- United Kingdom

- /

- Hospitality

- /

- LSE:PTEC

3 UK Penny Stocks With Market Caps Up To £2B

Reviewed by Simply Wall St

The United Kingdom's financial markets have recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and global economic uncertainties. Despite these broader market pressures, investors continue to seek opportunities in various sectors, including those offered by penny stocks. Although the term 'penny stocks' may seem outdated, these investments in smaller or newer companies can still present valuable opportunities when backed by solid financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.94 | £303.33M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.97 | £320.73M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.975 | £448.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.1189 | £397.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.692 | £216.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.73 | £1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £156.34M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.228 | £2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 402 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries, with a market cap of £1.33 billion.

Operations: The company's revenue is generated from the UK & Ireland, contributing £5.15 billion, and the Nordics, accounting for £3.43 billion.

Market Cap: £1.33B

Currys plc has shown impressive earnings growth of 121.2% over the past year, outpacing the Specialty Retail industry, despite a low net profit margin of 0.7%. The company has effectively reduced its debt to equity ratio from 14.1% to 0.05% over five years and maintains more cash than total debt, although its interest coverage by EBIT remains low at 2x. While short-term assets do not fully cover short-term liabilities (£2.5 billion), they exceed long-term liabilities (£992 million). With a seasoned management team but an inexperienced board, Currys forecasts continued earnings growth at 13.1% per year.

- Dive into the specifics of Currys here with our thorough balance sheet health report.

- Understand Currys' earnings outlook by examining our growth report.

Playtech (LSE:PTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies globally with a market cap of £1.11 billion.

Operations: Playtech's revenue is primarily derived from its Gaming B2B segment, which generated €754.3 million, complemented by B2C operations including HAPPYBET at €18.9 million and Sun Bingo along with other B2C activities contributing €78.9 million.

Market Cap: £1.11B

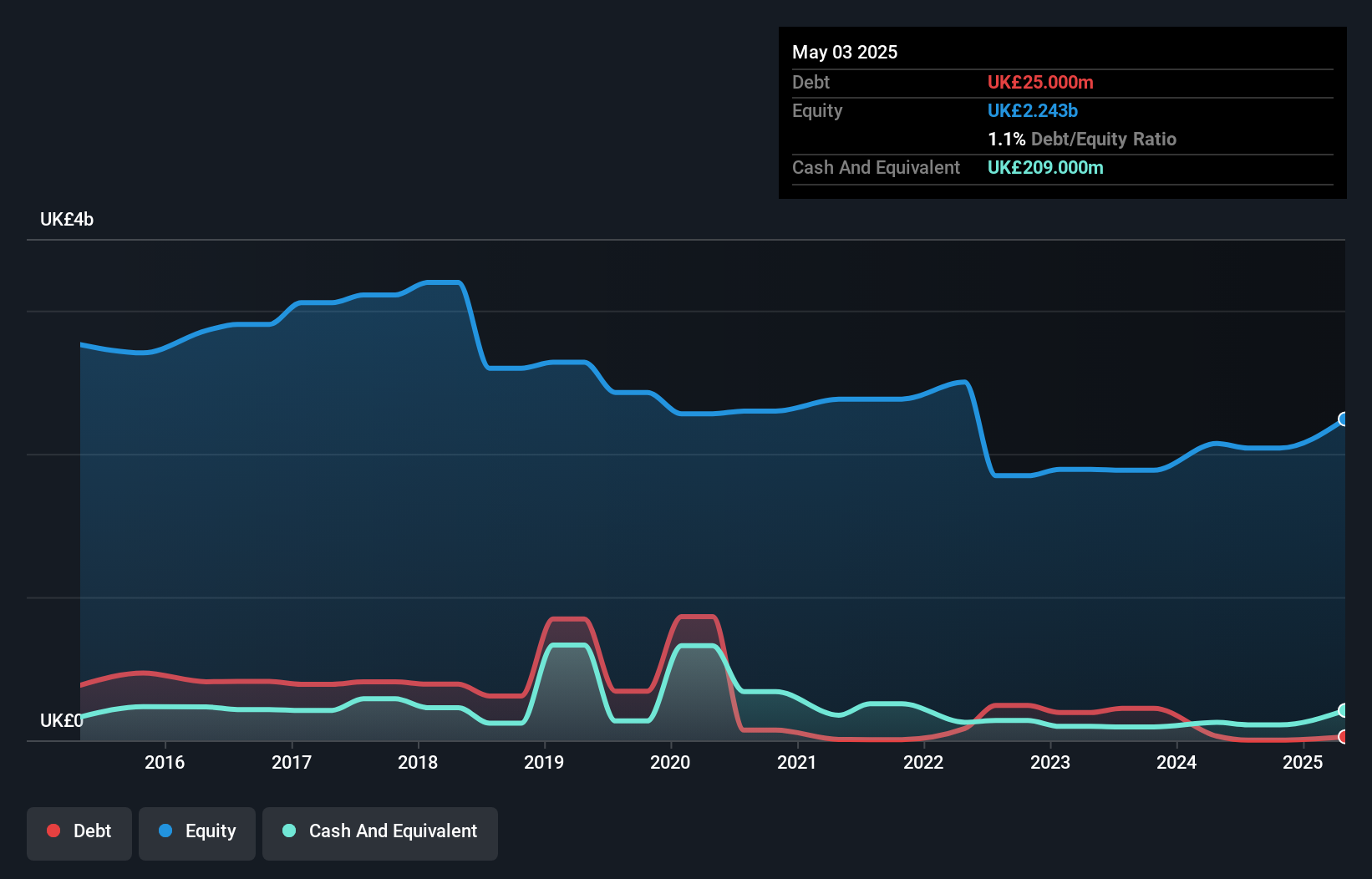

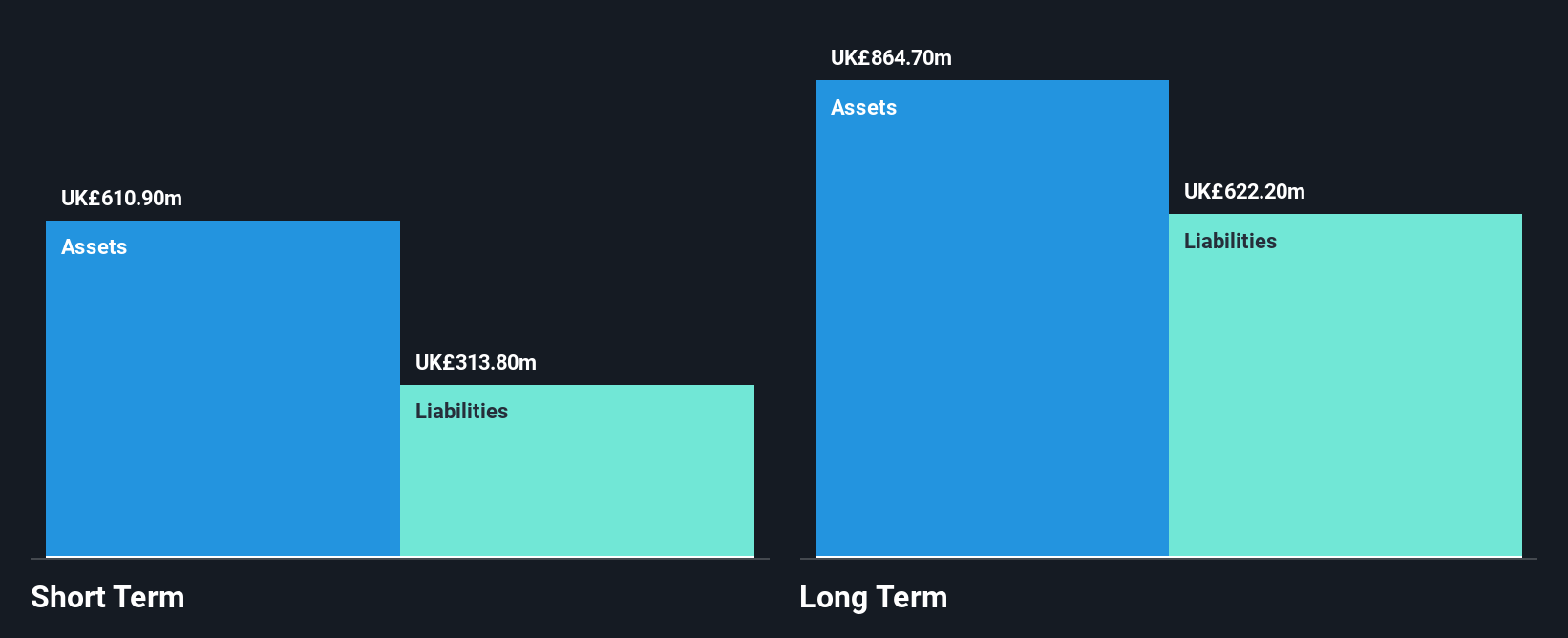

Playtech plc, with a market cap of £1.11 billion, has experienced volatility in its share price and remains unprofitable, reporting a net loss of €23.9 million for 2024 despite revenue growth to €848 million. The company recently announced a special dividend following the sale of Snaitech and plans to redeem €150 million in senior secured notes using sale proceeds. Playtech's debt management shows improvement, with a reduced debt-to-equity ratio from 76.6% to 24.7% over five years and satisfactory net debt levels at 9.9%. Short-term assets significantly exceed both short- and long-term liabilities, supporting financial stability amidst earnings challenges.

- Click to explore a detailed breakdown of our findings in Playtech's financial health report.

- Examine Playtech's earnings growth report to understand how analysts expect it to perform.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States, with a market capitalization of approximately £992.78 million.

Operations: The company's revenue is derived from two key geographical segments: £718.9 million from the US and £842.4 million from the UK and Europe.

Market Cap: £992.78M

Watches of Switzerland Group PLC, with a market cap of £992.78 million, has seen its net profit margins decline to 2.6% from last year's 6.8%, despite reducing its debt-to-equity ratio from 75.2% to 41.7% over five years and maintaining satisfactory net debt levels at 21.5%. The company has initiated a share buyback program authorized by shareholders, potentially enhancing shareholder value amid stable weekly volatility of 7%. While short-term assets cover short-term liabilities comfortably, they fall slightly short against long-term obligations, and the company faces challenges with negative earnings growth over the past year.

- Unlock comprehensive insights into our analysis of Watches of Switzerland Group stock in this financial health report.

- Learn about Watches of Switzerland Group's future growth trajectory here.

Summing It All Up

- Access the full spectrum of 402 UK Penny Stocks by clicking on this link.

- Curious About Other Options? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Playtech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PTEC

Playtech

A technology company, operates as a gambling software, services, content, and platform technologies provider worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives