- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:WINE

Discover UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, impacting companies with significant exposure to the Chinese economy. Despite these challenges, investors seeking opportunities beyond established names might find value in penny stocks—smaller or newer companies that can offer surprising potential. While the term "penny stock" may seem outdated, these investments remain relevant for those looking to uncover hidden value and financial strength in lesser-known firms.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.61 | £187.74M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £356.66M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.825 | £62.48M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.25 | £106.71M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.335 | £426.76M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4245 | $246.77M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Lexington Gold (AIM:LEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lexington Gold Ltd is engaged in the exploration and development of gold projects in the United States and South Africa, with a market cap of £13.43 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £13.43M

Lexington Gold Ltd, with a market cap of £13.43 million, is pre-revenue and has recently become profitable, marking a significant milestone in its financial journey. The company is debt-free and boasts stable weekly volatility at 6%, suggesting a steady performance amidst the inherent risks of penny stocks. Its management team and board are experienced, with average tenures of 8.2 and 4.8 years respectively. Recent developments include an agreement with Letsema Holdings and Gold One Africa to explore collaboration opportunities in South Africa, potentially enhancing the financial viability of their gold projects through shared infrastructure and expertise.

- Get an in-depth perspective on Lexington Gold's performance by reading our balance sheet health report here.

- Gain insights into Lexington Gold's past trends and performance with our report on the company's historical track record.

Naked Wines (AIM:WINE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates as a direct-to-consumer wine retailer in Australia, the United Kingdom, and the United States, with a market cap of £39.89 million.

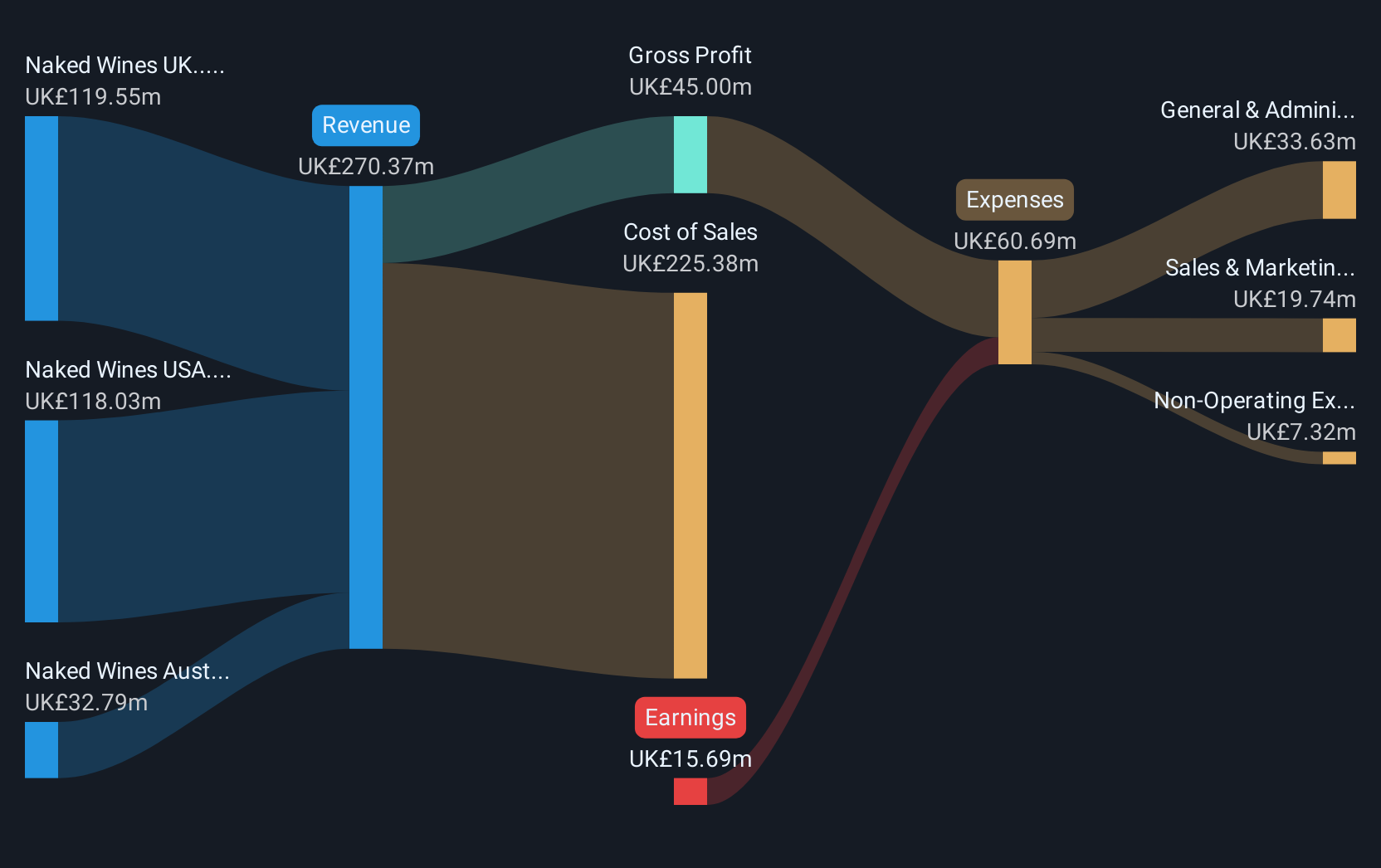

Operations: The company generates revenue from its direct-to-consumer wine retail operations in the UK (£124.41 million), USA (£131.13 million), and Australia (£34.87 million).

Market Cap: £39.89M

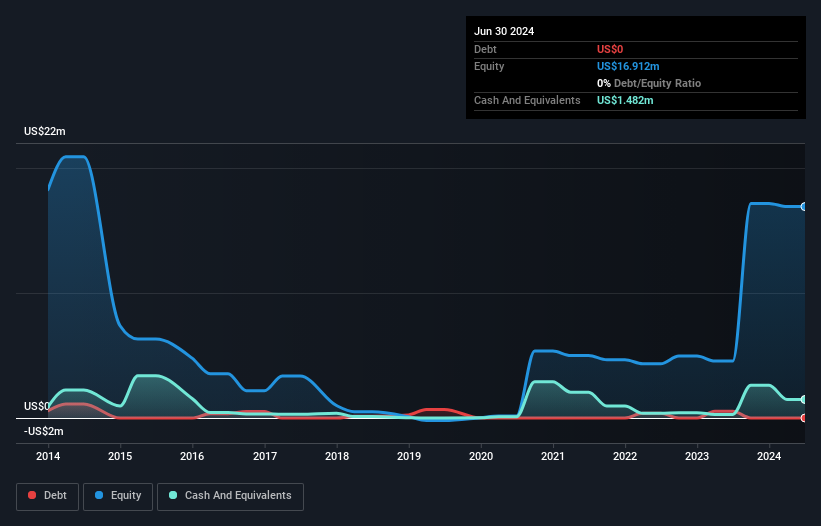

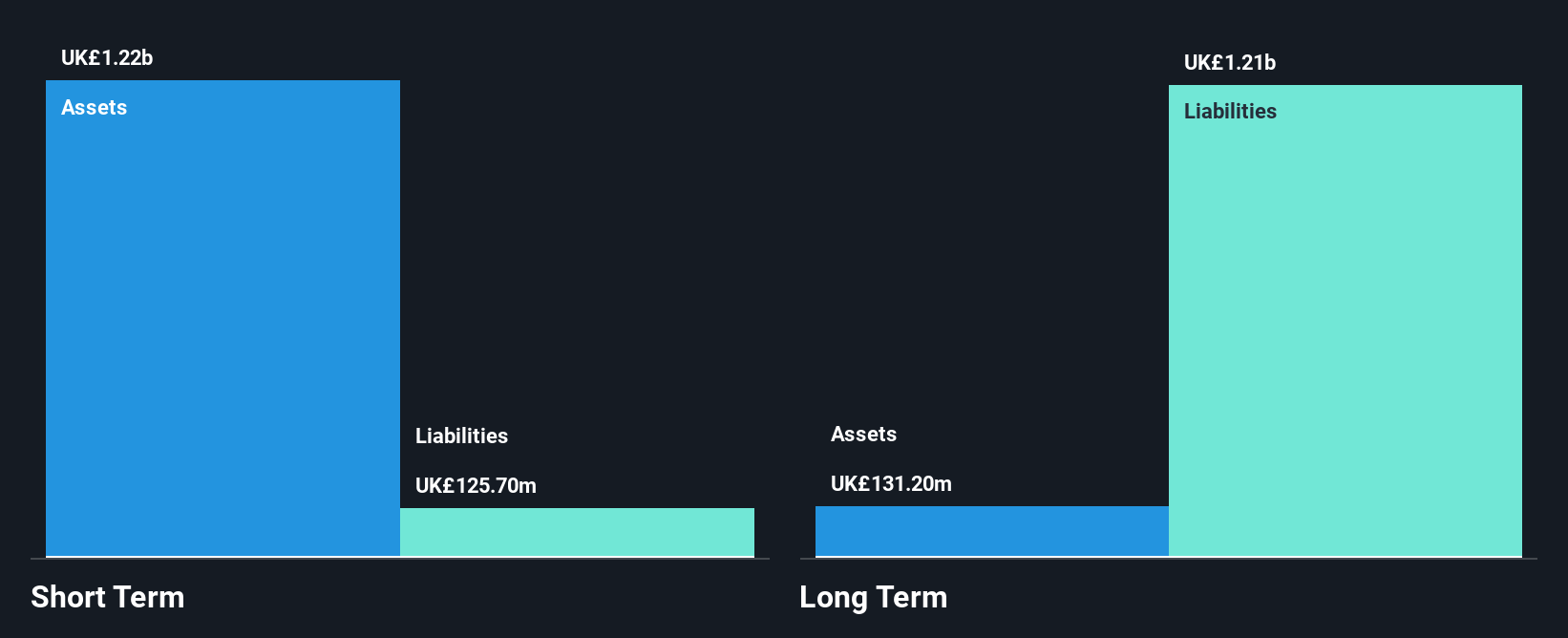

Naked Wines plc, with a market cap of £39.89 million, faces challenges as it remains unprofitable and reported a net loss of £20.84 million for the year ended April 2024. Despite this, its short-term assets exceed liabilities, providing some financial resilience. The company benefits from a cash runway exceeding three years if current free cash flow levels are maintained. Recent leadership changes include the appointment of Dominic Neary as CFO, bringing extensive experience in returning businesses to profitability and optimizing digital investments—potentially aiding Naked Wines' strategic direction amidst industry pressures.

- Dive into the specifics of Naked Wines here with our thorough balance sheet health report.

- Gain insights into Naked Wines' future direction by reviewing our growth report.

Hansard Global (LSE:HSD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hansard Global plc is a specialist long-term savings provider offering savings and investment products to investors, institutions, and wealth-management groups in the Isle of Man, Republic of Ireland, and The Bahamas, with a market cap of £64.33 million.

Operations: The company generates £168.3 million from the distribution and servicing of long-term investment products.

Market Cap: £64.33M

Hansard Global plc, with a market cap of £64.33 million, reported revenues of £169.1 million for the year ended June 2024, reflecting growth from the previous year. Despite this revenue increase, net income slightly declined to £5.2 million with profit margins dropping to 3.1% from 6.3%. The company remains debt-free and its short-term assets significantly exceed liabilities, providing financial stability. Recent executive changes include Ollie Byrne's appointment as CFO and Executive Director, potentially influencing strategic direction positively given his extensive experience in life assurance and strategic management initiatives within Hansard Global.

- Click to explore a detailed breakdown of our findings in Hansard Global's financial health report.

- Assess Hansard Global's future earnings estimates with our detailed growth reports.

Make It Happen

- Unlock more gems! Our UK Penny Stocks screener has unearthed 462 more companies for you to explore.Click here to unveil our expertly curated list of 465 UK Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Naked Wines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WINE

Naked Wines

Engages in the direct-to-consumer retailing of wines in Australia, the United Kingdom, and the United States.

Flawless balance sheet and good value.