- United Kingdom

- /

- Capital Markets

- /

- LSE:IIG

3 UK Penny Stocks With Market Caps Over £200M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery. Despite these broader market fluctuations, investors continue to seek opportunities in various segments, including penny stocks. While the term "penny stocks" may seem outdated, it still represents a sector where smaller or newer companies can offer growth potential when supported by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.59 | £513.88M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.09 | £168.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.38 | £121.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.52 | £73.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.854 | £700.3M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology across the United Kingdom, Europe, the Americas, and internationally with a market cap of £292.28 million.

Operations: The company generates £56.32 million in revenue from its wireless communications equipment segment.

Market Cap: £292.28M

Filtronic plc has demonstrated significant growth, with earnings surging by a very large margin over the past year and revenue increasing to £56.32 million. The company is debt-free, which strengthens its financial position, and its short-term assets comfortably cover both short- and long-term liabilities. Filtronic's recent £47.3 million contract with SpaceX for their advanced GaN E-band product highlights their technical prowess in RF technology, although future earnings are forecast to decline by an average of 45% annually over the next three years. The management team is relatively new but supported by an experienced board of directors.

- Get an in-depth perspective on Filtronic's performance by reading our balance sheet health report here.

- Examine Filtronic's earnings growth report to understand how analysts expect it to perform.

Integrated Diagnostics Holdings (LSE:IDHC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Integrated Diagnostics Holdings plc is a consumer healthcare company offering medical diagnostics services, with a market capitalization of $311.01 million.

Operations: The company's revenue is primarily derived from its operations in Egypt (EGP 5614.74 million), followed by Jordan (EGP 1005.21 million), with additional contributions from Nigeria (EGP 101.12 million) and Saudi Arabia (EGP 39.45 million).

Market Cap: $311.01M

Integrated Diagnostics Holdings plc has shown robust earnings growth, with a 34.3% increase over the past year, surpassing industry averages. The company’s revenue streams are diversified across Egypt, Jordan, Nigeria, and Saudi Arabia. Despite its volatility and unstable dividend record, it trades at a significant discount to estimated fair value. Its financial health is reinforced by high-quality earnings and strong cash flow coverage of debt (842.3%). Short-term assets exceed liabilities significantly, while more cash than total debt enhances stability. However, net profit margins have slightly decreased from last year’s figures amidst ongoing expansion efforts.

- Take a closer look at Integrated Diagnostics Holdings' potential here in our financial health report.

- Understand Integrated Diagnostics Holdings' earnings outlook by examining our growth report.

Intuitive Investments Group (LSE:IIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intuitive Investments Group Plc focuses on investing in early and later-stage companies, with a market cap of £219.30 million.

Operations: Intuitive Investments Group Plc does not currently report any revenue from its segments.

Market Cap: £219.3M

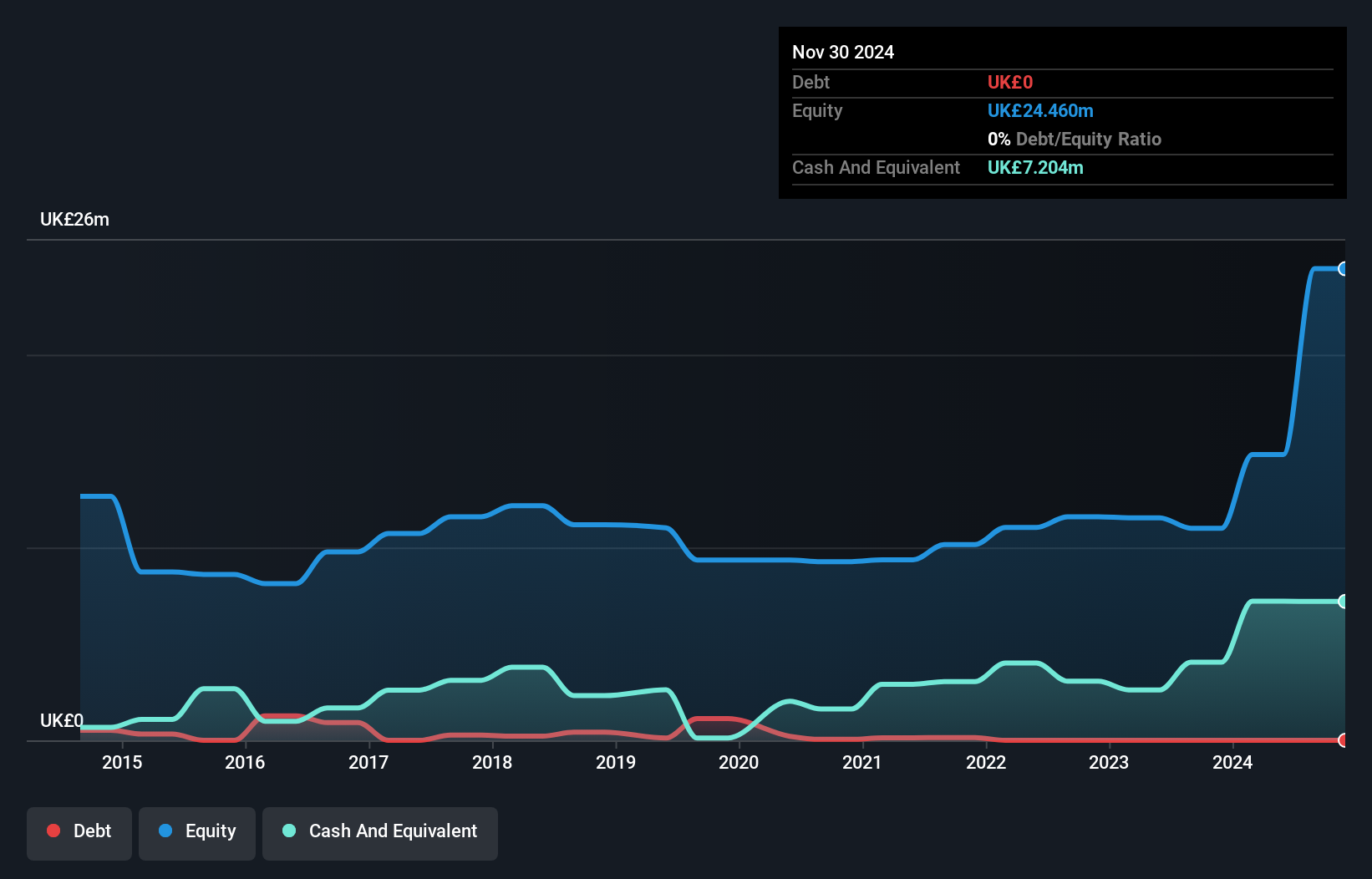

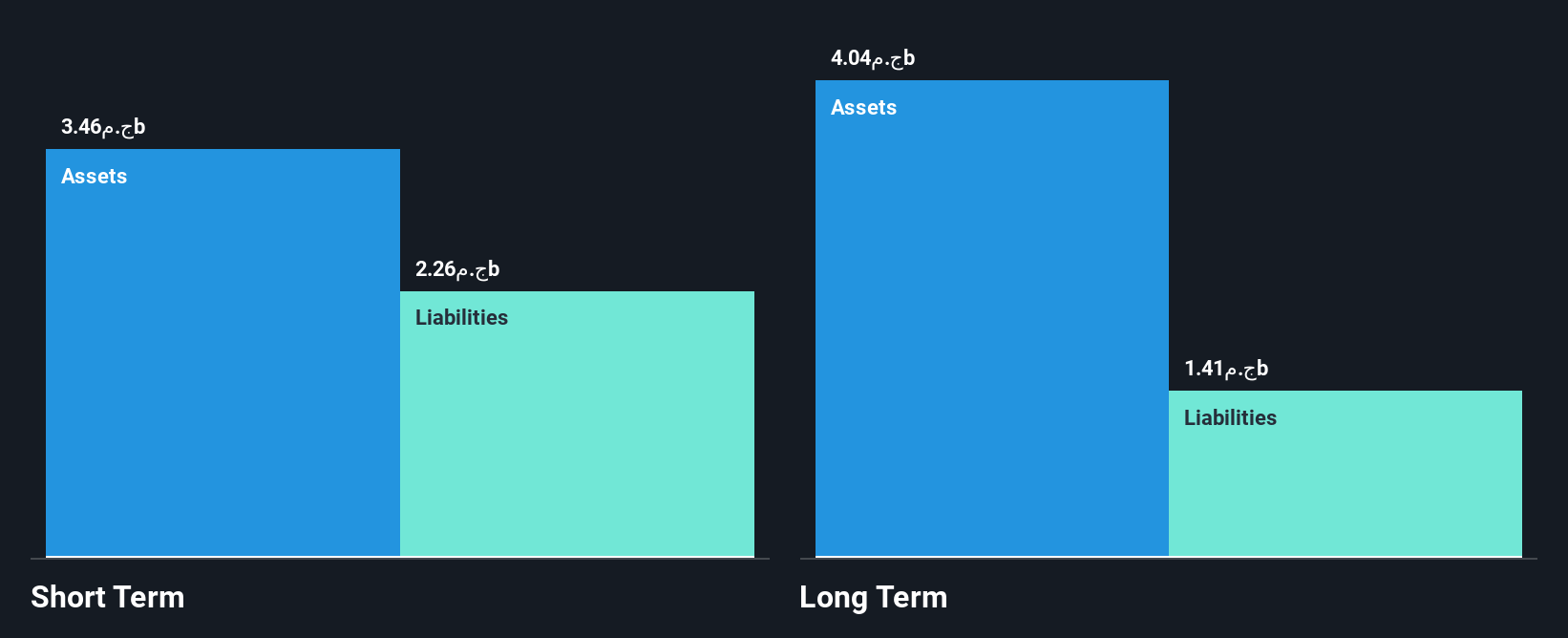

Intuitive Investments Group Plc, with a market cap of £219.30 million, is pre-revenue and unprofitable, reflecting its focus on early-stage investments. The company recently raised £3.65 million through a follow-on equity offering to bolster its cash position, which provides a short-term runway given its current cash flow challenges. Despite stable weekly volatility at 5%, the negative return on equity (-0.39%) highlights ongoing financial hurdles. With no debt or long-term liabilities, Intuitive Investments maintains financial flexibility but faces pressure from declining earnings and limited revenue generation under US$1 million (£-430K).

- Dive into the specifics of Intuitive Investments Group here with our thorough balance sheet health report.

- Learn about Intuitive Investments Group's historical performance here.

Make It Happen

- Investigate our full lineup of 293 UK Penny Stocks right here.

- Searching for a Fresh Perspective? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IIG

Intuitive Investments Group

Intuitive Investments Group Plc intends to invest in early and later-stage investments.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives