- United Kingdom

- /

- Software

- /

- AIM:KBT

3 UK Penny Stocks With Over £40M Market Cap

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, which impacts many UK-listed companies tied to global economic trends. Despite these broader market pressures, certain investment opportunities remain attractive for those looking beyond traditional blue-chip stocks. Penny stocks, though an outdated term, still represent a sector of smaller or newer companies that can offer growth potential when backed by solid fundamentals and financial stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.675 | £296.89M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.77 | £428.9M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.16 | £314.28M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.415 | £425.59M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.85 | £72.15M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.19 | £156.24M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.40 | £215.92M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

Click here to see the full list of 439 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Frenkel Topping Group (AIM:FEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frenkel Topping Group Plc, along with its subsidiaries, offers independent financial advisory, discretionary fund management, and financial services in the United Kingdom with a market cap of £40.55 million.

Operations: Frenkel Topping Group does not report specific revenue segments.

Market Cap: £40.55M

Frenkel Topping Group, with a market cap of £40.55 million, operates debt-free and holds a strong liquidity position, with short-term assets of £25.8 million surpassing its liabilities. Despite experiencing a one-off loss of £1.4 million affecting recent financials and a decline in profit margins from 8.2% to 3%, the company forecasts revenue growth of 14% for the year ending December 2024, reaching £37.4 million. The management team is experienced with an average tenure of 4.2 years, although earnings have faced challenges recently with negative growth over the past year at -57%.

- Navigate through the intricacies of Frenkel Topping Group with our comprehensive balance sheet health report here.

- Gain insights into Frenkel Topping Group's outlook and expected performance with our report on the company's earnings estimates.

K3 Business Technology Group (AIM:KBT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: K3 Business Technology Group plc offers computer software and consultancy services across various regions including the United Kingdom, Europe, the Middle East, Asia, and the United States with a market capitalization of £46.94 million.

Operations: K3 Business Technology Group plc has not reported specific revenue segments.

Market Cap: £46.94M

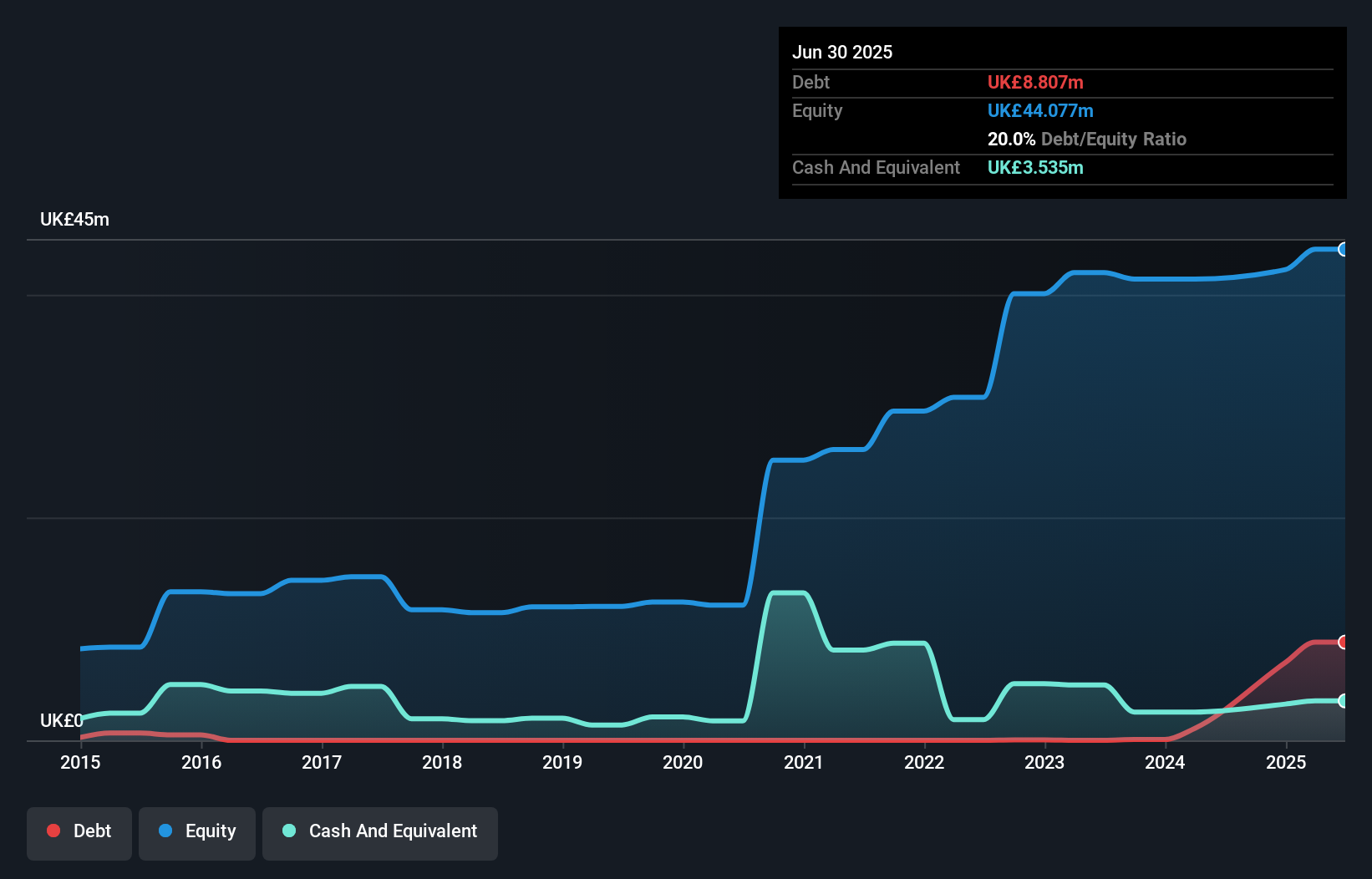

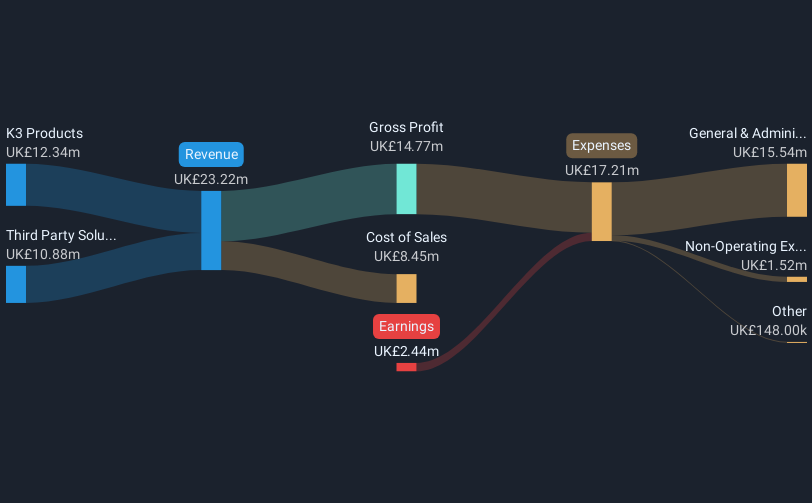

K3 Business Technology Group, with a market capitalization of £46.94 million, is navigating the challenges typical of penny stocks. Despite being unprofitable, it has reduced its losses by 24.4% annually over the past five years and maintains a cash runway exceeding three years due to positive free cash flow. The company's debt management is commendable, having eliminated its debt over five years while holding more cash than liabilities. Recent earnings show sales of £23.22 million for 2024 but highlight volatility with net income turning positive at £0.574 million from a previous loss, amidst fluctuating share prices and high stock volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of K3 Business Technology Group.

- Learn about K3 Business Technology Group's historical performance here.

Hansard Global (LSE:HSD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hansard Global plc is a specialist long-term savings provider offering savings and investment products to investors, institutions, and wealth-management groups in the Isle of Man, Republic of Ireland, and The Bahamas with a market cap of £69.65 million.

Operations: The company's revenue primarily comes from the distribution and servicing of long-term investment products, amounting to £168.3 million.

Market Cap: £69.65M

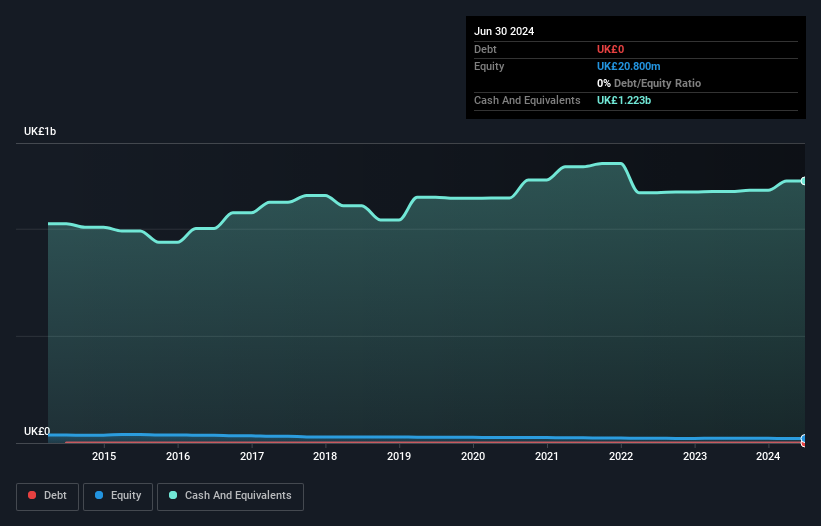

Hansard Global plc, with a market cap of £69.65 million, presents a mixed picture typical of penny stocks. It operates debt-free and boasts high return on equity at 25%, yet faces challenges with negative earnings growth (-8.8%) over the past year and declining profit margins (3.1% from 6.3%). The company's short-term assets (£1.2 billion) comfortably cover its short-term liabilities (£104.9 million), but not its long-term liabilities (£1.2 billion). Recent board changes could impact strategic direction, while dividends remain unsustainable due to insufficient earnings coverage, despite trading below estimated fair value by 42.9%.

- Get an in-depth perspective on Hansard Global's performance by reading our balance sheet health report here.

- Examine Hansard Global's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Jump into our full catalog of 439 UK Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K3 Business Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KBT

K3 Business Technology Group

Provides computer software and consultancy services in the United Kingdom, the Netherlands, Ireland, rest of Europe, the Middle East, Asia, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives