- United Kingdom

- /

- Construction

- /

- AIM:BILN

UK Penny Stocks: Spotlight on Billington Holdings and Two Other Promising Picks

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market fluctuations, investors often seek opportunities in smaller or newer companies that can offer potential growth and value. While the term "penny stocks" might seem outdated, it still refers to these affordable investment options that can provide significant returns when backed by strong financials. In this article, we will explore three such penny stocks in the UK market that stand out for their financial resilience and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.83 | £11.43M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.636 | £53.61M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.79 | £287.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.125 | £333.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.885 | £439.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.095 | £394.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Character Group (AIM:CCT) | £2.50 | £45.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.936 | £149.28M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.26 | £2.33B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Billington Holdings (AIM:BILN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Billington Holdings Plc, with a market cap of £49.93 million, operates through its subsidiaries to offer structural steel and construction safety solutions in the United Kingdom and Europe.

Operations: The company generates revenue from two primary segments: Structural Steelwork, contributing £101.06 million, and Safety Solutions, adding £12.63 million.

Market Cap: £49.93M

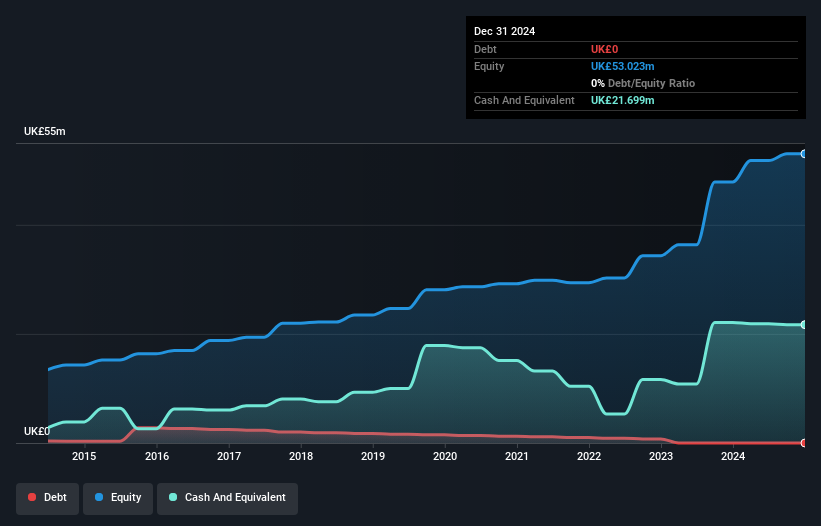

Billington Holdings Plc, with a market cap of £49.93 million, operates in the structural steel and construction safety sectors. Despite recent revenue decline to £113.06 million from £132.5 million, it maintains a strong financial position with no debt and short-term assets exceeding liabilities. The company has experienced management and board teams but faces challenges with declining earnings growth forecasted at an average of 14.7% per year over the next three years. Its price-to-earnings ratio is attractive at 6x compared to the UK market average of 16x, though its dividend history remains unstable amidst volatile share prices.

- Unlock comprehensive insights into our analysis of Billington Holdings stock in this financial health report.

- Understand Billington Holdings' earnings outlook by examining our growth report.

Peel Hunt (AIM:PEEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peel Hunt Limited operates as an integrated investment banking firm in the United Kingdom, with a market capitalization of £92.11 million.

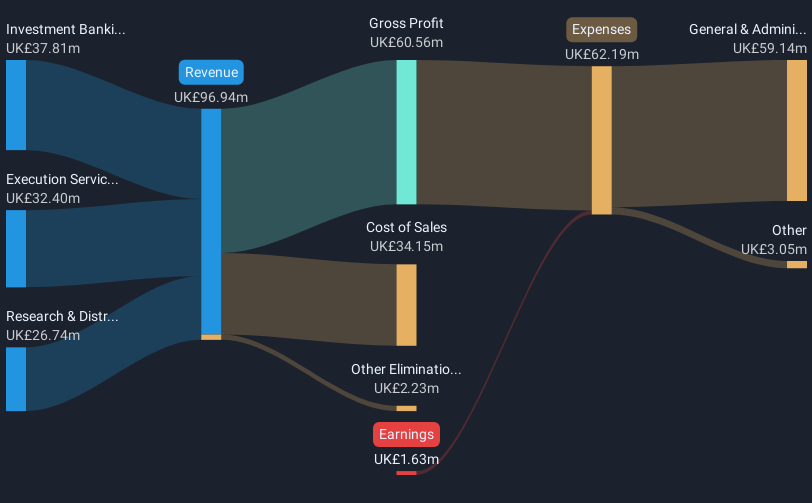

Operations: The firm's revenue is derived from three main segments: Execution Services (£32.40 million), Investment Banking (£37.81 million), and Research & Distribution (£26.74 million).

Market Cap: £92.11M

Peel Hunt Limited, with a market cap of £92.11 million, operates as an integrated investment banking firm in the UK. Despite being currently unprofitable with a negative return on equity of -1.97%, its debt is well managed, covered by operating cash flow at 28.9%, and reduced significantly over five years from 57.4% to 12.7%. The company holds more cash than total debt and maintains strong liquidity with short-term assets (£553.3M) surpassing both short-term (£457.2M) and long-term liabilities (£23.6M). Recent developments include its appointment as Joint UK Corporate Broker for PureTech Health plc alongside UBS.

- Navigate through the intricacies of Peel Hunt with our comprehensive balance sheet health report here.

- Examine Peel Hunt's earnings growth report to understand how analysts expect it to perform.

Renold (AIM:RNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renold plc manufactures and sells high precision engineered products and solutions across various international markets, with a market cap of £98.68 million.

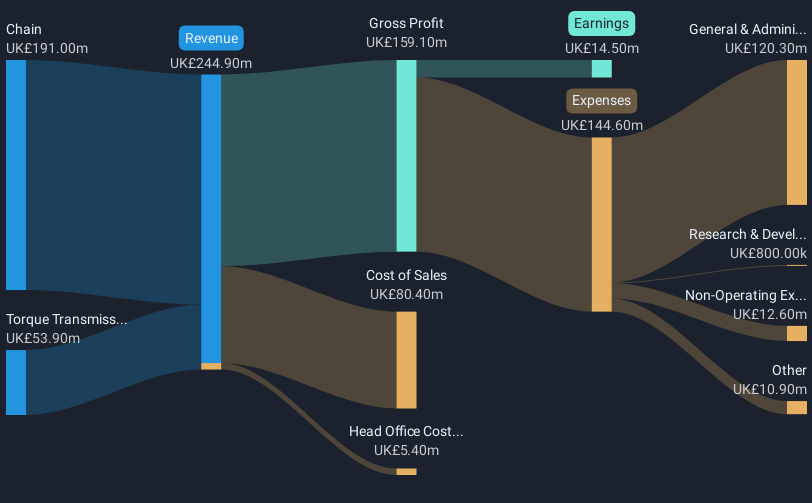

Operations: The company's revenue is derived from two main segments: Chain, generating £191 million, and Torque Transmission, contributing £53.9 million.

Market Cap: £98.68M

Renold plc, with a market cap of £98.68 million, shows resilience in the penny stock arena by maintaining high-quality earnings despite recent negative earnings growth of -9.9%. The company's debt is well covered by operating cash flow at 56.1%, though its net debt to equity ratio remains high at 77.3%. While short-term assets (£132.8M) exceed short-term liabilities (£76.6M), they fall short against long-term liabilities (£141.4M). Trading below its estimated fair value and showing stable weekly volatility (6%), Renold's seasoned management team supports future potential, with earnings forecasted to grow annually by 22.57%.

- Dive into the specifics of Renold here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Renold's future.

Summing It All Up

- Investigate our full lineup of 394 UK Penny Stocks right here.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Billington Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BILN

Billington Holdings

Through its subsidiaries, provides structural steel and construction safety solutions in the United Kingdom and Europe.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives