In recent months, the UK market has experienced fluctuations, with the FTSE 100 index facing challenges due to weak trade data from China and a decline in commodity prices impacting major exporters. Despite these hurdles, opportunities remain for discerning investors who seek value in lesser-known stocks that may offer resilience and potential growth amid broader economic uncertainties. Identifying such undiscovered gems often involves looking at companies with strong fundamentals and innovative strategies that can navigate current market conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Midwich Group (AIM:MIDW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Midwich Group plc, along with its subsidiaries, is a distributor of audio visual solutions to trade customers across various regions including the United Kingdom, Ireland, Europe, the Middle East, Africa, the Asia Pacific, and North America with a market cap of £293.64 million.

Operations: Midwich generates revenue primarily from the wholesale of computer peripherals, amounting to £1.32 billion.

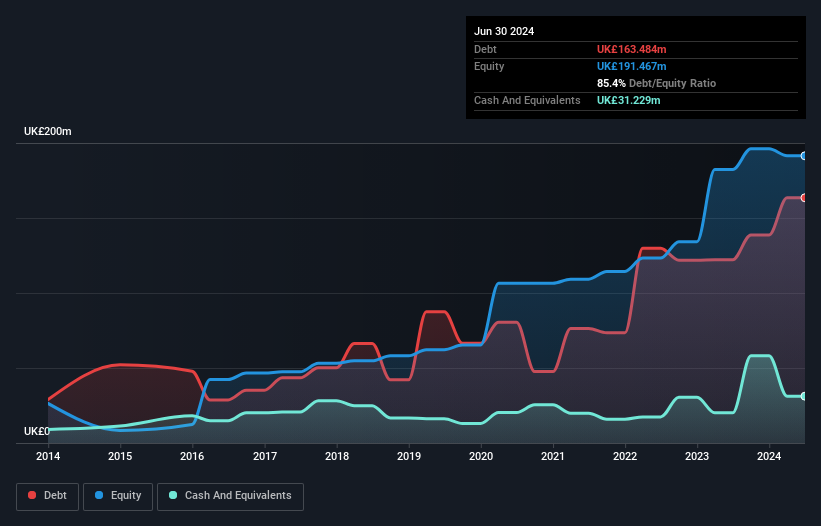

Midwich Group, a notable player in the AV industry, is trading at 51.2% below its estimated fair value, suggesting potential undervaluation. Despite facing challenging market conditions, the company expects revenue to be slightly higher than last year and has implemented an overhead reduction program to bolster operating profit margins. With earnings growth of 16.7% over the past year outpacing the electronic industry's 2%, Midwich demonstrates resilience. However, its net debt to equity ratio stands high at 69.1%, though it has decreased from 140.7% over five years, indicating improved financial management amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Midwich Group's health report.

Gain insights into Midwich Group's past trends and performance with our Past report.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Goodwin PLC, along with its subsidiaries, offers mechanical and refractory engineering solutions across the UK, Europe, the US, the Pacific Basin, and other international markets with a market capitalization of £575.24 million.

Operations: Goodwin PLC generates revenue primarily from its mechanical segment (£168.02 million) and refractory segment (£75.58 million).

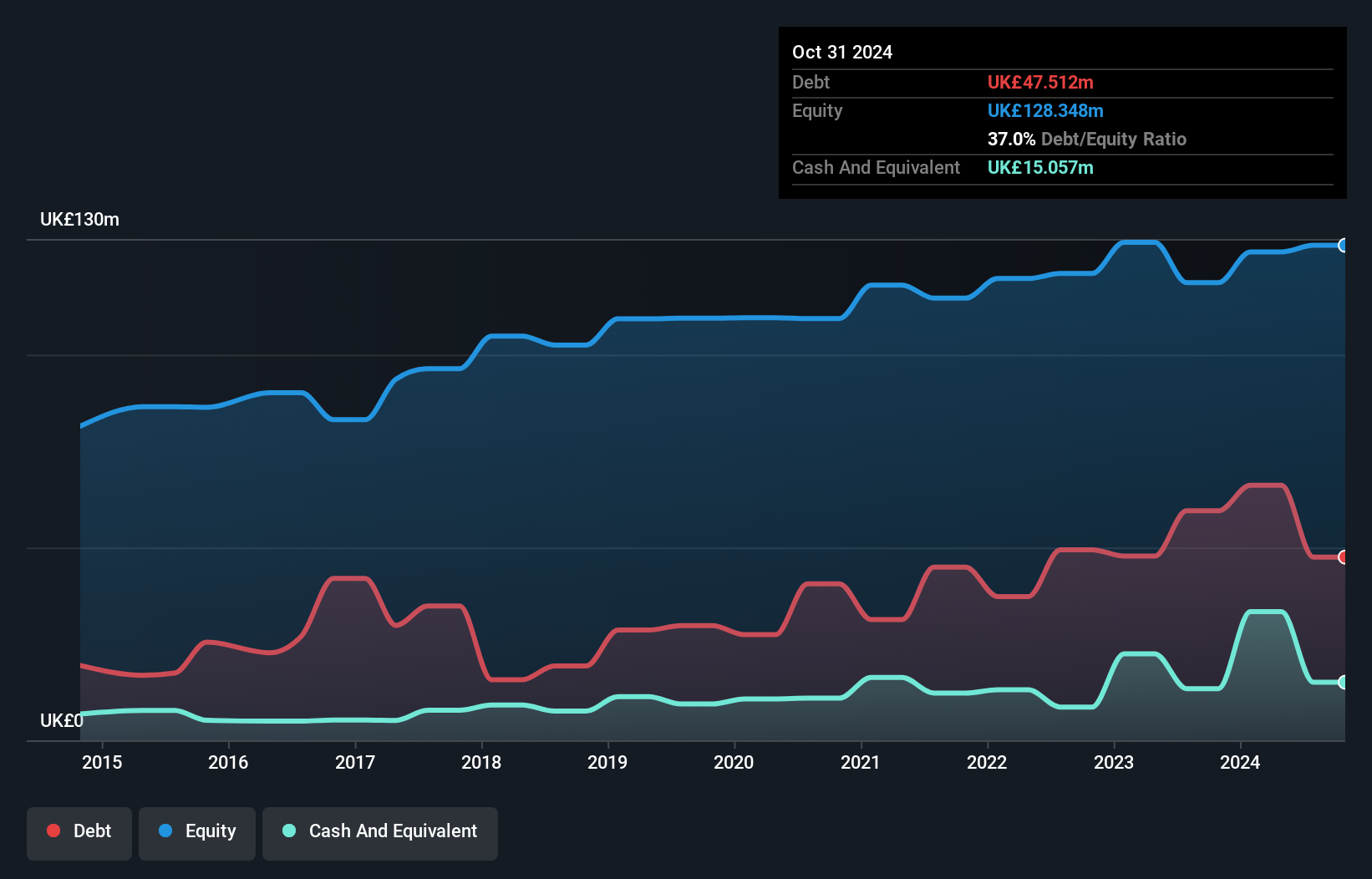

Goodwin, a UK-based machinery player, has shown robust performance with earnings growth of 22.9% in the past year, outpacing the industry average of -8.8%. Its net debt to equity ratio stands at a satisfactory 25.3%, indicating prudent financial management. The company's interest payments are well covered by EBIT at 8.4 times coverage, suggesting solid operational efficiency. Recent results reflect positive momentum; sales rose to £106 million from £98 million year-on-year and net income increased to £11 million from £9 million. Trading significantly below its estimated fair value by 57%, Goodwin seems poised for potential revaluation in the market.

- Take a closer look at Goodwin's potential here in our health report.

Explore historical data to track Goodwin's performance over time in our Past section.

Octopus Renewables Infrastructure Trust (LSE:ORIT)

Simply Wall St Value Rating: ★★★★★★

Overview: Octopus Renewables Infrastructure Trust plc is a closed-end investment company focusing on renewable energy infrastructure assets in Europe and Australia, with a market cap of £377.23 million.

Operations: Octopus Renewables Infrastructure Trust generates revenue primarily from its investments in renewable energy infrastructure assets, amounting to £25.30 million. The company's financial performance is highlighted by a focus on investment returns within the renewable sector across Europe and Australia.

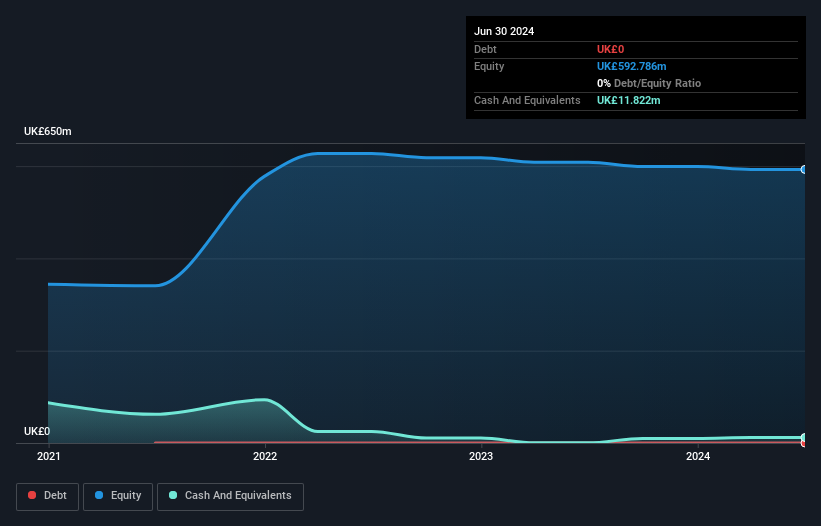

Octopus Renewables Infrastructure Trust, a niche player in the UK market, showcases intriguing financial dynamics. Despite a 14% annual earnings drop over five years, last year's earnings surged by 67%, outpacing the industry average of 4%. With no debt on its books for five years and positive free cash flow reaching £50.95 million as of June 2024, it’s financially robust. Recent board changes and dividend adjustments hint at strategic shifts ahead. An interim dividend of £0.015 per share was declared for Q3 2024, reflecting ongoing shareholder returns amidst evolving governance strategies.

- Dive into the specifics of Octopus Renewables Infrastructure Trust here with our thorough health report.

Learn about Octopus Renewables Infrastructure Trust's historical performance.

Summing It All Up

- Reveal the 68 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MIDW

Midwich Group

Distributes audio visual (AV) solutions to trade customers in the United Kingdom, Ireland, rest of Europe, the Middle East, Africa, the Asia Pacific, and North America.

Undervalued with excellent balance sheet and pays a dividend.