- United Kingdom

- /

- Oil and Gas

- /

- AIM:BOR

UK Penny Stocks: 3 Picks With Market Caps Under £400M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China. Despite these broader market pressures, there remains potential for investors in smaller companies often referred to as penny stocks—a term that, although somewhat outdated, still points to opportunities within less-established firms. By focusing on those with strong financials and growth potential, investors can uncover promising prospects among these more affordable stocks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.025 | £459.02M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.06 | £166.42M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.09 | £305.57M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.965 | £14.57M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.04 | £25.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.455 | £70.28M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.53 | £45.68M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Borders & Southern Petroleum (AIM:BOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Borders & Southern Petroleum plc is an independent oil and gas exploration company operating in the Falkland Islands with a market cap of £96.67 million.

Operations: Borders & Southern Petroleum does not report any revenue segments.

Market Cap: £96.67M

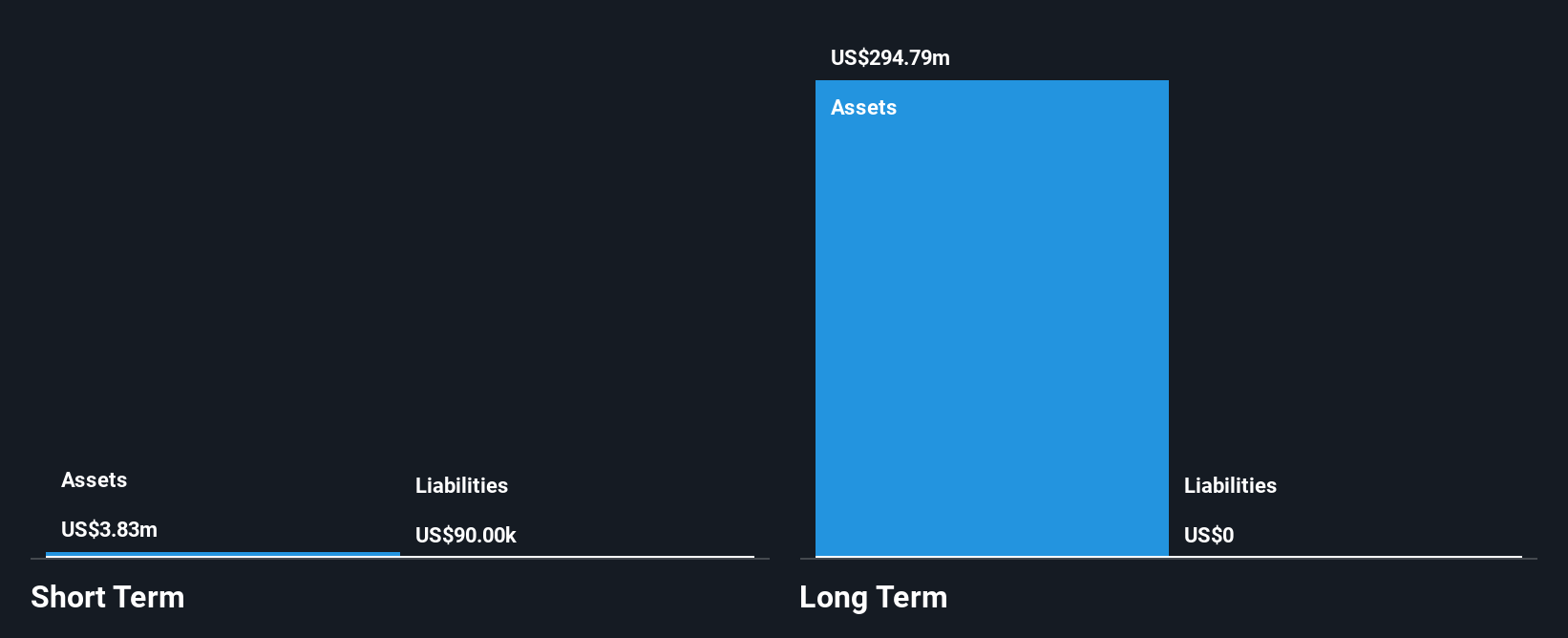

Borders & Southern Petroleum, with a market cap of £96.67 million, operates as a pre-revenue company in the oil and gas exploration sector. Despite its unprofitability and volatile share price, it remains debt-free with sufficient cash runway for over a year. The company reported a reduced net loss of US$0.441 million for the half-year ending June 2025, compared to US$0.578 million previously. While shareholders have not faced dilution recently and short-term assets comfortably cover liabilities, earnings are forecasted to decline by an average of 8.6% annually over the next three years without any significant revenue streams currently in place.

- Click here and access our complete financial health analysis report to understand the dynamics of Borders & Southern Petroleum.

- Assess Borders & Southern Petroleum's future earnings estimates with our detailed growth reports.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CAB Payments Holdings Limited operates through its subsidiaries to offer foreign exchange and cross-border payment services to banks, fintech companies, supranationals, and governments both in the United Kingdom and internationally, with a market cap of approximately £133.28 million.

Operations: The company's revenue segment is primarily focused on Unclassified Services, generating £88.73 million.

Market Cap: £133.28M

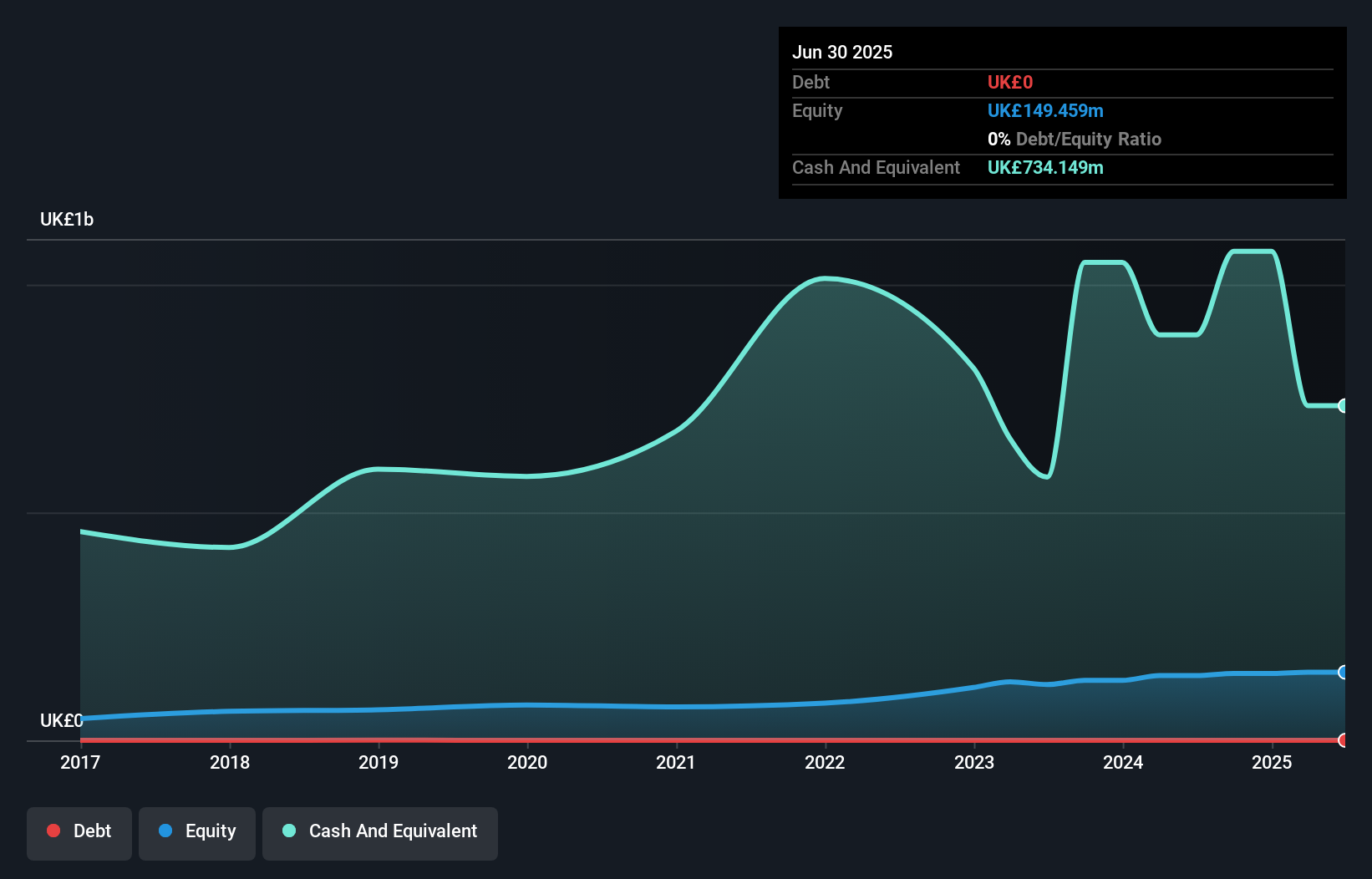

CAB Payments Holdings, with a market cap of £133.28 million, has experienced negative earnings growth in the past year and faces challenges with its short-term liabilities exceeding assets by £300 million. Despite this, the company is debt-free, eliminating concerns over interest coverage and debt management. The management team and board are relatively new, which may impact strategic stability. Although profit margins have decreased from 21.9% to 7.1%, CAB Payments is trading significantly below its estimated fair value and forecasts suggest a potential annual earnings growth of 31.44%. A large one-off loss recently impacted financial results as well.

- Navigate through the intricacies of CAB Payments Holdings with our comprehensive balance sheet health report here.

- Explore CAB Payments Holdings' analyst forecasts in our growth report.

On the Beach Group (LSE:OTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays under the On the Beach brand in the United Kingdom, with a market cap of £305.57 million.

Operations: On the Beach Group does not report specific revenue segments.

Market Cap: £305.57M

On the Beach Group, with a market cap of £305.57 million, has demonstrated stable financial health by maintaining a debt-free status and covering both short and long-term liabilities with substantial assets (£442 million). Despite a decline in net income to £8.6 million from £13 million last year, earnings per share improved due to increased profit margins (20.3% compared to 15.8%). The company's share repurchase program indicates confidence in its valuation, which is currently trading at 59.5% below fair value estimates. While earnings growth slowed recently (21.8%), it still outpaces the industry average of 12.3%.

- Get an in-depth perspective on On the Beach Group's performance by reading our balance sheet health report here.

- Evaluate On the Beach Group's prospects by accessing our earnings growth report.

Make It Happen

- Embark on your investment journey to our 305 UK Penny Stocks selection here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borders & Southern Petroleum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BOR

Borders & Southern Petroleum

Operates as an independent oil and gas exploration company in the Falkland Islands.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026