- United Kingdom

- /

- Consumer Durables

- /

- LSE:BOOT

3 UK Stocks That May Be Undervalued Based On Current Estimates In November 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. As these broader market pressures persist, investors may find opportunities in stocks that appear undervalued based on current estimates and have potential resilience against such economic headwinds.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.372 | £0.74 | 49.5% |

| Fevertree Drinks (AIM:FEVR) | £7.125 | £12.90 | 44.8% |

| ConvaTec Group (LSE:CTEC) | £2.144 | £3.88 | 44.8% |

| GlobalData (AIM:DATA) | £1.98 | £3.75 | 47.2% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| Informa (LSE:INF) | £8.13 | £15.48 | 47.5% |

| Auction Technology Group (LSE:ATG) | £4.52 | £8.35 | 45.9% |

| Foxtons Group (LSE:FOXT) | £0.58 | £1.05 | 45% |

| Quartix Technologies (AIM:QTX) | £1.70 | £3.08 | 44.8% |

| Genel Energy (LSE:GENL) | £0.794 | £1.46 | 45.7% |

We'll examine a selection from our screener results.

Henry Boot (LSE:BOOT)

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £307.37 million.

Operations: The company's revenue segments include £87.90 million from construction, £28.37 million from land promotion, and £170.56 million from property investment and development in the United Kingdom.

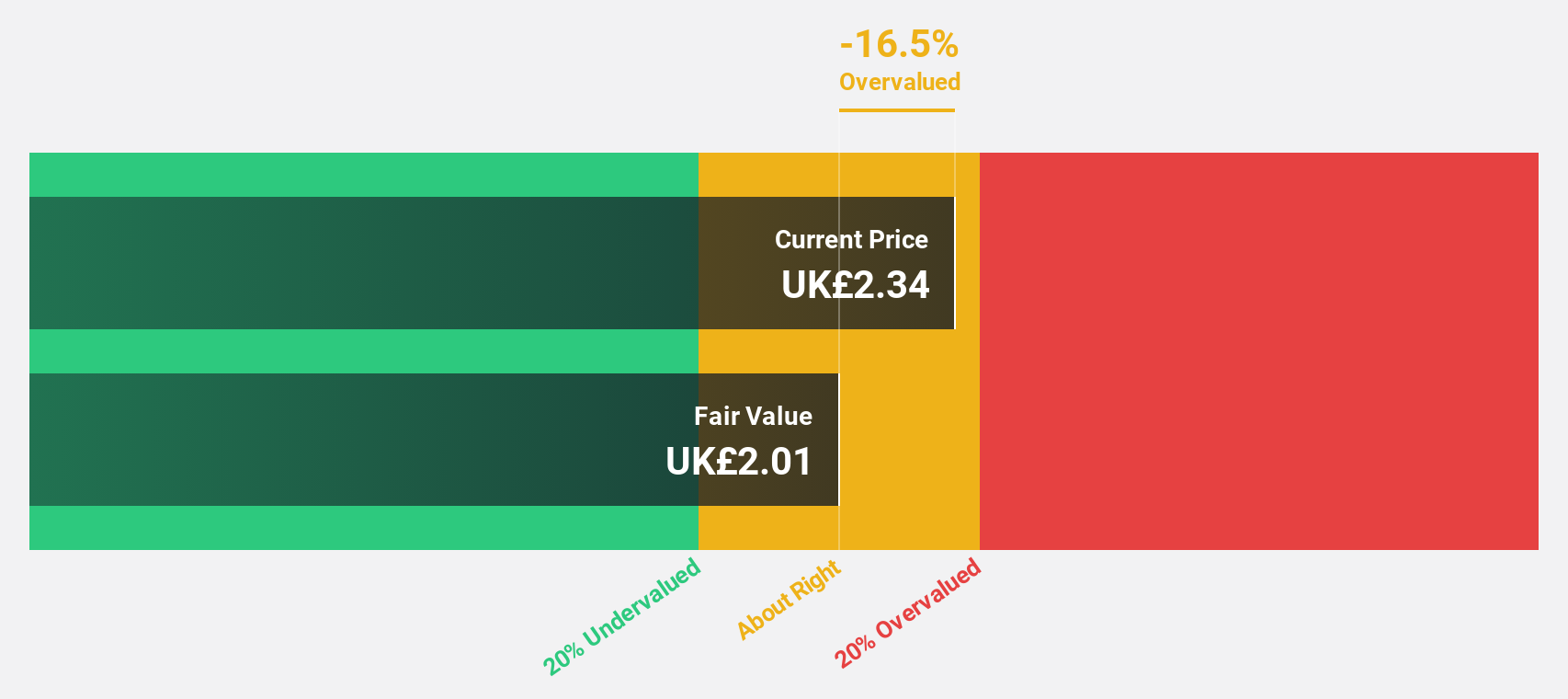

Estimated Discount To Fair Value: 22.2%

Henry Boot is trading at £2.3, 22.2% below its estimated fair value of £2.96, indicating it may be undervalued based on cash flows. Despite a significant dip in recent earnings—sales fell to £106.05 million from £179.76 million—the company expects revenue growth of 10.7% annually, outpacing the UK market's 3.6%. However, its dividend yield of 3.25% isn't well covered by free cash flows and return on equity is forecasted low at 5.8%.

- The growth report we've compiled suggests that Henry Boot's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Henry Boot stock in this financial health report.

On the Beach Group (LSE:OTB)

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays in the United Kingdom, with a market cap of £256.16 million.

Operations: The company's revenue segments include £7.10 million from Classic Package Holidays, £56.40 million from Classic Collection Holidays, and £114.60 million from OTB (Onthebeach.Co.Uk and Sunshine.Co.Uk).

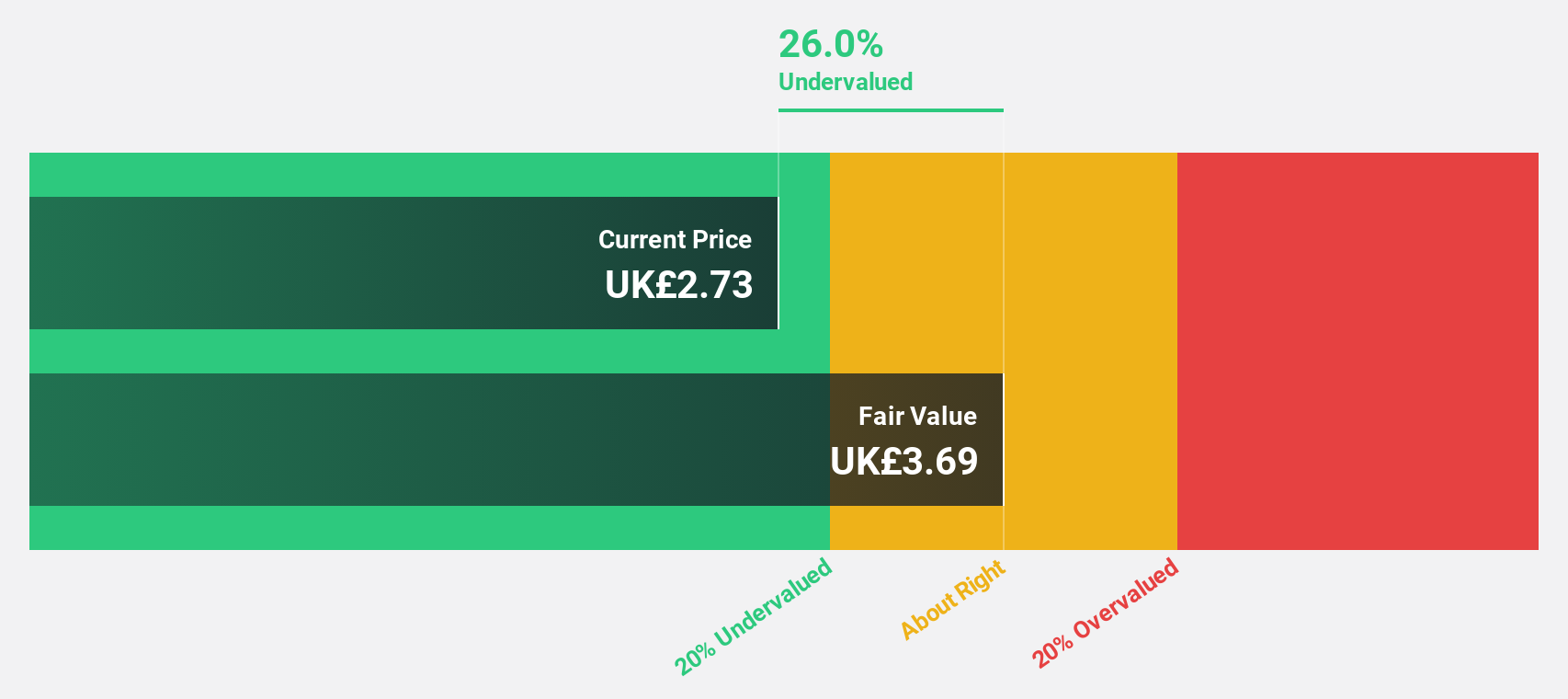

Estimated Discount To Fair Value: 50%

On the Beach Group, trading at £1.53, is significantly undervalued with a fair value estimate of £3.07. The company's earnings are expected to grow by 22% annually, outpacing the UK market's 14.3% growth forecast. Despite high non-cash earnings, On the Beach offers good relative value compared to peers and industry standards but faces slower revenue growth at 4.1%. Upcoming fiscal results on September 25 may provide further insights into financial health.

- Our growth report here indicates On the Beach Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in On the Beach Group's balance sheet health report.

Renewi (LSE:RWI)

Overview: Renewi plc operates in the collection, sorting, and processing of waste to produce secondary materials across several countries including the Netherlands, Belgium, and the UK, with a market cap of £487.38 million.

Operations: The company's revenue is derived from several segments: €911.50 million from Netherlands Commercial Waste, €476.20 million from Belgium Commercial Waste, €181.60 million from Mineralz & Water, and €175.20 million from Specialities.

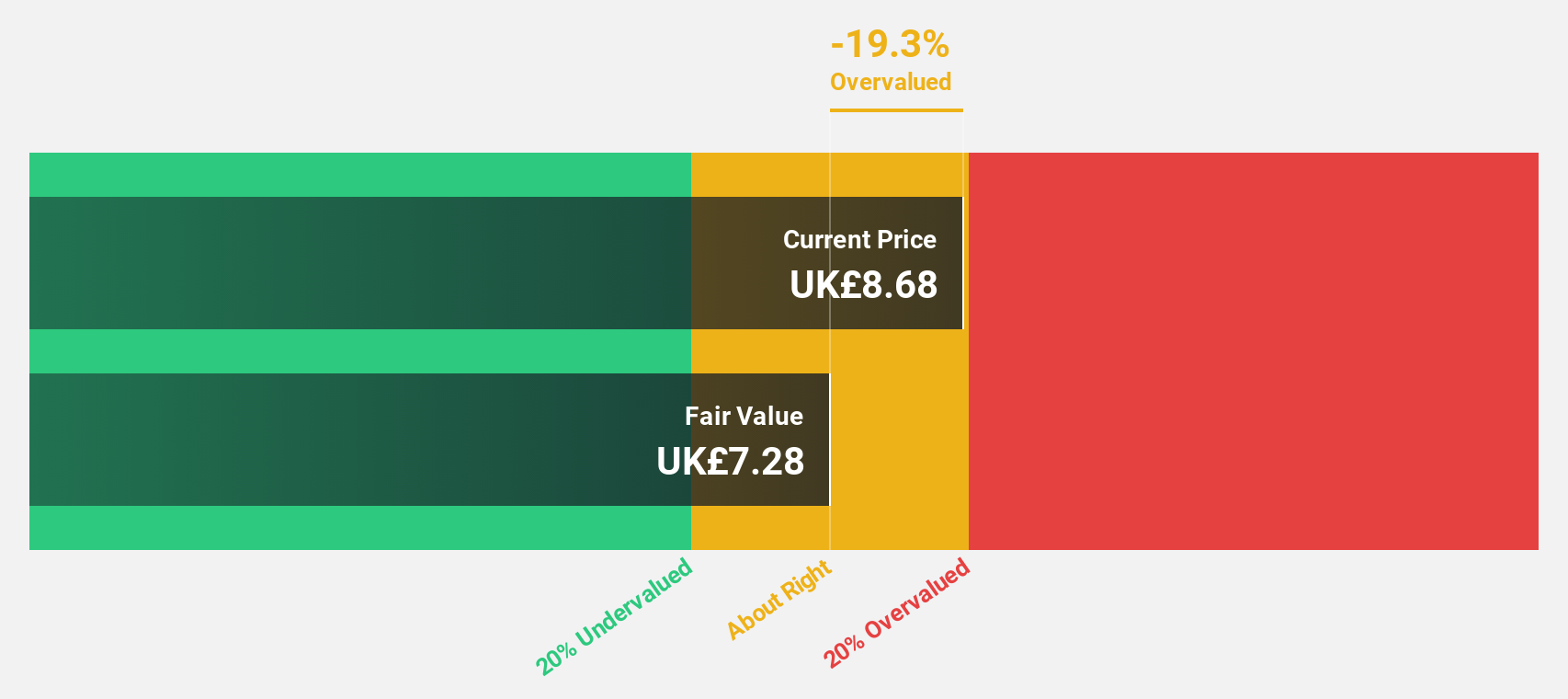

Estimated Discount To Fair Value: 14.8%

Renewi, priced at £6.05, is undervalued with a fair value estimate of £7.1, trading 14.8% below this valuation. While its revenue growth forecast of 5.2% annually surpasses the UK market average of 3.6%, it remains below the desired high-growth threshold of 20%. Earnings are expected to grow significantly at 21.67% per year, though profit margins have declined from last year’s figures and the company holds a high level of debt.

- Our comprehensive growth report raises the possibility that Renewi is poised for substantial financial growth.

- Dive into the specifics of Renewi here with our thorough financial health report.

Make It Happen

- Reveal the 55 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Boot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOOT

Henry Boot

Engages in property investment and development, land promotion, and construction activities in the United Kingdom.

Reasonable growth potential with adequate balance sheet.