- United Kingdom

- /

- Chemicals

- /

- LSE:VCT

UK's May 2025 Stock Picks That Might Be Priced Below Intrinsic Value

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences downward pressure due to weak trade data from China and falling commodity prices, investors are closely watching for opportunities that might be priced below their intrinsic value. In this environment, identifying stocks that are undervalued can offer potential for growth, especially those with strong fundamentals and resilience amid global economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £1.66 | 42% |

| Savills (LSE:SVS) | £9.70 | £16.51 | 41.2% |

| Aptitude Software Group (LSE:APTD) | £2.88 | £5.12 | 43.7% |

| Victrex (LSE:VCT) | £7.84 | £15.41 | 49.1% |

| Informa (LSE:INF) | £8.098 | £15.19 | 46.7% |

| SDI Group (AIM:SDI) | £0.746 | £1.37 | 45.7% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.53 | 45.4% |

| Vistry Group (LSE:VTY) | £6.02 | £11.26 | 46.5% |

| Entain (LSE:ENT) | £7.50 | £13.78 | 45.6% |

| Deliveroo (LSE:ROO) | £1.751 | £3.04 | 42.5% |

Let's explore several standout options from the results in the screener.

NewRiver REIT (LSE:NRR)

Overview: NewRiver REIT plc is a prominent UK Real Estate Investment Trust focused on acquiring, managing, and developing durable retail properties, with a market cap of £361.83 million.

Operations: NewRiver REIT plc generates its revenue primarily through the acquisition, management, and development of robust retail properties across the UK.

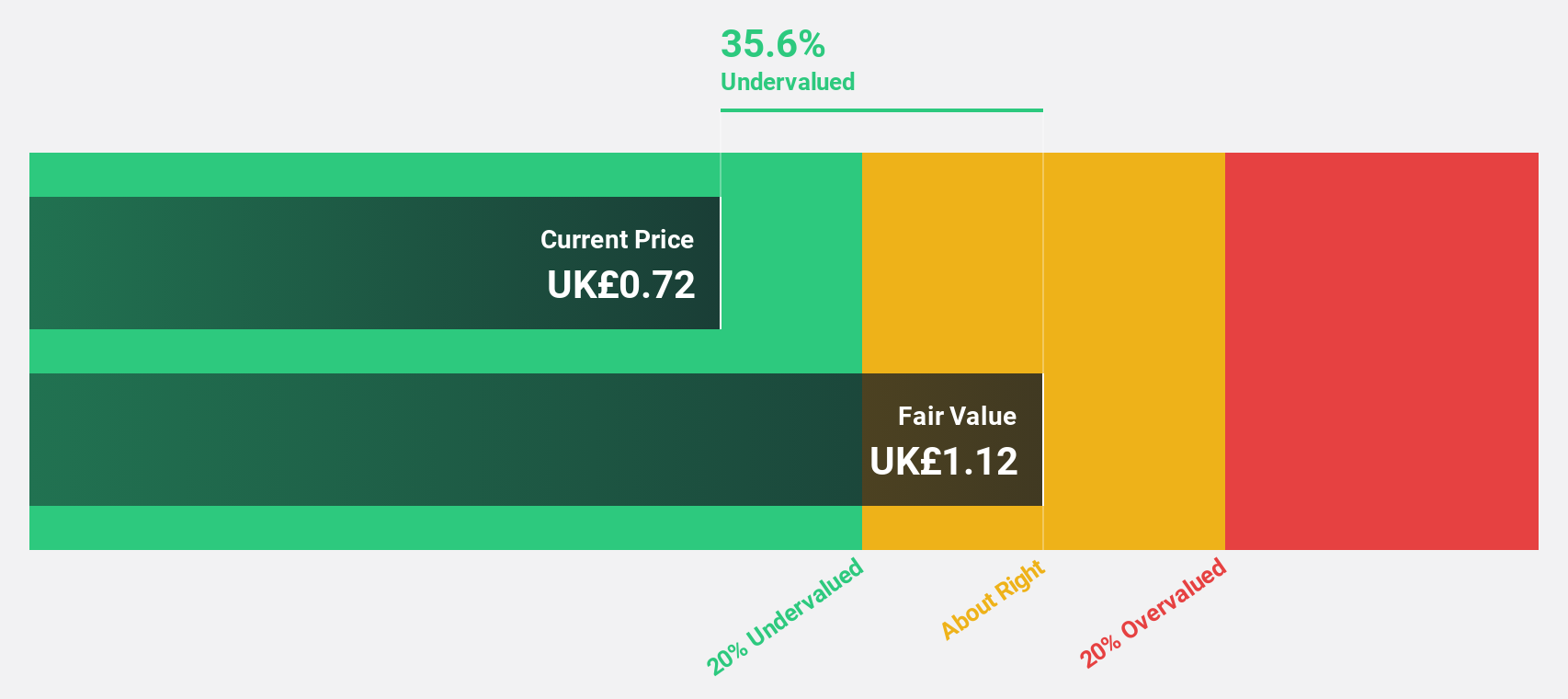

Estimated Discount To Fair Value: 32.8%

NewRiver REIT is trading at £0.76, significantly below its estimated fair value of £1.13, reflecting a potential undervaluation based on cash flows. Despite recent shareholder dilution and unsustainable dividend coverage by free cash flows, the company shows promising growth prospects with earnings expected to grow at 48.15% annually, outpacing the UK market's average growth rate. Recent strategic partnerships and retail expansions may enhance revenue streams and bolster its financial position further.

- Our earnings growth report unveils the potential for significant increases in NewRiver REIT's future results.

- Navigate through the intricacies of NewRiver REIT with our comprehensive financial health report here.

On the Beach Group (LSE:OTB)

Overview: On the Beach Group plc is an online retailer specializing in short haul beach holidays under the On the Beach brand in the United Kingdom, with a market cap of £406.05 million.

Operations: The company generates revenue primarily through its online platform, offering short haul beach holiday packages to customers in the United Kingdom.

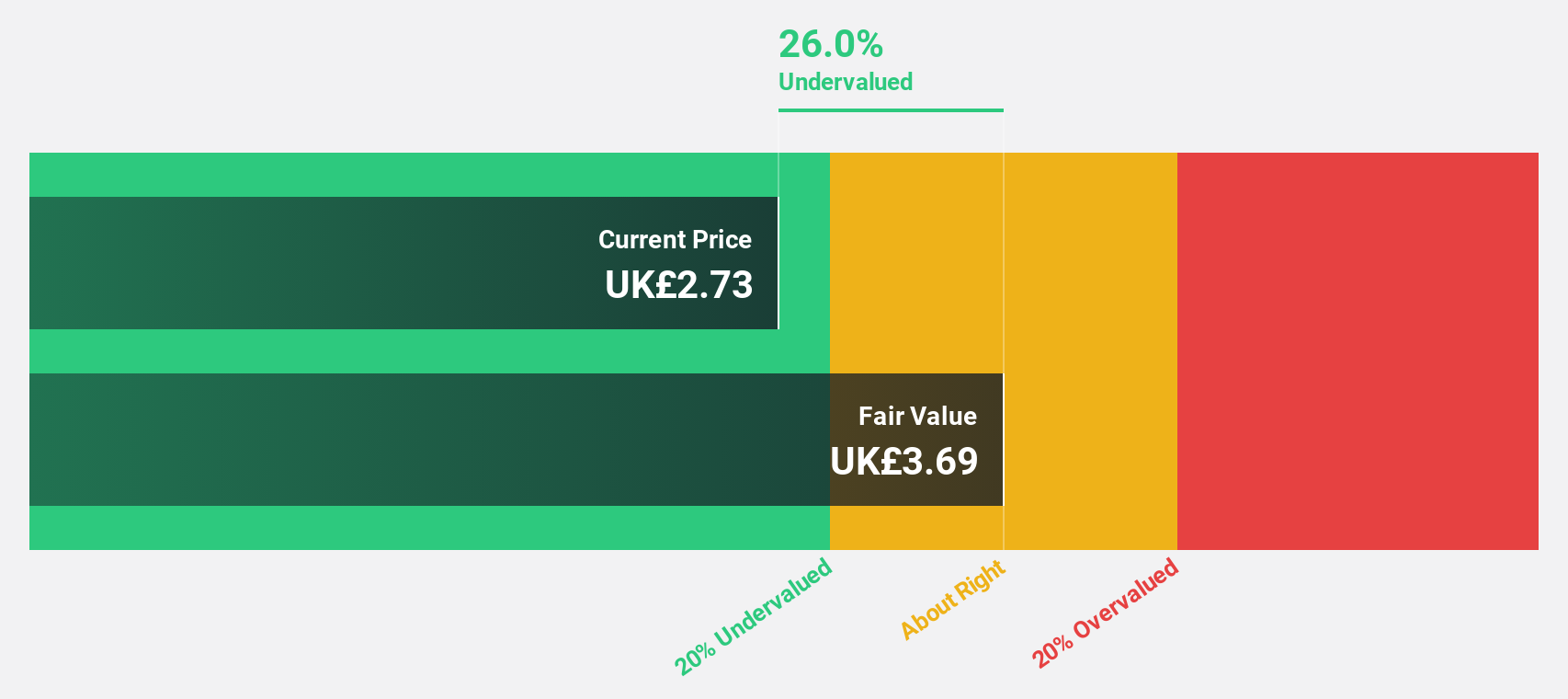

Estimated Discount To Fair Value: 31.4%

On the Beach Group is trading at £2.60, significantly below its estimated fair value of £3.78, indicating a potential undervaluation based on cash flows. Recent earnings results show net income rising to £3 million from £0.5 million year-on-year, with revenue growth forecasted at 10.9% annually, surpassing the UK market average of 3.7%. Analysts expect earnings to grow significantly at 24.5% per year, further supporting its undervaluation thesis despite a modest return on equity forecast of 17.7%.

- Our expertly prepared growth report on On the Beach Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of On the Beach Group stock in this financial health report.

Victrex (LSE:VCT)

Overview: Victrex plc, with a market cap of £681.89 million, is involved in the global manufacture and sale of polymer solutions through its subsidiaries.

Operations: Victrex's revenue segments include Industrial, generating £162.6 million, and Medical, contributing £53.9 million.

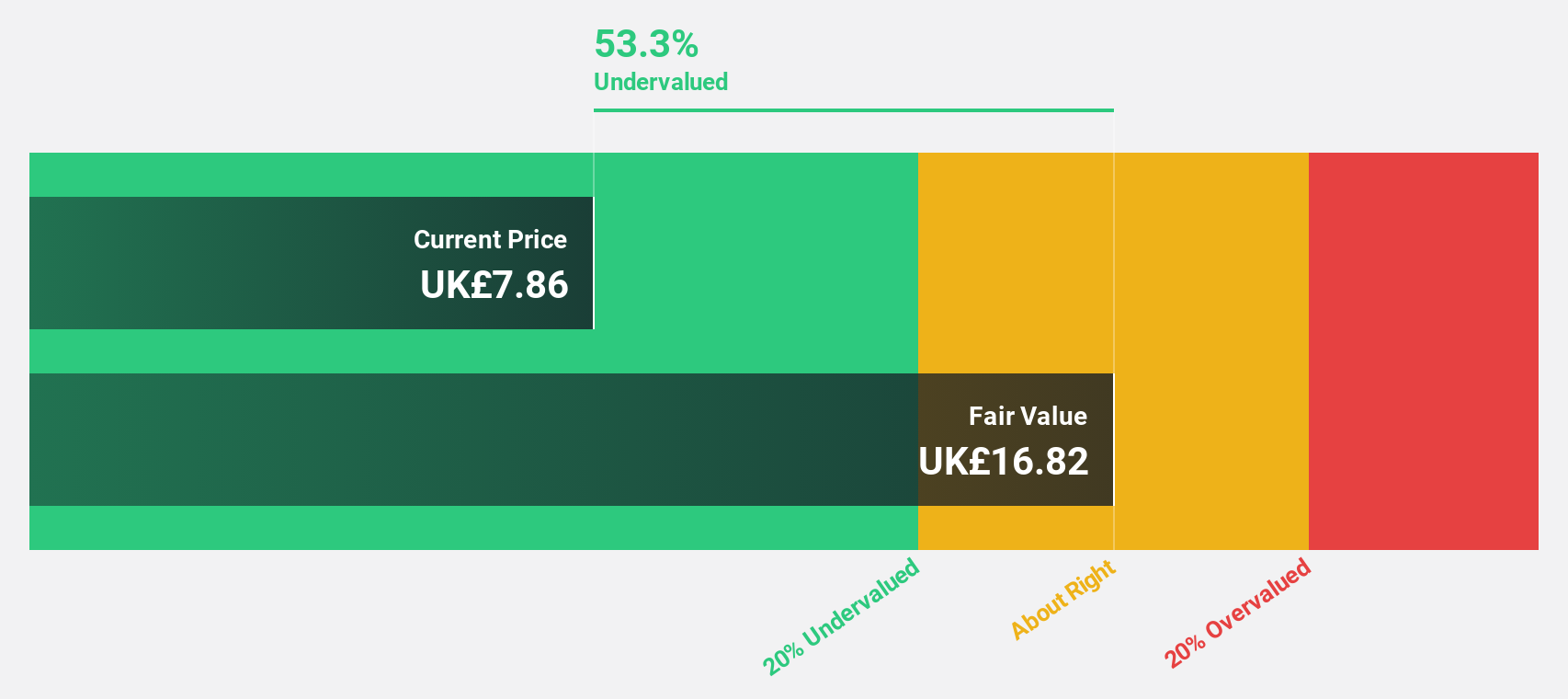

Estimated Discount To Fair Value: 49.1%

Victrex is trading at £7.84, considerably below its estimated fair value of £15.41, reflecting potential undervaluation based on cash flows. Recent earnings show a substantial rise in net income to £15.2 million from £2.7 million year-on-year, while revenue is forecasted to grow 4.8% annually, outpacing the UK market average of 3.7%. Although the dividend coverage is weak and return on equity projections are modest at 15.4%, earnings growth remains strong at 25.8% per year.

- Our comprehensive growth report raises the possibility that Victrex is poised for substantial financial growth.

- Click here to discover the nuances of Victrex with our detailed financial health report.

Key Takeaways

- Dive into all 49 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VCT

Victrex

Through its subsidiaries, engages in the manufacture and sale of polymer solutions worldwide.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives