- United Kingdom

- /

- Capital Markets

- /

- LSE:OCI

Insider Buying: The Oakley Capital Investments Limited (LON:OCI) Senior Partner & Co-Founder Just Bought 4.3% More Shares

Potential Oakley Capital Investments Limited (LON:OCI) shareholders may wish to note that the Senior Partner & Co-Founder, David Till, recently bought UK£196k worth of stock, paying UK£4.46 for each share. Although the purchase only increased their holding by 4.3%, it is still a solid purchase in our view.

See our latest analysis for Oakley Capital Investments

The Last 12 Months Of Insider Transactions At Oakley Capital Investments

In the last twelve months, the biggest single purchase by an insider was when Founder Peter Adam Dubens bought UK£601k worth of shares at a price of UK£3.78 per share. Even though the purchase was made at a significantly lower price than the recent price (UK£4.48), we still think insider buying is a positive. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

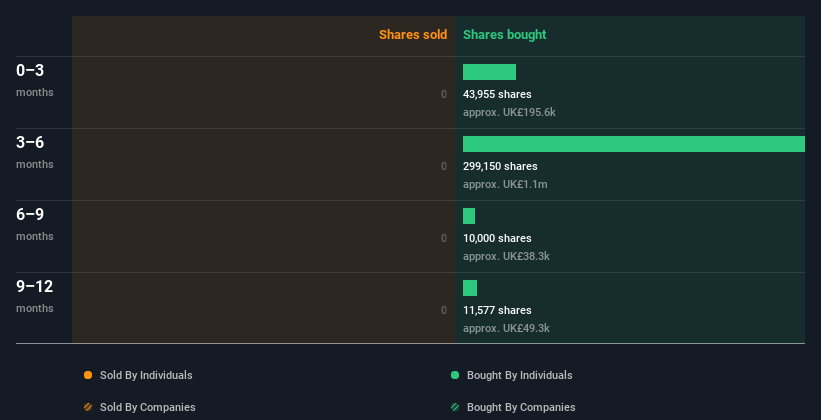

Oakley Capital Investments insiders may have bought shares in the last year, but they didn't sell any. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

Oakley Capital Investments is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership Of Oakley Capital Investments

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Oakley Capital Investments insiders own about UK£88m worth of shares (which is 11% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Oakley Capital Investments Insider Transactions Indicate?

The recent insider purchase is heartening. And an analysis of the transactions over the last year also gives us confidence. Insiders likely see value in Oakley Capital Investments shares, given these transactions (along with notable insider ownership of the company). In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Oakley Capital Investments. For example - Oakley Capital Investments has 1 warning sign we think you should be aware of.

But note: Oakley Capital Investments may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you're looking to trade Oakley Capital Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:OCI

Oakley Capital Investments

A private equity and venture capital firm specializing in investments in early stage, series B, growth, late stage, emerging growth, small, mid-markets, corporate carve-outs, buyouts, mezzanine, restructuring, management buy-outs, management buy-ins, small-mid buyout, mid-buyout, public to privates, re-financings, secondary purchases, growth capital, turnarounds, industry consolidation, business roll-outs and buy-and-build investments as well as investments in other funds.

Mediocre balance sheet very low.

Market Insights

Community Narratives