- United Kingdom

- /

- Chemicals

- /

- LSE:VCT

Henry Boot And 2 Other Stocks On UK Exchange Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China and a sluggish global economic recovery. Despite these headwinds, there are opportunities to find stocks trading below their fair value, which can be appealing for investors looking for potential growth in undervalued assets. In this article, we will explore Henry Boot and two other stocks on the UK exchange that are estimated to be trading below their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.38 | £0.76 | 49.9% |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.66 | £1.30 | 49.3% |

| Topps Tiles (LSE:TPT) | £0.463 | £0.9 | 48.3% |

| Informa (LSE:INF) | £8.454 | £16.81 | 49.7% |

| Redcentric (AIM:RCN) | £1.2925 | £2.45 | 47.3% |

| Moonpig Group (LSE:MOON) | £2.025 | £3.65 | 44.5% |

| Velocity Composites (AIM:VEL) | £0.44 | £0.82 | 46.4% |

| Tortilla Mexican Grill (AIM:MEX) | £0.515 | £1.01 | 48.9% |

| SysGroup (AIM:SYS) | £0.34 | £0.66 | 48.4% |

| Foxtons Group (LSE:FOXT) | £0.632 | £1.19 | 46.8% |

Let's uncover some gems from our specialized screener.

Henry Boot (LSE:BOOT)

Overview: Henry Boot PLC is a UK-based company involved in property investment and development, land promotion, and construction activities, with a market cap of £310.01 million.

Operations: Henry Boot PLC's revenue segments include property investment and development, land promotion, and construction activities in the United Kingdom.

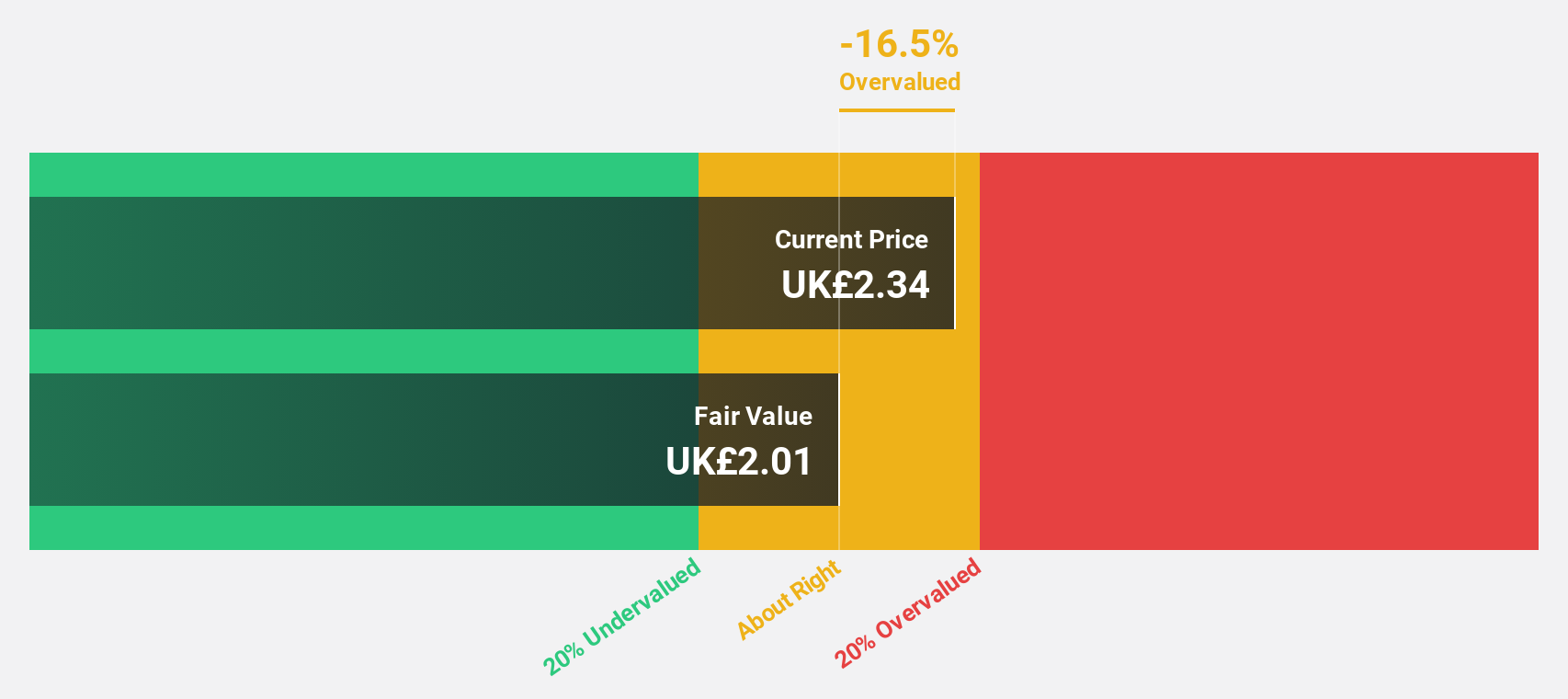

Estimated Discount To Fair Value: 20.4%

Henry Boot PLC's recent earnings report shows a significant drop in sales and net income, but the company remains undervalued based on discounted cash flow analysis. Trading at £2.32, it is 20.4% below its estimated fair value of £2.91. Despite lower earnings, the company has increased its interim dividend by 5%, reflecting confidence in future prospects. Additionally, ongoing business expansions like the Airport Business Park Southend project highlight growth potential and strategic investments in high-quality industrial spaces.

- According our earnings growth report, there's an indication that Henry Boot might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Henry Boot.

Trainline (LSE:TRN)

Overview: Trainline Plc operates an independent rail and coach travel platform selling tickets in the United Kingdom and internationally, with a market cap of £1.47 billion.

Operations: Trainline's revenue segments include Trainline Solutions at £134.76 million, International Consumer at £53.16 million, and United Kingdom Consumer at £208.80 million.

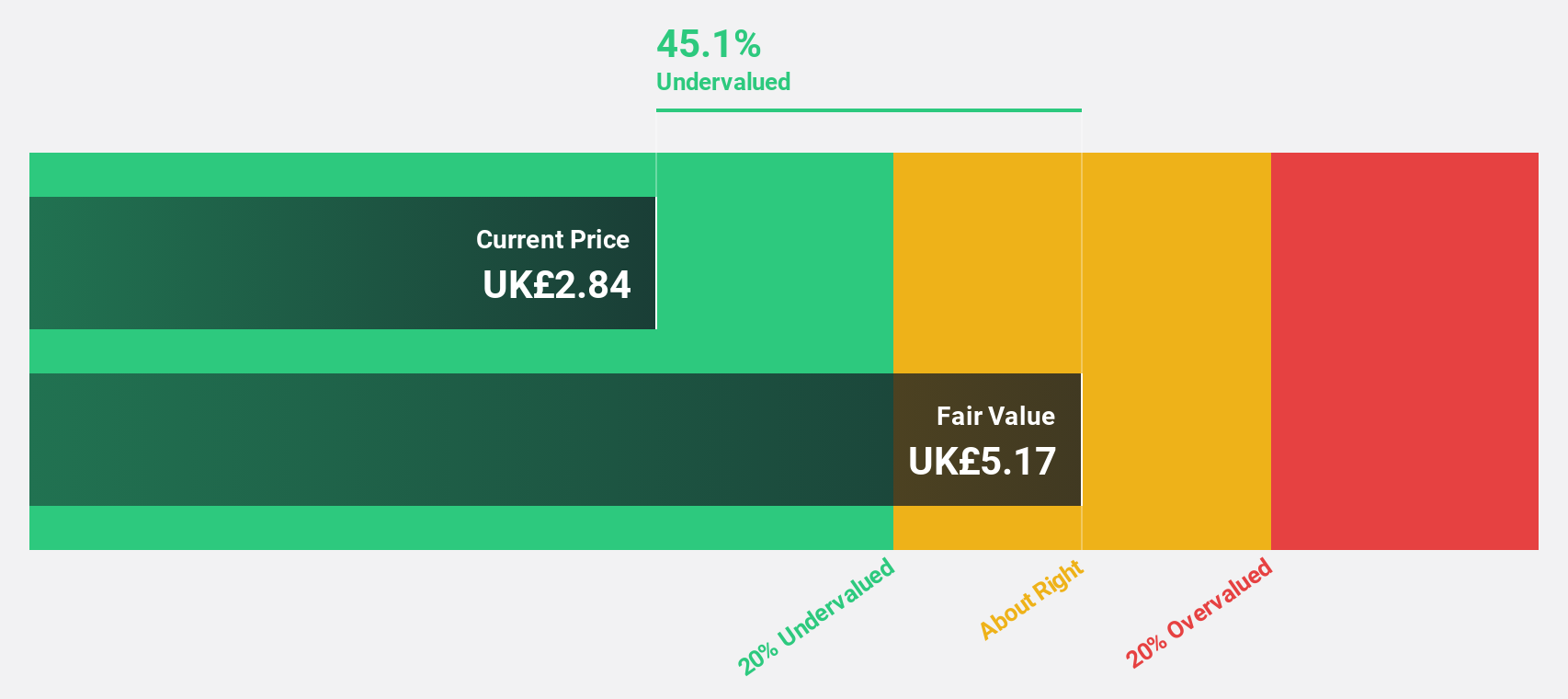

Estimated Discount To Fair Value: 34.1%

Trainline is trading at £3.31, significantly below its estimated fair value of £5.03, indicating strong undervaluation based on discounted cash flows. Earnings grew by 60.2% over the past year and are forecast to grow 22.78% annually, outpacing the UK market's expected growth of 14%. Despite slower revenue growth projections (6.8% per year), Trainline's return on equity is anticipated to be high at 22.8% in three years, supporting its potential as an undervalued stock based on cash flows.

- Our comprehensive growth report raises the possibility that Trainline is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Trainline stock in this financial health report.

Victrex (LSE:VCT)

Overview: Victrex plc, with a market cap of £834.81 million, manufactures and sells polymer solutions globally through its subsidiaries.

Operations: The company generates revenue from its Medical segment (£59.10 million) and Sustainable Solutions segment (£229.80 million).

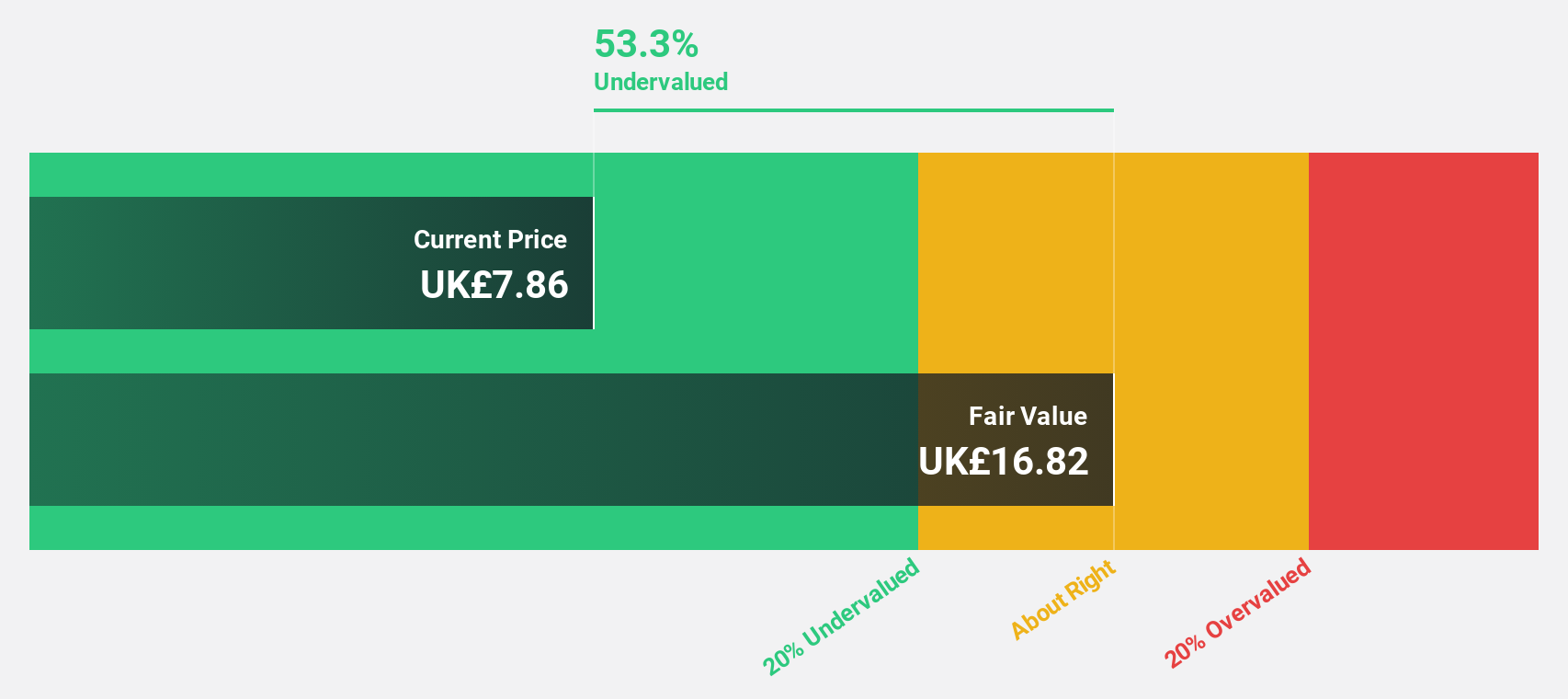

Estimated Discount To Fair Value: 44.5%

Victrex is trading at £9.60, significantly below its estimated fair value of £17.30, highlighting substantial undervaluation based on discounted cash flows. Despite a forecasted low return on equity (14%) in three years, earnings are expected to grow 38.07% annually, outpacing the UK market's 14%. Recent FDA approval for a clinical study of its PEEK-OPTIMA Femoral Component in the U.S. further supports potential revenue growth and market expansion opportunities.

- Our expertly prepared growth report on Victrex implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Victrex.

Taking Advantage

- Delve into our full catalog of 57 Undervalued UK Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VCT

Victrex

Through its subsidiaries, engages in the manufacture and sale of polymer solutions worldwide.

Excellent balance sheet with reasonable growth potential.