- United Kingdom

- /

- Luxury

- /

- LSE:DOCS

UK Stocks Conceivably Trading Below Intrinsic Value Estimates In January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with the ripple effects of weak trade data from China, reflecting broader global economic challenges, investors are keenly observing potential opportunities in undervalued stocks. In such a fluctuating market environment, identifying stocks that may be trading below their intrinsic value can offer strategic entry points for those looking to capitalize on long-term growth prospects amidst current uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ASA International Group (LSE:ASAI) | £0.8425 | £1.48 | 43.1% |

| Gaming Realms (AIM:GMR) | £0.368 | £0.72 | 48.9% |

| Zotefoams (LSE:ZTF) | £2.88 | £5.69 | 49.4% |

| GlobalData (AIM:DATA) | £2.06 | £3.76 | 45.2% |

| Duke Capital (AIM:DUKE) | £0.3125 | £0.58 | 46.5% |

| Vp (LSE:VP.) | £5.80 | £10.11 | 42.6% |

| Victrex (LSE:VCT) | £10.24 | £19.66 | 47.9% |

| Loungers (AIM:LGRS) | £3.08 | £5.38 | 42.8% |

| Quartix Technologies (AIM:QTX) | £1.56 | £3.07 | 49.2% |

| Watches of Switzerland Group (LSE:WOSG) | £5.20 | £9.22 | 43.6% |

Let's dive into some prime choices out of the screener.

AO World (LSE:AO.)

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £557.55 million.

Operations: The company's revenue is derived from its online retailing of domestic appliances and ancillary services, totaling £1.07 billion.

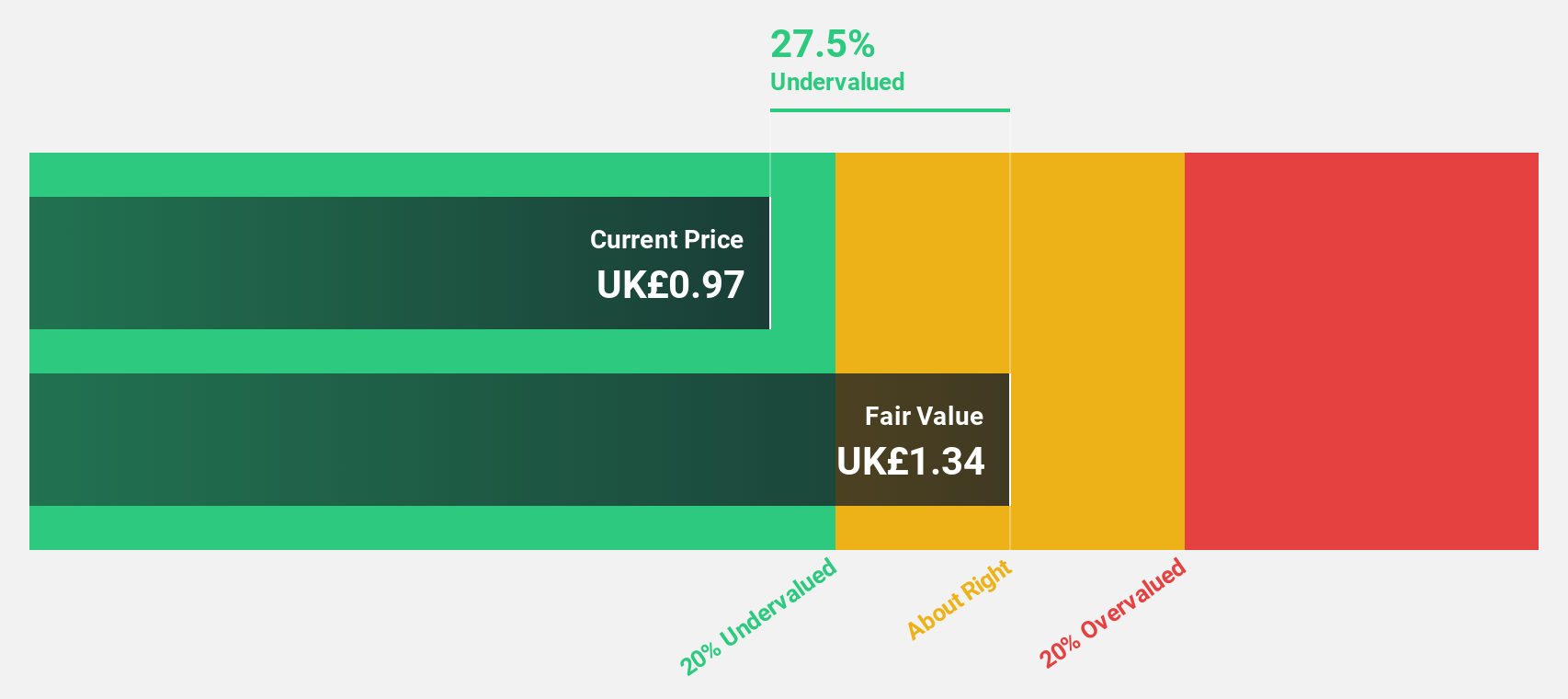

Estimated Discount To Fair Value: 28.4%

AO World is trading at approximately 28.4% below its estimated fair value of £1.37, with a current price of £0.98, suggesting it may be undervalued based on cash flows. Recent earnings show sales growth to £512.1 million and net income increase to £11.2 million for the half year ended September 2024, indicating solid financial performance. Revenue and earnings are forecast to grow faster than the UK market, enhancing its appeal as an undervalued stock in cash flow analysis.

- Our comprehensive growth report raises the possibility that AO World is poised for substantial financial growth.

- Get an in-depth perspective on AO World's balance sheet by reading our health report here.

Dr. Martens (LSE:DOCS)

Overview: Dr. Martens plc designs, develops, procures, markets, sells, and distributes footwear under the Dr. Martens brand and has a market capitalization of approximately £677.92 million.

Operations: The company's revenue is primarily derived from its footwear segment, which generated £805.90 million.

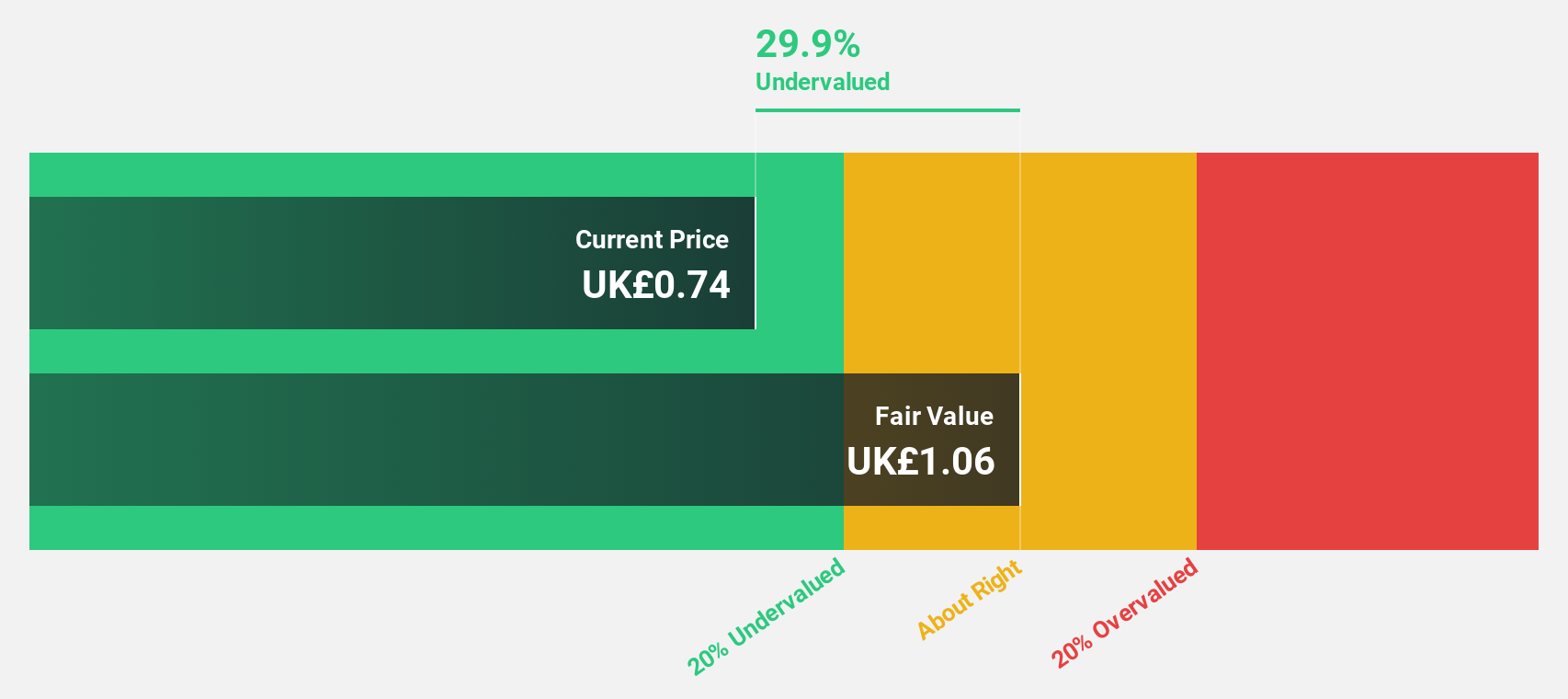

Estimated Discount To Fair Value: 10.4%

Dr. Martens is trading at £0.7, slightly below its estimated fair value of £0.78, indicating potential undervaluation based on cash flows. Despite a challenging half-year with sales dropping to £324.6 million and a net loss of £20.8 million, earnings are forecast to grow significantly over the next three years, outpacing the UK market's growth rate. However, interest payments remain poorly covered by earnings and profit margins have decreased from last year’s 10.6% to 3.6%.

