- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

Exploring Property Franchise Group And Two More Top UK Dividend Stocks

Reviewed by Kshitija Bhandaru

As the United Kingdom's financial markets exhibit resilience, with the FTSE 100 reaching new heights amid global economic fluctuations, investors are keenly observing market trends and potential opportunities. In this context, understanding what constitutes a robust dividend stock becomes crucial, especially in a landscape where steady income streams are highly valued against the backdrop of current economic events.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.52% | ★★★★★★ |

| Dunelm Group (LSE:DNLM) | 7.85% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.47% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.24% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.78% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.19% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 3.62% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 3.14% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.41% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.20% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Property Franchise Group (AIM:TPFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, manages residential real estate properties with a market capitalization of approximately £236.85 million.

Operations: The Property Franchise Group PLC generates its revenue primarily from two segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

Dividend Yield: 3.2%

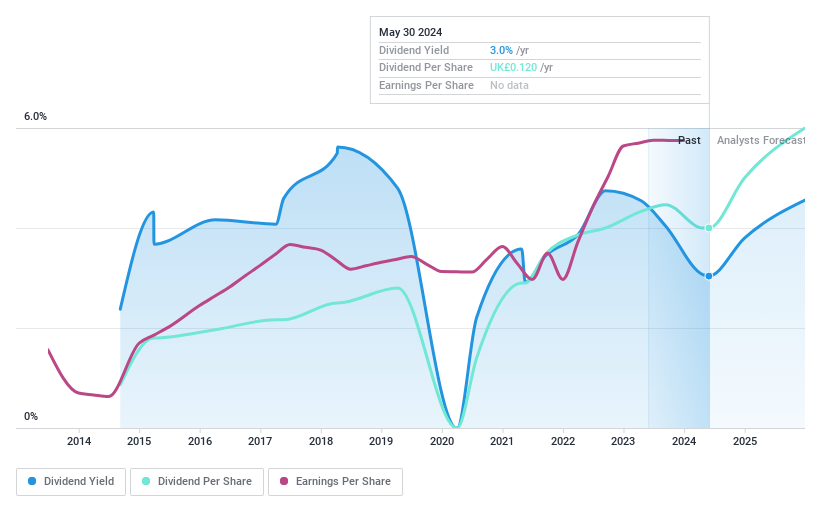

Property Franchise Group's dividend history shows a mix of strengths and concerns. While the company has increased its dividend payments over the past decade, these payments have been volatile, with significant annual fluctuations. The dividends are well-covered by earnings, with a payout ratio of 52.2%, and reasonably covered by cash flows at 85.4%. However, TPFG’s dividend yield stands at 3.16%, which is low relative to the top UK dividend payers' average of 5.78%. Additionally, recent financials indicate slight growth in sales and net income year-over-year for 2023, suggesting some level of earnings stability despite past dividend inconsistencies.

- Navigate through the intricacies of Property Franchise Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Property Franchise Group implies its share price may be lower than expected.

Kaspi.kz (LSE:KSPI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joint Stock Company Kaspi.kz operates in the Republic of Kazakhstan, offering payments, marketplace, and fintech solutions to consumers and merchants, with a market capitalization of approximately $22.83 billion.

Operations: Kaspi.kz generates revenue primarily through three segments: fintech (₸1.03 billion), payments (₸0.48 billion), and marketplace (₸0.45 billion).

Dividend Yield: 6.3%

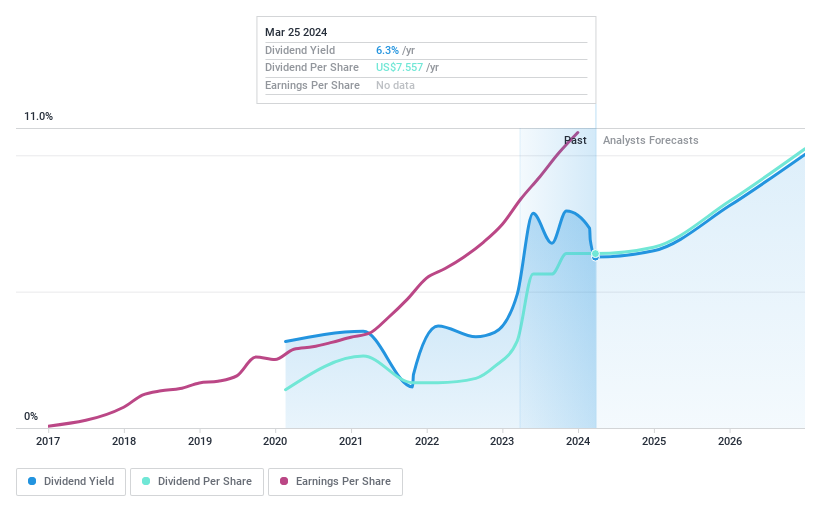

Kaspi.kz has shown a robust increase in earnings, with a notable 43.8% growth over the past year and projections for continued expansion at 16.98% annually. Despite this strong earnings performance, the company's dividend history is marked by instability; it has only been paying dividends for four years with fluctuating payments. However, its current dividend yield of 6.27% is competitive, standing above the UK market average of 6.08%. Dividends are well-supported by both earnings and cash flows, with payout ratios of 72.2% and 61%, respectively. Recent corporate actions include an approved dividend payment at its AGM on April 8, 2024, but investors should note Kaspi.kz’s delisting from the London Stock Exchange as of March 25, which may affect liquidity and accessibility for some investors.

- Unlock comprehensive insights into our analysis of Kaspi.kz stock in this dividend report.

- Upon reviewing our latest valuation report, Kaspi.kz's share price might be too pessimistic.

TBC Bank Group (LSE:TBCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of services including banking, leasing, brokerage, insurance, and card processing with a market capitalization of approximately £1.87 billion.

Operations: TBC Bank Group PLC generates revenue primarily from its Georgian financial services, contributing ₾2.02 billion, with additional segments in Uzbekistan through Payme and TBC UZ totaling ₾173 million.

Dividend Yield: 6.2%

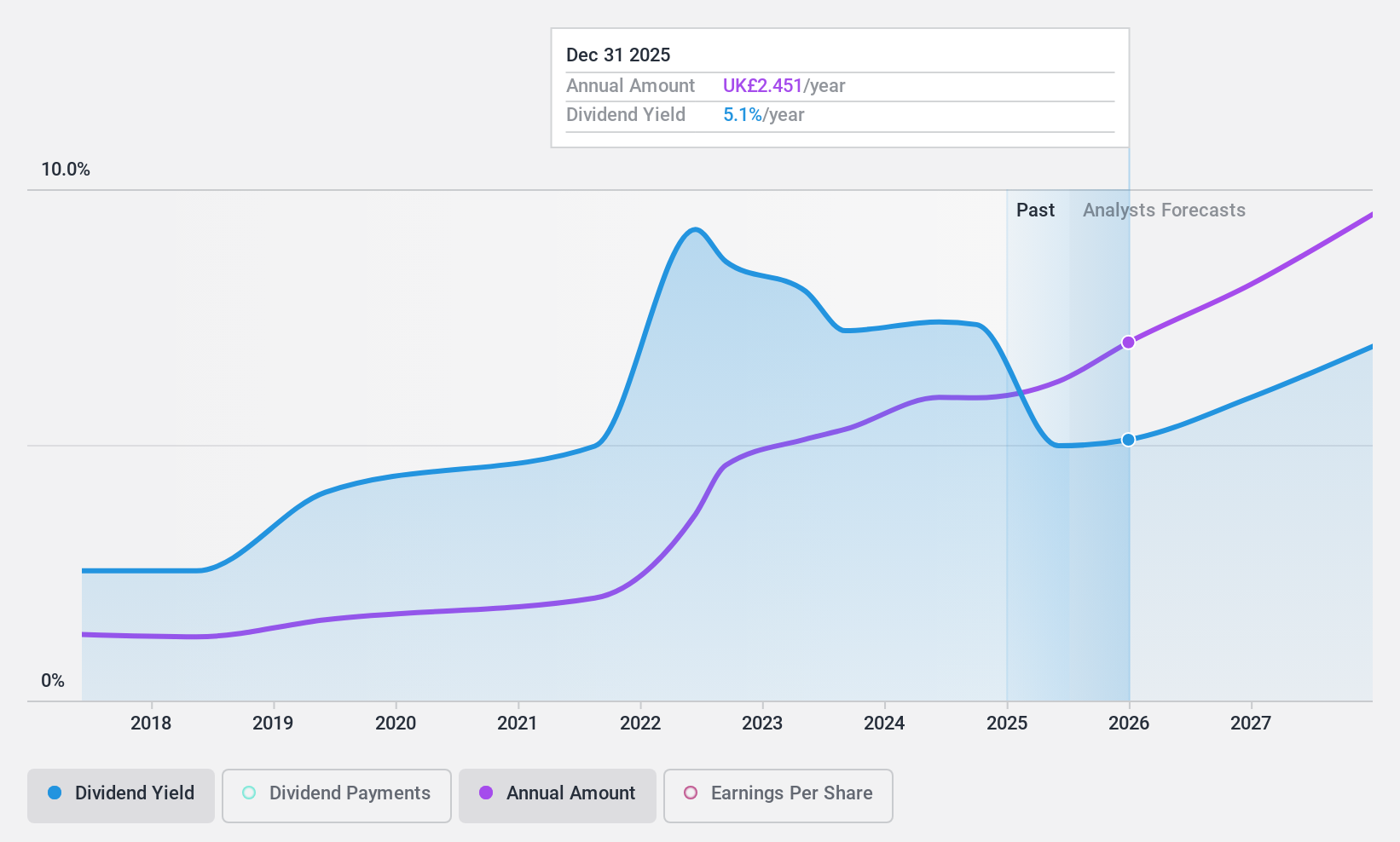

TBC Bank Group has demonstrated strong financial performance with a 23.3% annual earnings growth over the past five years and is projected to grow at 14.95% annually. Its dividend yield of 6.23% ranks in the top quartile of UK dividend payers, supported by a sustainable payout ratio of 28.4%. Despite its reliable dividends, TBCG’s dividend history is relatively short at seven years, posing potential concerns about long-term stability. The company recently proposed a final dividend for 2023 of GEL 4.67 per share, pending shareholder approval, indicating confidence in ongoing profitability and shareholder returns.

- Click here to discover the nuances of TBC Bank Group with our detailed analytical dividend report.

- The analysis detailed in our TBC Bank Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Explore the 55 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TPFG

Property Franchise Group

Manages and leases residential real estate properties in the United Kingdom.

High growth potential and good value.