- United Kingdom

- /

- Capital Markets

- /

- LSE:CGEO

Georgia Capital (LON:CGEO) shareholders are still up 64% over 3 years despite pulling back 10% in the past week

Georgia Capital PLC (LON:CGEO) shareholders might be concerned after seeing the share price drop 10% in the last week. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 64% during that period.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

See our latest analysis for Georgia Capital

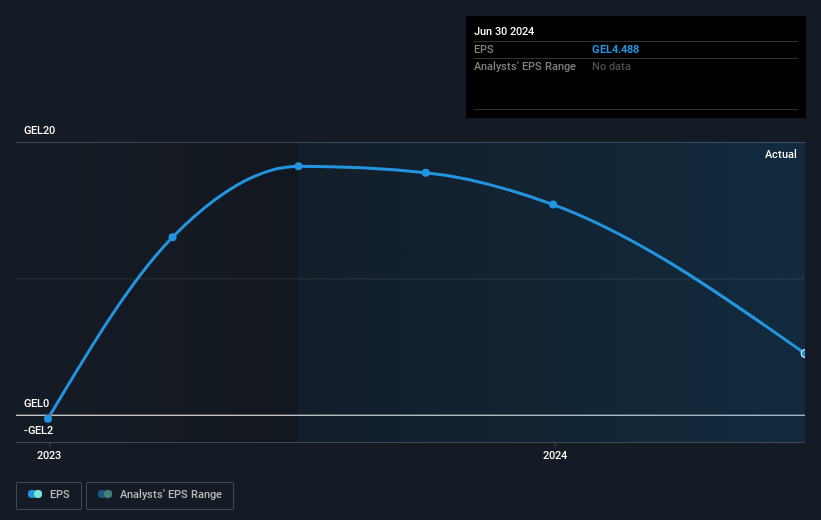

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

A Different Perspective

Georgia Capital shareholders gained a total return of 2.4% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 6% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Georgia Capital better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Georgia Capital you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CGEO

Georgia Capital

A private equity and venture capital firm specializing in early stage, organic growth and acquisitions.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives