- United Kingdom

- /

- Metals and Mining

- /

- AIM:GLR

Discover UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

Over the last 7 days, the UK market has dropped 1.0%, but it has risen by 6.9% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this context, identifying stocks with solid financial health and growth potential is crucial for investors seeking opportunities in smaller or newer companies. Penny stocks—though an outdated term—remain relevant as they often offer affordability and growth prospects; let's explore some that stand out for their financial strength and potential returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.61 | £187.74M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £356.66M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.825 | £62.48M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.25 | £106.71M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.335 | £426.76M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4245 | $246.77M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Deltic Energy (AIM:DELT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Deltic Energy Plc is a natural resources investing company focused on the exploration, evaluation, and development of gas and oil licenses in the Southern and Central North Sea, with a market cap of £4.79 million.

Operations: Deltic Energy Plc has not reported any revenue segments.

Market Cap: £4.79M

Deltic Energy Plc, with a market cap of £4.79 million, is currently pre-revenue and unprofitable. Despite this, the company is debt-free and has not diluted shareholders in the past year. Recent developments include a confirmed gas discovery at the Selene prospect in the UK Southern North Sea, where Deltic holds a 25% interest. The project is advancing towards development without further drilling required before an investment decision. However, political and fiscal challenges in the UK have prompted Deltic to consider international opportunities while reducing operational spending by 40% next year to focus on key assets.

- Navigate through the intricacies of Deltic Energy with our comprehensive balance sheet health report here.

- Evaluate Deltic Energy's prospects by accessing our earnings growth report.

Galileo Resources (AIM:GLR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Galileo Resources Plc is engaged in the exploration and development of mineral projects across South Africa, Botswana, the United Kingdom, and the United States, with a market cap of £12.80 million.

Operations: The company's revenue is primarily derived from its mineral assets, totaling £0.13 million.

Market Cap: £12.8M

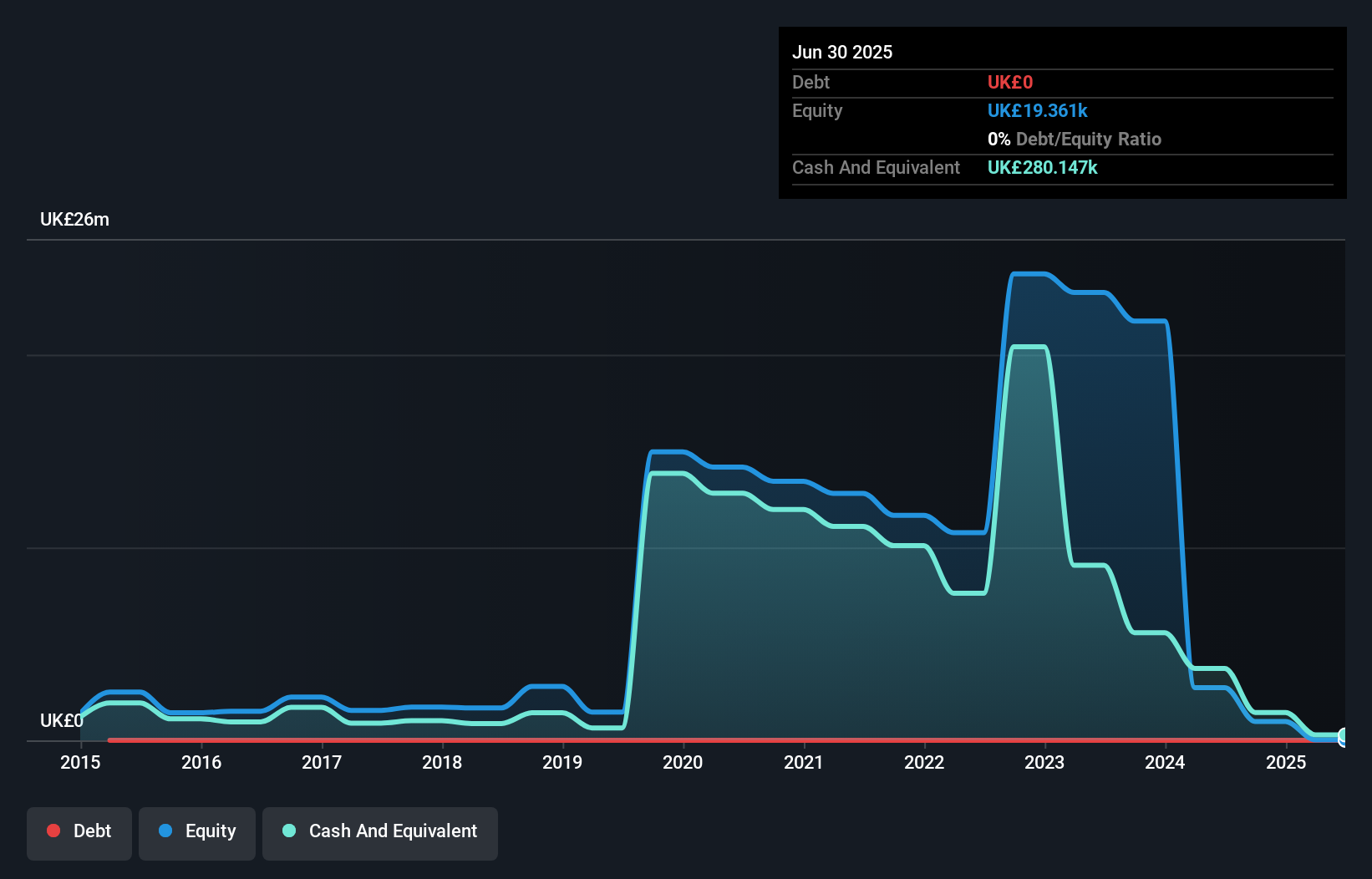

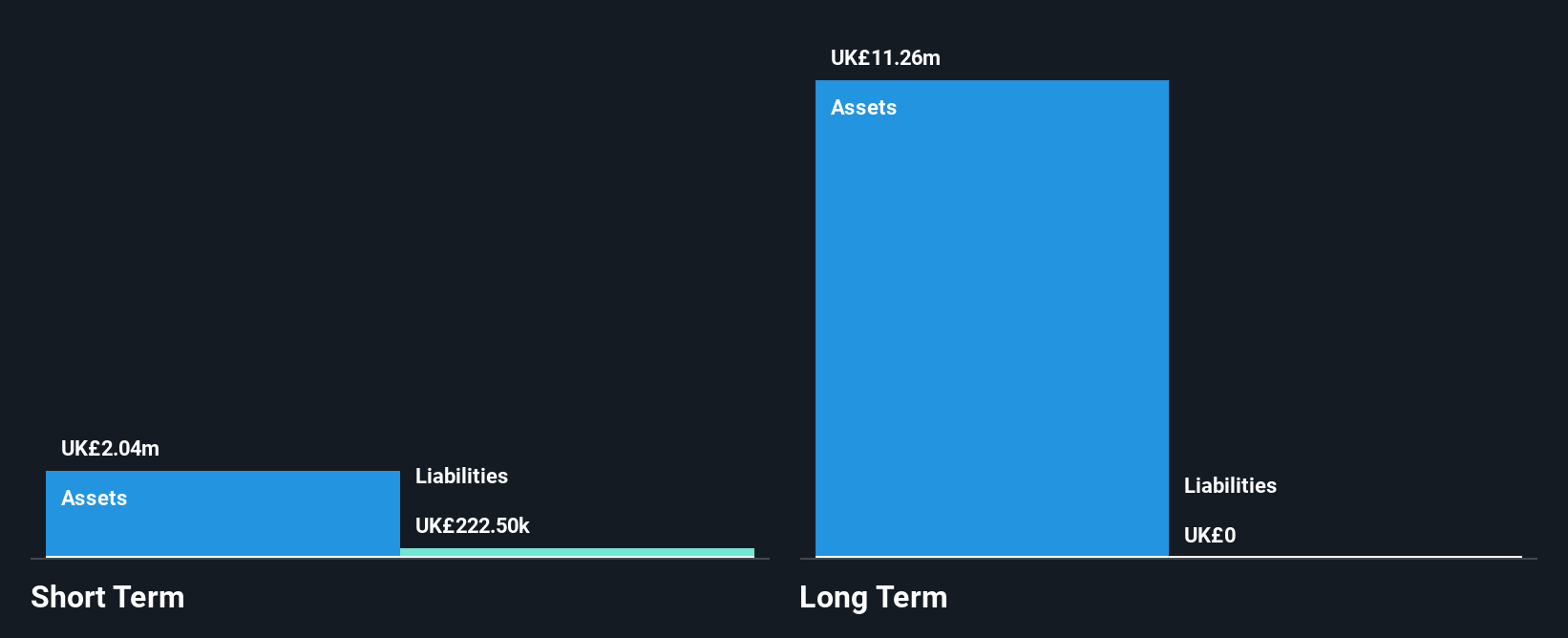

Galileo Resources Plc, with a market cap of £12.80 million, is pre-revenue and unprofitable but remains debt-free. Recent exploration efforts focus on the Kalahari Copperbelt and Shinganda Licence, targeting copper and gold mineralisation. The company plans to conduct geophysical surveys to refine drilling targets in Botswana and has commenced Phase 3 drilling in Zambia's Shinganda region. While Galileo's financial runway is limited with less than a year of cash available, its experienced board provides strategic oversight as it navigates these exploratory phases without significant shareholder dilution over the past year.

- Take a closer look at Galileo Resources' potential here in our financial health report.

- Assess Galileo Resources' previous results with our detailed historical performance reports.

EJF Investments (LSE:EJFI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EJF Investments Limited is a principal investment firm with a market cap of £68.79 million.

Operations: The company's revenue segment includes an investment in EJFIH amounting to £11.30 million.

Market Cap: £68.79M

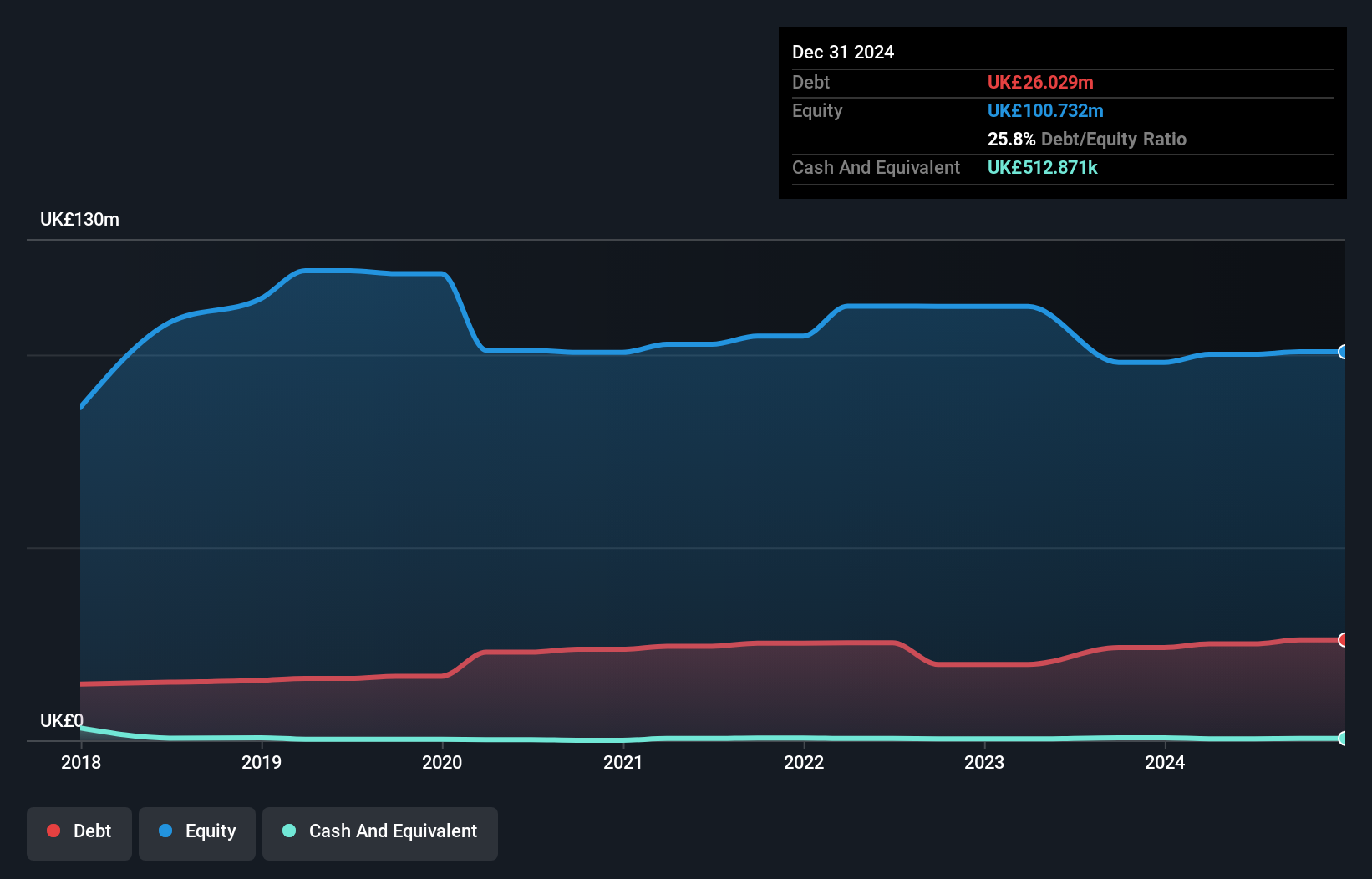

EJF Investments, with a market cap of £68.79 million, has recently achieved profitability, reporting half-year revenue of £7.28 million and net income of £5.37 million. The company trades at 39.9% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 24.6%. Its earnings are high quality, but the return on equity remains low at 7.9%. While dividends are not well covered by earnings or free cash flows, they continue to be paid out regularly with recent affirmations for Q3 2024 dividends declared at 2.675 pence per share payable in GBP or USD as elected by shareholders.

- Click to explore a detailed breakdown of our findings in EJF Investments' financial health report.

- Assess EJF Investments' future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock more gems! Our UK Penny Stocks screener has unearthed 462 more companies for you to explore.Click here to unveil our expertly curated list of 465 UK Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GLR

Galileo Resources

Explores and develops mineral projects in South Africa, Botswana, the United Kingdom, and the United States.

Adequate balance sheet slight.