- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:WINE

Cavendish Leads The Charge In UK Penny Stock Trio

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, closing lower amid weak trade data from China, highlighting the interconnectedness of global markets. Despite these broader market challenges, certain investment opportunities remain attractive, particularly in the realm of penny stocks. While the term 'penny stocks' might seem outdated, it continues to signify smaller or newer companies that can offer significant potential when underpinned by strong financials. In this article, we explore three such UK penny stocks that combine balance sheet strength with promising growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.59 | £513.88M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.09 | £168.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.38 | £121.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.52 | £73.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.854 | £700.3M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cavendish (AIM:CAV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cavendish plc, along with its subsidiaries, functions as an investment bank in the United Kingdom and has a market cap of £37.27 million.

Operations: The company generates revenue of £55.28 million from its Corporate Advisory and Broking, M&A Advisory, and Institutional Stockbroking segments.

Market Cap: £37.27M

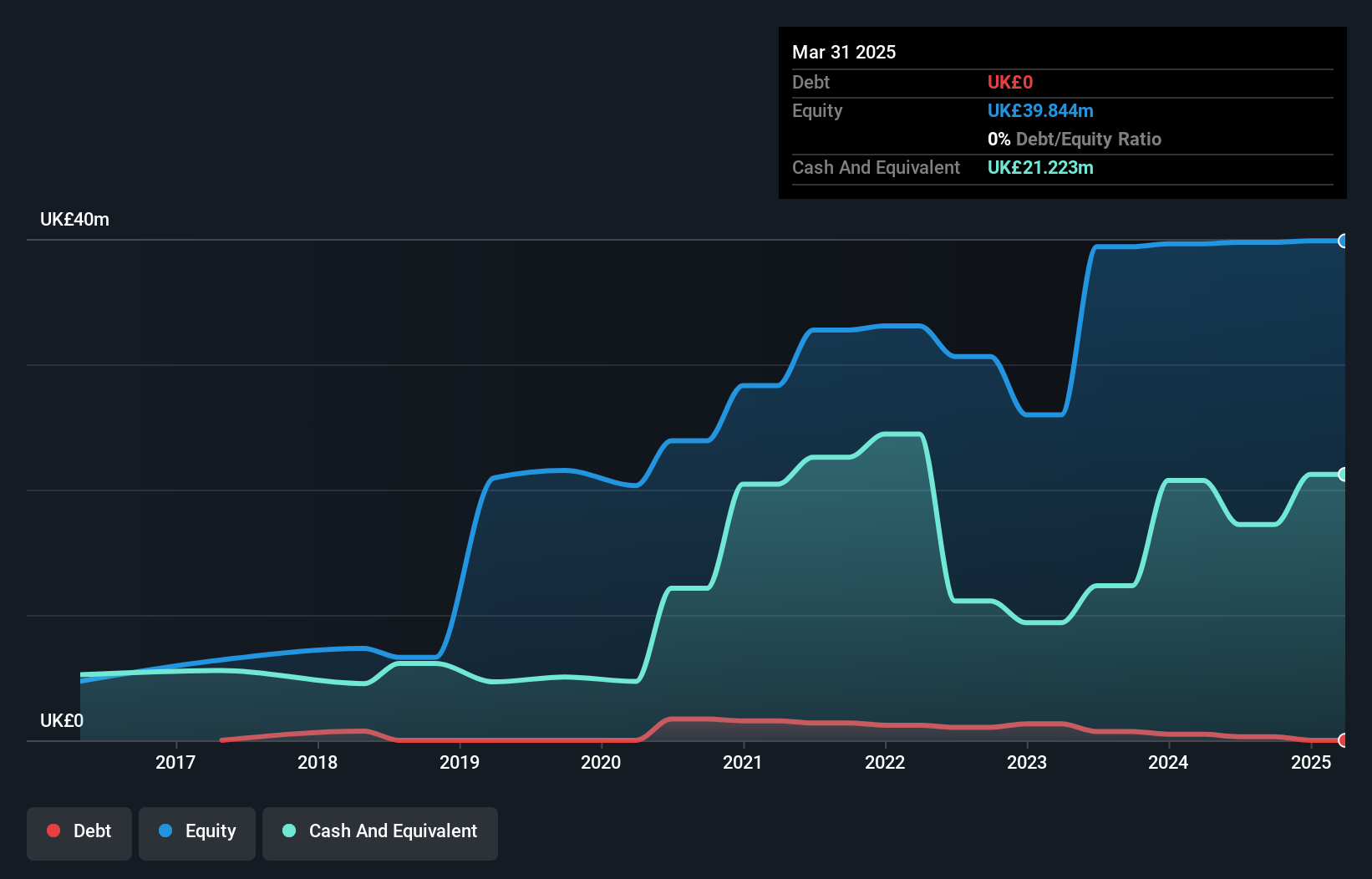

Cavendish plc, with a market cap of £37.27 million and revenue of £55.28 million, has recently become profitable, marking a significant shift in its financial trajectory. Despite experiencing a large one-off loss of £294K impacting recent results, the company remains debt-free and has not diluted shareholders over the past year. Its short-term assets comfortably cover both short-term and long-term liabilities, though its dividend yield of 9.01% isn't well covered by earnings. While Cavendish's earnings growth is forecasted at 73.61% annually, its return on equity remains low at 1.9%. The board's average tenure suggests relatively new leadership.

