- United Kingdom

- /

- Consumer Durables

- /

- LSE:SRAD

UK Penny Stock Insights: Diaceutics Among 3 Companies To Watch

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these challenges, investors often seek opportunities in smaller or newer companies that can offer surprising value even amid broader market volatility. Penny stocks, though an outdated term, continue to attract attention for their affordability and potential for growth when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.105 | £470.93M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.02 | £163.19M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.225 | £322.41M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.91 | £13.74M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.21 | £28.04M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6475 | $376.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.474 | £181.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.435 | £69.3M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.76M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

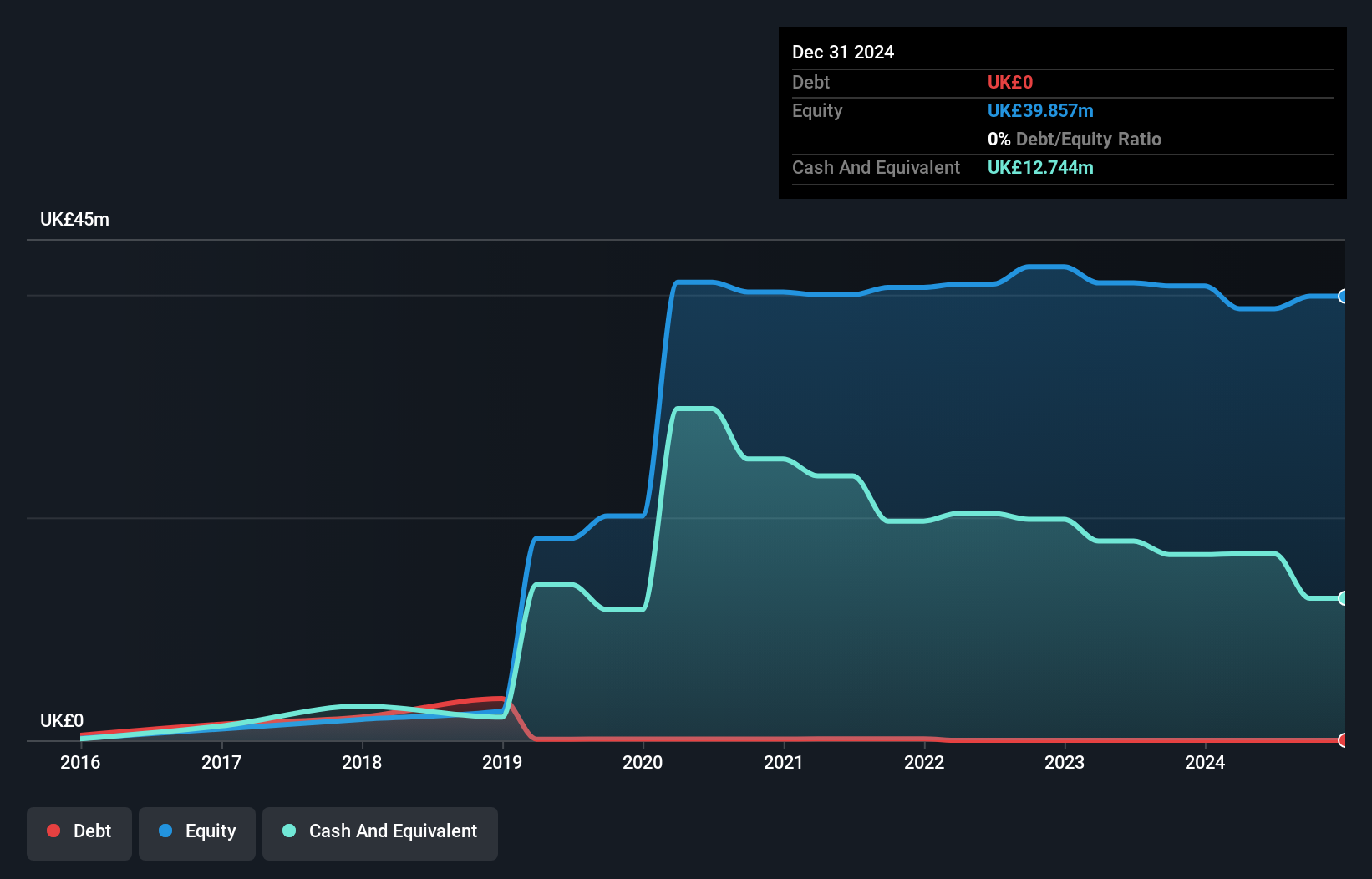

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Diaceutics PLC is a diagnostic commercialization company that offers data, data analytics, and implementation services to pharmaceutical and biotech companies, with a market cap of £118.92 million.

Operations: Diaceutics generates its revenue from the Medical Labs & Research segment, amounting to £34.40 million.

Market Cap: £118.92M

Diaceutics PLC, with a market cap of £118.92 million, operates in the Medical Labs & Research segment and reported half-year sales of £14.56 million for June 2025, up from £12.32 million the previous year. Despite being debt-free and having sufficient cash runway for over a year, Diaceutics remains unprofitable with increasing losses over the past five years at 62% annually. Analysts forecast earnings to grow significantly by 75.84% per year, and shares are trading below fair value estimates by 33%. The management team and board have limited experience with average tenures under two years.

- Navigate through the intricacies of Diaceutics with our comprehensive balance sheet health report here.

- Understand Diaceutics' earnings outlook by examining our growth report.

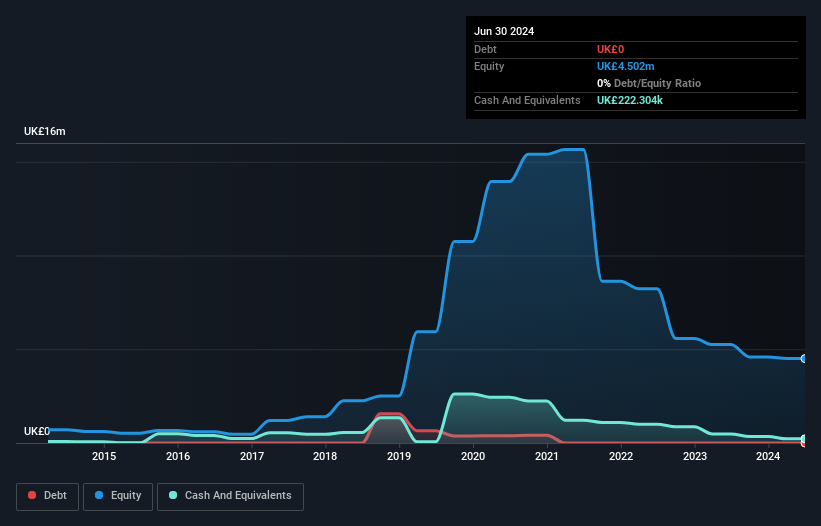

Westmount Energy (AIM:WTE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westmount Energy Limited is a venture capital firm that provides seed capital to small and medium-sized companies, with a market cap of £5.62 million.

Operations: Westmount Energy Limited does not report any specific revenue segments.

Market Cap: £5.62M

Westmount Energy Limited, with a market cap of £5.62 million, remains pre-revenue and unprofitable but has reduced its losses over the past five years by 14.1% annually. Despite high volatility and a negative return on equity, Westmount is debt-free with sufficient short-term assets to cover liabilities and a cash runway exceeding one year. The board is experienced with an average tenure of 14 years, although management experience data is insufficient. Recent earnings showed a net loss reduction from £0.75 million to £0.55 million for the year ended June 2025, reflecting improved financial management amidst challenging conditions for penny stocks.

- Click here to discover the nuances of Westmount Energy with our detailed analytical financial health report.

- Explore historical data to track Westmount Energy's performance over time in our past results report.

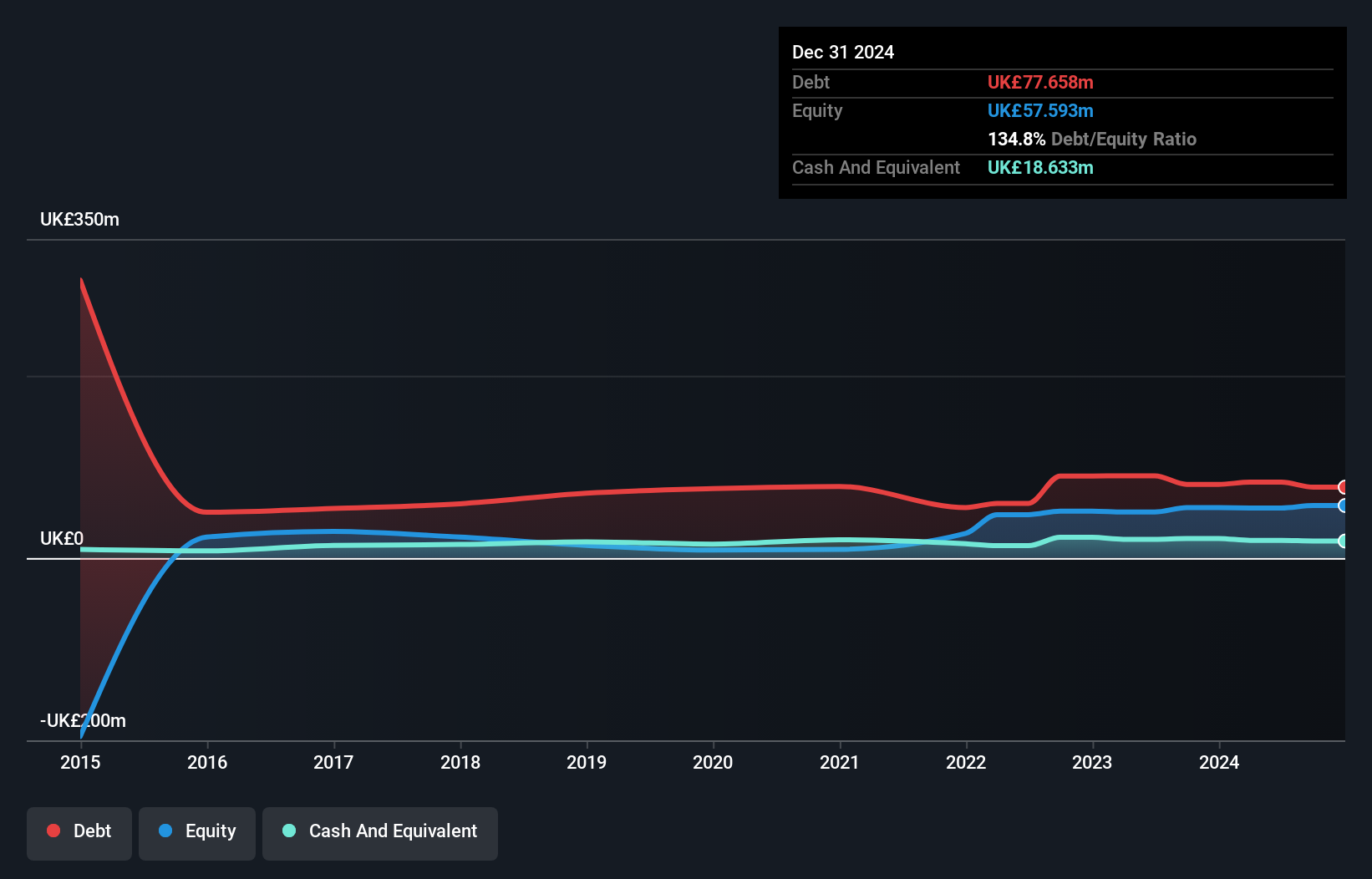

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and other international markets with a market cap of £173.20 million.

Operations: The company generates revenue of £283.94 million from its radiator manufacturing and distribution operations.

Market Cap: £173.2M

Stelrad Group PLC, with a market cap of £173.20 million, faces challenges typical for penny stocks, including a high net debt to equity ratio of 125.3% and low return on equity at 9.8%. Despite these concerns, the company has reduced its debt significantly over five years and maintains interest coverage at 4.3 times EBIT. Short-term assets exceed both short-term and long-term liabilities, indicating financial stability amidst negative earnings growth of -67.3% last year due to a £9.6 million one-off loss. Analysts expect earnings to grow by 63.25% annually, suggesting potential future recovery in profitability despite current volatility.

- Jump into the full analysis health report here for a deeper understanding of Stelrad Group.

- Learn about Stelrad Group's future growth trajectory here.

Next Steps

- Access the full spectrum of 306 UK Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SRAD

Stelrad Group

Manufactures and distributes radiators in the United Kingdom, Ireland, Europe, Turkey, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion