- United Kingdom

- /

- Capital Markets

- /

- LSE:IHP

Discover UK Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The UK stock market has experienced some turbulence recently, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market fluctuations, penny stocks continue to intrigue investors by offering potential growth opportunities at lower price points. These smaller or newer companies can present unique investment prospects when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.21M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.81 | £417.98M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.44 | £82.58M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.88 | £367.99M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.05 | £87.29M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £181.48M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Eden Research (AIM:EDEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eden Research plc develops and sells biopesticide solutions for crop protection, animal health, and consumer products industries in the UK and Europe, with a market cap of £19.20 million.

Operations: The company's revenue is primarily derived from the Agrochemicals segment, which generated £3.86 million, while the Consumer Products segment contributed £0.07 million.

Market Cap: £19.2M

Eden Research plc, with a market cap of £19.20 million, remains unprofitable despite generating £3.86 million from its Agrochemicals segment. The company is debt-free and has sufficient cash runway for over three years, indicating financial stability amidst ongoing losses. Recent regulatory approvals for its fungicide products in Mexico and Germany highlight potential growth opportunities in international markets, particularly within organic farming sectors. Partnerships with distributors like Sipcam Oxon and Sumi Agro Europe enhance Eden's market reach across Central Europe and Latin America, positioning the company to capitalize on increasing demand for sustainable biopesticide solutions.

- Jump into the full analysis health report here for a deeper understanding of Eden Research.

- Gain insights into Eden Research's outlook and expected performance with our report on the company's earnings estimates.

Peel Hunt (AIM:PEEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peel Hunt Limited operates as an integrated investment banking firm in the United Kingdom, with a market capitalization of £111.75 million.

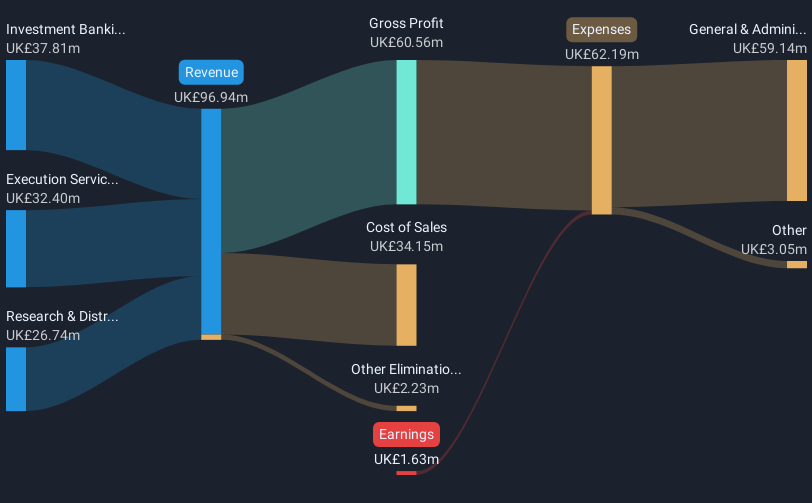

Operations: The firm's revenue is derived from three main segments: Execution Services (£32.40 million), Investment Banking (£37.81 million), and Research & Distribution (£26.74 million).

Market Cap: £111.75M

Peel Hunt Limited, with a market cap of £111.75 million, has shown improved financial performance by reporting a net income of GBP 0.889 million for the half year ended September 30, 2024, compared to a net loss in the previous period. The company is unprofitable overall but has strong liquidity with short-term assets exceeding both its short and long-term liabilities. Despite having more cash than total debt and reducing its debt-to-equity ratio significantly over five years, Peel Hunt's negative return on equity reflects ongoing profitability challenges. Management stability is supported by an experienced team and board members with average tenures exceeding three years.

- Click to explore a detailed breakdown of our findings in Peel Hunt's financial health report.

- Explore Peel Hunt's analyst forecasts in our growth report.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc operates an investment platform serving UK financial advisers and their clients, with a market cap of £1.18 billion.

Operations: The company's revenue is primarily derived from Investment Administration Services (£71.7 million), Insurance and Life Assurance Business (£68.3 million), and Adviser Back-Office Technology (£4.9 million).

Market Cap: £1.18B

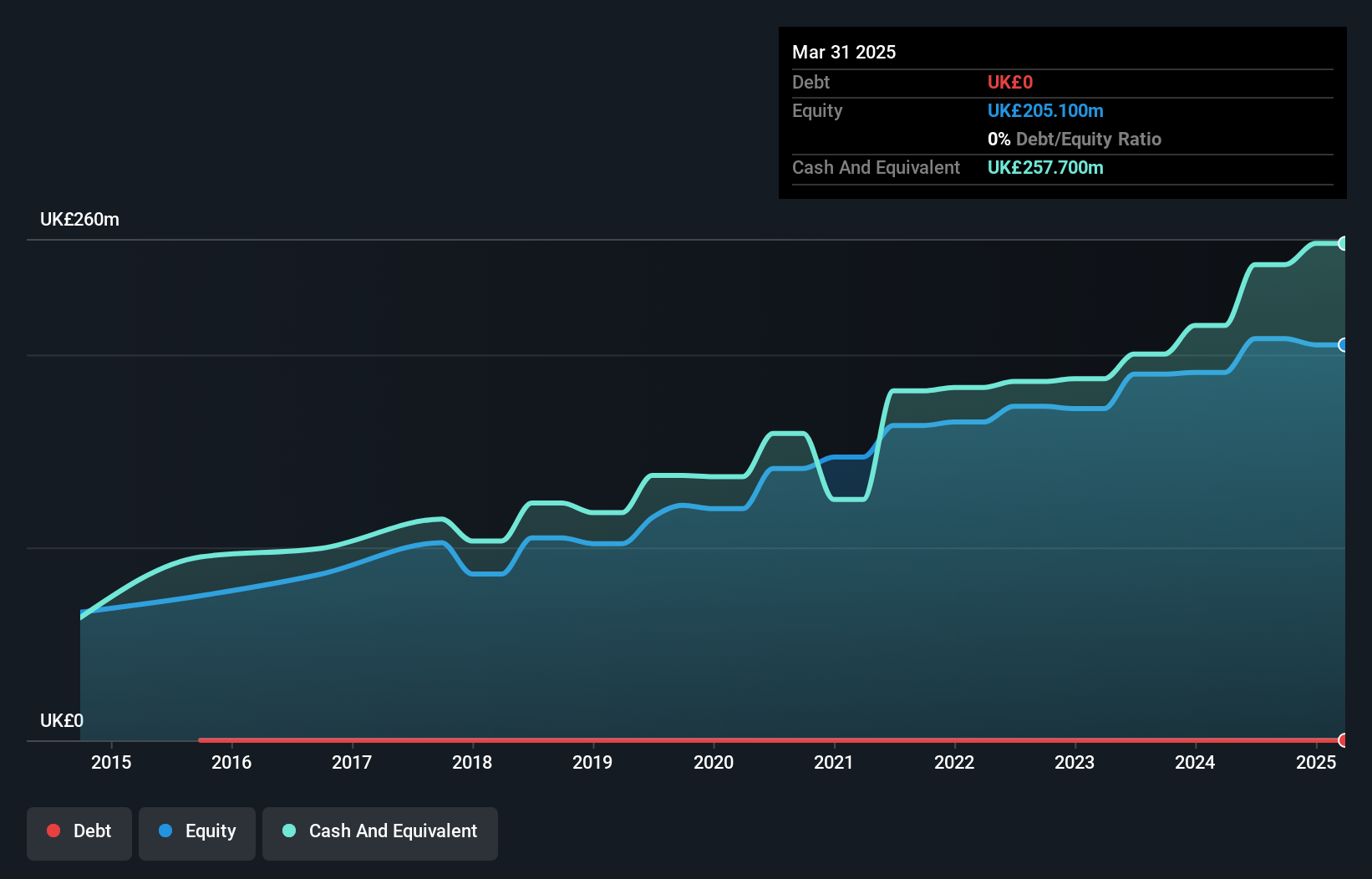

IntegraFin Holdings, with a market cap of £1.18 billion, demonstrates financial stability through its debt-free status and strong liquidity, as short-term assets (£270M) cover both short-term (£47.5M) and long-term liabilities (£46.8M). Earnings have grown modestly at 2.5% annually over five years, with recent earnings growth of 4.4%. Despite a slight dip in profit margins from last year (37% to 36%), the company maintains high-quality earnings and offers dividends, recently increased to 10.4 pence per share for the year ended September 2024. Recent board changes include appointing Irene McDermott Brown as a non-executive director.

- Click here and access our complete financial health analysis report to understand the dynamics of IntegraFin Holdings.

- Understand IntegraFin Holdings' earnings outlook by examining our growth report.

Key Takeaways

- Unlock our comprehensive list of 445 UK Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IHP

IntegraFin Holdings

Provides an investment platform for UK financial advisers and their clients.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives