- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:WINE

Naked Wines (LON:WINE) pulls back 9.8% this week, but still delivers shareholders impressive 31% CAGR over 3 years

It might be of some concern to shareholders to see the Naked Wines plc (LON:WINE) share price down 14% in the last month. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 118% compared to three years ago. It's not uncommon to see a share price retrace a bit, after a big gain. The thing to consider is whether the underlying business is doing well enough to support the current price.

Since the long term performance has been good but there's been a recent pullback of 9.8%, let's check if the fundamentals match the share price.

View our latest analysis for Naked Wines

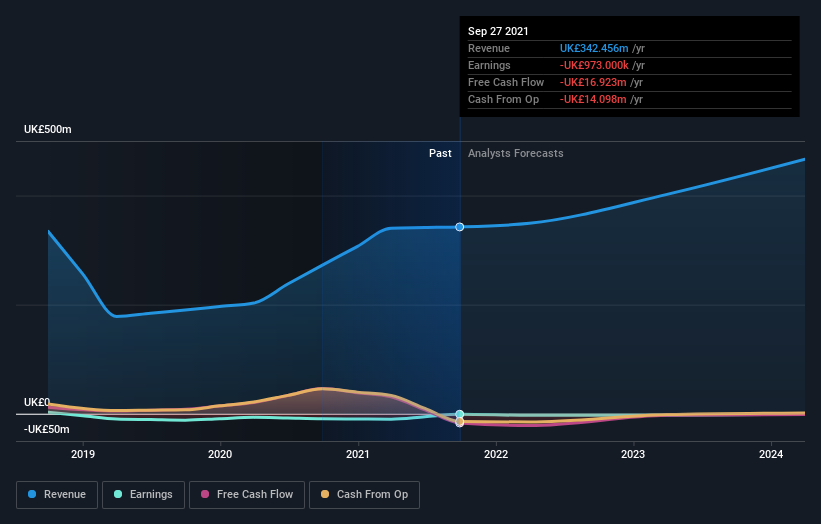

Because Naked Wines made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Naked Wines has grown its revenue at 14% annually. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 30% per year. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Naked Wines stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Naked Wines' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Naked Wines shareholders, and that cash payout contributed to why its TSR of 123%, over the last 3 years, is better than the share price return.

A Different Perspective

Naked Wines shareholders are down 13% for the year, but the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 12%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Naked Wines that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Naked Wines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WINE

Naked Wines

Engages in the direct-to-consumer retailing of wines in Australia, the United Kingdom, and the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives