- United Kingdom

- /

- Diversified Financial

- /

- AIM:FNX

Discover UK Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China impacting companies closely tied to its economy. Despite these broader market fluctuations, investors continue to explore opportunities in lesser-known areas such as penny stocks. While the term "penny stocks" may seem outdated, it still refers to smaller or newer companies that can offer significant growth potential when backed by strong fundamentals and solid financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.91 | £549.71M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.10 | £169.65M | ✅ 3 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5225 | $303.74M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.942 | £348.33M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.51 | £257.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.185 | £188.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.725 | £9.98M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.38 | £72.51M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 287 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Technologies PLC, operating under the Buddi brand, develops and provides remote monitoring technologies and services for the offender and personal monitoring industry, with a market cap of £245.34 million.

Operations: Big Technologies PLC has not reported any specific revenue segments.

Market Cap: £245.34M

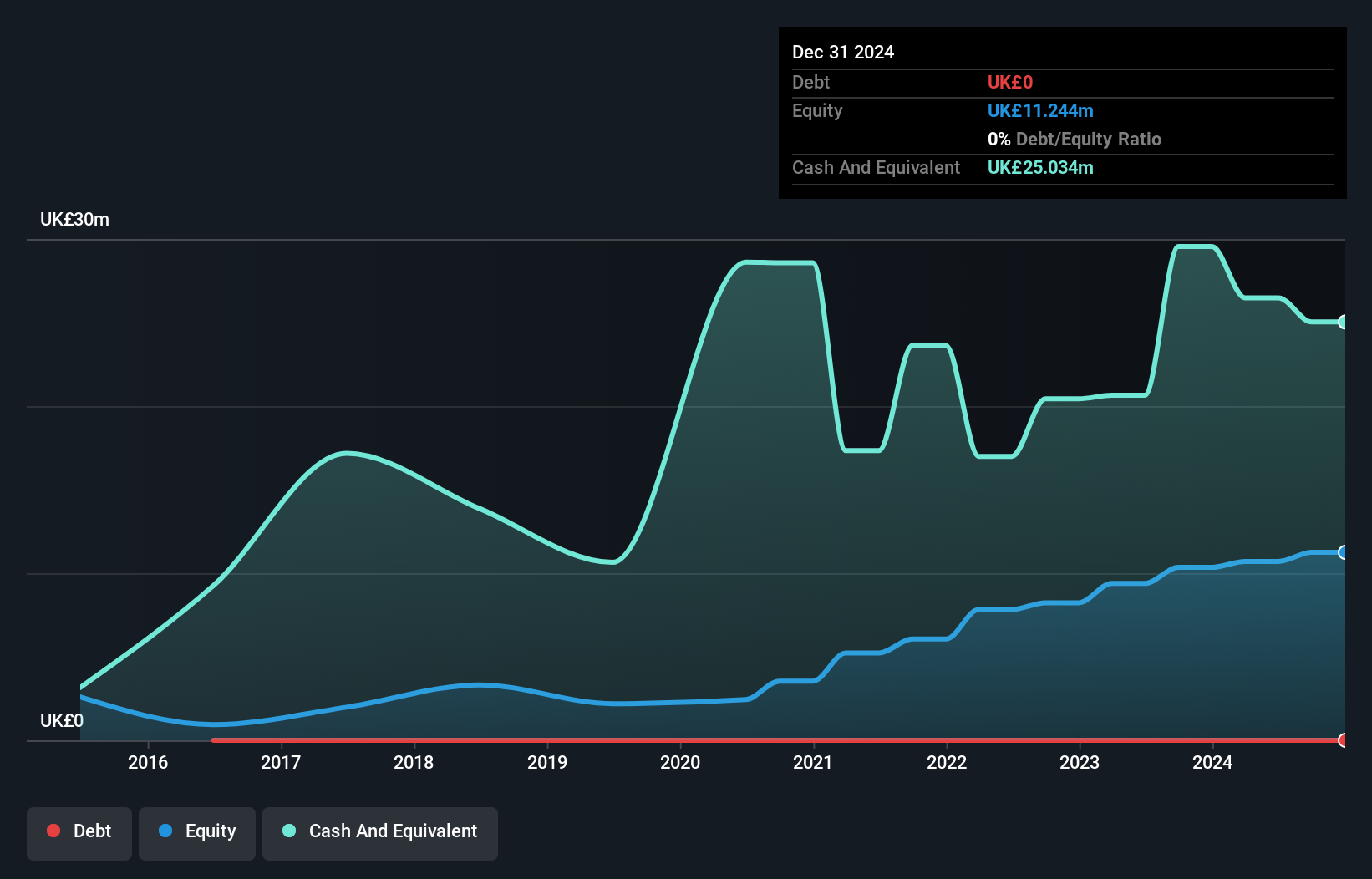

Big Technologies PLC, with a market cap of £245.34 million, is currently trading significantly below its estimated fair value and maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities. Despite being debt-free, the company reported a net loss of £28.84 million for the half year ending June 2025, contrasting with a net income in the previous year. Leadership changes are ongoing as Sangita Shah steps in as interim chair amidst litigation challenges involving former CEO Sara Murray. The management and board's lack of experience may be concerning for investors seeking stability in this volatile penny stock environment.

- Navigate through the intricacies of Big Technologies with our comprehensive balance sheet health report here.

- Assess Big Technologies' future earnings estimates with our detailed growth reports.

Fonix (AIM:FNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fonix Plc operates in the United Kingdom, offering mobile payments, messaging, and managed services across sectors such as media, charity, gaming, and e-mobility with a market cap of £200.16 million.

Operations: The company's revenue is derived from its mobile payments and messaging facilitation segment, totaling £72.78 million.

Market Cap: £200.16M

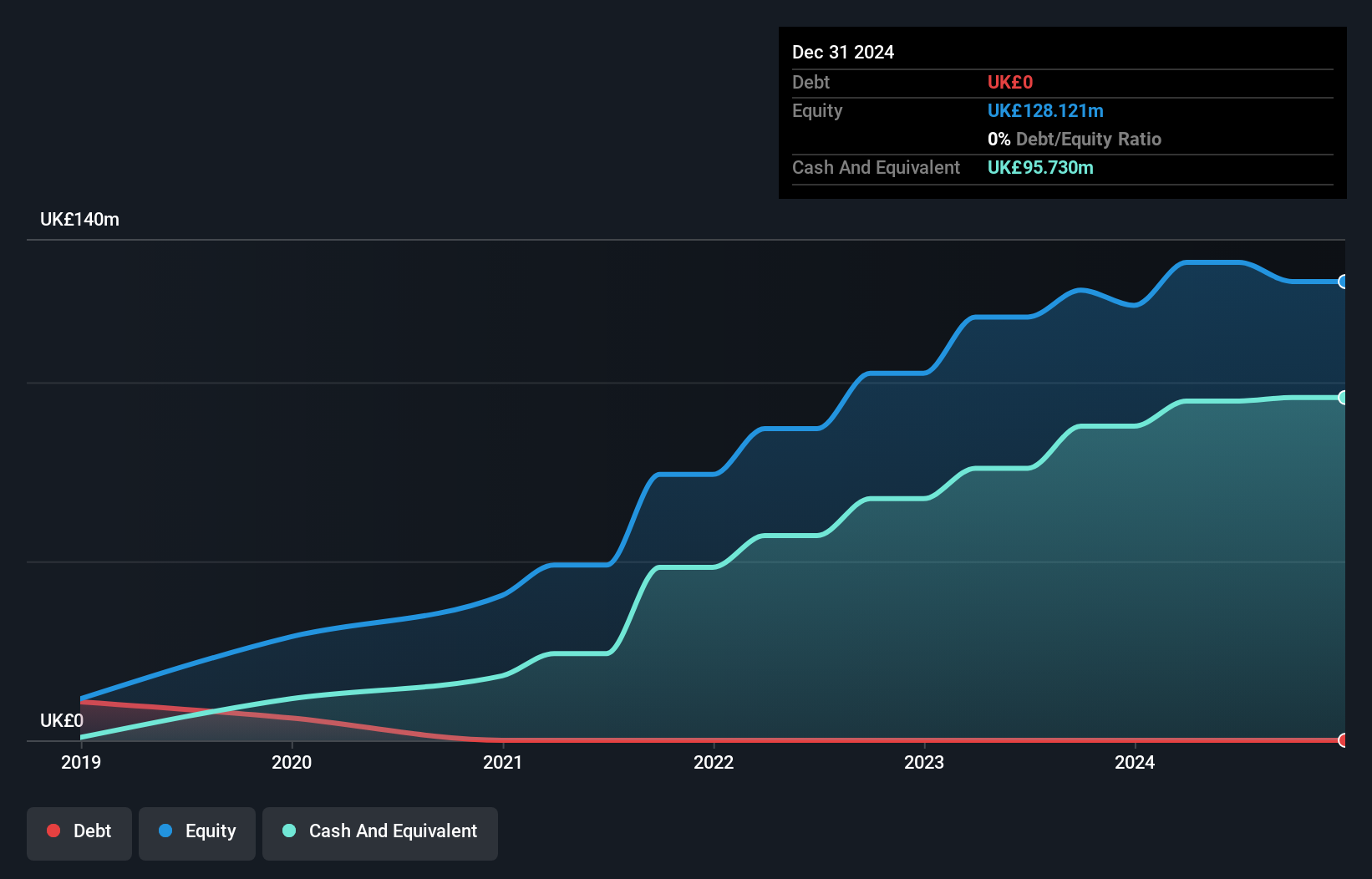

Fonix Plc, with a market cap of £200.16 million, demonstrates financial stability with short-term assets surpassing both short and long-term liabilities and remains debt-free. Its Return on Equity is outstanding at 105.8%, though recent earnings growth of 5% lags behind its five-year average of 14%. The company recently announced an increased final dividend, reflecting its commitment to a progressive dividend policy despite dividends not being well-covered by free cash flows. Earnings for the year ended June 2025 showed slight improvement in net income to £11.15 million from the previous year’s £10.62 million, indicating modest profitability growth amidst stable operations.

- Unlock comprehensive insights into our analysis of Fonix stock in this financial health report.

- Learn about Fonix's historical performance here.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Made Tech Group Plc offers digital, data, and technology services to the UK public sector, with a market cap of £52.98 million.

Operations: The company's revenue is derived from its Computer Graphics segment, which generated £46.43 million.

Market Cap: £52.98M

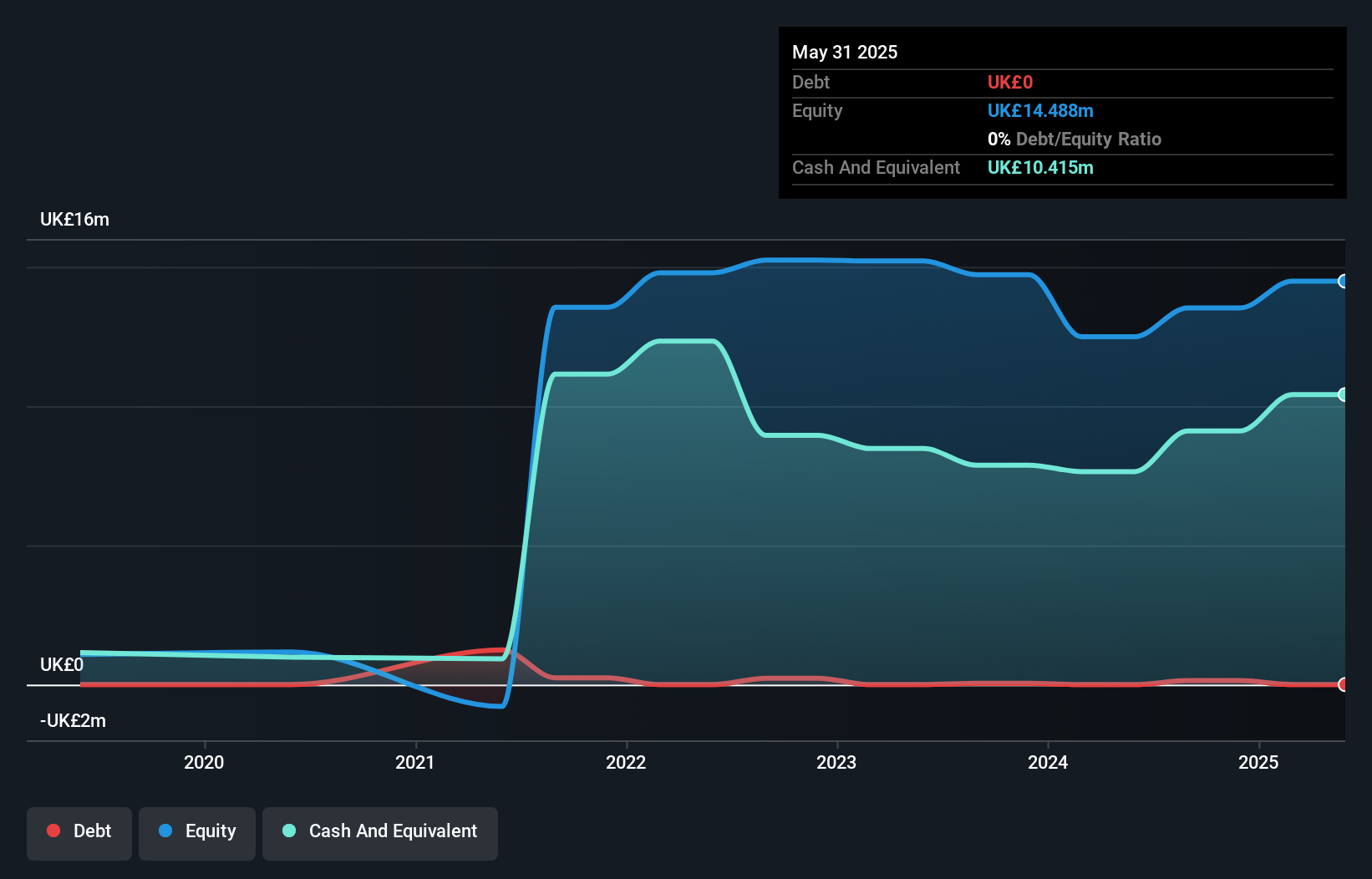

Made Tech Group Plc, with a market cap of £52.98 million, has shown improved financial performance by becoming profitable this year, reporting net income of £1.4 million for the full year ending May 31, 2025. The company is debt-free and maintains strong liquidity with short-term assets of £17.4 million exceeding both its short-term and long-term liabilities. Despite high weekly volatility at 7%, Made Tech trades slightly below its estimated fair value and offers high-quality earnings amidst a less experienced management team averaging 1.3 years in tenure. Recent earnings growth reflects a turnaround from the previous year's net loss of £2.45 million.

- Click here and access our complete financial health analysis report to understand the dynamics of Made Tech Group.

- Examine Made Tech Group's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Navigate through the entire inventory of 287 UK Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNX

Fonix

Provides mobile payments and messaging, and managed services for media, charity, gaming, e-mobility, and other digital service businesses in the United Kingdom.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives