- United Kingdom

- /

- Diversified Financial

- /

- LSE:PAG

Top UK Dividend Stocks To Watch In October 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such uncertain times, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these turbulent waters.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| RS Group (LSE:RS1) | 3.99% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.32% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.05% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.57% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.27% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.33% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.38% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.81% | ★★★★★☆ |

| Games Workshop Group (LSE:GAW) | 3.57% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.46% | ★★★★★★ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Macfarlane Group (LSE:MACF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macfarlane Group PLC, with a market cap of £142.06 million, operates through its subsidiaries to design, manufacture, and distribute protective packaging products to businesses in the United Kingdom and Europe.

Operations: Macfarlane Group PLC generates its revenue primarily from Packaging Distribution (£228.28 million) and Manufacturing Operations (£65.34 million).

Dividend Yield: 4.1%

Macfarlane Group's dividend payments have been volatile over the past decade, though recent affirmations of a 0.96 pence per share interim dividend indicate stability for now. The company's dividends are well covered by both earnings (48.6% payout ratio) and cash flows (27.8% cash payout ratio), suggesting sustainability despite past inconsistencies. Recent inclusion in the S&P Global BMI Index could enhance visibility among investors, although its 4.08% yield is below top UK dividend payers' levels.

- Navigate through the intricacies of Macfarlane Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Macfarlane Group shares in the market.

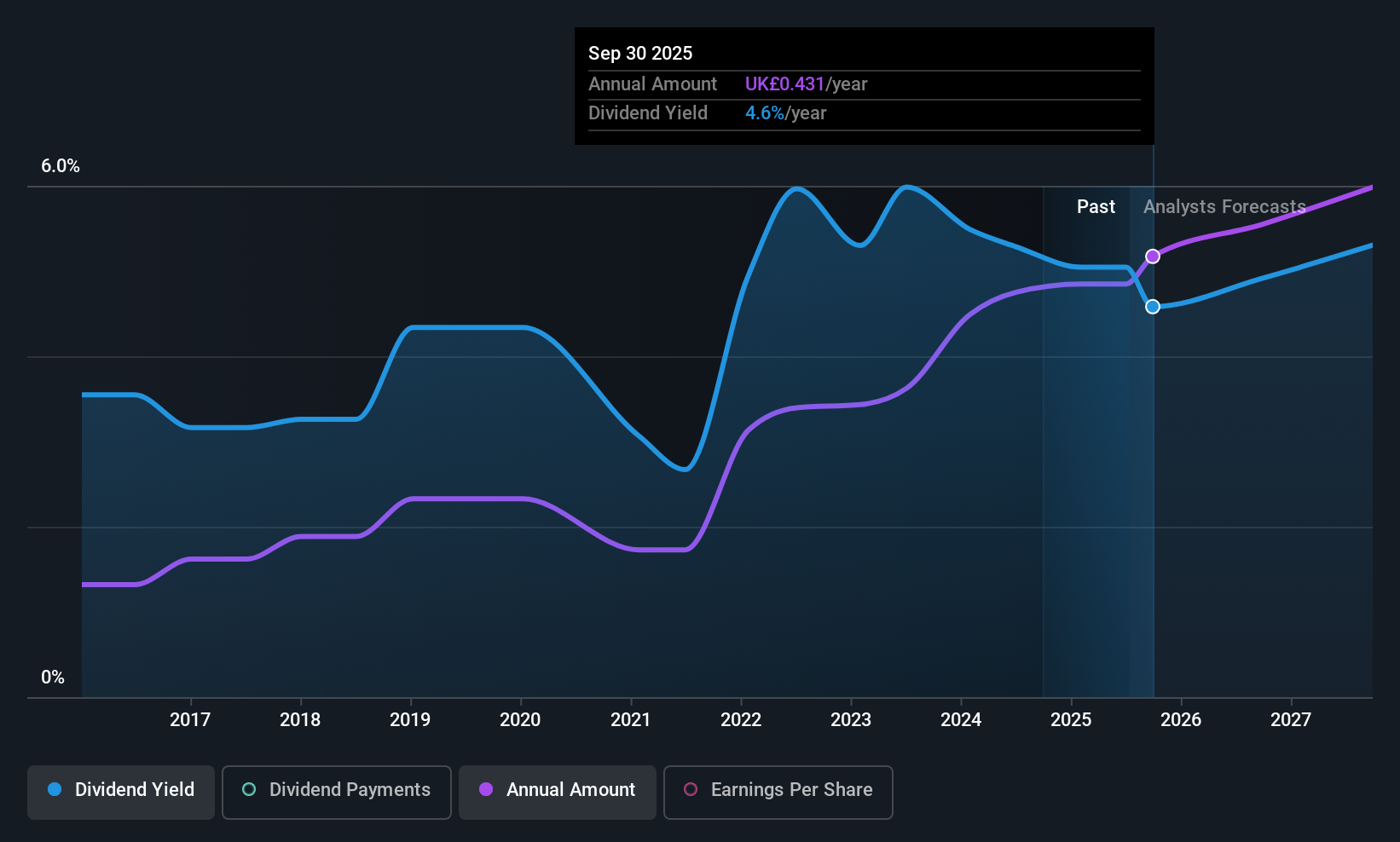

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC offers financial products and services in the United Kingdom with a market cap of £1.63 billion.

Operations: Paragon Banking Group PLC generates revenue through its Mortgage Lending segment, which accounts for £278.30 million, and its Commercial Lending segment, contributing £106.80 million.

Dividend Yield: 4.8%

Paragon Banking Group's dividend payments have been volatile over the past decade, yet they are well covered by both earnings (40.6% payout ratio) and cash flows (17.6% cash payout ratio), indicating sustainability. Despite a 4.76% yield that lags behind top UK dividend payers, the company's dividends have grown over the past 10 years. Trading at 40% below its estimated fair value suggests good relative value compared to peers in the industry.

- Take a closer look at Paragon Banking Group's potential here in our dividend report.

- Our valuation report unveils the possibility Paragon Banking Group's shares may be trading at a discount.

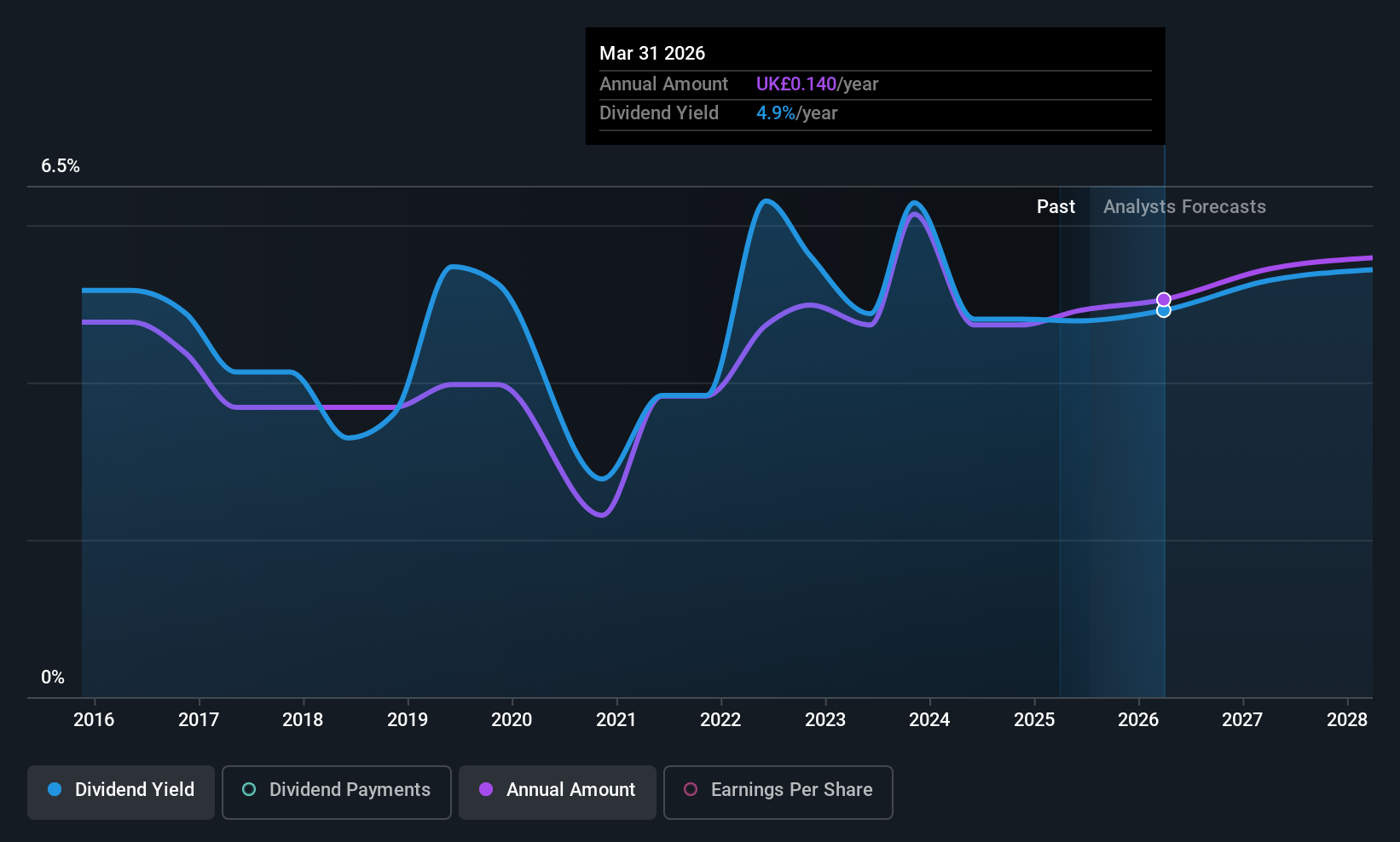

J Sainsbury (LSE:SBRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Sainsbury plc operates in the United Kingdom through its subsidiaries, focusing on food, general merchandise and clothing retailing, along with financial services, and has a market cap of £7.51 billion.

Operations: J Sainsbury plc generates revenue primarily from its Retail segment, contributing £32.63 billion, and its Financial Services segment, adding £182 million.

Dividend Yield: 4.1%

J Sainsbury's dividend yield of 4.08% trails the top UK dividend payers, and its dividends have been volatile over the past decade. However, with a payout ratio of 75.5% and a cash payout ratio of 27.4%, dividends are covered by both earnings and cash flows, indicating sustainability despite an unstable track record. Recent termination of Argos sale discussions highlights strategic focus on enhancing digital capabilities and operational efficiencies to support growth amidst mixed results from Argos operations.

- Delve into the full analysis dividend report here for a deeper understanding of J Sainsbury.

- The analysis detailed in our J Sainsbury valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Discover the full array of 50 Top UK Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PAG

Paragon Banking Group

Provides financial products and services in the United Kingdom.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives