- United Kingdom

- /

- Hospitality

- /

- LSE:GYM

Have The Gym Group plc (LON:GYM) Insiders Been Selling Their Stock?

Some The Gym Group plc (LON:GYM) shareholders may be a little concerned to see that the Founder & Executive Director, John Treharne, recently sold a substantial UK£1.0m worth of stock at a price of UK£2.04 per share. That sale reduced their total holding by 16% which is hardly insignificant, but far from the worst we've seen.

Check out our latest analysis for Gym Group

Gym Group Insider Transactions Over The Last Year

In fact, the recent sale by John Treharne was the biggest sale of Gym Group shares made by an insider individual in the last twelve months, according to our records. So it's clear an insider wanted to take some cash off the table, even below the current price of UK£2.19. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 16% of John Treharne's stake.

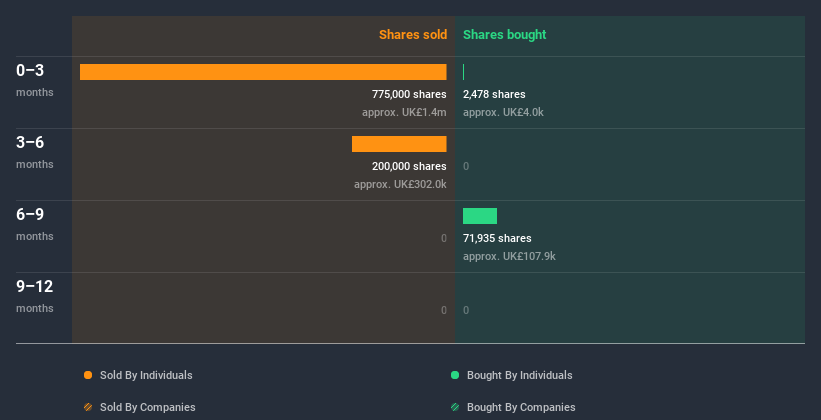

Happily, we note that in the last year insiders paid UK£112k for 74.41k shares. But they sold 975.00k shares for UK£1.7m. John Treharne ditched 975.00k shares over the year. The average price per share was UK£1.77. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Gym Group

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Insiders own 2.7% of Gym Group shares, worth about UK£9.6m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Gym Group Tell Us?

Unfortunately, there has been more insider selling of Gym Group stock, than buying, in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. Insiders own relatively few shares in the company, and when you consider the sales, we're not particularly excited about the stock. So we'd only buy after very careful consideration. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. In terms of investment risks, we've identified 3 warning signs with Gym Group and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Gym Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:GYM

Gym Group

Operates a network of gym facilities under the Gym Group brand name in the United Kingdom.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.