- Take a closer look at Cavendish's potential here in our financial health report.

- Assess Cavendish's future earnings estimates with our detailed growth reports.

Sosandar (AIM:SOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sosandar Plc is involved in the manufacture and distribution of clothing products both in the United Kingdom and internationally, with a market cap of £14.89 million.

Operations: The company generates revenue from retail sales amounting to £37.13 million.

Market Cap: £14.89M

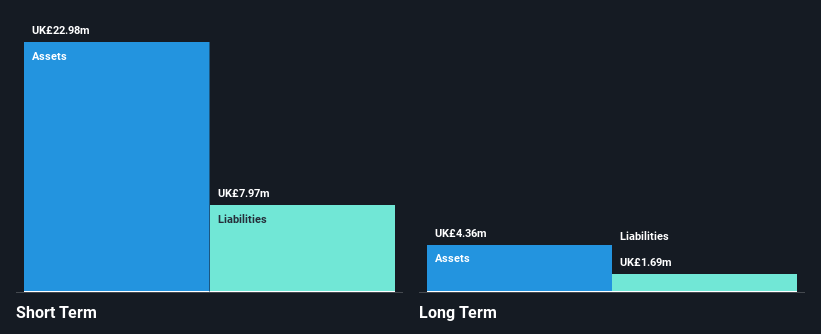

Sosandar Plc, with a market cap of £14.89 million and revenue of £37.13 million, has reiterated its earnings guidance for the year ending 31 March 2026, projecting revenues of £43.6 million. The company remains unprofitable but has reduced losses by a very large rate over the past five years while maintaining a debt-free status. Short-term assets (£22.2M) exceed both short-term (£7.7M) and long-term liabilities (£3.4M), indicating financial stability despite high share price volatility recently noted in the market. The board is experienced with an average tenure of 7.9 years, supporting strategic continuity amidst growth efforts.

- Dive into the specifics of Sosandar here with our thorough balance sheet health report.

- Explore Sosandar's analyst forecasts in our growth report.

Naked Wines (AIM:WINE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates as a direct-to-consumer wine retailer in Australia, the United Kingdom, and the United States, with a market cap of £53.50 million.

Operations: The company's revenue is generated from its direct-to-consumer wine sales across the UK (£111.40 million), USA (£111.80 million), and Australia (£29.93 million).

Market Cap: £53.5M

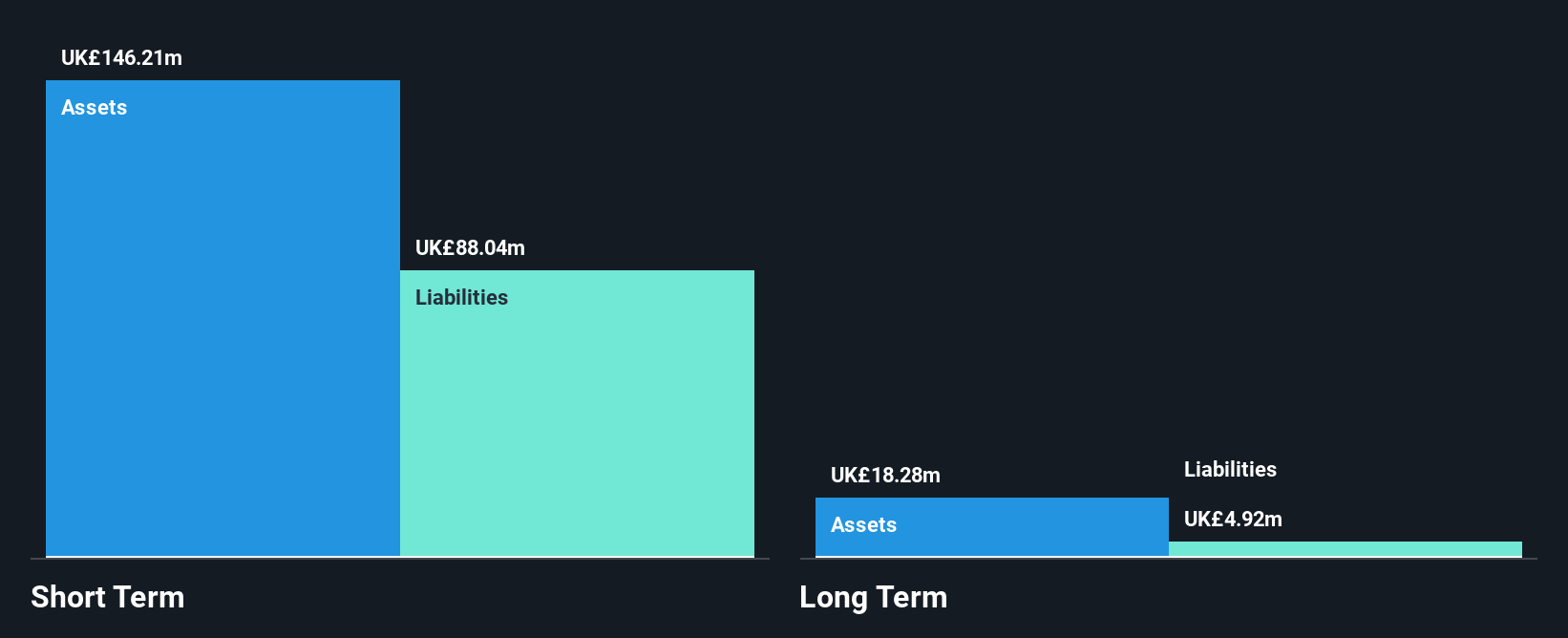

Naked Wines plc, with a market cap of £53.50 million, faces challenges amidst its unprofitability and recent auditor concerns about its going concern status. Despite these issues, the company maintains a strong balance sheet with short-term assets of £146.2 million exceeding both short-term and long-term liabilities. Recent strategic appointments to the board aim to bolster marketing and growth initiatives, while a share repurchase program seeks to enhance shareholder value. However, the company's revenue has declined from £290.41 million to £250.22 million year-on-year, reflecting ongoing operational hurdles that need addressing for future stability.

- Jump into the full analysis health report here for a deeper understanding of Naked Wines.

- Gain insights into Naked Wines' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Unlock more gems! Our UK Penny Stocks screener has unearthed 289 more companies for you to explore.Click here to unveil our expertly curated list of 292 UK Penny Stocks.

- Interested In Other Possibilities? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Naked Wines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WINE

Naked Wines

Engages in the direct-to-consumer retailing of wines in Australia, the United Kingdom, and the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives