- United Kingdom

- /

- Consumer Finance

- /

- LSE:IPF

International Personal Finance plc's (LON:IPF) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

International Personal Finance plc (LON:IPF) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 42%.

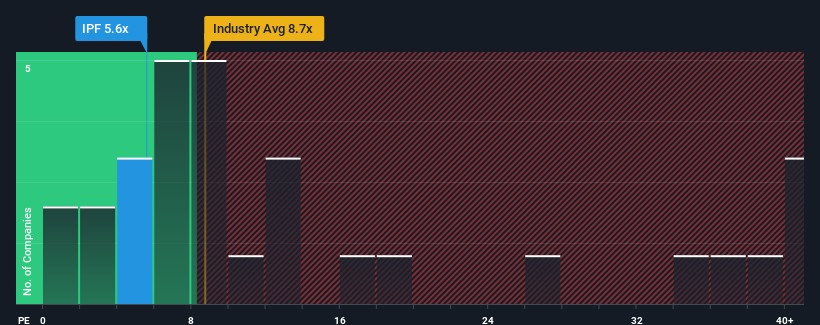

Even after such a large jump in price, International Personal Finance's price-to-earnings (or "P/E") ratio of 5.6x might still make it look like a strong buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 16x and even P/E's above 27x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

International Personal Finance certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for International Personal Finance

Does Growth Match The Low P/E?

In order to justify its P/E ratio, International Personal Finance would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The latest three year period has also seen an excellent 49% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 9.2% per year over the next three years. That's shaping up to be materially lower than the 16% each year growth forecast for the broader market.

With this information, we can see why International Personal Finance is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On International Personal Finance's P/E

Shares in International Personal Finance are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that International Personal Finance maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with International Personal Finance (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of International Personal Finance's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IPF

International Personal Finance

Engages in financial services business in Europe and Mexico.

Very undervalued with proven track record.

Market Insights

Community Narratives