- United Kingdom

- /

- Diversified Financial

- /

- AIM:LIT

3 Promising UK Penny Stocks Under £100M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market pressures, penny stocks continue to offer intriguing opportunities for investors looking for affordable entry points into potentially high-growth companies. While the term "penny stocks" may seem outdated, these investments can still provide significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £4.08 | £329.19M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £146.94M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.41M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.57 | £87.16M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.295 | £327.71M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £181.48M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gattaca (AIM:GATC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gattaca plc is a human capital resources company offering contract and permanent recruitment services across private and public sectors, with a market cap of £23.14 million.

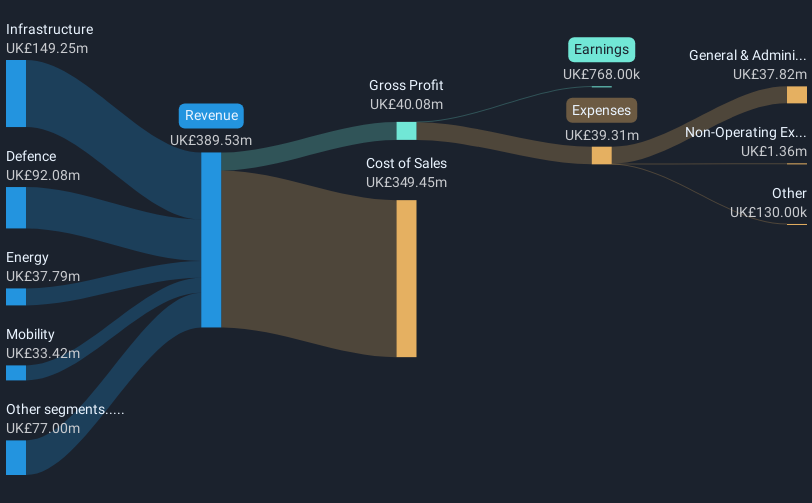

Operations: Gattaca's revenue is primarily derived from its Infrastructure segment (£149.25 million), followed by Defence (£92.08 million), Energy (£37.79 million), Mobility (£33.42 million), Technology, Media & Telecoms (£31.63 million), Gattaca Projects (£11.36 million), and International operations (£3.28 million).

Market Cap: £23.14M

Gattaca plc, with a market cap of £23.14 million, is a human capital resources company that draws its primary revenue from the Infrastructure segment (£149.25 million). The management team is experienced with an average tenure of 2.8 years, although the board lacks similar experience. Gattaca's financials reveal no debt and sufficient short-term assets (£76.2M) to cover liabilities (£51.3M), yet profit margins have decreased to 0.2% from 0.9% last year due to a £1.1M one-off loss impacting results until July 2024. Despite negative earnings growth recently, shareholders approved a final dividend of 2.5 pence per share in December 2024.

- Navigate through the intricacies of Gattaca with our comprehensive balance sheet health report here.

- Examine Gattaca's earnings growth report to understand how analysts expect it to perform.

Litigation Capital Management (AIM:LIT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Litigation Capital Management Limited offers dispute finance and risk management services in Australia and the United Kingdom, with a market capitalization of £92.33 million.

Operations: The company's revenue is derived from its Group's Fund Structures, generating A$51.42 million, and its Litigation Capital Management operations, contributing A$47.95 million.

Market Cap: £92.33M

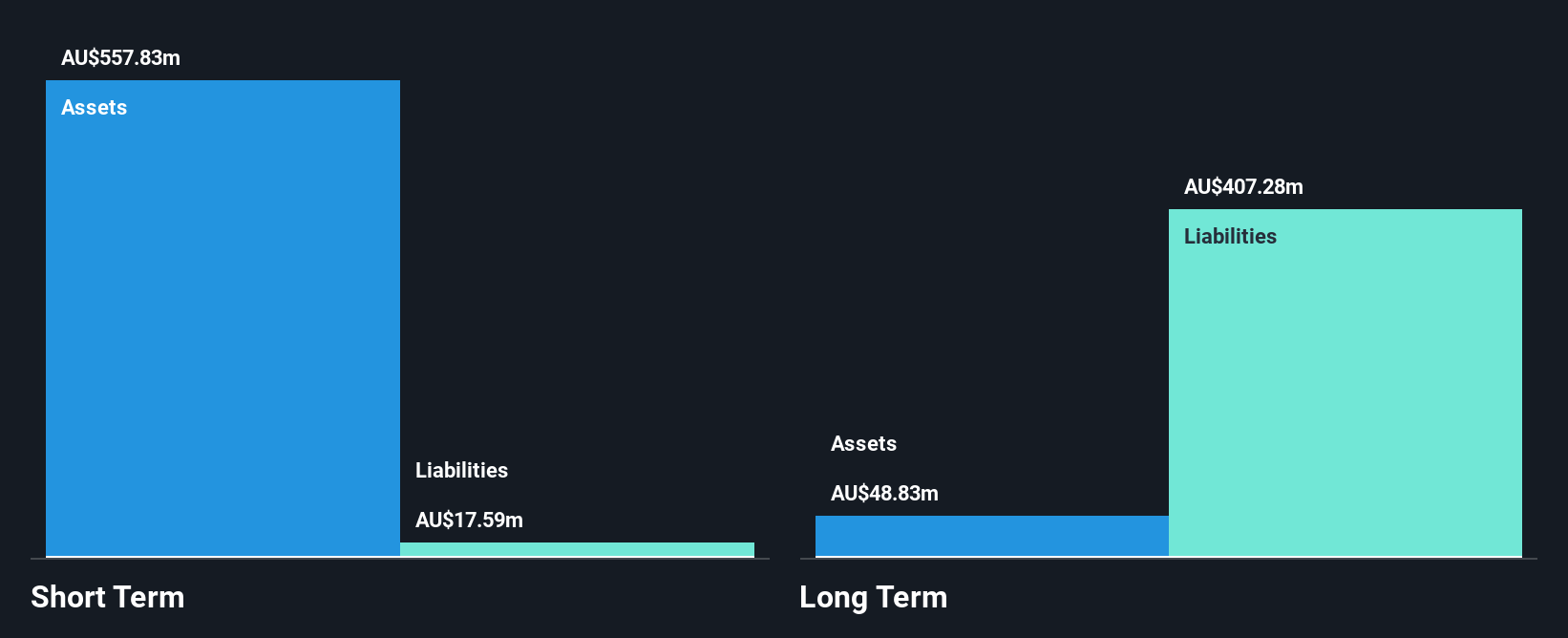

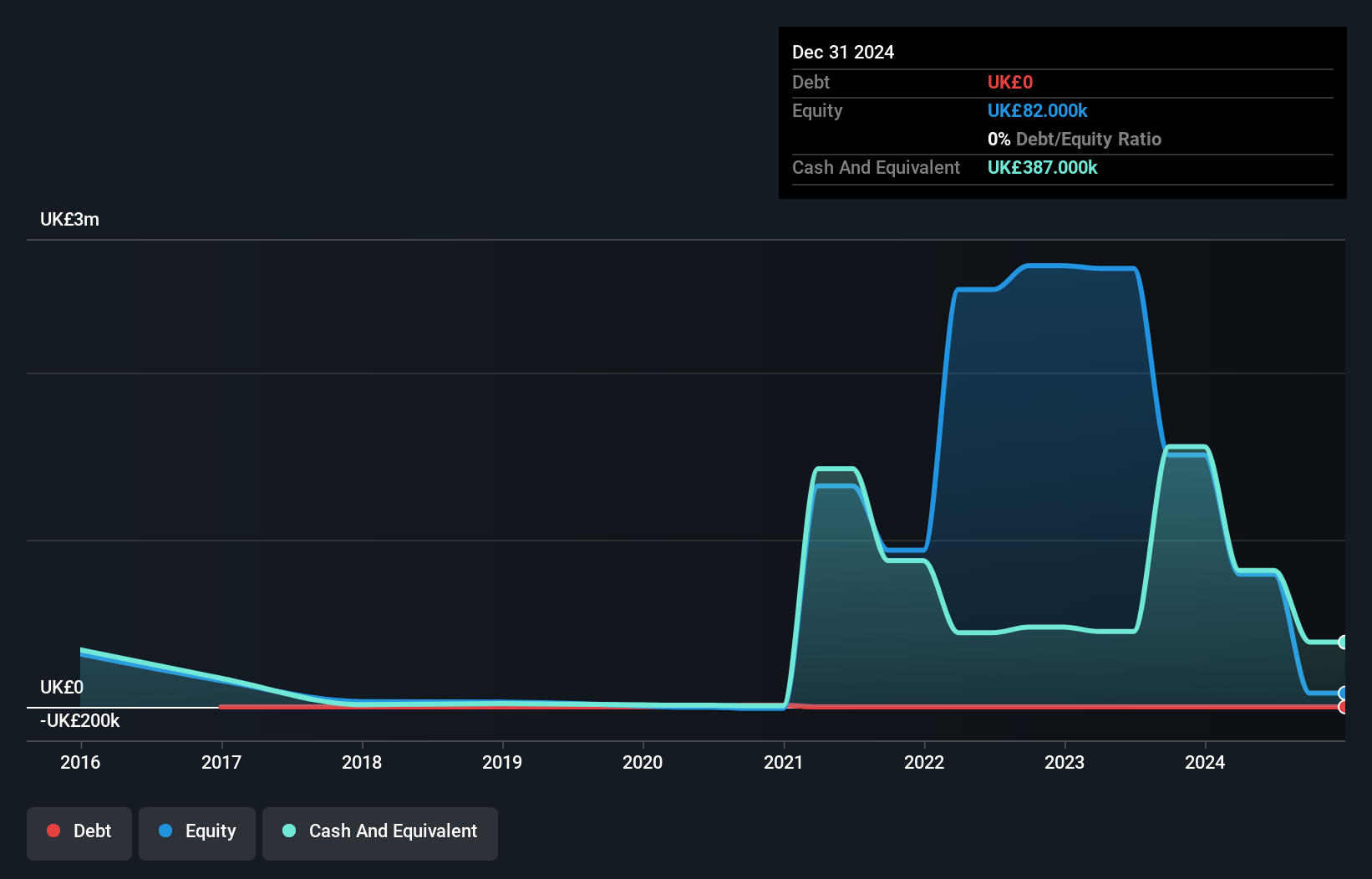

Litigation Capital Management, with a market cap of £92.33 million, has demonstrated financial resilience despite challenges. Its debt is well covered by operating cash flow, and it holds more cash than total debt. The company reported high-quality earnings but faced negative earnings growth of -59.6% over the past year, impacting comparisons with industry averages. Recent developments include securing a USD 75 million credit facility from Northleaf Capital Partners to support its growth strategy and board changes with David Collins joining as a director and Gerhard Seebacher stepping down in January 2025 due to external commitments.

- Dive into the specifics of Litigation Capital Management here with our thorough balance sheet health report.

- Evaluate Litigation Capital Management's prospects by accessing our earnings growth report.

Cizzle Biotechnology Holdings (LSE:CIZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cizzle Biotechnology Holdings Plc, with a market cap of £7.53 million, focuses on developing an immunoassay test for the CIZ1B cancer biomarker aimed at the early detection of lung cancer in the United Kingdom.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £7.53M

Cizzle Biotechnology Holdings, with a market cap of £7.53 million, is pre-revenue and focuses on developing an ELISA-based test for early lung cancer detection using the CIZ1B biomarker. Recent advancements include successful technical validation of the assay's cost-effectiveness and scalability, alongside strategic executive changes to enhance partnerships in North America. The company has extended its licensing agreement to cover the Caribbean, accelerating market entry and potential revenue streams. Despite having no debt or long-term liabilities, it faces high share price volatility and negative earnings growth but maintains a sufficient cash runway for over a year.

- Click to explore a detailed breakdown of our findings in Cizzle Biotechnology Holdings' financial health report.

- Assess Cizzle Biotechnology Holdings' previous results with our detailed historical performance reports.

Taking Advantage

- Navigate through the entire inventory of 446 UK Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LIT

Litigation Capital Management

Provides dispute finance and risk management services in Australia and the United Kingdom.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives