- United Kingdom

- /

- Capital Markets

- /

- AIM:PMI

Litigation Capital Management And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over weak trade data from China. In such a climate, investors often turn their attention to penny stocks, which despite being an older term, still represent intriguing opportunities for growth at lower price points. By focusing on companies with solid financials and potential for growth, these stocks can offer a unique avenue for those looking to capitalize on the potential of smaller or newer firms in the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Litigation Capital Management (AIM:LIT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Litigation Capital Management Limited offers dispute finance and risk management services in Australia and the United Kingdom, with a market cap of £116.57 million.

Operations: The company's revenue is derived from its Group’s Fund Structures, contributing A$51.42 million, and its Litigation Capital Management operations, which generated A$47.95 million.

Market Cap: £116.57M

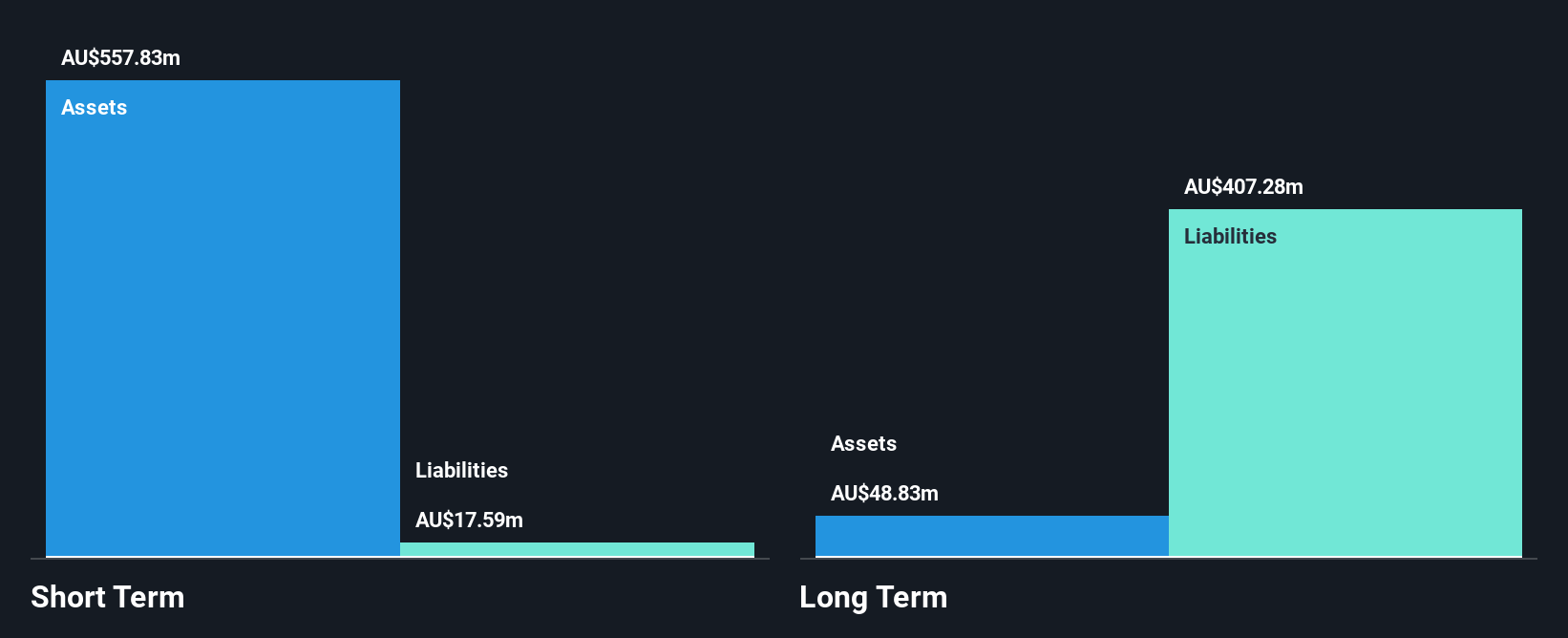

Litigation Capital Management Limited, with a market cap of £116.57 million, demonstrates strong asset management with short-term assets (A$548.3M) exceeding both short-term (A$31.3M) and long-term liabilities (A$371.6M). Its new USD 75 million credit facility offers growth flexibility without profit participation for lenders, enhancing its strategic position in litigation finance. However, recent negative earnings growth (-59.6%) contrasts sharply with its past five-year performance and industry averages, indicating potential volatility risks for investors in penny stocks. The board's experience and stable weekly volatility provide some reassurance amid these challenges.

- Click to explore a detailed breakdown of our findings in Litigation Capital Management's financial health report.

- Gain insights into Litigation Capital Management's outlook and expected performance with our report on the company's earnings estimates.

Premier Miton Group (AIM:PMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Premier Miton Group plc is a publicly owned investment manager with a market cap of £97.43 million.

Operations: Premier Miton Group plc has not reported any specific revenue segments.

Market Cap: £97.43M

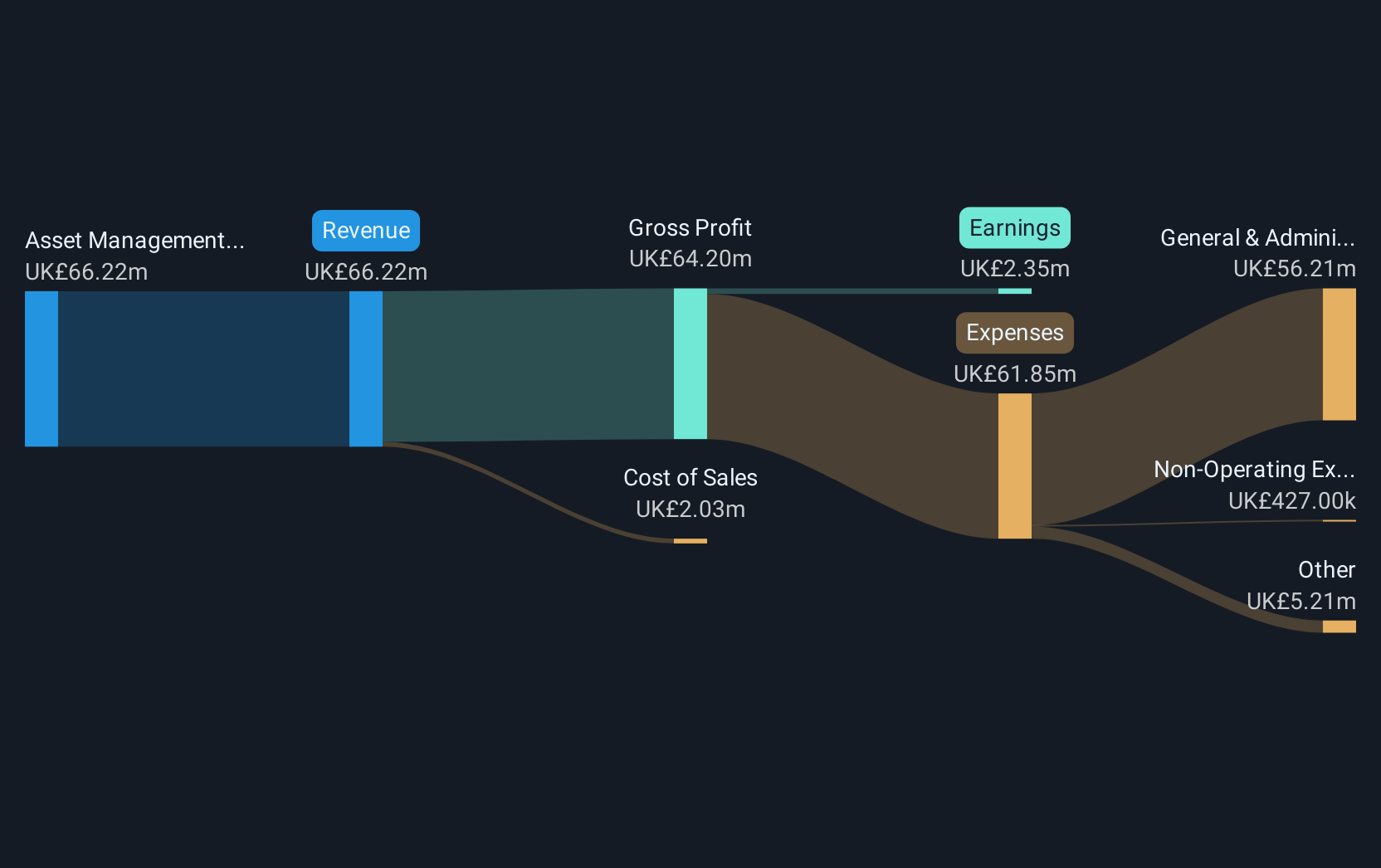

Premier Miton Group plc, with a market cap of £97.43 million, faces challenges as earnings have declined by 20.3% annually over five years and recent negative earnings growth of -48.7%. Despite this, the company is debt-free with strong asset coverage for liabilities—short-term assets (£131.4M) surpassing both short (£99.4M) and long-term liabilities (£5.9M). The board's experience (average tenure 4.8 years) supports stability amid shareholder dilution concerns and lower profit margins (2.9%). Premier Miton seeks acquisitions to enhance scale, aiming to improve margins despite current dividend sustainability issues due to insufficient earnings coverage.

- Take a closer look at Premier Miton Group's potential here in our financial health report.

- Evaluate Premier Miton Group's prospects by accessing our earnings growth report.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £187.58 million.

Operations: The company generates revenue primarily through its Asset Management segment, which accounts for $69.45 million.

Market Cap: £187.58M

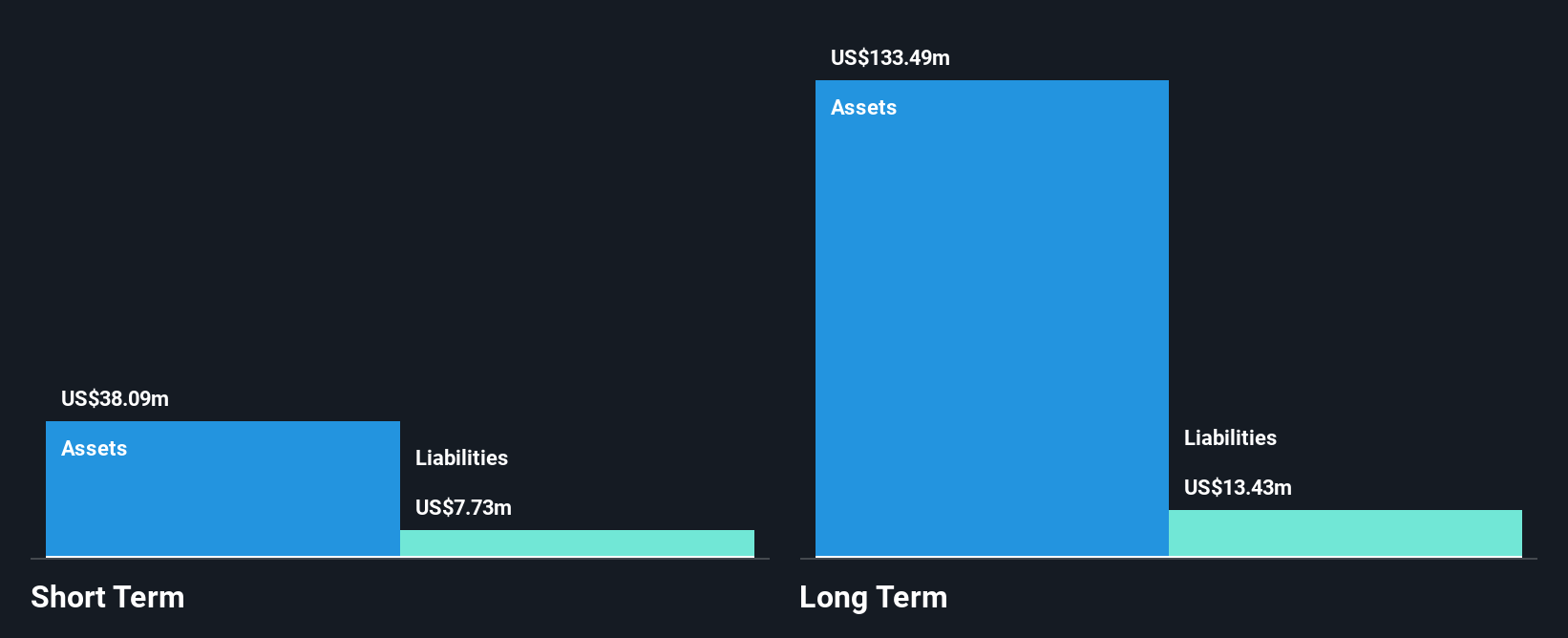

City of London Investment Group, with a market cap of £187.58 million, operates debt-free and maintains stable weekly volatility at 4%. Despite experiencing negative earnings growth of -2.2% over the past year, the company forecasts a 25.37% annual earnings increase moving forward. Its short-term assets ($42.3M) comfortably cover both short ($11M) and long-term liabilities ($14.4M). However, its dividend yield of 8.56% is not well covered by earnings or free cash flows, posing sustainability concerns despite high-quality past earnings and an experienced management team averaging 4.9 years in tenure.

- Dive into the specifics of City of London Investment Group here with our thorough balance sheet health report.

- Explore City of London Investment Group's analyst forecasts in our growth report.

Make It Happen

- Reveal the 472 hidden gems among our UK Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PMI

Flawless balance sheet with reasonable growth potential.