | 190% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 25.4% |

| Judges Scientific (AIM:JDG) | 10.7% | 23.7% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

We'll examine a selection from our screener results.

Alphawave IP Group (LSE:AWE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphawave IP Group plc develops and sells connectivity solutions across multiple regions including North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom with a market cap of £1.10 billion.

Operations: The company's revenue is primarily generated from its Communications Equipment segment, totaling $225.52 million.

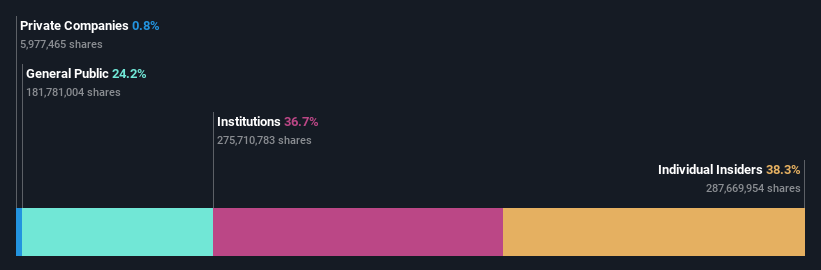

Insider Ownership: 38.3%

Revenue Growth Forecast: 28.1% p.a.

Alphawave IP Group is experiencing significant growth potential with a forecasted revenue increase of 28.1% annually, outpacing the UK market. The company is poised for profitability within three years, aligning with its high insider ownership and innovative advancements in chiplet connectivity solutions. Recent developments include the introduction of a 64 Gbps UCIe IP Subsystem and collaborations like Rebellions Inc., enhancing their position in AI and data center markets despite recent lowered earnings guidance for 2024.

- Click here and access our complete growth analysis report to understand the dynamics of Alphawave IP Group.

- Upon reviewing our latest valuation report, Alphawave IP Group's share price might be too optimistic.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £412.15 million.

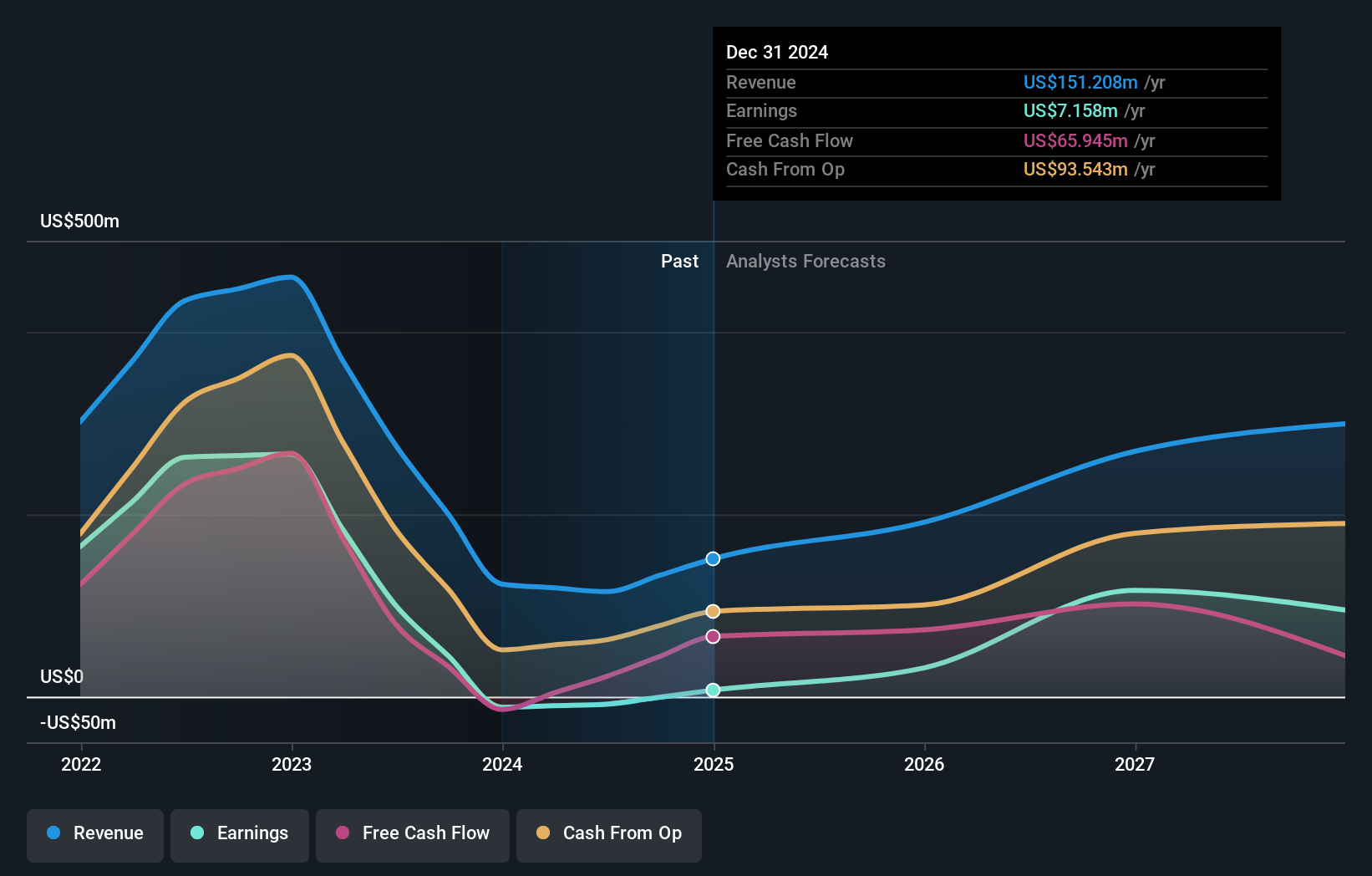

Operations: The company's revenue segment is derived entirely from the exploration and production of oil and gas, amounting to $115.15 million.

Insider Ownership: 12.2%

Revenue Growth Forecast: 31.8% p.a.

Gulf Keystone Petroleum is set for robust growth, with revenue expected to rise by 31.8% annually, surpassing UK market averages. The company anticipates profitability within three years and has seen substantial insider buying recently, indicating confidence in its trajectory. Despite a dividend yield of 7.71% not being well-covered by earnings or cash flows, the stock trades significantly below fair value estimates. Recent production results show an 86% increase year-over-year to 40,689 bopd for 2024.

- Dive into the specifics of Gulf Keystone Petroleum here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Gulf Keystone Petroleum is trading beyond its estimated value.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PensionBee Group plc is a direct-to-consumer financial technology company offering online pension services in the United Kingdom and the United States, with a market cap of £379.25 million.

Operations: The company generates revenue of £28.32 million from its Internet Information Providers segment.

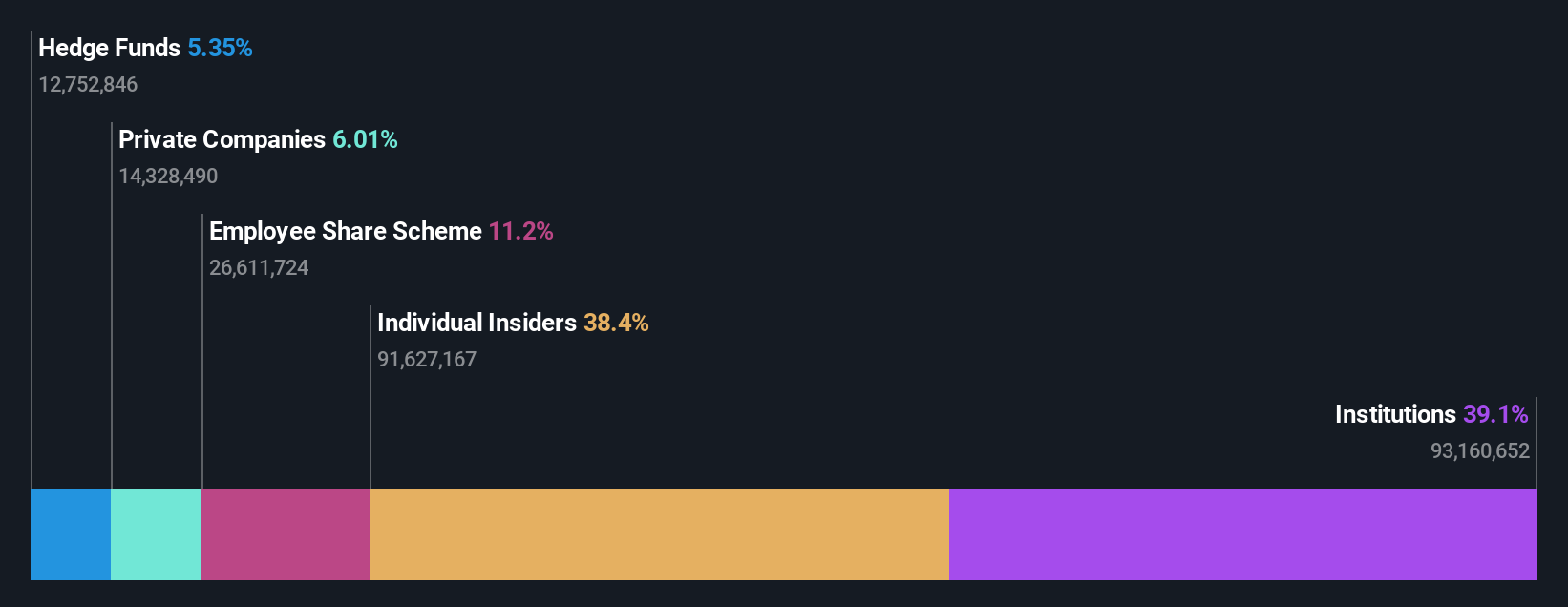

Insider Ownership: 38.7%

Revenue Growth Forecast: 19.2% p.a.

PensionBee Group, listed on the London Stock Exchange, is poised for growth with revenue projected to increase by 19.2% annually, outpacing the UK market. The company aims to achieve profitability within three years and recently raised $25 million for its U.S. expansion efforts. A strategic partnership with State Street Global Advisors enhances its investment offerings via a new app designed to streamline pension management and expand customer engagement in the U.S., having already attracted 10,000 new customers.

- Get an in-depth perspective on PensionBee Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that PensionBee Group is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 61 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives