- United Kingdom

- /

- Capital Markets

- /

- LSE:ASHM

Insider Buying Highlights Undervalued Small Caps On UK Exchange January 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and a broader global economic slowdown. As larger indices falter, attention may turn to small-cap stocks on the UK exchange, where insider buying can sometimes indicate potential value opportunities amidst uncertain market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| NCC Group | NA | 1.3x | 26.67% | ★★★★★★ |

| 4imprint Group | 15.7x | 1.3x | 39.66% | ★★★★★☆ |

| Breedon Group | 15.1x | 1.0x | 47.09% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.29% | ★★★★★☆ |

| Robert Walters | 35.7x | 0.2x | 28.90% | ★★★★☆☆ |

| Sabre Insurance Group | 11.2x | 1.5x | 13.95% | ★★★★☆☆ |

| iomart Group | 24.1x | 0.6x | 33.95% | ★★★★☆☆ |

| Warpaint London | 24.1x | 4.2x | 1.38% | ★★★☆☆☆ |

| Telecom Plus | 17.7x | 0.7x | 31.32% | ★★★☆☆☆ |

| THG | NA | 0.3x | -517.31% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a UK-based real estate investment trust specializing in the development and management of primary care properties, with a market cap of £2.19 billion.

Operations: Core revenue reached £164.4 million, with a gross profit margin of 90.75%. Operating expenses were recorded at £14.3 million, while non-operating expenses stood at £68.8 million, impacting net income significantly.

PE: 18.1x

Assura, a player in the UK market, shows potential as an undervalued opportunity. Despite its reliance on external borrowing for funding, which carries higher risk than customer deposits, the company reported a significant turnaround with net income of £77.1 million for the half-year ending September 2024, compared to a loss previously. Insider confidence is evident with recent share purchases throughout 2024. While earnings are expected to grow by nearly 20% annually, investors should consider its financial structure and past shareholder dilution when evaluating future prospects.

- Click to explore a detailed breakdown of our findings in Assura's valuation report.

Gain insights into Assura's past trends and performance with our Past report.

Ashmore Group (LSE:ASHM)

Simply Wall St Value Rating: ★★★☆☆☆

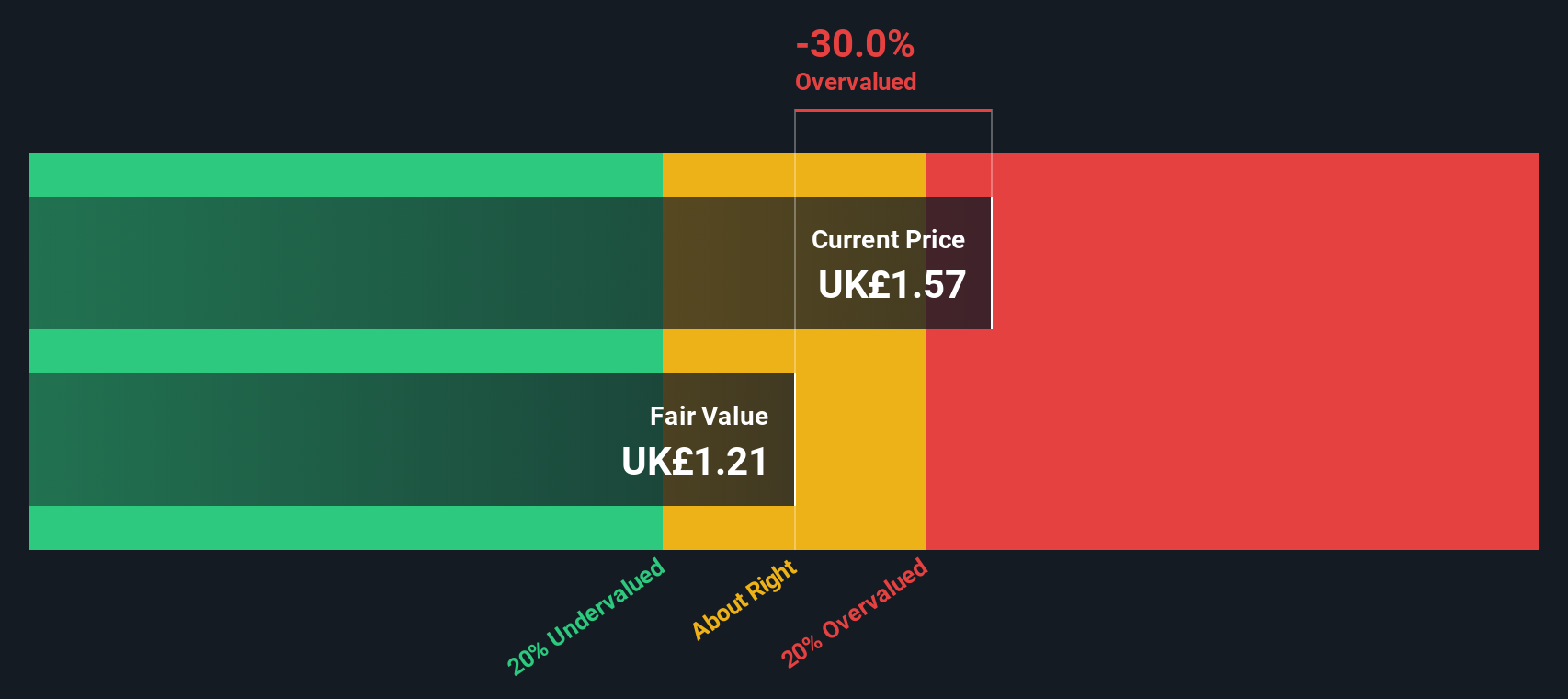

Overview: Ashmore Group is a UK-based investment management company specializing in emerging markets, with a market capitalization of approximately £1.57 billion.

Operations: The company generates revenue primarily from investment management services, with recent figures showing £186.8 million. The cost of goods sold has increased to £85.1 million, impacting the gross profit margin, which is currently at 54.44%. Operating expenses are consistent at £29.8 million, while non-operating activities have resulted in a credit of -£21.8 million for the latest period.

PE: 11.1x

Ashmore Group, a UK-based investment manager, has caught attention with insider confidence as insiders purchased shares over the past year. Despite facing challenges with external borrowing as its sole funding source, the company remains committed to shareholder returns, affirming a final dividend of £0.12 per share for the year ending June 2024. However, projected earnings decline by an average of 5.1% annually over the next three years presents potential headwinds in its growth trajectory.

- Get an in-depth perspective on Ashmore Group's performance by reading our valuation report here.

Gain insights into Ashmore Group's historical performance by reviewing our past performance report.

Marston's (LSE:MARS)

Simply Wall St Value Rating: ★★★★★☆

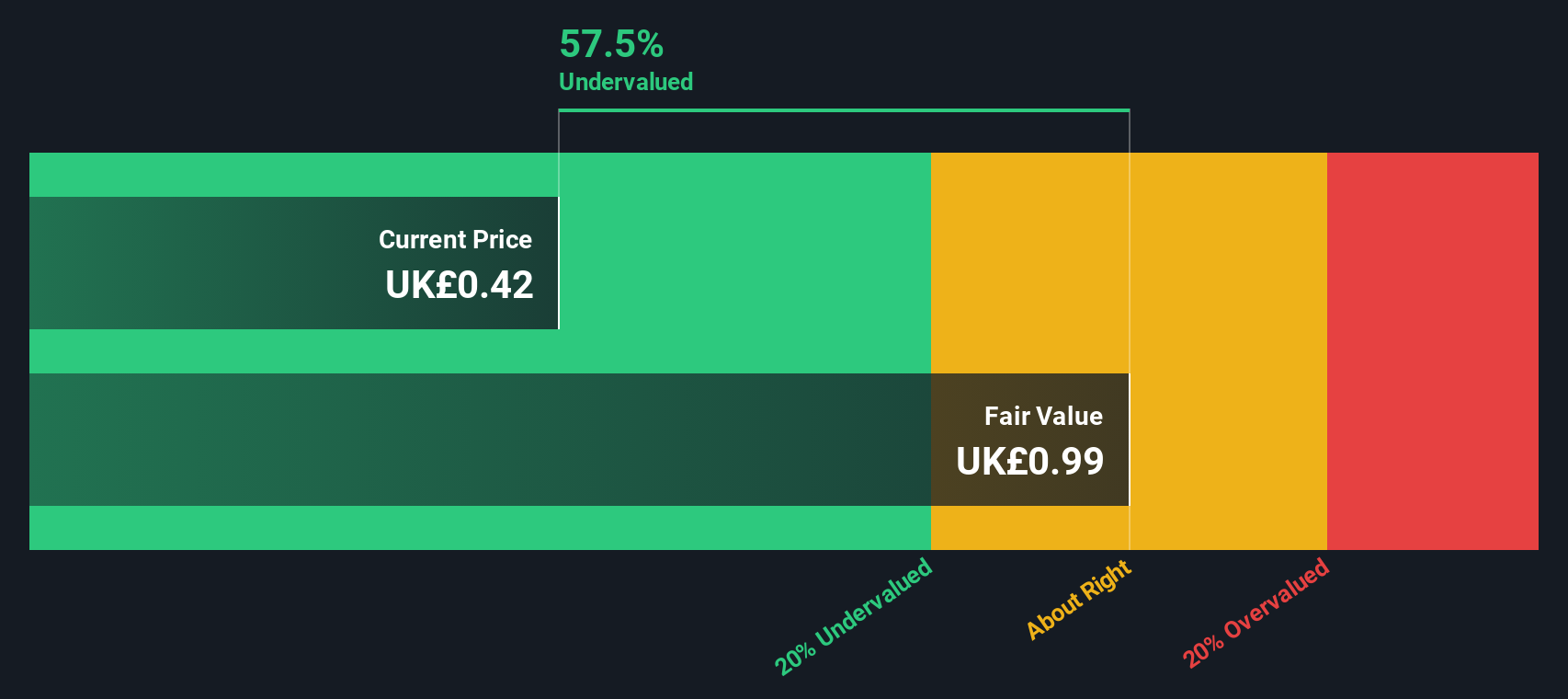

Overview: Marston's operates a network of pubs and bars, focusing on hospitality services, with a market capitalization of approximately £0.39 billion.

Operations: The company generates revenue primarily from its Pubs and Bars segment, with a recent gross profit margin of 51.87%. Operating expenses and non-operating expenses are significant cost components impacting net income, which was £17.5 million in the latest period.

PE: 15.3x

Marston's, a smaller player in the UK market, shows potential despite facing challenges. Their recent earnings call highlighted sales of £898.6 million for the year ending September 2024, up from £872.3 million previously, though net loss widened to £18.5 million. CEO and Director Justin Platt's purchase of 148,103 shares valued at approximately £66,528 signals insider confidence amidst financial hurdles like high-risk funding and insufficient interest coverage by earnings. Earnings are projected to grow annually by 36%, hinting at future opportunities for improvement.

- Unlock comprehensive insights into our analysis of Marston's stock in this valuation report.

Examine Marston's past performance report to understand how it has performed in the past.

Summing It All Up

- Unlock more gems! Our Undervalued UK Small Caps With Insider Buying screener has unearthed 32 more companies for you to explore.Click here to unveil our expertly curated list of 35 Undervalued UK Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ASHM

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives