- United Kingdom

- /

- Beverage

- /

- LSE:CCR

3 Undervalued Small Caps In UK With Insider Buying

Reviewed by Simply Wall St

The UK market has been navigating turbulent waters, with the FTSE 100 and FTSE 250 indices recently slipping due to weak trade data from China, highlighting global economic challenges. Amidst this backdrop, small-cap stocks present unique opportunities as investors seek companies that may be undervalued yet poised for growth, particularly those demonstrating insider buying—a potential indicator of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| iomart Group | 15.9x | 0.8x | 21.49% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 26.18% | ★★★★★☆ |

| Sabre Insurance Group | 11.0x | 1.4x | 14.31% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 47.70% | ★★★★☆☆ |

| J D Wetherspoon | 15.3x | 0.4x | 19.67% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 38.55% | ★★★★☆☆ |

| Reach | 6.8x | 0.5x | -133.71% | ★★★☆☆☆ |

| Great Portland Estates | NA | 8.1x | -19.06% | ★★★☆☆☆ |

| Genus | 141.4x | 1.7x | 27.01% | ★★★☆☆☆ |

| THG | NA | 0.3x | -950.10% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

C&C Group (LSE:CCR)

Simply Wall St Value Rating: ★★★☆☆☆

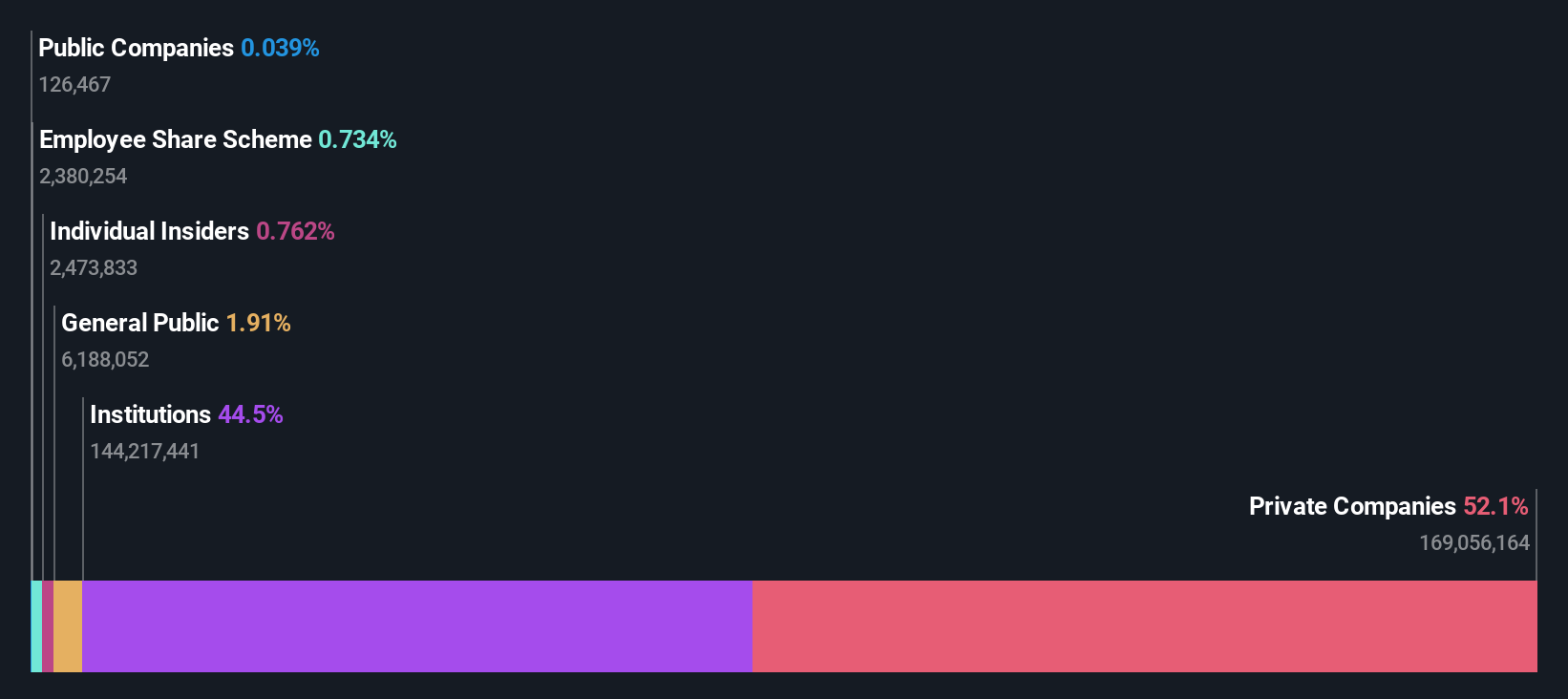

Overview: C&C Group is a leading manufacturer, marketer, and distributor of branded cider, beer, wine, spirits, and soft drinks with a market capitalization of approximately €1.09 billion.

Operations: C&C Group's revenue has seen fluctuations, with a peak of €1.70 billion in February 2020 and more recent figures around €1.65 billion by August 2024. The cost of goods sold (COGS) consistently represents a significant portion of expenses, impacting the gross profit margin, which was at its lowest at 6.67% in February 2019 and rose to approximately 23.28% by August 2024. Operating expenses have remained substantial, contributing to variations in net income margins over time, including periods of negative net income margins such as -7.21% in August 2024.

PE: -5.8x

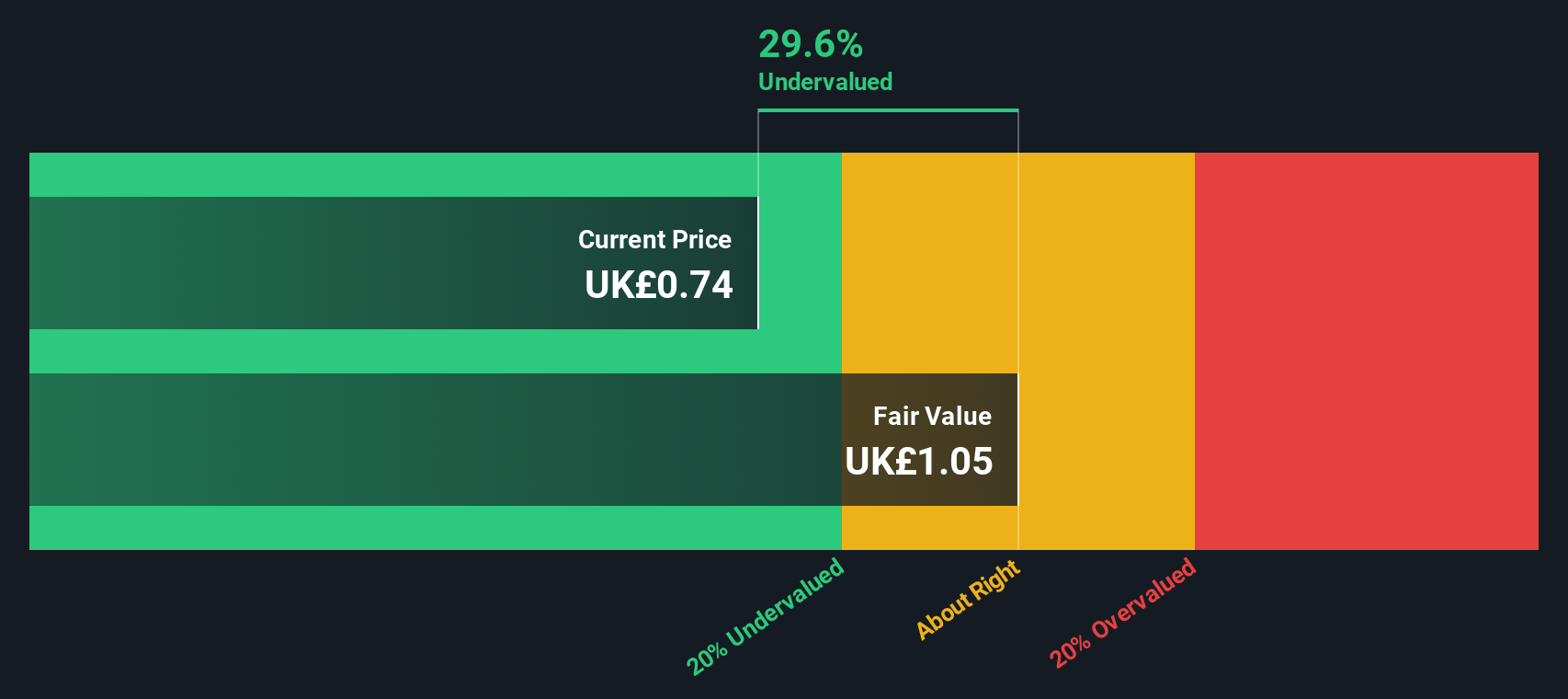

C&C Group, a company with external borrowing as its sole funding source, forecasts earnings growth of 90.1% annually. Recent financials show a slight dip in sales to €1.04 billion for H1 2024 and net income at €12.9 million, down from €18.3 million the previous year. Insider confidence is evident with recent share repurchases worth €15 million aimed at reducing share capital by January 2025, potentially enhancing shareholder value amidst industry challenges and strategic shifts in their distribution business post-ERP disruption recovery efforts.

- Get an in-depth perspective on C&C Group's performance by reading our valuation report here.

Examine C&C Group's past performance report to understand how it has performed in the past.

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Dr. Martens is a British footwear company known for its iconic boots and shoes, with a market capitalization of approximately £2.43 billion.

Operations: The company generates its revenue primarily from footwear sales, with a recent gross profit margin of 65.58%. Operating expenses are significant, including substantial general and administrative costs.

PE: 8.0x

Dr. Martens, a UK-based footwear brand, faces challenges with declining sales of £324.6 million for the half year ending September 30, 2024, compared to £395.8 million the previous year. Net loss hit £20.8 million versus a prior net income of £19 million. Despite this, insider confidence is evident with recent share purchases by company insiders during October 2024. The forecasted annual earnings growth rate of 5.68% suggests potential recovery amidst high debt and volatile share prices.

- Click to explore a detailed breakdown of our findings in Dr. Martens' valuation report.

Review our historical performance report to gain insights into Dr. Martens''s past performance.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harworth Group is a UK-based company focused on the regeneration of land and property for development, with a market cap of approximately £0.41 billion.

Operations: Harworth Group generates revenue through three main streams: Income Generation, Capital Growth from Other Property Activities, and the Sale of Development Properties. The company has experienced fluctuations in its gross profit margin, with a notable decline to 11.43% as of June 30, 2024. Operating expenses have consistently increased over time, reaching £29.98 million in the latest period reported.

PE: 11.2x

Harworth Group, recently added to the FTSE 250 and FTSE 350 indices, has demonstrated significant growth in its financials. For the first half of 2024, sales soared to £41.31 million from £18.24 million a year prior, with net income rising to £14.78 million from £2.85 million. Insider confidence is evident as their Independent Non-Executive Chairman acquired 50,000 shares for approximately £80,000 in September 2024. Despite relying solely on external borrowing for funding, earnings are projected to grow by over 26% annually.

- Take a closer look at Harworth Group's potential here in our valuation report.

Explore historical data to track Harworth Group's performance over time in our Past section.

Where To Now?

- Explore the 25 names from our Undervalued UK Small Caps With Insider Buying screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CCR

C&C Group

Manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the Republic of Ireland, Great Britain, and internationally.

Flawless balance sheet with reasonable growth potential.