The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines influenced by weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, penny stocks remain an intriguing area for investors seeking opportunities beyond established companies. Although the term "penny stocks" may seem outdated, it still captures the essence of smaller or newer companies that can offer significant potential when backed by strong financials and strategic growth plans.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £434.2M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.254 | £193.4M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.685 | £366.5M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.47 | $273.22M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.475 | £316.24M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ECO Animal Health Group (AIM:EAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ECO Animal Health Group plc develops, registers, and markets pharmaceutical products for animals globally, with a market cap of £48.45 million.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, which generated £84.60 million.

Market Cap: £48.45M

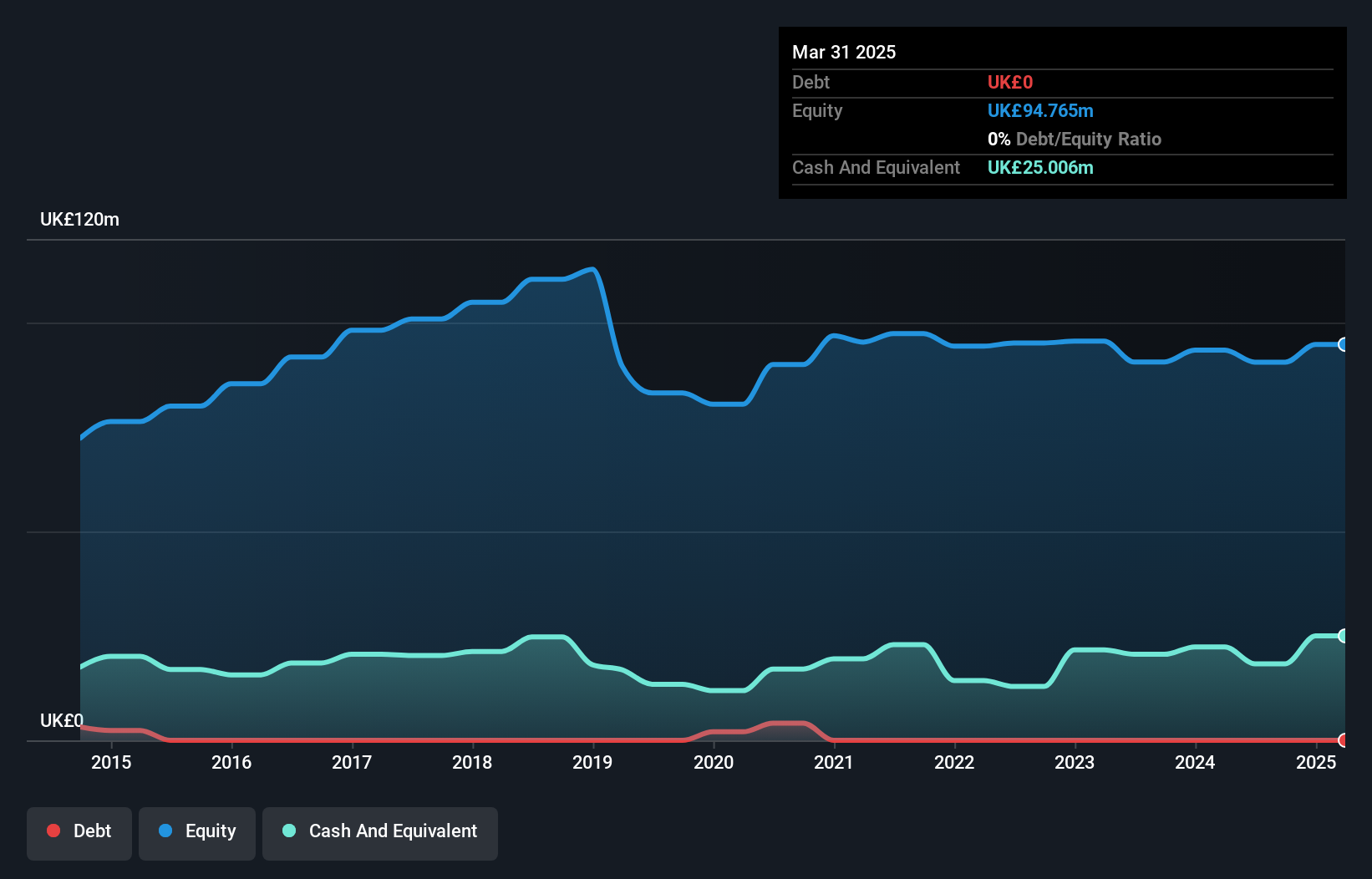

ECO Animal Health Group plc, with a market cap of £48.45 million, reported half-year sales of £33.18 million but faced a net loss of £1.7 million, reflecting challenges in maintaining profitability amid declining revenues from the previous year. Despite this, the company is debt-free and has strong short-term asset coverage over liabilities (£63.0M vs £16.9M). While earnings have declined by 47.4% annually over five years, recent profitability marks a positive shift with forecasted earnings growth at 39.23% per year. The board and management show seasoned experience, though return on equity remains low at 1.6%.

- Dive into the specifics of ECO Animal Health Group here with our thorough balance sheet health report.

- Understand ECO Animal Health Group's earnings outlook by examining our growth report.

Iofina (AIM:IOF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iofina plc, operating in the United States and the United Kingdom, is engaged in the exploration, development, and production of iodine and halogen-based specialty chemical derivatives from oil and gas operations, with a market cap of £36.93 million.

Operations: The company generates revenue of $51.71 million from its Halogen Derivatives and Iodine segment.

Market Cap: £36.93M

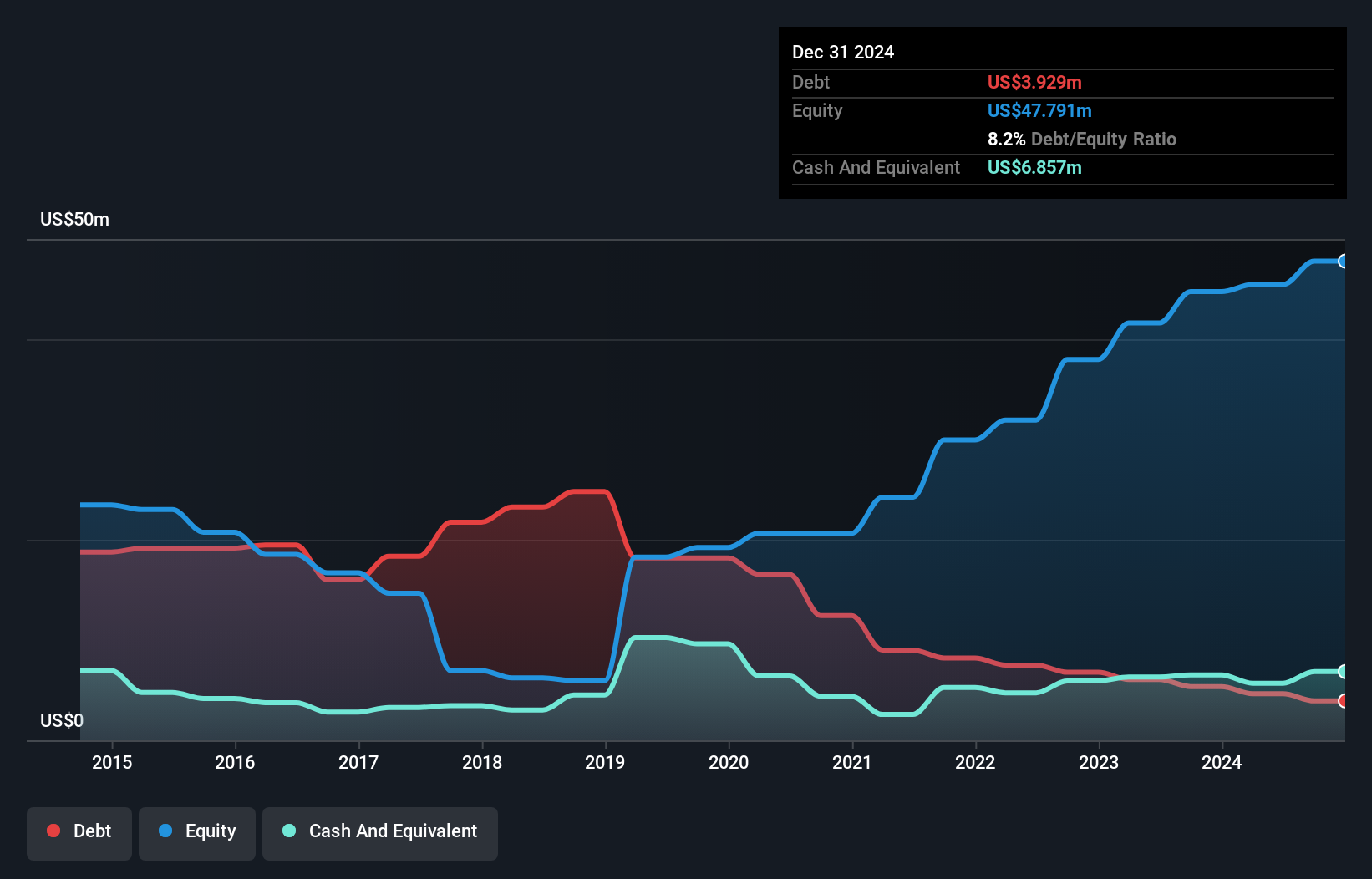

Iofina plc, with a market cap of £36.93 million, generates US$51.71 million in revenue from its iodine and halogen derivatives operations. The company's debt is well covered by operating cash flow at 182.3%, and it has more cash than total debt, indicating strong financial health. Its short-term assets exceed both short-term ($10.9M) and long-term liabilities ($3.6M). Despite negative earnings growth last year (-62%), Iofina has achieved profitability over the past five years with an average annual earnings growth of 33.7%. However, current profit margins (7%) have decreased from last year's 20.1%.

- Unlock comprehensive insights into our analysis of Iofina stock in this financial health report.

- Gain insights into Iofina's future direction by reviewing our growth report.

Roebuck Food Group (AIM:RFG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Roebuck Food Group plc, along with its subsidiaries, operates in product sourcing, plant and ingredients, and dairy sectors across the United Kingdom, Ireland, and internationally with a market cap of £8.69 million.

Operations: No specific revenue segments are reported for Roebuck Food Group.

Market Cap: £8.69M

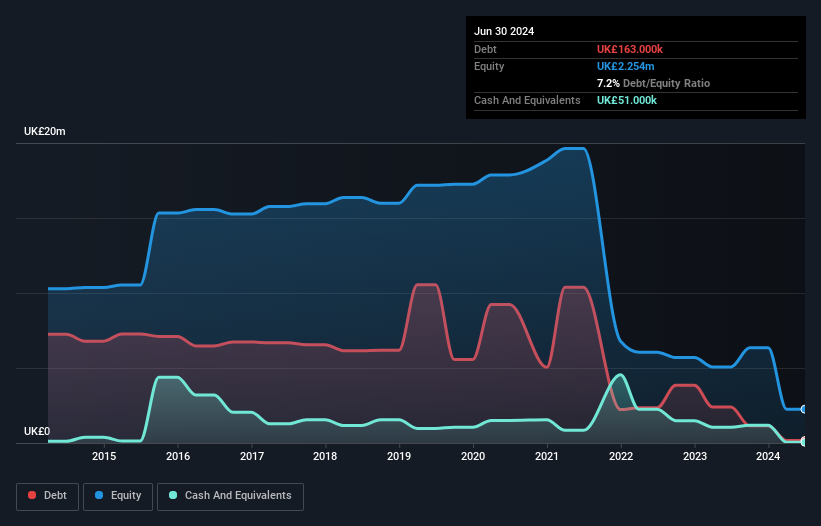

Roebuck Food Group plc, with a market cap of £8.69 million, is currently pre-revenue and unprofitable, facing a significant annual decline in earnings over the past five years. Despite this, the company has managed to reduce its debt to equity ratio from 61.4% to 7.2%, indicating improved financial management. Recent follow-on equity offerings totaling over £8 million suggest efforts to bolster capital amidst these challenges. Short-term assets (£7 million) exceed both short-term (£6.3 million) and long-term liabilities (£100 thousand), providing some liquidity cushion as the company navigates its financial difficulties and strategic changes following leadership transitions.

- Navigate through the intricacies of Roebuck Food Group with our comprehensive balance sheet health report here.

- Learn about Roebuck Food Group's historical performance here.

Key Takeaways

- Take a closer look at our UK Penny Stocks list of 466 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RFG

Roebuck Food Group

Engages in the product sourcing, plant and ingredients, and dairy businesses in the United Kingdom, Ireland, and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives