- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRST

When Should You Buy Crest Nicholson Holdings plc (LON:CRST)?

Crest Nicholson Holdings plc (LON:CRST), might not be a large cap stock, but it saw a significant share price rise of over 20% in the past couple of months on the LSE. As a stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. But what if there is still an opportunity to buy? Let’s take a look at Crest Nicholson Holdings’s outlook and value based on the most recent financial data to see if the opportunity still exists.

See our latest analysis for Crest Nicholson Holdings

Is Crest Nicholson Holdings still cheap?

What kind of growth will Crest Nicholson Holdings generate?

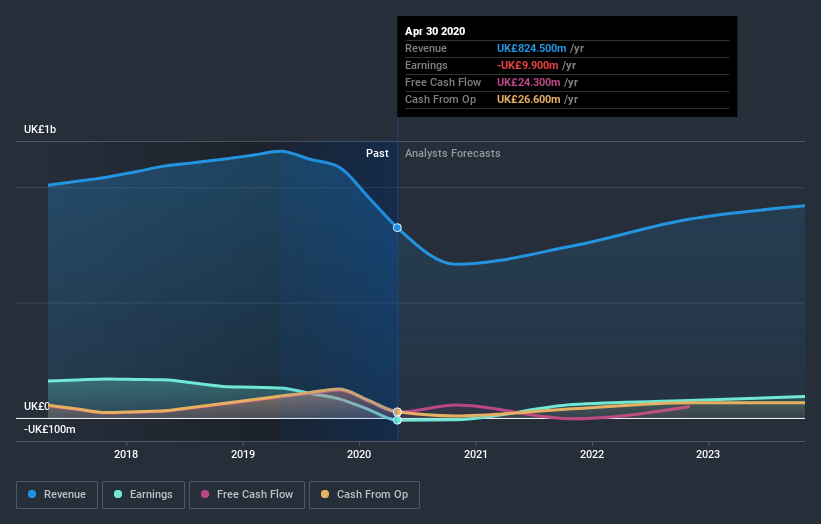

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Though in the case of Crest Nicholson Holdings, it is expected to deliver a relatively unexciting top-line growth of 7.9% in the next few years, which doesn’t help build up its investment thesis. Growth doesn’t appear to be a main reason for a buy decision for the company, at least in the near term.

What this means for you:

With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, Crest Nicholson Holdings has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you are no longer interested in Crest Nicholson Holdings, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you’re looking to trade Crest Nicholson Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CRST

Crest Nicholson Holdings

Engages in building residential homes in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)