- United Kingdom

- /

- Hospitality

- /

- LSE:MAB

Mitchells & Butlers' (LON:MAB) underlying earnings growth outpaced the notable return generated for shareholders over the past three years

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Mitchells & Butlers plc (LON:MAB), which is up 91%, over three years, soundly beating the market return of 27% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 6.5% in the last year.

In light of the stock dropping 3.8% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

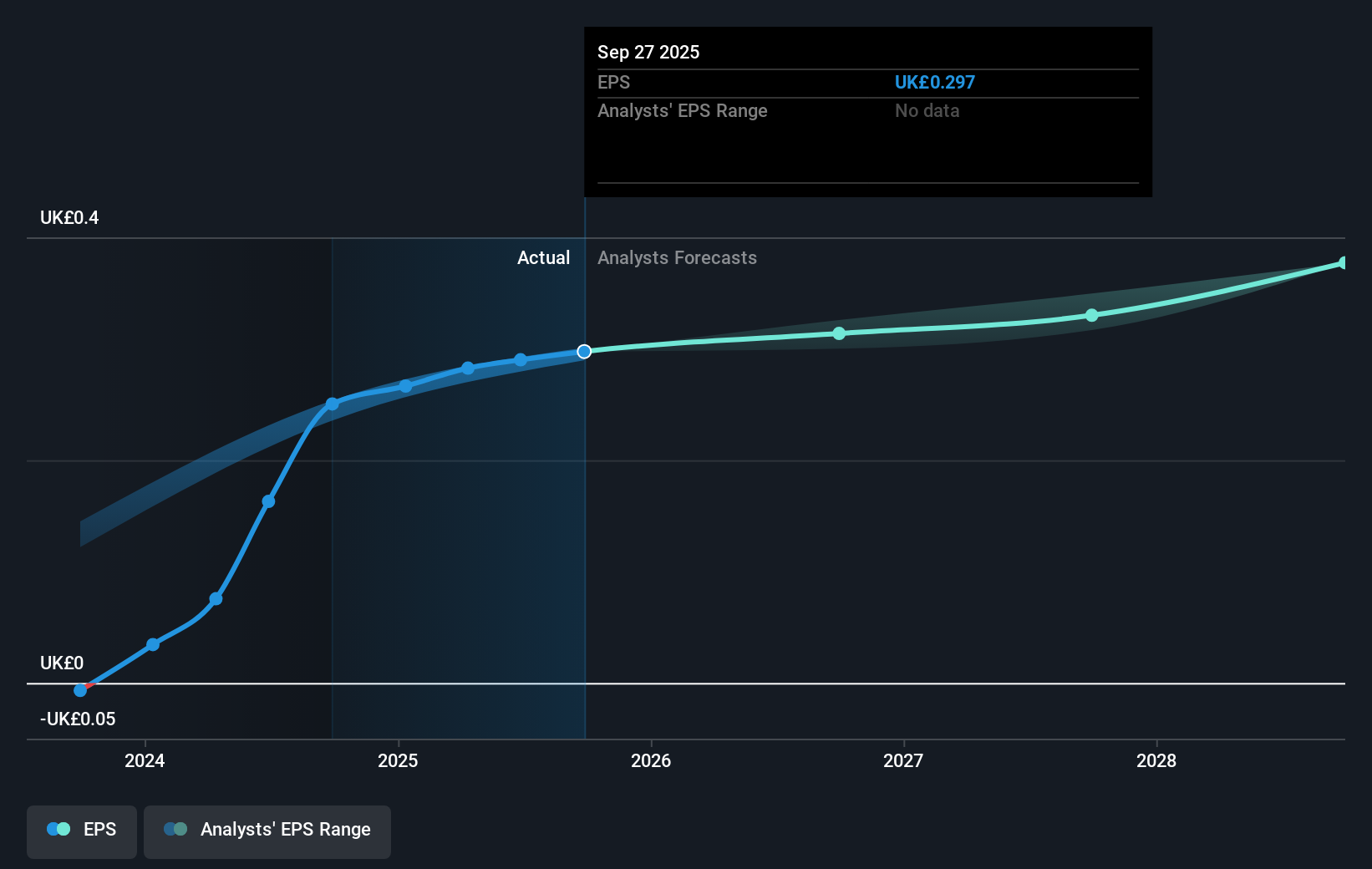

Mitchells & Butlers was able to grow its EPS at 139% per year over three years, sending the share price higher. The average annual share price increase of 24% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time. We'd venture the lowish P/E ratio of 8.53 also reflects the negative sentiment around the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Mitchells & Butlers has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Mitchells & Butlers stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Mitchells & Butlers shareholders are up 6.5% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 4% over half a decade It is possible that returns will improve along with the business fundamentals. Before forming an opinion on Mitchells & Butlers you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MAB

Mitchells & Butlers

Engages in the management of pubs, bars, and restaurants in the United Kingdom and Germany.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)