- United Kingdom

- /

- Capital Markets

- /

- LSE:LIO

Does Liontrust Asset Management (LON:LIO) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Liontrust Asset Management (LON:LIO). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Liontrust Asset Management

Liontrust Asset Management's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Liontrust Asset Management has grown EPS by 47% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

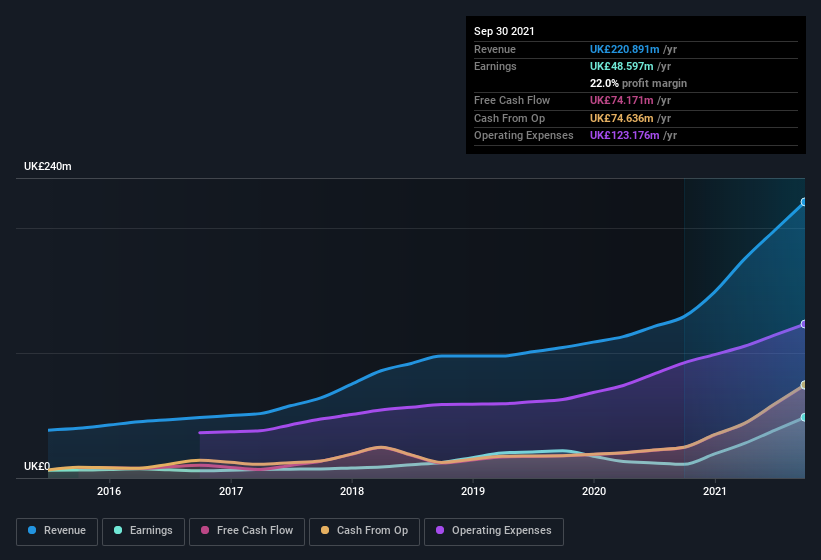

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Liontrust Asset Management is growing revenues, and EBIT margins improved by 13.7 percentage points to 34%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Liontrust Asset Management's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Liontrust Asset Management Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Liontrust Asset Management insiders both bought and sold shares over the last twelve months, but they did end up spending UK£29k more on stock than they received from selling it. So, on balance, the insider transactions are mildly encouraging. We also note that it was the CEO & Executive Director, John Ions, who made the biggest single acquisition, paying UK£612k for shares at about UK£12.31 each.

On top of the insider buying, it's good to see that Liontrust Asset Management insiders have a valuable investment in the business. Indeed, they hold UK£19m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Liontrust Asset Management Worth Keeping An Eye On?

Liontrust Asset Management's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Liontrust Asset Management belongs on the top of your watchlist. You should always think about risks though. Case in point, we've spotted 4 warning signs for Liontrust Asset Management you should be aware of.

As a growth investor I do like to see insider buying. But Liontrust Asset Management isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:LIO

Liontrust Asset Management

Liontrust Asset Management Plc is a publicly owned investment manager.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.