Three Undervalued Small Caps In United Kingdom With Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns about global economic recovery. As broader market sentiment remains cautious, investors might find opportunities in small-cap stocks that demonstrate resilience through strategic insider buying, suggesting potential undervaluation amidst these uncertain conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.8x | 0.6x | 38.39% | ★★★★★★ |

| Bytes Technology Group | 22.3x | 5.7x | 11.28% | ★★★★★☆ |

| NWF Group | 8.2x | 0.1x | 38.45% | ★★★★★☆ |

| John Wood Group | NA | 0.2x | 38.70% | ★★★★★☆ |

| Genus | 169.2x | 2.0x | 9.32% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 27.60% | ★★★★★☆ |

| Marlowe | NA | 0.7x | 42.30% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 38.78% | ★★★★☆☆ |

| Robert Walters | 42.6x | 0.2x | 40.79% | ★★★☆☆☆ |

| Essentra | 722.6x | 1.4x | 26.93% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

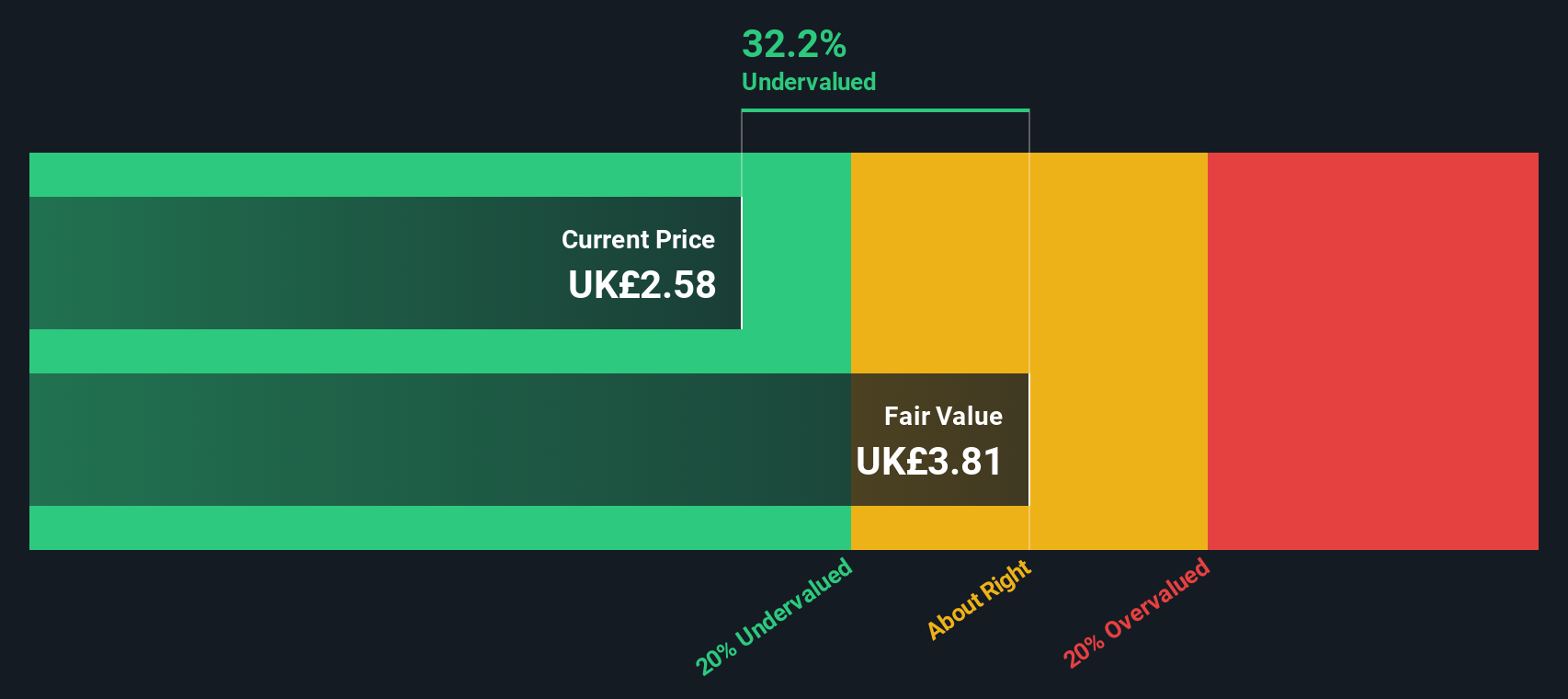

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout chain, primarily generating income through sales to franchisees, corporate store operations, advertising and ecommerce services, rental income from properties, and franchise-related fees; the company has a market capitalization of approximately £1.5 billion.

Operations: The company generates revenue primarily through sales to franchisees, corporate store income, advertising and ecommerce income, rental income from properties, and royalties and fees. Over recent periods, the gross profit margin has shown a trend of fluctuation but reached 47.48% in June 2024. Operating expenses have been a significant component of costs with general & administrative expenses being notable.

PE: 15.6x

Domino's Pizza Group, a smaller player in the UK market, is navigating financial complexities with external borrowing as its sole funding source. Despite this, insider confidence is evident through share repurchases authorized in May 2024. The company aims to maintain momentum into late 2024 by boosting order counts and sales despite a dip in net income from £80.2 million to £42.3 million year-over-year for H1 2024. An interim dividend of 3.5p per share reflects ongoing shareholder returns amidst strategic execution challenges and opportunities for growth within the competitive landscape.

- Take a closer look at Domino's Pizza Group's potential here in our valuation report.

Evaluate Domino's Pizza Group's historical performance by accessing our past performance report.

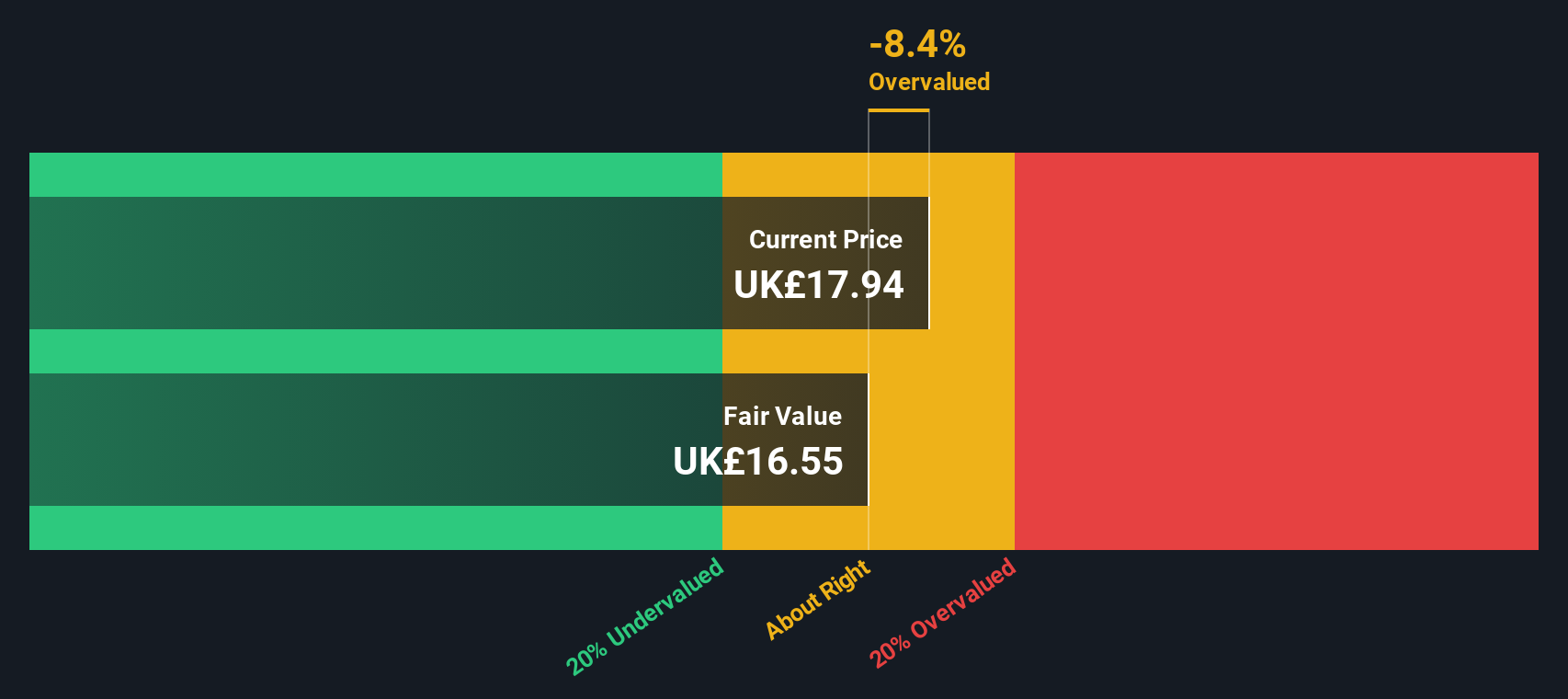

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Instruments is a company specializing in the development and manufacturing of high-technology tools and systems for research, discovery, service, healthcare, materials analysis, and characterization with a market cap of approximately £1.75 billion.

Operations: Oxford Instruments generates revenue primarily from three segments: Materials & Characterisation (£252.20 million), Research & Discovery (£142.10 million), and Service & Healthcare (£76.10 million). The company has seen fluctuations in its net income margin, which peaked at 13.22% in September 2023, reflecting varying profitability over time. Operating expenses are a significant cost component, with sales and marketing being the largest expense within this category.

PE: 24.2x

Oxford Instruments, a key player in the UK's small stock sector, has caught attention with insider confidence demonstrated through recent share purchases. Their strategic presentations at various global conferences, including the NanoFabUK Symposium and Faraday Institution Conference, highlight their active industry engagement. Despite relying solely on external borrowing for funding, which poses higher risk compared to customer deposits, earnings are projected to grow 10% annually. This growth potential suggests promising future prospects for investors seeking value opportunities.

- Navigate through the intricacies of Oxford Instruments with our comprehensive valuation report here.

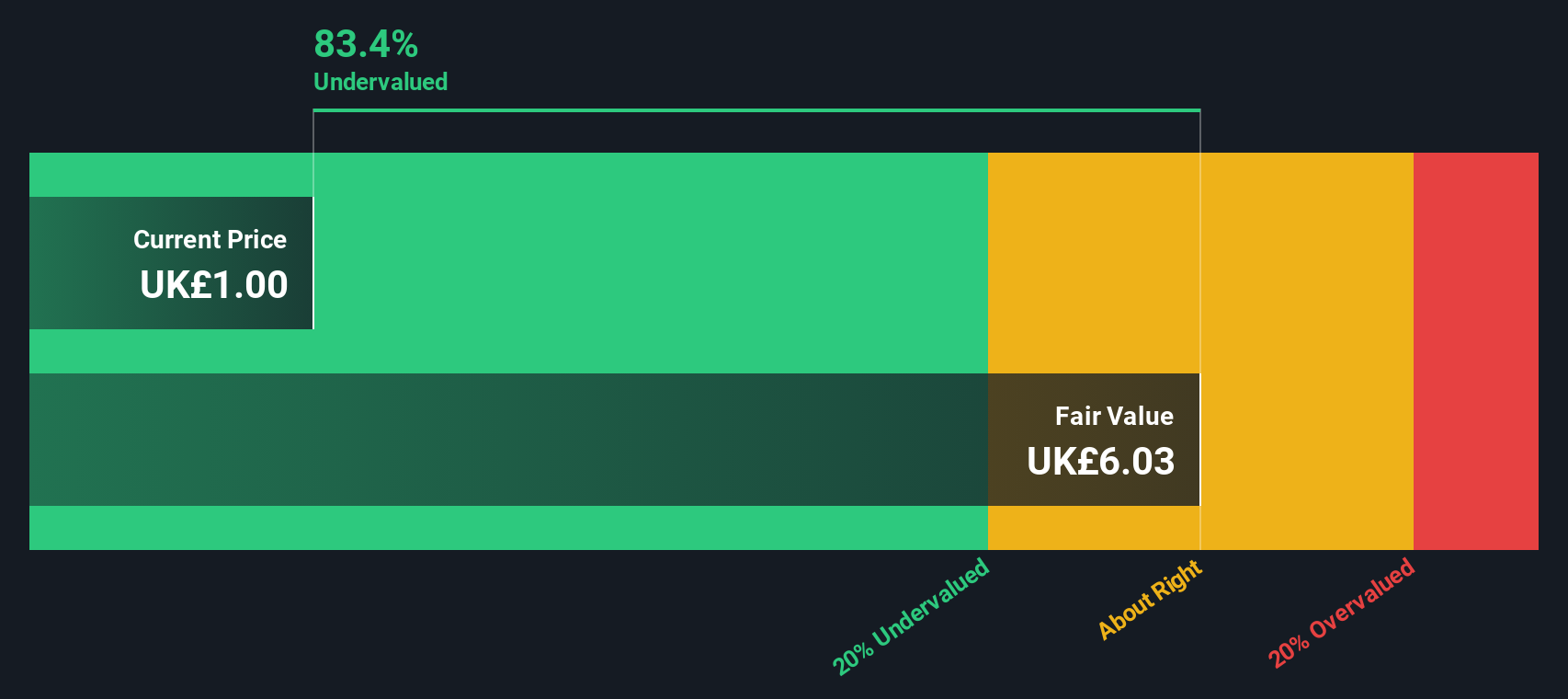

Videndum (LSE:VID)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Videndum is a company specializing in providing media, creative, and production solutions with a market cap of £0.37 billion.

Operations: Videndum generates revenue primarily from Media Solutions (£144.70 million), Creative Solutions (£54.90 million), and Production Solutions (£98 million). The company's net income margin has shown variability, with recent figures indicating a decline to -8.74% as of October 2024. Operating expenses include significant allocations to sales and marketing, R&D, and general & administrative costs, impacting overall profitability.

PE: -10.2x

Videndum, a UK-based company with a small capitalization, has recently faced challenges including being dropped from the S&P Global BMI Index on September 10, 2024. Despite reporting a net loss of £12.8 million for H1 2024 compared to £46.5 million the previous year, insider confidence remains evident through significant share purchases over recent months. While its funding primarily relies on external borrowing, Videndum's earnings are projected to grow significantly at an annual rate of 113%, suggesting potential future value amidst current volatility and past shareholder dilution.

- Click to explore a detailed breakdown of our findings in Videndum's valuation report.

Assess Videndum's past performance with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 27 Undervalued UK Small Caps With Insider Buying selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oxford Instruments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXIG

Oxford Instruments

Oxford Instruments plc provide scientific technology products and services for academic and commercial organizations worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives