- United Kingdom

- /

- Capital Markets

- /

- LSE:AJB

3 UK Penny Stocks With Market Caps Under £2B

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, there remain opportunities for investors willing to explore beyond established blue-chip stocks. Penny stocks—typically smaller or newer companies—can still offer intriguing prospects when they exhibit strong financial health and potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.195 | £827M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.91 | £68.92M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.555 | £181.33M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.465 | £361.6M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.275 | £72.73M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.2325 | £105.22M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.393 | $228.46M | ★★★★★★ |

Click here to see the full list of 462 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impax Asset Management Group Plc is a publicly owned investment manager with a market cap of £431.24 million.

Operations: The company generated revenue of £176.56 million from its investment management activities.

Market Cap: £431.24M

Impax Asset Management Group Plc, with a market cap of £431.24 million and revenue of £176.56 million, stands out for its financial stability, boasting no debt and strong short-term asset coverage over liabilities. Despite a recent dip in earnings growth (-18.1%), the company maintains high-quality earnings and a robust return on equity (34.5%). Trading at 64% below estimated fair value suggests potential for appreciation, though investors should be cautious of its unstable dividend history and relatively inexperienced board (2.4 years average tenure). Recent participation in investor conferences highlights active engagement with stakeholders.

- Unlock comprehensive insights into our analysis of Impax Asset Management Group stock in this financial health report.

- Gain insights into Impax Asset Management Group's future direction by reviewing our growth report.

AJ Bell (LSE:AJB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AJ Bell plc operates investment platforms in the United Kingdom and has a market capitalization of approximately £1.89 billion.

Operations: The company's revenue from Investment Services amounts to £244.98 million.

Market Cap: £1.89B

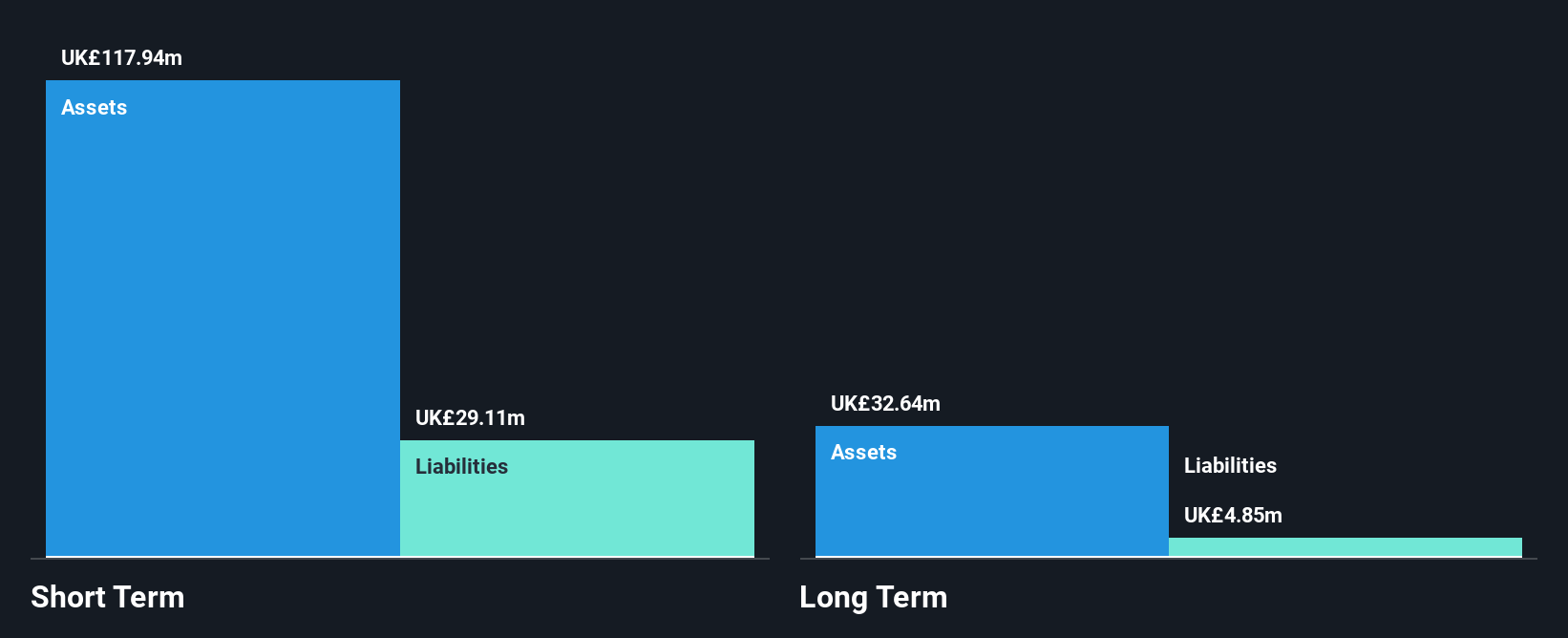

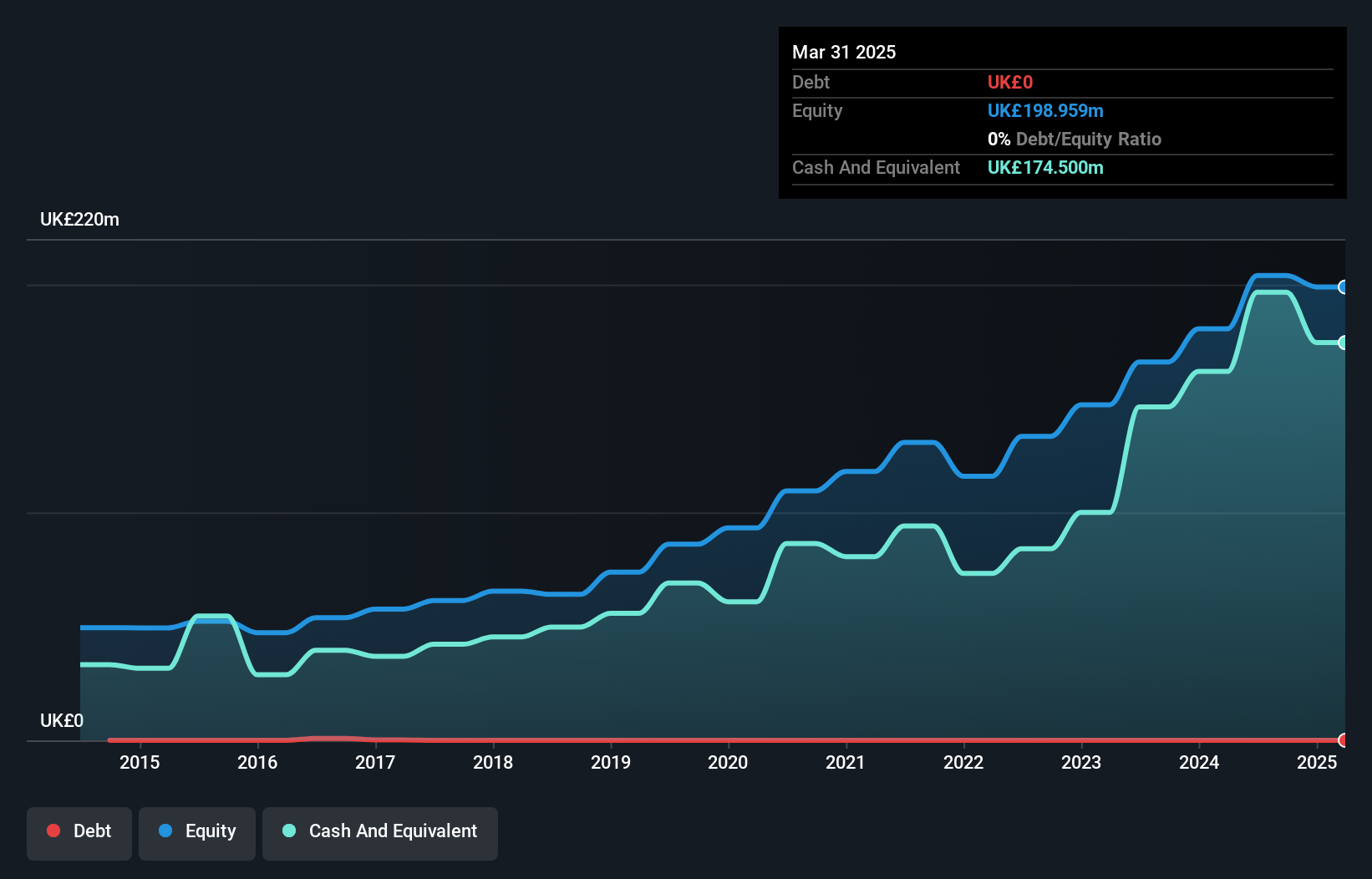

AJ Bell plc, with a market cap of £1.89 billion and revenue of £244.98 million, exhibits strong financial health as it operates debt-free and maintains robust asset coverage over liabilities. The company has demonstrated impressive earnings growth, outpacing the industry with a 38.6% increase last year and an outstanding return on equity of 45%. However, recent significant insider selling could be a concern for potential investors. Recent executive changes include Ryan Hughes' appointment as MD and Stephen Westgate as group corporate development director, indicating strategic shifts in leadership amidst ongoing operational adjustments.

- Navigate through the intricacies of AJ Bell with our comprehensive balance sheet health report here.

- Understand AJ Bell's earnings outlook by examining our growth report.

CAB Payments Holdings (LSE:CABP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CAB Payments Holdings Limited offers foreign exchange and cross-border payment services to banks, fintech companies, development organizations, and governments globally, with a market cap of £184.51 million.

Operations: No revenue segments have been reported for CAB Payments Holdings Limited.

Market Cap: £184.51M

CAB Payments Holdings, with a market cap of £184.51 million, has faced challenges despite some financial strengths. The company's short-term assets (£858 million) exceed long-term liabilities (£122.9 million), but do not cover its short-term liabilities (£1.4 billion). Recent M&A activity saw StoneX Group withdraw acquisition plans after CAB Payments' board deemed offers not in shareholders' best interest. Earnings have declined by 46.9% over the past year, and profit margins dropped from 59.2% to 21.9%. Despite these setbacks, CAB Payments trades at a significant discount to estimated fair value and maintains more cash than total debt, indicating potential for recovery if strategic adjustments are made effectively.

- Click here and access our complete financial health analysis report to understand the dynamics of CAB Payments Holdings.

- Assess CAB Payments Holdings' future earnings estimates with our detailed growth reports.

Key Takeaways

- Get an in-depth perspective on all 462 UK Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AJB

AJ Bell

Through its subsidiaries, operates investment platforms in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives