- United Kingdom

- /

- Capital Markets

- /

- LSE:MOH

Bakkavor Group And 2 Other Promising UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China impacting global economic sentiment. Despite these broader market pressures, there remain opportunities for investors willing to explore smaller companies that may offer potential value. Penny stocks, though an outdated term, still highlight smaller or less-established companies that can provide significant growth opportunities when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.59 | £513.88M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.78 | £11.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.125 | £15.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.485 | $281.94M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.883 | £326.51M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.1M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.42 | £73.73M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.828 | £690.48M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 290 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, is involved in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market cap of approximately £1.25 billion.

Operations: The company's revenue is primarily derived from the United Kingdom, contributing £1.95 billion, with an additional £233 million generated from the United States.

Market Cap: £1.25B

Bakkavor Group's recent financial performance reflects challenges typical of penny stocks, with net income declining to £16.8 million for the half year ended June 28, 2025. Despite this, Bakkavor maintains a satisfactory net debt to equity ratio of 33.2% and has reduced its debt significantly over five years. The company's earnings were impacted by a £44.2 million one-off loss, though it still manages to cover interest payments well with EBIT at five times coverage. While profit margins have decreased from last year, Bakkavor is trading slightly below its estimated fair value and forecasts suggest potential earnings growth ahead.

- Click here to discover the nuances of Bakkavor Group with our detailed analytical financial health report.

- Gain insights into Bakkavor Group's future direction by reviewing our growth report.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market capitalization of approximately £1.05 billion.

Operations: The company generates revenue primarily through its building and property development segment, amounting to €778.20 million.

Market Cap: £1.05B

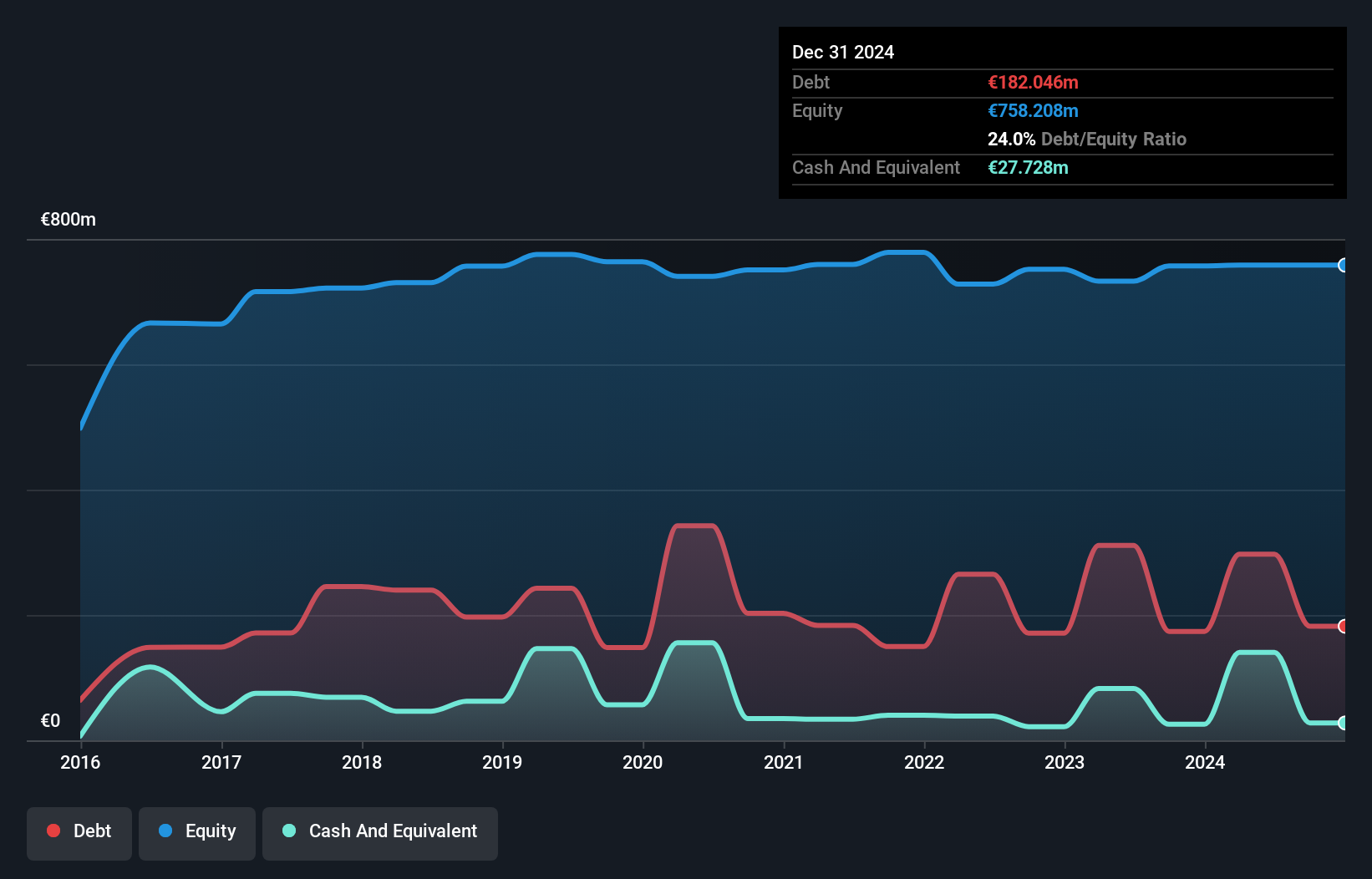

Cairn Homes has experienced a challenging period, with half-year sales declining to €284.46 million from €366.13 million and net income falling to €31.69 million from the previous year's €46.89 million. Despite these setbacks, the company maintains strong financial stability, with short-term assets exceeding both short and long-term liabilities significantly. However, its dividend of 4.22% is not well covered by free cash flows, raising sustainability concerns. The company's debt level remains high with a net debt to equity ratio of 40.3%, though interest payments are well covered by EBIT at nearly ten times coverage, indicating robust earnings quality amidst volatility in earnings growth.

- Dive into the specifics of Cairn Homes here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Cairn Homes' future.

MOH Nippon (LSE:MOH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MOH Nippon Plc offers real estate crowdfunding services in Japan and has a market cap of £78.31 million.

Operations: The company generates revenue from commission services amounting to ¥1.91 billion and its real estate operations totaling ¥2.10 billion.

Market Cap: £78.31M

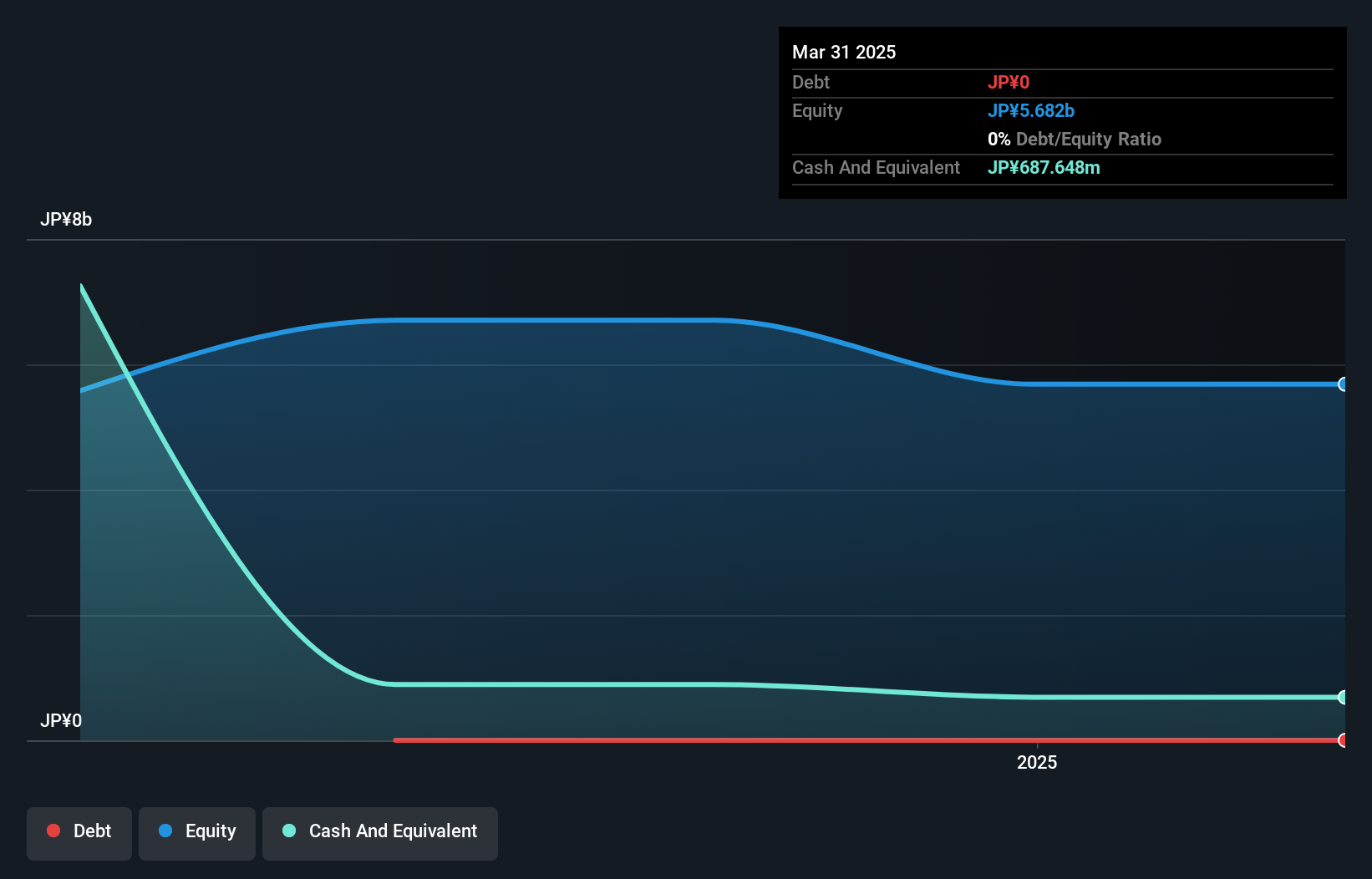

MOH Nippon Plc has faced significant challenges, with annual revenue dropping to ¥4.01 billion from ¥11.11 billion, resulting in a net loss of ¥1.47 billion compared to a previous net income of ¥2.08 billion. Despite this, the company remains debt-free and maintains strong short-term financial stability with assets totaling ¥5.2 billion against liabilities of only ¥634.8 million combined short and long term liabilities. Leadership changes have occurred recently, with Kazuo Ichimura stepping in as Chairman following Chiaki Takahashi's resignation, which may impact strategic direction amidst its current volatility and unprofitability issues.

- Click to explore a detailed breakdown of our findings in MOH Nippon's financial health report.

- Explore historical data to track MOH Nippon's performance over time in our past results report.

Next Steps

- Gain an insight into the universe of 290 UK Penny Stocks by clicking here.

- Interested In Other Possibilities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MOH

Flawless balance sheet with low risk.

Market Insights

Community Narratives