- In light of our recent growth report, it seems possible that Dr. Martens' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Dr. Martens stock in this financial health report.

Genus (LSE:GNS)

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia; it has a market cap of £984.04 million.

Operations: Genus generates revenue through its segments: Genus ABS, including operations in Asia, which contributes £314.90 million, and Genus PIC, also including Asian operations, contributing £352.50 million.

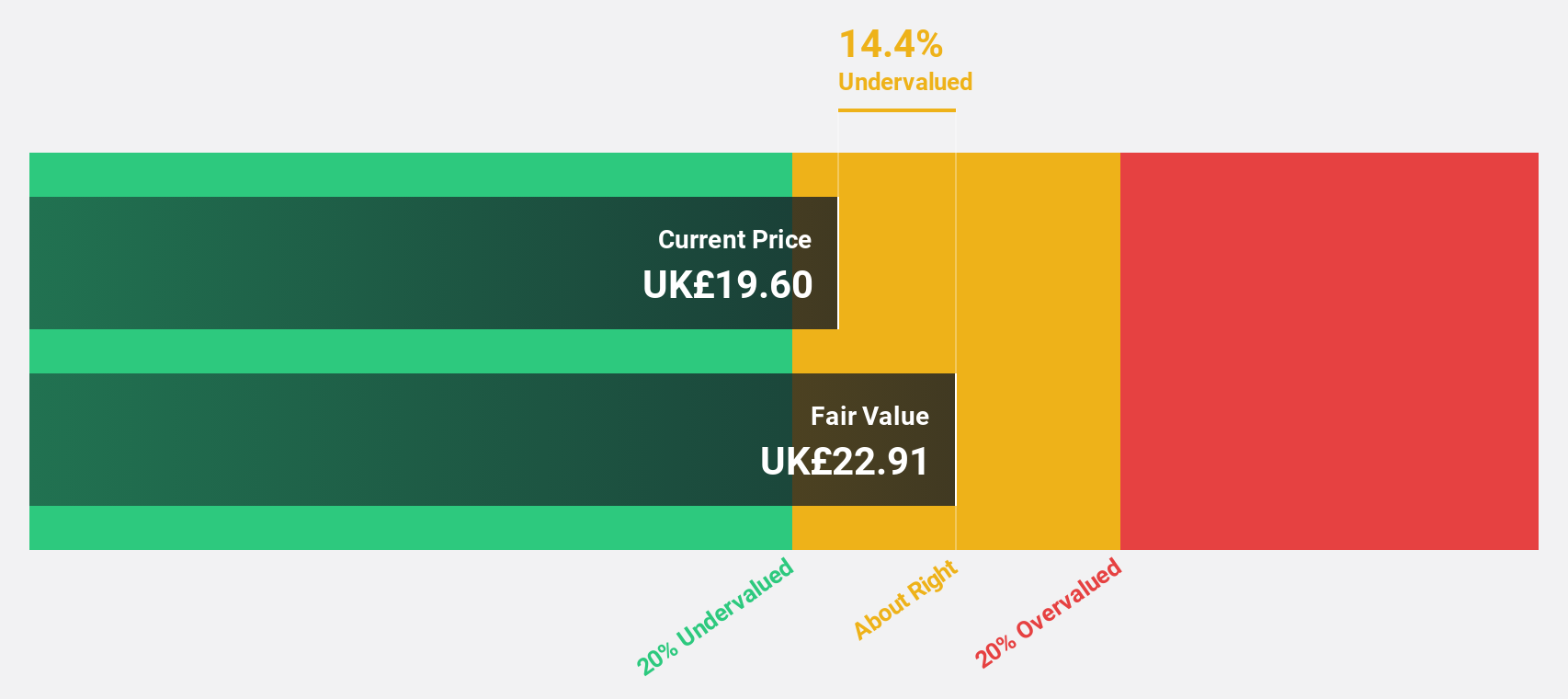

Estimated Discount To Fair Value: 32.1%

Genus is trading at £14.98, significantly below its estimated fair value of £22.05, highlighting potential undervaluation based on cash flows. Despite a dip in profit margins from 4.8% to 1.2%, earnings are projected to grow substantially at 31.5% annually over the next three years, surpassing UK market growth rates. Recent changes include appointing PricewaterhouseCoopers as auditor and affirming a dividend of 21.7 pence per share, with CFO Alison Henriksen set to retire in July 2025.

- According our earnings growth report, there's an indication that Genus might be ready to expand.

- Dive into the specifics of Genus here with our thorough financial health report.

Key Takeaways

- Embark on your investment journey to our 55 Undervalued UK Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dr. Martens, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DOCS

Dr. Martens

Designs, develops, procures, markets, sells, and distributes footwear under the Dr.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives