The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like 3i Group (LON:III), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for 3i Group

3i Group's Improving Profits

In the last three years 3i Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. 3i Group boosted its trailing twelve month EPS from UK£4.15 to UK£4.75, in the last year. This amounts to a 14% gain; a figure that shareholders will be pleased to see.

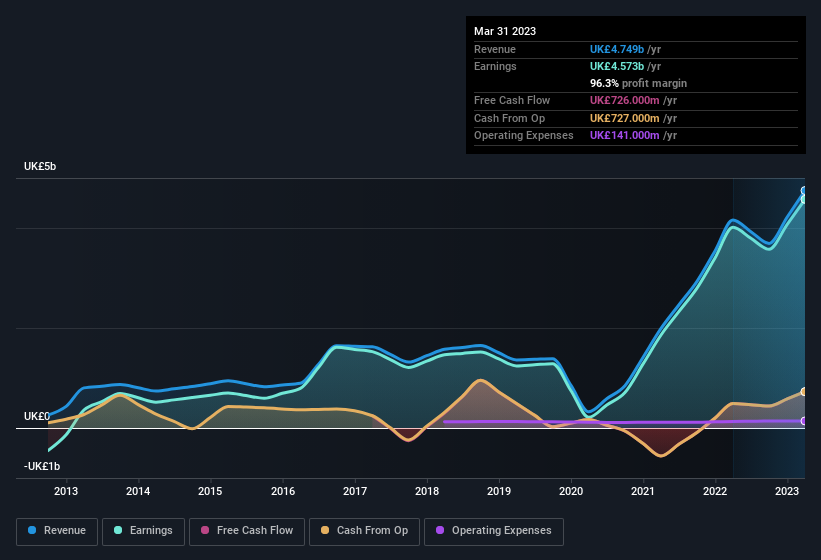

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that 3i Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note 3i Group achieved similar EBIT margins to last year, revenue grew by a solid 14% to UK£4.7b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for 3i Group's future profits.

Are 3i Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite UK£47k worth of sales, 3i Group insiders have overwhelmingly been buying the stock, spending UK£613k on purchases in the last twelve months. An optimistic sign for those with 3i Group in their watchlist. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board David A. Hutchison for UK£230k worth of shares, at about UK£16.34 per share.

The good news, alongside the insider buying, for 3i Group bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth UK£324m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Should You Add 3i Group To Your Watchlist?

One important encouraging feature of 3i Group is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Before you take the next step you should know about the 2 warning signs for 3i Group that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, 3i Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if 3i Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:III

3i Group

A private equity firm specializing in mature companies, growth capital, middle markets, infrastructure, and management leveraged buyouts and buy-ins.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026