- United Kingdom

- /

- Diversified Financial

- /

- LSE:CABP

UK Penny Stock Insights: Warpaint London And 2 More Compelling Picks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China impacting global economic sentiment. For investors looking beyond blue-chip stocks, penny stocks offer intriguing possibilities, especially when backed by robust financials. Although the term "penny stocks" might seem outdated, these smaller or newer companies continue to present opportunities for affordability and growth potential in today's complex market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Supreme (AIM:SUP) | £2.00 | £234.63M | ✅ 2 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.24 | £476.23M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.35 | £351.42M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.862 | £1.16B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.44 | £47.61M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.16 | £325.52M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.75 | £134.86M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.085 | £173.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.825 | £11.36M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.25 | £69.96M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Warpaint London (AIM:W7L)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £351.42 million, produces and sells cosmetics through its subsidiaries.

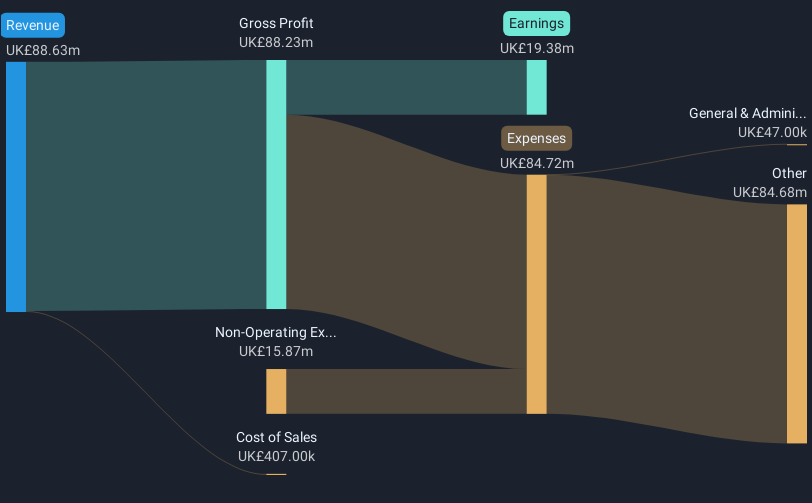

Operations: The company's revenue is primarily generated from its Own Brand segment, contributing £99.36 million, with an additional £2.25 million from the Close-Out segment.

Market Cap: £351.42M

Warpaint London PLC, with a market cap of £351.42 million, has shown strong financial performance and growth potential in the penny stock segment. The company reported full-year 2024 sales of £101.61 million, up from £89.59 million in the previous year, with net income rising to £18.23 million from £13.9 million. Its earnings have grown significantly by 60.1% per year over the past five years and are expected to grow by 12.57% annually moving forward. Despite high volatility and a dividend not well covered by free cash flows, Warpaint benefits from being debt-free and having seasoned management and board members.

- Take a closer look at Warpaint London's potential here in our financial health report.

- Gain insights into Warpaint London's future direction by reviewing our growth report.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CAB Payments Holdings Limited operates through its subsidiaries to offer foreign exchange and cross-border payment services to banks, fintech companies, development organizations, and governments both in the United Kingdom and internationally, with a market cap of approximately £116.65 million.

Operations: The company's revenue segment comprises £91.04 million from Unclassified Services.

Market Cap: £116.65M

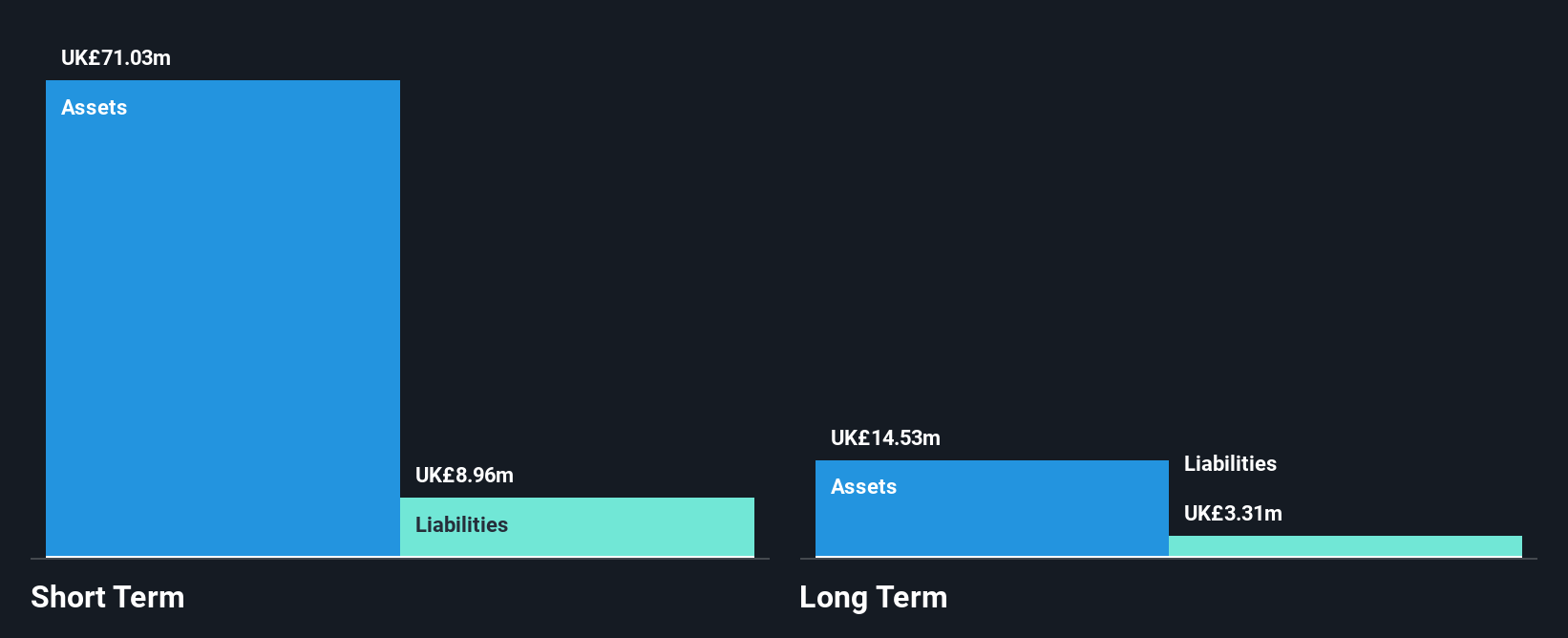

CAB Payments Holdings, with a market cap of £116.65 million, presents a mixed picture in the penny stock arena. The company is debt-free and has seen significant earnings growth over the past five years, yet it recently experienced negative earnings growth of -37.8%. Its profit margins have declined from 28.8% to 15.6%, and short-term liabilities exceed assets by £0.1 billion. Despite trading at nearly 70% below estimated fair value and having no shareholder dilution over the past year, its board and management lack experience but recent appointments aim to bolster strategic oversight with expertise in payments and technology sectors.

- Unlock comprehensive insights into our analysis of CAB Payments Holdings stock in this financial health report.

- Assess CAB Payments Holdings' future earnings estimates with our detailed growth reports.

S4 Capital (LSE:SFOR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: S4 Capital plc, with a market cap of £161.42 million, offers digital advertising and marketing services across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: S4 Capital generates its revenue from three main segments: Content (£566.7 million), Technology Services (£86.5 million), and Data & Digital Media (£195 million).

Market Cap: £161.42M

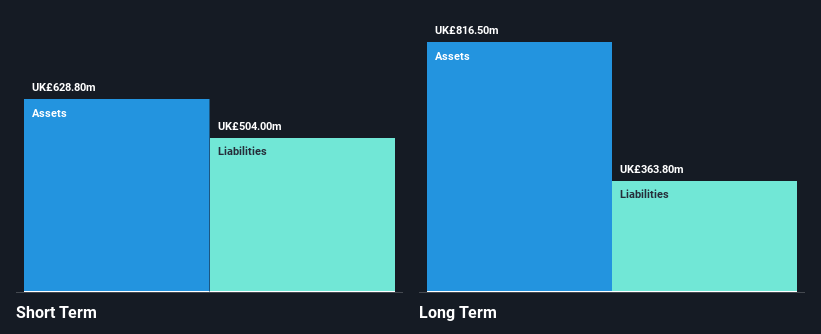

S4 Capital, with a market cap of £161.42 million, is navigating the penny stock landscape with both opportunities and challenges. The company has launched Dev2 through Monks Technology Services, aiming to enhance AI-driven application development in partnership with Windsurf. Despite being unprofitable and experiencing increased losses over five years, S4's cash runway remains stable for over three years due to positive free cash flow. Its short-term assets exceed liabilities, but debt levels have risen significantly in recent years. Recent executive changes may provide strategic direction as it trades well below estimated fair value amidst high share price volatility.

- Dive into the specifics of S4 Capital here with our thorough balance sheet health report.

- Gain insights into S4 Capital's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Unlock our comprehensive list of 297 UK Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CABP

CAB Payments Holdings

Through its subsidiaries, provides foreign exchange (FX) and cross-border payments services to banks, fintech companies, development organizations, and governments in the United Kingdom and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives